Morgan Stanley was founded in 1935 and is headquartered in New York City. They are an American multinational investment bank and financial services company recognized as a leader in wealth management. With over $1.19 billion in assets, Morgan Stanley is among the top 15 biggest banks in the world.

According to the bank’s Second Quarter 2023 Earnings Results, Morgan Stanley reported a net revenue of $13.5 billion for the June 30, 2023 quarter. This figure is up from last year, with the firm reporting $13.1 billion at that time.

Morgan Stanley has invested in AI to help financial advisors understand client needs. The firm also uses data analytics and machine learning to personalize client communication. Developing AI tools requires investments in multiple areas, including hardware, computing power, data storage, networking and bandwidth, and additional data scientists.

In this article, we will examine two use cases demonstrating how Morgan Stanley uses AI to support their core business goals. One recent initiative with OpenAI appears to begin as several previous AI projects reach maturity. Our reporting will build off our last profile of AI initiatives at Morgan Stanley from April 2020, including a focus on enhancing recommendation systems in their Next Best Action wealth management tool:

- Internal-facing chatbots for financial advisors: Using large language models (LLMs) to deliver relevant content and insights to financial advisors to drive efficiency and scale.

- Enhancing recommendation systems for client interactions: Increase client engagement through data analytics and machine learning to personalize client communication and increase financial advisors’ engagement with clients.

- Impact analysis through data analytics: Assist clients with aligning their portfolios with their desire to make a social and environmental impact through data analytics.

Drive Efficiency and Scale

Processing data is no doubt costly. According to Cano Intelligence, large-sized investment firms spend between $1.8 and $3.6 million dollars ingesting, processing, and extracting data from documents.

Morgan Stanley Wealth Management (MSWM) teamed up with OpenAi earlier this year to create a customized solution that leverages OpenAI’s technology. This strategic alignment provides them with early access to new products from OpenAI.

MSWM uses GPT4 as the back end of an internal-facing chatbot. The conversational AI enterprise capability allows financial advisors to retrieve relevant insights in seconds by interacting with the chatbot. The benefit becomes more apparent when you consider the breadth and size of Morgan Stanley’s document library, spanning hundreds of thousands of pages.

Their content library consists of different types of documents, including the following:

- Investment strategies

- Market research and commentary

- Analyst insights

Jeff McMillan, Co-President and Head of Morgan Stanley Wealth Management explained how using OpenAi frees up valuable time. He explained how OpenAI’s technology gives Morgan Stanley’s financial advisors a competitive advantage by distilling their vast knowledge library into valuable insights. With that workflow loop closed, it frees up valuable time for financial advisors allowing them to serve their clients better directly.

Using GPT-4 reduces the time financial advisors take to sift through thousands of documents. As a result, financial advisors can significantly reduce the turnaround time for providing their clients with needed information.

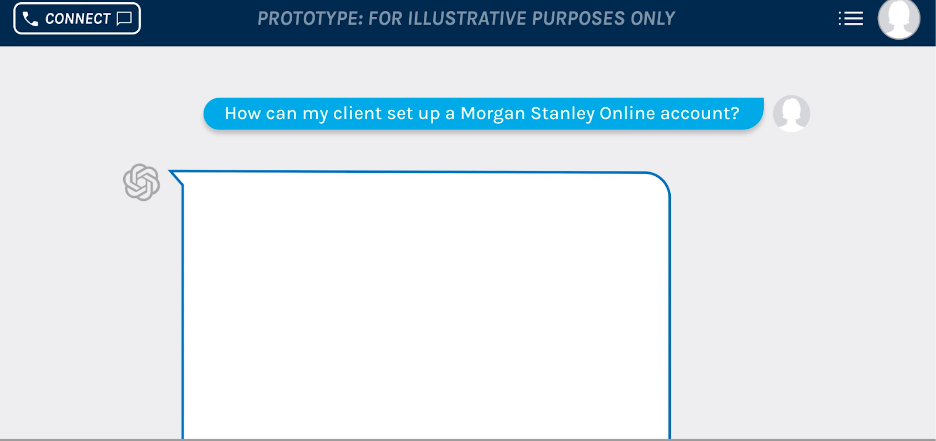

Screenshot showing Prototype of Morgan Stanley’s Internal GPT4-Powered Chatbot. (Source: OpenAI)

OpenAI’s website features Morgan Stanley’s customer story; Morgan Stanley was OpenAI’s only strategic client in wealth management that had early access to OpenAi’s products.

In their customer story, McMillan explains how large language models changed how companies utilize knowledge. His words in the report describe the fundamental change in three parts:

- GPT4 can access, process, and synthesize content almost instantaneously

- Morgan Stanley has vast intellectual capital because they publish thousands of papers yearly. The topics they cover include insights on:

- Capital markets

- Asset classes

- Industry analysis

- Economic regions

- Morgan Stanley’s large team of financial advisors excels in serving their clients. The team has trained GPT-4 specifically for their internal needs.

In an interview with CNBC, McMillan said the tool would allow his bank’s 16,000+ advisors to make sense of the bank’s vast collection of research and data. He described the benefit as similar to having the company’s chief strategy officer sitting next to the financial advisors when they’re on the phone with clients.

Currently, 6% of Morgan Stanley’s financial advisors use the tool. The full rollout is slated to occur in the third quarter of this year. For that reason, tangible results in the form of quantitative impact are not yet available. Successful digital transformation can be challenging, but ChatGPT relies on humanlike conversational dialog, reducing the learning curve.

McMillan previously told Forbes that he foresees integrating their GPT4 capabilities with their Next Best Action system, described below.

Personalize Client Communication

Personalizing client interactions first requires appropriately pairing clients with the right financial advisor. Morgan Stanley developed a lead management platform, LeadIQ, for this purpose. A 2019 survey by Gartner showed that firms stand to lose as much as 38% of their customers due to issues executing personalization efforts.

According to the company’s case study report, LeadIQ internally pairs financial advisors with prospective clients. It is powered by machine learning software and chooses which financial advisors will get referrals from a pool of 1,500 pre-selected advisors. The software prioritizes advisors based on their historical close rate with clients.

Morgan Stanley internally built Next Best Action, an AI-based engine, to improve personalization of messages they send to clients. In our previous report on AI at Morgan Stanley from April 2020, we covered Next Best Action as a developing AI initiative.

Morgan Stanley introduced Next Best Action, an industry-leading system, in 2018. The system offers multiple capabilities, including:

- Functioning as a platform for personalized communication and engagement with clients.

- AI-based recommendation engine to provide investment and wealth-management ideas for financial advisors to share with their clients

As of mid-2022, more than 90% of Morgan Stanley’s brokers adopted the Next Best Action system.

Initially, this system relied on a rule-based system to make recommendations. It now uses machine learning to recommend investments based on client preferences. Next Best Action uses machine learning to identify personalized investment ideas. They distribute those ideas and relevant messages to specific clients with their Customer Relationship Management (CRM) systems.

When the system was initially introduced, the main focus was on personalizing investment offers. However, shifting the focus to the client engagement aspects proved beneficial. Financial advisors had easy access to personalized recommendations that ultimately improved client engagement; MSWM also found that financial advisors’ success depends mainly on frequent client engagement.

According to the Morgan Stanley Client Council Survey, Q2 2021, 98% of clients are satisfied with how their financial advisor handles questions and requests.

Impact Analysis Tool

Client retention is a primary motivator of Morgan Stanley’s sustainable investing options. As Chief Sustainability Officer Audrey Choi told Jason Jay of MIT at the 2022 MIT Energy Conference, “Sustainability is now increasingly a driver of whether you can attract talent, retain talent, retain customers, and retain investors.”

For that reason, Morgan Stanley has long been at the forefront of climate-conscious investing; Choi founded Morgan Stanley’s Institute for Sustainable Investing in 2013. One of its goals is to drive the adoption of sustainable investing strategies across capital markets.

Morgan Stanley recognized that their investors want to make a more significant impact on the world with their investment choices. To fill this need, Morgan Stanley created a patented impact analysis tool called Morgan Stanley Impact Quotient®, more known as Morgan Stanley IQ®.

Previously, it was difficult for investors to determine if their investments aligned with their desire to impact specific areas. The difficulty resulted from:

- A lack of standardized metrics to evaluate the question

- Competing frameworks for measuring impact

Morgan Stanley IQ focuses on the impact preferences of their clients. The analysis focuses on these preferences in three ways:

- A comprehensive framework that includes nine impact themes and more than 100 social and environmental impact preferences helps clients identify and prioritize what’s important to them.

- Aligns investments with the previously identified client preferences by using proprietary analytics and third-party data sources.

- Provides financial advisors with investment solutions aligned with client impact preferences for the long term.

The Morgan Stanley IQ tool is integral to their Investing with Impact Platform. The below video describes how their clients can achieve racial equity investing at the 36 second mark.