Credit card companies could make use of AI applications across multiple business areas. AI-based fraud detection is among the most widely discussed AI applications in the financial sector, and it seems to work for credit cards similarly to how it works for banks. Additionally, credit card companies and financial institutions could use AI software to improve customer service and develop customer-targeted marketing campaigns.

In this article, we detail three prominent use-cases for AI software in the credit card industry and describe how customers interact with some of them daily. These use-cases include:

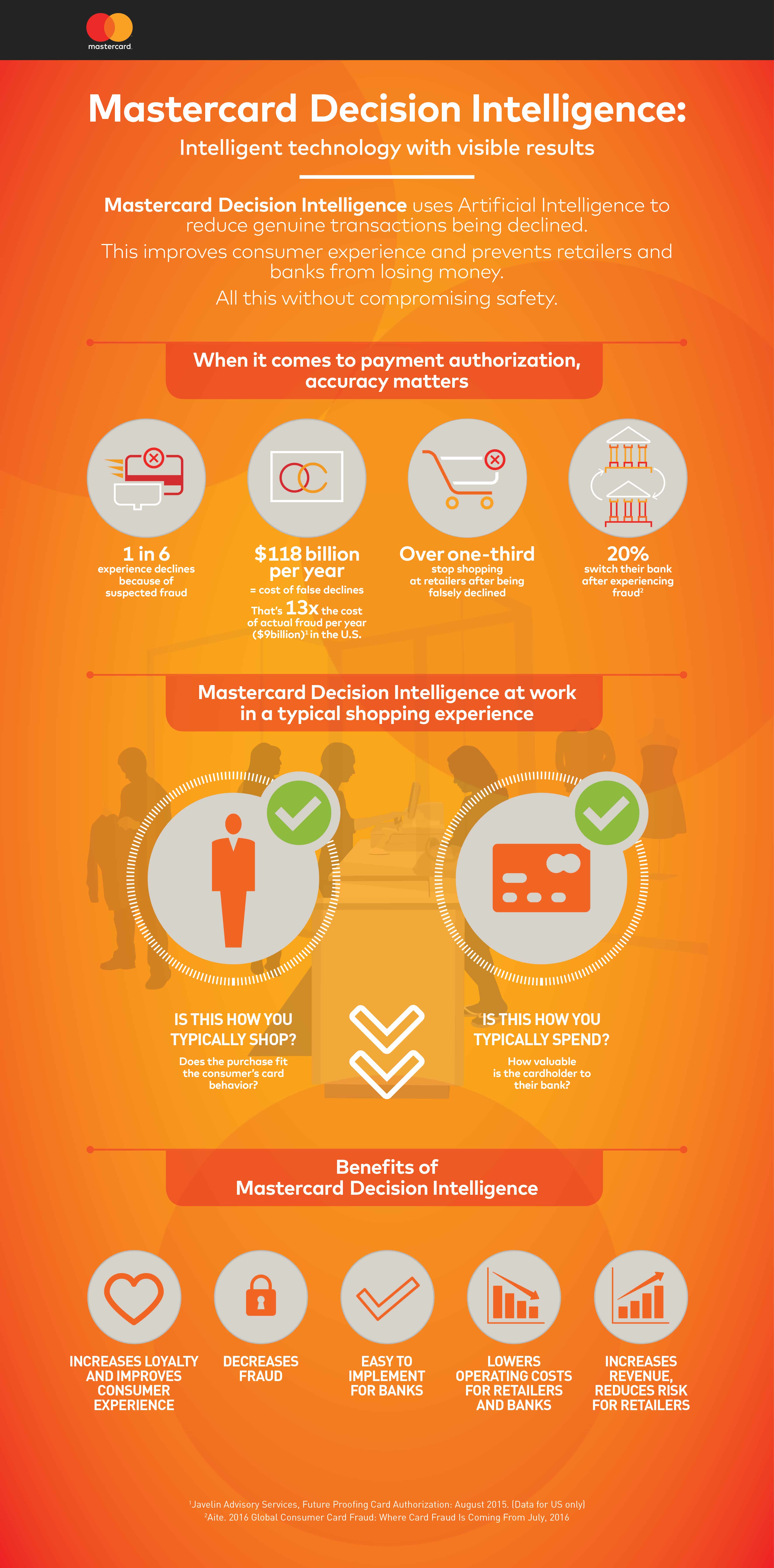

- Fraud Detection: Credit card companies might implement predictive analytics into their existing fraud detection workflows to reduce false positives.

- Chatbots for Travel: Credit card companies offer customers chatbots for checking their bank balances and more while traveling. These chatbots run on natural language processing (NLP).

- Card-Linked Marketing: Using demographic data and credit card purchase history, credit card companies can offer targeted promotions and deals to customers digitally.

We also discuss how the largest credit card companies, including Mastercard and Visa, use these applications whether or not they are seeing success with them. We begin our exploration of AI for credit cards with fraud detection and how predictive analytics may achieve it for credit card companies and banks alike. It may prove important for both banks and credit card companies to have strong fraud management methods in order to keep their customers, other business partners, and each other safe.

Fraud Detection

AI software could analyze and score credit card transactions on their likelihood of being fraudulent similarly to how it may score a banking transaction. Credit card companies may use either predictive analytics or anomaly detection to accomplish this, but predictive analytics solutions may be more difficult to employ because of the more intensive approach to training the software.

Predictive analytics algorithms must be trained on a large volume of banking data. In this case, this would be a series of “events” containing data about individual credit card transactions. Data scientists tasked with training the algorithm would expose it to the database all at once.

This approach is what allows the algorithm to gradually begin to “understand” what an acceptable transaction looks like while letting it discover fraud on its own. Additionally, software trained this way has the potential to discover previously undiscovered fraud methods and start flagging more fraudulent transactions.

Mastercard’s Decision Intelligence

Mastercard’s predictive analytics-based fraud detection solution, Decision Intelligence, purportedly analyzes customer data, merchant data, and numerous other data sources to score transactions on their likelihood of fraud. It declines transactions that fall below the client credit card company’s chosen threshold. For example: A 90% likelihood of fraud.

Mastercard also claims their software segments customers into groups with similar likelihoods of experiencing fraud. They claim this has the potential to decrease false positives. The graphic below explains the purported benefits of Decision Intelligence both for Mastercard’s clients and their customers:

Decision Intelligence factors in data such as:

- Customer data, including online shopping behavior

- Time of day

- Geolocational data

- Data about who the merchant is and the general demographics of their customer base

- The type of purchase, such as a recurring membership or individual product

We spoke to Sanmay Das, Associate Professor of Computer Science and Engineering at Washington University at St.Louis, about how financial institutions make use of this data. The interview concerns both fraud detection and credit risk scoring for customers. When asked how original credit risk models worked, Das said:

An individual bank will have all of that information, which is basically ‘what are exactly all of the purchases that you made,’ ‘where did you make the purchases,’ ‘what are the dollar values,’ and so on and so forth. And that is incredibly useful, in fact there has been prior work that shows that that information can be used very well using machine learning techniques to assess the risk that somebody is likely to default on their credit card debt.

In the work we’re doing, we don’t actually have the detailed data of all the purchases that a person is making. What we have is essentially the top line figures that you would see on monthly statements. So you would get to see information about ‘what is your outstanding balance,’ ‘what was your previous payment,’ ‘how many days late did you make a payment if you made a late payment,’ and so on and so forth which is still actually a lot of information.

Individual credit card companies may benefit from partnerships in which they share data in order to improve both their fraud detection and credit risk prediction methods. This is because the credit card company may not have granular data about each customer, but still have access to general credit information necessary for credit scoring and determining a customer’s risk of committing fraud.

Vendor Landscape: DataVisor

DataVisor also offers predictive analytics for fraud detection. The company claims its software can create fraud risk scores for transactions, insurance claims, loan applications, and recurring payments. They also state their software can identify new risk factors based on newly found fraud methods.

One of DataVisor’s case studies states they helped a global financial institution detect fraud methods that were getting past their existing anti-fraud measures. The case study states that the client had employed many fraud detection solutions from various companies, but wanted to increase the accuracy and efficiency of their fraud detection methods.

According to the case study, DataVisor helped the financial institution increase their number of detected fraudulent transactions by 20%. It also states they saw a rise to 94% detection accuracy and a decrease in their false positive rates down to 0.9%. The client purportedly saved over $12 million annually from avoiding chargebacks.

We covered AI for credit card fraud detection in great depth in our article, Machine Learning for Credit Card Fraud – 7 Applications for Detection and Prevention

Chatbots for Travel

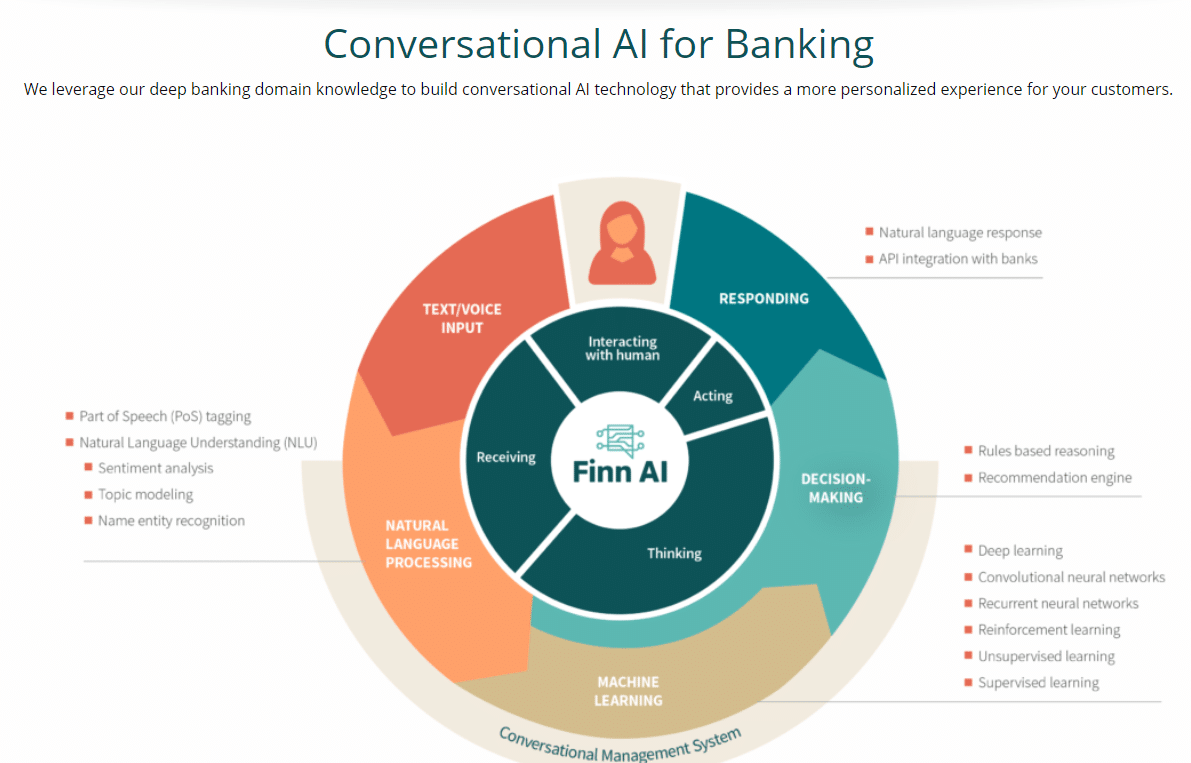

Some credit card companies benefit from equipping their mobile finance apps with AI. For example, Visa Canada collaborated with Finn AI to enhance the natural language processing algorithm behind the Visa app chatbot.

Visa’s chatbot purportedly allows customers to find important financial information while travelling within their own country or abroad. This includes the locations of the nearest ATMs and the exchange rate information for the country they are visiting.

Additionally, customers can purportedly ask the chatbot about how to prepare their bank account and credit card for travel. This involves making sure mobile app notifications are turned on for travel, enabling international financial services, and disabling a misplaced card.

Below is an image from Finn AI’s website that shows the steps their chatbot take to understand what is being asked and respond accurately. We have included a list explaining these steps in more detail:

- Text/Voice Input: The customer types or records their question and sends it to the chatbot. This is usually done from a smartphone through a mobile app.

- Natural Language Processing: Tagging individual parts of speech to determine sentence meaning along with analyzing the sentiment behind the question. Additionally, this involves recognizing the names of important entities, such as the bank itself, the name of the customer, or the type of issue they are dealing with.

- Machine Learning (ML): Running the information extracted from the user’s question through the algorithm that will decide how the chatbot responds. In the image, Finn AI refers to these processes as different forms of “learning,” but these are largely marketing terms and do not fundamentally change the ML process.

- Decision-making: Finn AI claims the software refers back to some hard rules when it decides on the type of response to give, which may help the ML model produce a legible response.

- Responding: The chatbot responds to the user’s question in text form, and that question and response is later used to further train the chatbot

Adopting Chatbots Into Workflows

We spoke to Madhusudan Mathihalli, CTO and co-founder of Passage AI, about how companies can get chatbots to work to their advantage. When we asked him about how chatbots can handle specific questions, Mathihalli said:

And we don’t have to be very, very customized to that particular customer’s order, like personalized. We can still understand the natural language, understand the dependencies. Whether you say with cheese, without cheese, cheese on the side. These are all just different ways of rendering the same thing. We just need to identify using natural language, how do I understand what the user is asking, comprehend the request, understand the intent and map it to a workflow. And we should be able to handle a lot of these sorts of scenarios.

Mathihalli claims that identifying the user’s question with natural language is a fundamental aspect of driving success with the software. ML algorithms can gradually come to understand more words as they are used repeatedly by customers, which means financial institutions may not need to be concerned with every granular detail of how their customers might speak when just starting to train their chatbot.

Card-Linked Marketing

Credit card companies could utilize customer data and spending behavior for showing customers third-party advertisements based on their credit or debit card activity. This is called card-linked marketing.

Factors that affect which deals are matched with which customer include demographic data, time of year, and the geographical location of the customer. Then, these factors are essentially run against shopping and financial habits in order to show the most targeted ad for the customer.

Credit card transactions create data about where the customer spent money and a general idea of what product they purchased. This data could allow a machine learning model to match customers with deals in real time based on their most recent spending habits.

Training an Algorithm for Card-Linked Marketing

When analyzing demographic signifiers with machine learning, a company would not likely build hardline rules for their software to recognize those differences in individuals. This means that an ML algorithm for this type of application would not necessarily need extensive training to teach it about gendered products or family products such as baby food. Instead, the system can come to find these details about customers through their spending habits.

This is done by labeling gendered products as more likely to be sold to men or women, then allowing the algorithm to gradually gain a wider “understanding” of what men and women buy more often. In cases like these, the machine learning algorithm is not actually trained to recognize a customer as a man or woman. Instead, it is trained to correlate their spending habits along gendered guidelines with the intent of more effective marketing.

While at some point the software would need to mark one product or another as “for men,” or “for women,” it could still recommend one of those products to the opposite gender if their spending behavior indicates a higher likelihood of success than usual.

We spoke to Sumit Borar, Director of Data Sciences and Engineering at Myntra about the opportunities for AI in Indian retail and eCommerce. When asked about how his company finds and stores demographic data, Borar said:

While we ask for genders, we have an explicit gender and an implicit gender. Implicit gender involves who someone is shopping for. For example, I might be male, but I might be shopping for my wife. So showing recommendations for just men might not be the right way to go. We start with explicit gender and we slowly move more and more toward implicit gender [based on purchase history].

Borar claims his company allows their AI software to determine a customer’s “implicit gender,” or where the customer’s taste for gendered products leans. This would likely allow for a slightly wider range of possible sales given that some men and women may have a use for products typically associated with the opposite gender.

In theory, a customer could get a notification while they are shopping about a deal on a product they are likely to buy. This is a best-case scenario when attempting to achieve card-linked marketing, or marketing specifically dependant on credit and debit card activity.

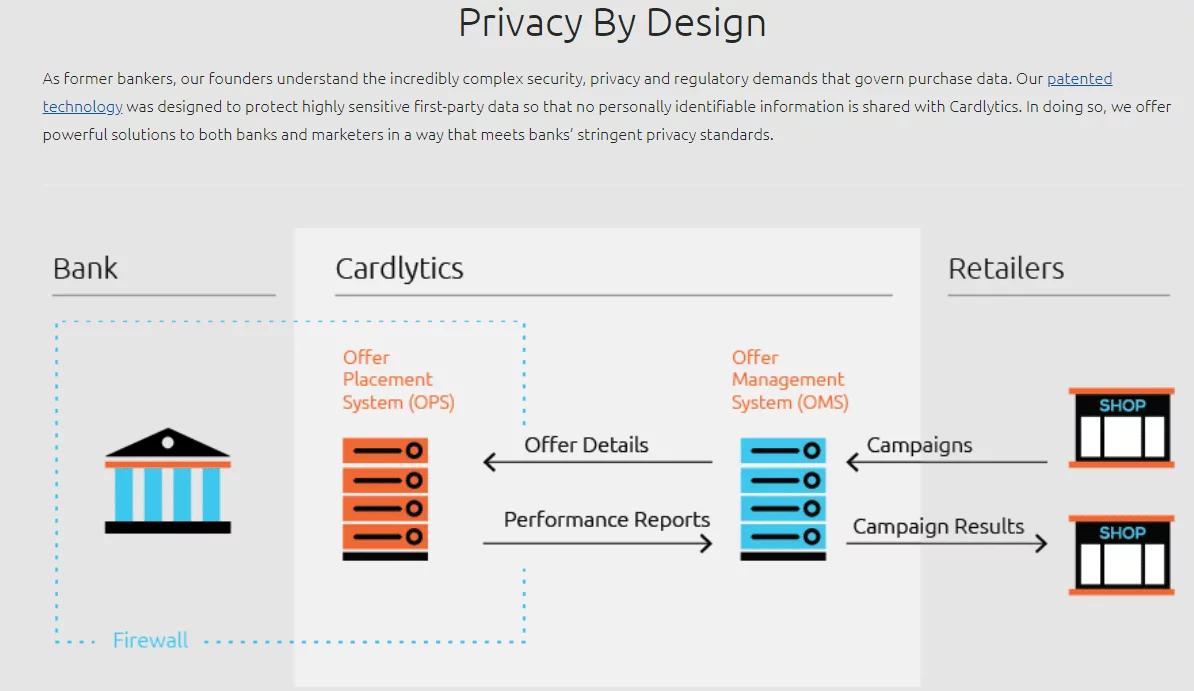

Vendor Landscape: Cardlytics

Cardlytics is one AI vendor that sells card-linked marketing software into the financial industry. They claim to use “purchasegraphics,” or demographics based on purchasing behavior to match customers with deals they are likely to spend money on.

The company also claims to have designed their AI software to prioritize privacy of sensitive customer information while still offering efficient marketing deals and customer matches. Below is a graphic from Cardlytics’ website that illustrates their safety-focused flow of information:

Performance reports are sent from the bank’s database to the Cardlytics’ marketing front, which then communicates that information with the retailers. Retailers then likely use this information to make better marketing campaigns, which they then submit back to Cardlytics to be matched to the customer base.

Cardlytic published a press release regarding a case study conducted by Celent about Bank of America’s “BankAmeriDeals” marketing program. According to the case study, Bank of America became a client of Cardlytics which uses spending data from about 70% of U.S. households.

The study also showed that retailers can reliably dedicate portions of their marketing budgets on card-linked marketing and see significant ROI. This means that companies looking to target their technology-aware customers in a way that is profitable may want to look further into the uses of AI enabled card-linked marketing.

Header Image Credit: Indepedent.co.uk