Job automation predictions from an individual expert typically draw from years of academic research experience, or time “in the trenches” of industry. With growing interest and speculation on the job market of the next decade, we set out to garner a perspective as to what Silicon Valley thinks about the possibilities of automations in various business tasks.

We wanted to know – what work functions have the most potential for near-term automation?

In the infographics and article below, we explore the survey responses from nearly 80 Bay Area investors, founders, and tech folks – on which business functions have the greatest potential for automation today, and in the coming five years ahead.

Together with San Francisco-based venture firm BootstrapLabs, we designed a simple survey that was handed out during their “Autonomous Corporation” event in November 2016. Below are the responses to this survey, and our interpretations and gleaned ideas:

Automation Predictions – Current

It is interesting to note all three groups of respondents considered business intelligence to be the business function with the most current automation potential.

Similarly, investors, founders, and “other” respondents were also unanimous in ranking human resources as the business function with the least current automation potential. It seems plausible that job automation in the HR department is less likely than the BI department, and that the predictions of our respondents would reflect this.

A uniform response for “highs” and “lows” was not expected, and seems to signal that there is strong shared sentiment around those two particular business functions.

While there seemed to be relative consensus around business intelligence, human resources, and marketing, other business functions – such as security and finance – didn’t have the same uniform optimism or pessimism across respondent groups.

Automation Predictions – 5 Years Out

It seemed highly unlikely from the outset, but one major trend resounded from the “Current” survey section to the responses in the “5 Year Future” section: Business intelligence again ranked highest amongst all options by all three groups, and human resources again ranked dead last for all three groups as well.

Based on the survey size (78 respondents, about one third investors, one third founders, one third “other”), this is by no means conclusive. There are no “conclusive” predictions in the first place (good startup idea though, someone should work on that). Rather, this seems

Manufacturing stands out as a major outlier from “current” to “5 years out.” Ranked among the lowest areas of current automation, manufacturing jumped ahead to nearly overtake business intelligence for the area of most optimism in the coming five years. It is possible that this is due to the heavier hard-cost investment of industrial manufacturing processes as compared to domains like business intelligence, marketing, of finance – where “automation” never has to reach it’s robot arms into the real world.

It is interesting to note that the current industry trends in funding AI and machine learning doesn’t seem to provide much evidence for heavy investment in manufacturing, so we might presume that the optimism of the investors and founders in the crowd spawned from another source.

Intersections with Other Artificial Intelligence Industry Research

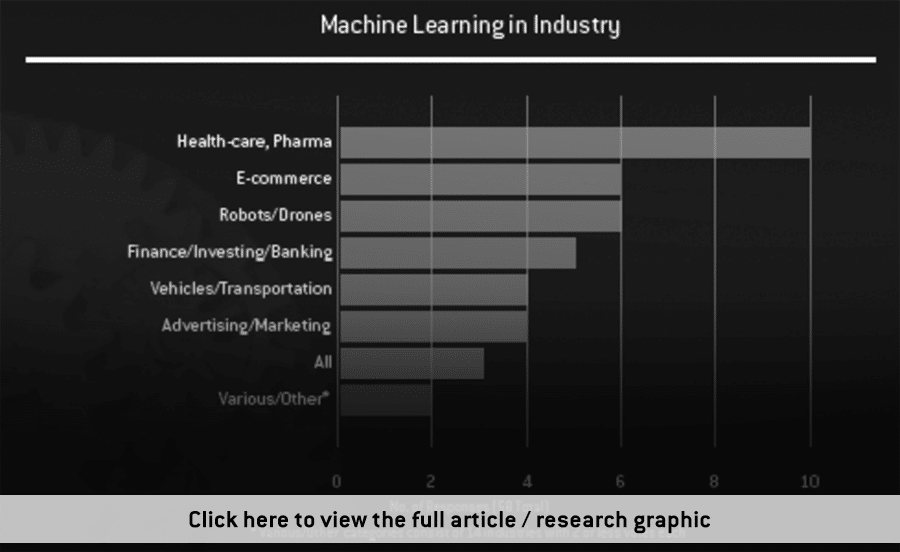

- In a previous AI researcher / founder consensus, we asked our 30 respondents “What industries do you believe to be most poised to take advantage of machine learning in a business context?” It should be noted that respondents in this survey were asked an open-ended question, and answers were only categorized after they had been collected and analyzed. Here we also see finance and marketing / advertising among the top selections, but in this case they are being referred to as an industry, rather than as a business function. View the full machine learning in industry graphic below:

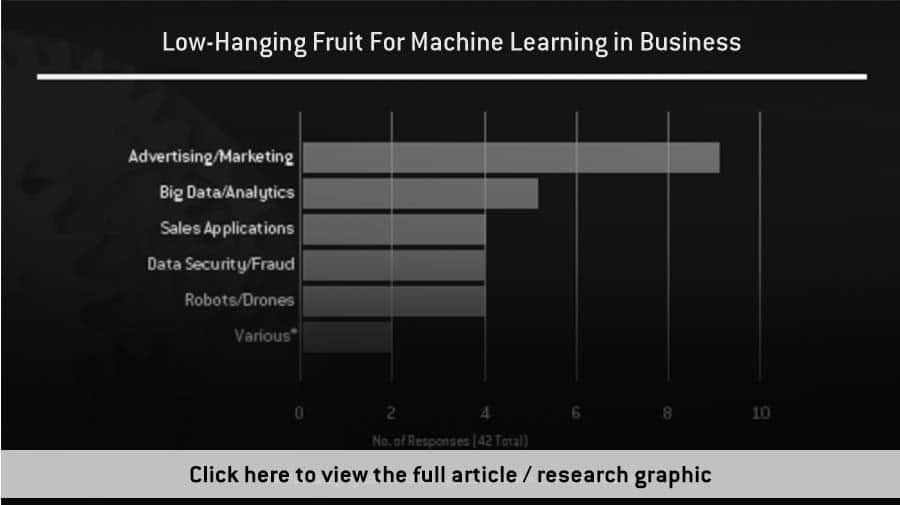

- In the same general survey mentioned above, we asked 30 artificial intelligence researchers and founders where they believed was the best “low-hanging fruit” for machine learning applications within business. It is interesting to note that in this particular survey, advertising was identified as the top selection. As to why this result is different from our Autonomous Corporation data, we can’t be sure – but it should be noted that “automation” and “applications of machine learning” are not synonymous, so while machine learning may play an important role in marketing, it may still involve a good deal of hands-on work and human expertise. Click the graphic below to refer to the full consensus article and graphic:

- The graphic below is from our late 2015 research on artificial intelligence risk. Thirty-three AI researchers were asked their opinion on the most likely risks of artificial intelligence in the next 20 years. The most common response (comprising over one third of all responses for this question) was “Automation / Economy.” View the AI Risk Consensus graphic in a separate tab by clicking below:

Closing Thoughts on Business Function Automation

Though our set of responses is not intended in any way to be conclusive, there are a few interesting themes that seem to warrant illumination:

- Business intelligence seemed to have a near overwhelming optimism amongst the business functions with automation potential, both now and in the coming 5 years ahead. We’ve seen a great number of business intelligence companies in our industry assessments and on our podcast (including IBM Watson, DMWay, and others).

- Human resources seems to have extremely low automation potential, as expressed by the respondents of this survey. Investors, founders, and “other” respondents unanimous rated it amongst the area of least automation potential. This isn’t to say that machine learning applications are of little value in this field, but rather that automation of human resources-related tasks is not as plausible as in, say, the marketing domain. We’ve interviewed the CEOs of Talent Analytics and Humanyze, two companies aiming to bring AI into the HR domain.

- The greatest outlier from this survey seems to be the business function of manufacturing, which seems to be one of the areas of greatest optimism for automation in the coming 5 years. We’ve seen relatively little investment in machine learning or AI-related manufacturing companies, but it seems reasonable to suppose that robotics, improvements in sensors, and other non-AI-related technologies will continue to push the bounds on bringing us human-less factories in the future.

- Averaged across all business functions, responses lifted approximately 50% from the “current” timeframe to the “5 years ahead” timeframe.

- Investors and founders/executives seemed to have more optimism than our “other” guests (comprised mostly of tech company employees, journalists, academics). On average, the “other” guests were about 8% less optimistic across all business functions in the “current” timeframe, and about 4.5% less optimistic in the “5 years ahead” timeframe.

A note about the survey itself: Our survey was handed out at the beginning of the event (before the presentations), and attendees were encouraged to fill one out before leaving. Survey respondents to our “Job Automation Predictions” survey included 26 tech investors, 23 founders / executives, and 29 “other” guests (including academics, journalists, and tech employees). None of the presentation topics of the “Autonomous Corporation” event had any specific theme, and many of the most popular survey subjects – including business intelligence – weren’t covered during the event at all. We believe that the presentations – mostly given after the surveys were handed out and filled out – had a negligible impact on the responses of the audience.

A special thanks to our friend Luigi Congedo at BootstrapLabs, who organized the printing of the survey, and encouraged his staff to get an adequate number of respondents, including many respected investors and founders.

Image credit: digitimes