Intellectual property (IP) is about more than preventing competitors from copying a technology or idea. IP informs a number of other strategic initiatives for companies:

- Corporations study their competitor’s intellectual portfolio to get a sense of their R&D initiatives, and innovation priorities

- Large organizations of venture capital firms scope out acquisition targets that have desirable or unique IP assets

- Financial firms perform due diligence on the value of underlying technologies that a target company holds

- Corporations looking for trends in their sector or industry need to see trends in broad patent filings

- Corporations trying to uncover voids in their technology portfolio or in the broader market

- And more…

In this article, we spoke with Valuenex, a big data predictive analytics and consulting services company with a focus on data visualization for intellectual property.

We examine the business value of IP analytics using real IP examples from the IP portfolios of Facebook and Amazon. Much of this article is based on an in-person interview at Valuenex’s Menlo Park office, where I was joined by members of the Valuenex team, including President and Founder Tatsuo Nakamura.

The topics for our Valuenex interview – and the resulting article below – were drawn from Valuenex’s recent 12-page white paper called “Facebook – A Breach in the Wall”.

The white paper gives a technological approach and assessment of Facebook’s IP that allowed the recent Cambridge Analytica scandal to happen, shows the areas of direct overlap between Facebook and Amazon’s IP innovations and shortcomings, and explores more screenshots and features from Valuenex’s big data visualization solution.

The Role of Artificial Intelligence in Patent Analytics

Artificial intelligence isn’t required to search for patents. The US Patent and Trademark Office website allows for simple searches based on terms and companies.

The business value, however, isn’t simply in creating lists of patents filed by a given company. Dr. Nakamura told us that for business leaders, the value is found in determining what that patent activity means.

One-by-one searches aren’t able to determine important context about the meaning of patents, including:

- The “direction” of a company’s patent developments (i.e. what technologies are receiving more or less investment over time?)

- The “white space” of what might be missing from a patent portfolio, or what new technologies could be developed off of a company’s existing IP efforts

- Mapping the context of different IP innovations

Sam Kovach, Director of Global Operations at Valuenex, explains the fundamentals of the product:

“There are many tools which allow you to search patents. Actually understanding the evolutions of what’s going on within a company’s portfolio, or within an industry – that’s where the Valuenex analytics come in.

We can take up to 100,000 patents and analyze them together and see where they fall in a landscape. We can see where a company was in it’s innovations during the beginning of a time range, its movement throughout, and its trajectory at the end of that time range – which can help predict where they will move in the future.”

These problems are the reason Dr. Nakamura began his work applying artificial intelligence to making meaning from IP data. He tells us that proprietary and advanced algorithms transforming thousands of patents into a visual “landscape” of clusters is the secret sauce of what Valuenex does.

We were told that the process for that “landscape” happens in the following steps:

- A group of patents is selected from companies, fields, and/or time ranges

- The text information of those patents (from the title, the abstract, and the body of the patent itself) are semantically analyzed to determine which words and phrases are most important for that patent in relation to all others in the dataset

- Then, after applying scaling methods that bring the datasphere down to 2D, the patents are visually displayed in a landscape, with close or “clustered” patents representing closely related similarities in total text content, and farther away patents representing less related terms and phrases, a.k.a. different technological coverage

Dr. Nakamura tells us that Valuenex customers use this visual display to determine new areas for product development, R&D strategy planning, competitive insight, and much more.

An automotive company may realize that a white space between touchscreen-related patents and communications-related patents might represent an opportunity to develop a new product to fulfill both needs. This might be confirmed if the automotive company uses the same Valuenex analysis to find that its competitors have patents that bridge both touchscreen and communications areas.

During our conversation, Sam mentioned that – five years ago – the Valuenex team had seen both Honda and Google converging with more and more similarities in their patent portfolios. Upon closer inspection, “autonomous driving” technologies were where the overlap was happening, and more specifically, sensor technologies. Looking back today it seems obvious that the two would converge in that area, but Valuenex found this well before any joint efforts between Honda and Google were publicly announced.

Sam states that this kind of trend is potentially easier to find if you’re able to look at a company’s patent filings month-over-month.

Jiyoung Choi, Chief Operating Officer at Valuenex summed up what she believes to be the core challenge of patent search – and why AI is required to solve the problem.

“The problem with patent search is… search. You can only find what exists, and that doesn’t tell companies enough about what they should be developing, or the directions that their competitors are moving in.”

Example Analysis of Facebook’s IP

To see this patent visualization application in action, I asked Valuenex to give us a tour through the intellectual property of some of tech’s biggest firms. Fortunately, Valuenex had just finished their white paper on Facebook and Amazon, so we had a series of interesting findings to explore right away.

In the video below, Sam takes me through an exploration of Facebook’s IP, analyzing the “clusters” of patents, and what the changes and variations in those patents have meant over time:

As we see in the video, Facebook’s largest patent cluster seems to be in the domain of “instant messaging and communication systems” and “third party systems”. More recent patents files outside of Facebook’s existing clusters include “managing silence in voice recognition” and “navigating virtual environments”.

It’s important to note that the clusters of terms don’t emerge from some kind of manual tagging of each patent, but by an artificial intelligence determining the most important words in any given patent’s text.

Sam took us a bit farther into the analysis of Facebook’s activity over time, using Valuenex software to find a kind of “trend line” through the landscape of patent filings over time:

Comparing Facebook’s first 3 years of filings to their most recent years, we see changes in the “cloud” of terms that summarize those years. For instance, “graphics” doesn’t seem to show up (percentage-wise) as much today as it did years ago, and “content” and “node” seem to be a greater focus in more recent years.

Example Analysis of Amazon’s IP

Through a view in Valuenex’s software, it seems clear that Amazon’s IP portfolio is much wider in scope than Facebook’s – which makes sense given the fact that Facebook’s technology is almost entirely limited to the digital world, while Amazon has logistics, warehousing, robotics, Echo (hardware), and other core areas of focus.

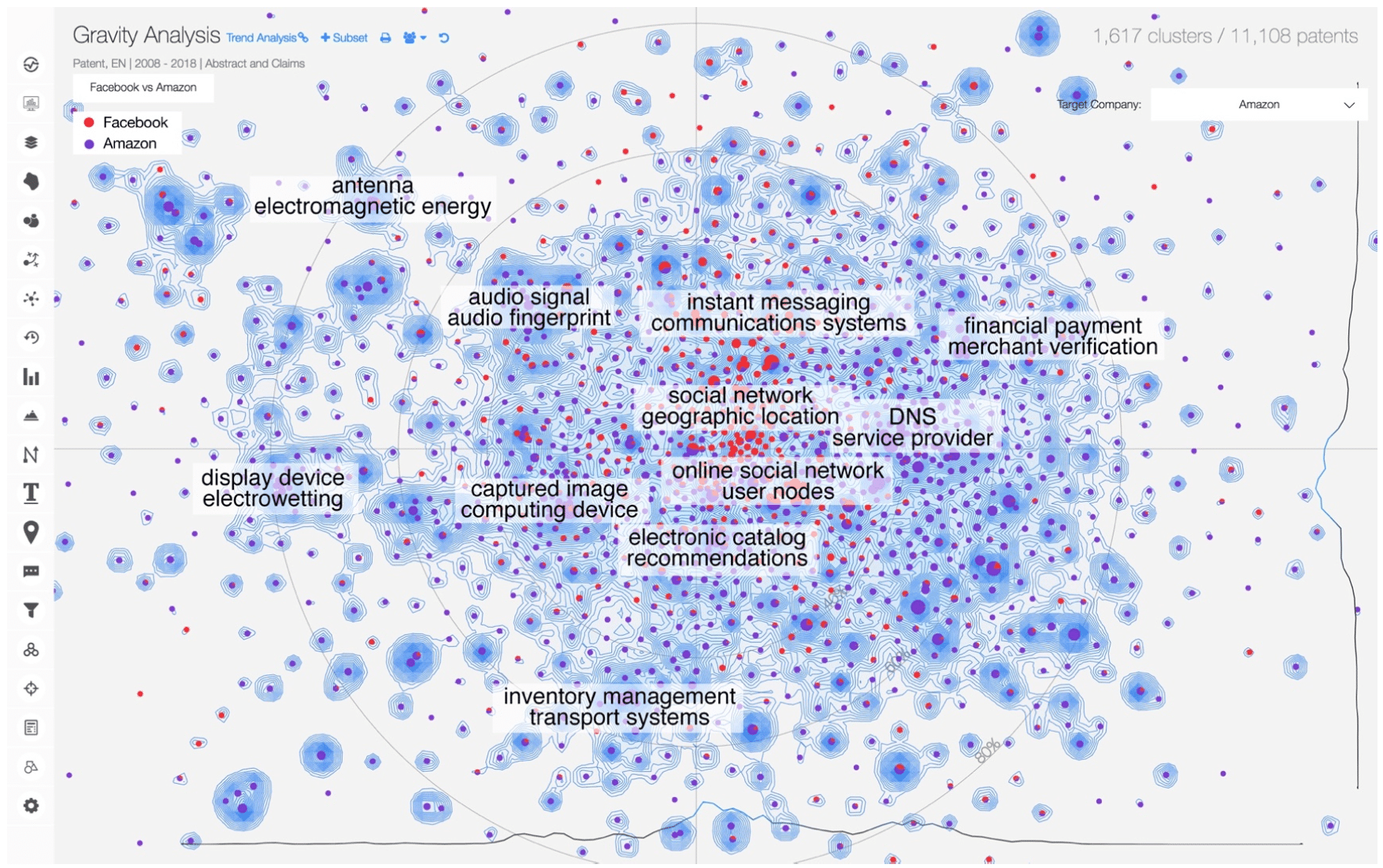

Amidst the 11,108 Amazon patents between 2008 and 2018, we see clusters that are wholly unique from Facebook, including: “electromagnetic energy, audio signals, financial payments, DNS servers, and inventory management systems”.

Comparing and Overlapping Intellectual Property Maps

After exploring a few examples on Mr. Nakamura’s laptop, it became clear which new kinds of questions could be asked of the data. For example, it seemed evident that Amazon had many more patents related to the keyword “security” than did Facebook.

Our hunch was that this might be because Amazon handle’s so many credit card transactions that it might need to develop more security for payment information, and by inspecting Amazon’s IP portfolio we were able to see clearly that financial transaction security was indeed a large portion of the firm’s security IP.

In the video below, we went deeper into the Facebook-Amazon comparison with Sam Kovach, including the areas of technology overlap between the two firms, and a direct comparison of the overall range of their patent filings:

Data Visualization Applications Beyond Patents

Using artificial intelligence to create visual “landscapes” of unstructured data is an ability not limited to the domain of IP.

While I’m told that IP remains a major focus on Valuenex’s clientele, the firm frequently performs analyses and case studies with non-patent literature, such as scientific reports, financial news, customer reviews, and more.

During our visit at Valuenex’s Menlo Park office, Jiyoung Choi gave a recent example of how their data visualization data can be used with unstructured data related to investing and acquisitions:

“We recently analyzed the Crunchbase database for companies in different sectors, including AI and IoT. There might be 8,000 AI companies in Crunchbase, so it’s hard to understand who are the key players with a simple search.

We can create a network map of founders, investors, universities, and use those as proxies to determining how likely the companies are to succeed in growing or raising funds.”

Jiyoung mentions that companies might use this kind of data for:

- Finding companies to partner with

- Finding companies to acquire

- Finding companies to invest in

About Valuenex

Valuenex was our sponsor and partner for this article about AI for patent search. ValueNex is a big data, predictive analytics, and consulting services company. Founded in Tokyo in 2006, the company provides solutions for R&D strategy, IP monetization and evaluation, financial investment analyses and leveraging, and technology convergence mapping.

To learn more about the insights to be found through visual patent analysis, and to go deeper into the comparison of patent activity between Facebook and Amazon, download Valuenex’s recent white paper titled: “Facebook – A Breach in the Wall”.

This article was sponsored by Valuenex, and was written, edited and published in alignment with our transparent Emerj sponsored content guidelines. Learn more about reaching our AI-focused executive audience on our Emerj advertising page.

Header image credit: White & Case