A company by company examination of the top car makers public investment and statements by their top executives makes it clear that most car companies are betting that artificial intelligence utilized in self-driving will be inevitable, and they’re all jumping in with investment and initiatives.

With billions of dollars in R&D and acquisitions, there’s plenty of fodder for media hype in machine learning, but there haven’t been many concerted efforts to bring together the facts and answer fundamental questions, such as:

- What do companies like Ford, GM, BMW and others have as their self-driving car timelines?

- What have the major automakers invested in their self-driving initiatives, in terms of internal investment and acquisitions?

At Emerj, the AI Research and Advisory Company, we provide business leaders with insight on how AI will affect their industry in the short and long-term and what they need to do to compete in the market. Part of our AI Opportunity Landscape methodology involves research into what executives at the top players in a given industry are saying about how their companies are investing in AI.

In this article, we do just that—laying out research and CEO quotes to determine the self-driving timelines of the world’s 11 largest automakers. All businesses and industries will be impacted by the impending transitions in autonomous vehicle tech, and we aim to put the most relevant facts together for business leaders and auto enthusiasts alike.

First, we’ll break down what “self-driving” means (in it’s 5 different levels of autonomy). The rest of the article will be an ordered list of the 11 top automakers, followed by their predictions, executive quotes, and any noteworthy financial data about their self-driving initiatives.

Defining “Self-Driving” in Levels

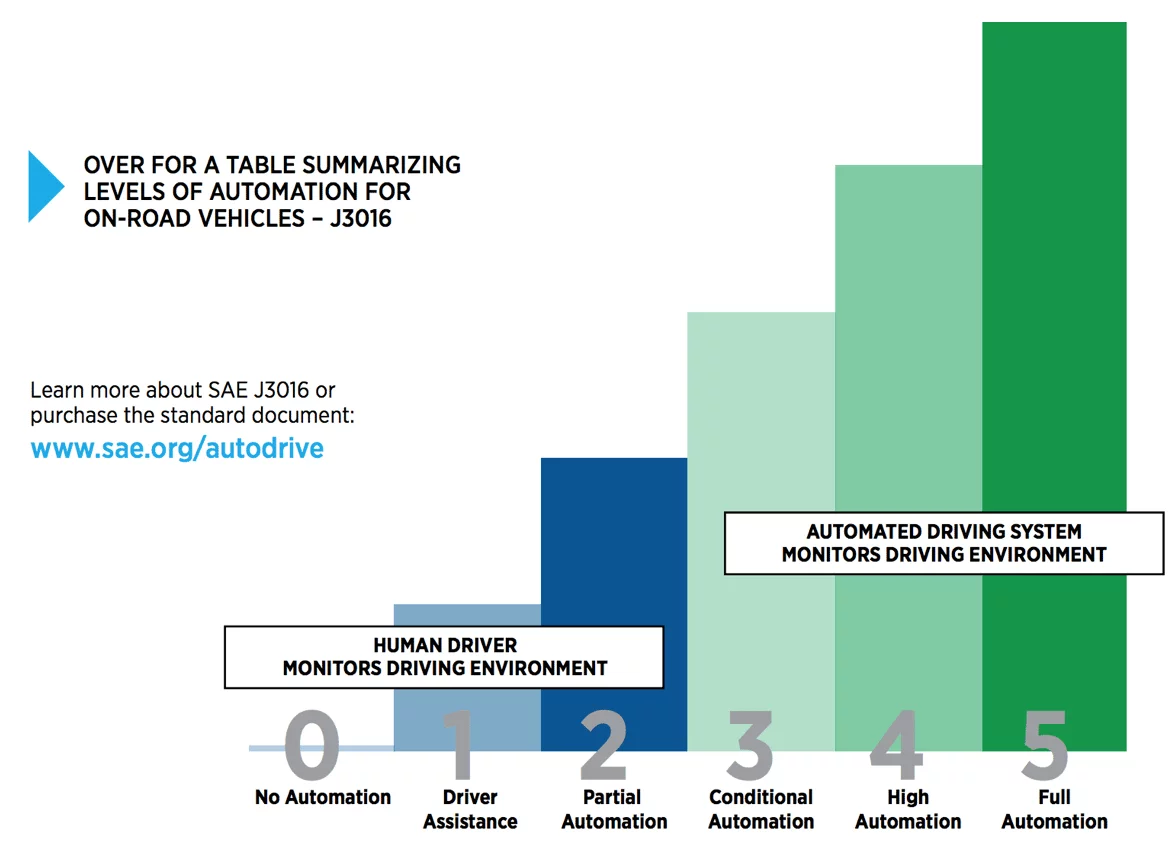

“Self-driving” is a rather vague term with a vague meaning. For this article, we’ll be referencing the “self-driving levels” as defined by the SAE International, which can be viewed below:

This means the vehicle can safely drive itself under specific conditions but the driver will need to quickly intervene when called on. This is a car that could drive itself on the highway while you watch a movie but would need you to take control when you get off the highway. Some may view this as only partially self-driving.

- Level 1 automation some small steering or acceleration tasks are performed by the car without human intervention, but everything else is fully under human control

- Level 2 automation is like advance cruise control or original autopilot system on some Tesla vehicles, the car can automatically take safety actions but the driver needs to stay alert at the wheel

- Level 3 automation still requires a human driver, but the human is able to put some “safety-critical functions” to the vehicle, under certain traffic or environmental conditions. This poses some potential dangers as humans pass the major tasks of driving to or from the car itself, which is why some car companies (Ford included) are interested in jumping directly to level 4

- Level 4 automation is a car that can drive itself almost all the time without any human input, but might be programmed not to drive in unmapped areas or during severe weather. This is a car you could sleep in.

- Level 5 automation means full automation in all conditions

Since these levels don’t mean much to people outside the industry, car makers often don’t talk about their technology in these specific SAE terms. The big potential promise for people is either car that drive themselves for a large part of a person’s highway commute (level 3) or cars that can drive themselves almost as long as you live in a covered metropolitan area (level 4).

As you read the rest of this article, it will be useful to understand that most executives referring to “self-driving” are referring to levels 3 and 4. Whenever possible, we distinguish between what kind of self-driving a specific executive is speaking about (i.e. Highway autonomy, or full metropolitan autonomy).

GM – Self-Driving Beyond 2020

In 2016, GM spent $581 million to acquire Cruise Automation, and in 2017, CEO Mary Barra wrote, “We expect to be the first high-volume auto manufacturer to build fully autonomous vehicles in a mass-production assembly plant.” The company intended to focus its self-driving car efforts on a ride-hailing service.

As such, in early 2017, Reuters reported that GM was rumored to have plans to deploy thousands of self-driving electric cars in 2018 with its ride-sharing affiliate Lyft. GM spent $500 million to buy part 9 percent stake in Lyft as part of its strategy to create an integrated network of on-demand autonomous vehicles.

Making mobility as a service the first use of GM self-driving cars has several clear advantages. It means these cars will only need to be programmed to operate in a limited geographic area. The significant external hardware additions needed for autonomous systems in cars might also turn away average car buyers in favor of something more traditional and pleasing to the eye.

However, GM didn’t meet its stated goal. Reuters reported that GM was delaying its launch of self-driving cars to the public until well after 2019, citing the need for further testing. According to former GM President and current Cruise CEO Daniel Ammann, “When you’re working on the large scale deployment of mission critical safety systems, the mindset of ‘move fast and break things certainly doesn’t cut it.”

This kind of statement contrasts with the way executives at the largest carmakers were talking in 2016, but it’s indicative of a shift in the self-driving car conversation. Carmakers are no longer rushing to be the first to deploy fleets of autonomous vehicles for consumers and ride-hailing services. Instead, they’re in large part backing away from their earlier predictions as to when self-driving cars will be on the road.

As of 2019, Cruise is focusing on testing their vehicles in select cities. The company is testing its vehicles in various cities across California, Arizona, and Michigan. According to Ammann, “In order to reach the level of performance and safety validation required to deploy a fully driverless service in San Francisco, we will be significantly increasing our testing and validation miles over the balance of this year, which has the effect of carrying the timing of fully driverless deployment beyond the end of the year.”

In addition, GM asked the federal government for clearance on developing self-driving cars that lack parts like steering wheels. The US Department of Transportation won’t make a decision on the request until at least 2020.

Ford – True Self-Driving by 2021

In 2017, Ford invested $1 billion into AI-startup Argo AI. The robotics company was created by former Google and Uber leaders. Ford first intended to use these vehicles for a ride-hailing service, similar to GM.

In 2019, Ford’s Argo AI invested $15 million into creating an Autonomous Vehicle Research Center at Carnegie Mellon University, renowned for its machine learning department. For the next five years, the Autonomous Vehicle Research Center will focus on improving self-driving technology, including more refined sensors and more robust algorithms. The Center is headed by Deva Ramanan, Associate Professor at Carnegie Mellon University and Principal Scientist at Argo AI.

Also in 2017, Ford Motor CEO Mark Fields told CNBC that Ford planned to have a “Level 4 vehicle in 2021, no gas pedal, no steering wheel, and the passenger will never need to take control of the vehicle in a predefined area.”

Ford actually planned to skip right over Level 3 automation and go straight to Level 4. During testing, Ford’s Chief Technology Officer Raj Nair found that level 3 automation would lead to the company’s engineers dozing off and not being situationally ready to take over when called on.

However, in early 2019, Ford CEO Jim Hackett admitted: “We overestimated the arrival of autonomous vehicles.” When speaking about Ford’s planned self-driving car fleet, which the company still expects to launch in 2021, Hackett said “Its applications will be narrow, what we call geo-fenced, because the problem is so complex.

That said, less than a week later, Ford announced in its earnings call that the company planned to have 100 autonomous vehicles on the road by the end of 2019. It’s unclear if this will happen, especially given the caution with which Hackett discussed self-driving technology.

Ford’s President of Mobility, Marcy Klevoran, said, in general, Ford tests its self-driving cars in cities in which it’s “really difficult… to prove capability” (in other words, cities with a lot of people, construction, and unconventional roads and intersections). This could train the algorithms that supply the self-driving capacity of the cars for more unexpected, hectic situations. As a result, these cars would be more likely to stop, turn, or slow down in variety of nuanced situations that call for it.

Once again, it’s apparent that in 2019, executives at the largest automotive companies are focusing on branding their approaches to self-driving technology as “safety first” over appearing on the cutting edge, as was the case in 2016.

Honda – Self-Driving on the Highway by 2020

At the end of 2016, Honda announced it was in discussions with Waymo, Alphabet Inc.’s self-driving car company, to include Waymo self-driving technology in their vehicles.

Honda’s goal was to have cars that can at least drive themselves on highways by 2020, but this may be too lofty a goal given recent developments. Honda ended its talks with Waymo in 2018 over differences in how both parties wanted their work together to roll out. Waymo wanted Honda to supply cars for its self-driving technology, whereas Honda wanted access to that technology.

Shortly after, Honda bought into GM’s Cruise to create an autonomous vehicle specific to Cruise. It seems as though Honda is having a harder time jumping into self-driving technology in comparison to GM and Ford, both of which invested heavily into or acquired self-driving car startups several years ago.

Toyota – Self-Driving on the Highway by 2020

Toyota has been one of the car companies most skeptical about autonomous vehicles, but in 2015 they made a big investment to catch up. Toyota invested $1 billion over five years in the Toyota Research Institute to develop robotics and AI technology. Toyota hoped to launch products based on its Highway Teammate programs in 2020.

Gill Pratt, the CEO of the Toyota Research Institute, said “none of us in the automobile or IT industries are close to achieving true Level 5 autonomy. We are not even close.” As of 2016, however, he did believe that it is very likely a number of companies will within a decade have Level 4 cars operating in specific areas, which would be very useful to ride-sharing companies.

In 2019, Toyota announced it will be employing NVIDIA’s technology to bolster its autonomous vehicles.

Renault-Nissan – 2020 for Autonomous Cars in Urban Conditions, 2025 for Truly Driverless Cars

In 2016, Renault-Nissan partnered with Microsoft to help advance its autonomous vehicle efforts. In 2019, the company also began talks to merge with Fiat-Chrysler in large part to combine efforts into self-driving car technology, although the merger did not come to fruition. In addition, Renault-Nissan partnered with Waymo to work on self-driving car technology for its vehicles.

The carmaker planned to release 10 different self-driving cars by 2020. CEO Carlos Ghosn told TechCrunch, “So we know that autonomy is something of high interest for the consumers. This is the first brick — one-lane highway. Then you’re going to have multi-lane highway, and then you’re going to have urban driving. All of these steps are going to come before 2020. […] 2020 for the autonomous car in urban conditions, probably 2025 for the driverless car.”

Volvo – Self-Driving on the Highway by 2021

Volvo is betting that self-driving cars will change both the ride-sharing industry and the luxury car market. In 2016, Volvo entered into a $300 million joint venture with Uber to develop next generation autonomous driving cars.

The company is providing the physical vehicles for Uber’s self-driving tests. Volvo and Uber are still working together as of 2019.

CEO Hakan Samuelsson said in an interview, “It’s our ambition to have a car that can drive fully autonomously on the highway by 2021.” He envisioned that full autopilot would be a highly enticing option on premium vehicles and at first would cost $10,000.

Volvo has already taken steps to avoid some of the consumer concern and legal issues that could slow the development of self-driving vehicles. In 2015, Volvo became the first car company to promise to accept full liability whenever one of its cars are in autonomous mode.

Hyundai – Highway 2020, Urban Driving 2030

Hyundai is working on self-driving vehicles but with more of a focus on affordability. In 2016, Hyundai claimed it was, “developing its own autonomous vehicle operating system, with the goal of using a lot less computing power. This will result in a low-cost platform, which can be installed in future Hyundai models the average consumer can afford.”

In 2016, Hyundai Senior Research Engineer Byungyong You told Drive, “We are targeting for the highway in 2020 and urban driving in 2030.” To achieve this goal, Hyundai invested $1.7 billion into its self-driving car program.

Hyundai Vice Chairman Euison Chung painted a relatively clear vision for their autonomous initiatives (what they’re calling “Future Mobility”) at CES 2017. To skip the initial tee-up and housekeeping, we recommend skipping ahead to 6:15 in the video below:

In 2019, Hyundai partnered with Russian search company Yandex, which has been working on self-driving car technology. According to Yandex, the goal of the partnership is to “to create a self-driving platform that can be used by any car manufacturer or taxi fleet”

Hyundai also invested $30 million in self-driving car developer Aurora. The companies have been working together since 2018 to integrate Aurora’s technology into one of Hyundai’s vehicle lines. Aurora focuses on Level 4 self-driving cars.

Daimler and BMW- Nearly Fully Autonomous by Early 2020’s

In 2017, Daimler announced a high profile development agreement with Bosch, one of the largest parts suppliers. The goal is to bring both level 4 and level 5 autonomous vehicles to urban areas “by the beginning of the next decade.” This announcement came less than a month after Bosch announced its own collaboration with NVIDIA to develop self-driving systems.

Also at the start of 2017, Daimler announced a deal with Uber to introduce its self-driving cars on Uber’s ride-share platform in the coming years. Like several other car makers, Daimler view mobility as a service as a logical place to first use self-driving cars.

But in 2019, Daimler partnered with BMW to offer their own ride-sharing service in competition with Uber, combining five of their ride-hailing services. According to Harald Kreuger, CEO of BMW, “The five services will melt together more and more into a mobility offering with fully electric and self-driving fleets…This will be a central pillar of our strategy as a mobility provider.” The partnership will involve up to 1,200 engineers and technicians from both companies working to create level 4 autonomous vehicles.

BMW and Daimler’s Mercedes also partnered to work on creating Level 4 self-driving cars. The companies are eyeing 2024 for commercial release of the vehicles. This is departure from BMW’s predictions from several years ago.

In 2016, BMW announced a high profile collaboration with Intel and Mobileye to develop autonomous cars. Officially the goal was to get “highly and fully automated driving into series production by 2021.”

Elmar Frickenstein, BMW’s Senior Vice President for Autonomous Driving, said that they should have Level 3 cars by that deadline but it would be possible the company could deliver cars with Level 4 or 5 capacity in 2021.

Daimler is in a similar position with regards to its predictions. Ola Källenius, Chairman of the Board at Daimler, predicted large-scale commercial production of self-driving cars to take off between 2020 and 2025.

Dailmer’s self-driving “Freightliner Inspiration Truck” is currently allowed to drive in Nevada.

Fiat-Chrysler – CEO expects there to be some self driving on the road by 2021

In 2016, Fiat-Chrysler began work with Waymo to test self-driving Chrysler Pacifica Hybrid minivans. Around the same time, Fiat-Chrysler’s late CEO Sergio Marchionne suspected self-driving cars could be on the road by 2021.

Unlike Honda, Fiat-Chrysler has continued to work with Waymo. John Krafcik, Waymo’s CEO, stated that the company planned to launch 10 Chrysler Pacificas through Lyft at the end of June 2019. In addition, in 2019, Fiat-Chrysler entered into a partnership with Aurora as well.

Tesla – Beginning of 2020

Tesla stands out from the other automotive companies in the way its leadership continues to make bold claims about the trajectory of self-driving car technology. CEO Elon Musk predicted that by the end of 2017, a Tesla would be able to drive from Los Angeles to New York City without a human touching the wheel.

That prediction didn’t exactly come true. That said, Tesla Autopilot does seem to allow for Level 4 self-driving on highways, as shown in the video below in which a passenger merely sits in the driver’s seat; the car drives itself:

In 2019, Musk’s approach to predicting when Tesla vehicles will have full autonomy is much less conservative than his peers. While others have backed down from their original predictions, going so far as to suggest Level 5 self-driving is still relatively far away, Tesla announced that it plans to provide its vehicles with a software update sometime by the end of 2019 or beginning of 2020 that would allow “full self-driving.”

According to Wired, he elaborated on this timeline, suggesting that Teslas will be fully autonomous by the end of 2020.

Although there are some carmakers that haven’t directly walked back their predictions for when their vehicles will be autonomous, the earliest date amongst these predictions have remained 2021 for several years. Others have recently predicted needing several more years.

But although Musk was wrong about his prediction that full self-driving would be possible by the end of 2017, this hasn’t seemed to stop him from setting another ambitious date.

Concluding Thoughts for the Business of Autonomous Vehicles

Although in 2016 many industry leaders expected autonomous vehicles to be commonplace on highways in the early 2020s, this doesn’t seem likely. When they made their predictions, automotive executives were likely caught up in the AI hype. Now that the conversation around AI in the enterprise is more informed, executives are walking back their initial statements because they understand how difficult machine learning projects are in general, let alone those for self-driving cars.

Many of the largest institutions are only now starting to look into artificial intelligence for digitizing paper documents and searching through their digital databases. Although there’s a lot of talk about them, chatbots aren’t anywhere near the point of being able to hold human-like conversations with customers.

It makes sense that despite the massive amounts of venture capital in the space, self-driving car technology is still a long way off before they become available to people at any legitimate scale.

The other consideration is that self-driving adoption timelines depend heavily on the regulatory developments in the next few years. Autonomous vehicles require both the right legal and technological frameworks.

There are serious liability concerns when machines operate themselves in a potentially dangerous environment. Obviously, a car company doesn’t have much incentive to mass produce a true self-driving car if there is nowhere they can legally drive, or if the legal liability they bear would be considered too risky. Regulations regarding AI are likely only going to grow in number and complexity, making it difficult for companies to navigate how they use the technology.

This challenge is compounded for AI use-cases that involve people’s lives. Healthcare, for example, is unlikely to see widespread AI adoption in the coming years due to what’s at stake if, for instance, a machine learning-based software for diagnostics misdiagnoses someone. The same goes for self-driving cars. A self-driving car has already been involved in the deaths of five people since 2016.

Even with a heavy degree of skepticism, it seems likely that if you live in a major city you will be able to hail some form of automatic car ride in less than a decade. AI is becoming more and more a part of everyday life and automobiles are no exception.

Emerj For Enterprise Leaders

Leaders at global companies use Emerj AI Opportunity Landscapes to stay abreast of AI trends in their industries. Clients get a ranking of the AI vendors in their industry and analysis of how AI is impacting their industries today, allowing them to select the right AI vendor and invest in the AI solutions most likely to deliver a strong ROI. Contact us to learn more.