There are numerous AI vendors servicing the banking industry, but many of them lack the kind of funding that these five vendors have raised. In this article, we run through the top 5 AI vendors in banking by funding according to information on Owler. We provide an overview of their products and the AI tech that makes them possible.

We begin with Dataminr, a company which has raised almost double the vendor with the second-most funding.

Dataminr

Total Funds Raised: $577 MM

Technical Capabilities: Natural language processing for retrieving data on the web

Functions: Wealth management/trading

Dataminr offers an AI-based information search and retrieval software that they claim can help banking and financial firms automatically stay aware of the news that might impact financial markets.

The software pulls information from various text sources and provides the user with a timeline in which each important event takes place. Dataminr’s clients include institutions that use this solution to determine corporate risk, disseminate relevant news, or plan company spend on energy and other utilities.

The Dataminr software can purportedly analyze social media data from platforms such as Twitter live streams and financial news outlets to identify the most relevant information for a client. These may include emerging financial trends and the availability of certain resources.

The software likely uses natural language processing (NLP) because it allows for analyzing text data. The software can likely automatically read through large volumes of information to then retrieve only the parts that are relevant to the client’s needs.

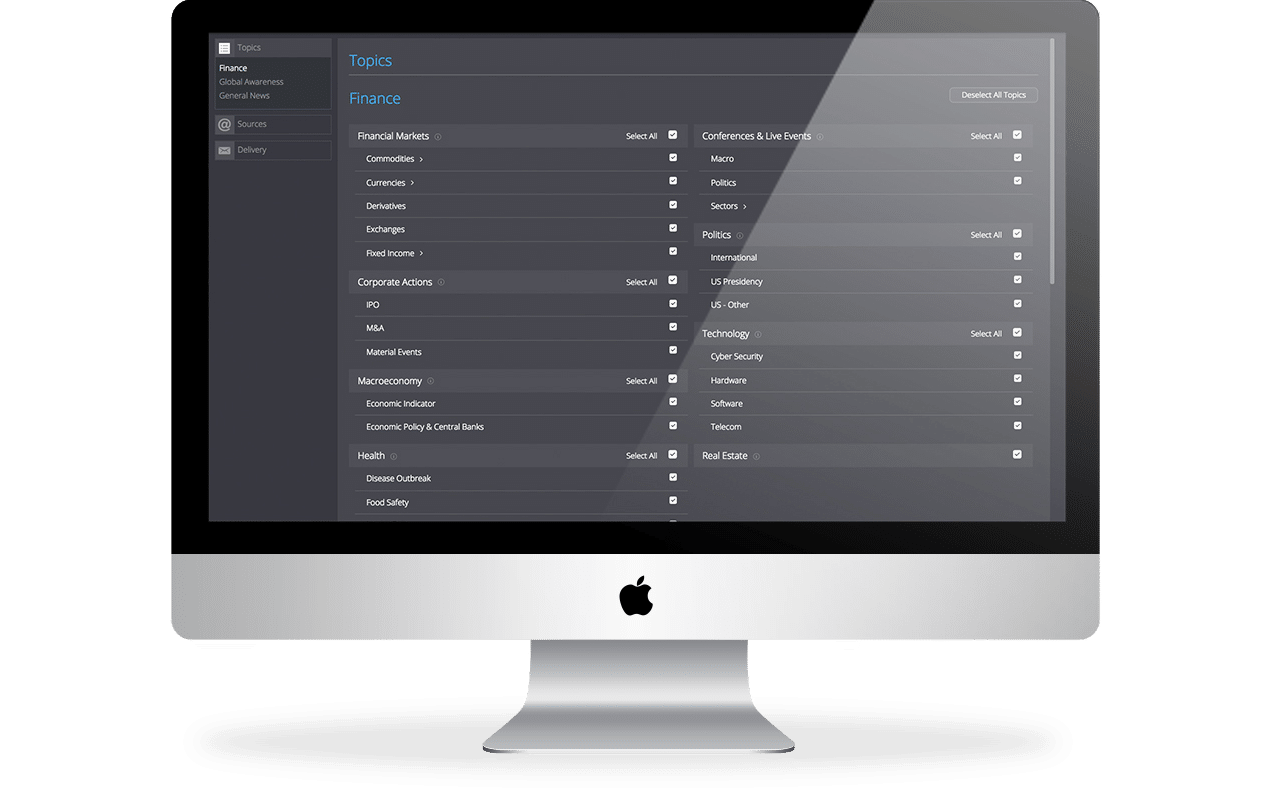

According to Dataminr, the ML algorithms that power their software have been trained to extract information based on the client’s inputs on a user dashboard. The figure below shows how users can input the topics, companies, or economic factors that they want to monitor:

Dataminr’s software can purportedly classify information from news or social media to create connections between names of companies, financial tickers, and brands. This classification system also categorizes each new event based on the priority and urgency of its potential impact. It is likely that users can use the dashboard to view the events listed by priority or in chronological order.

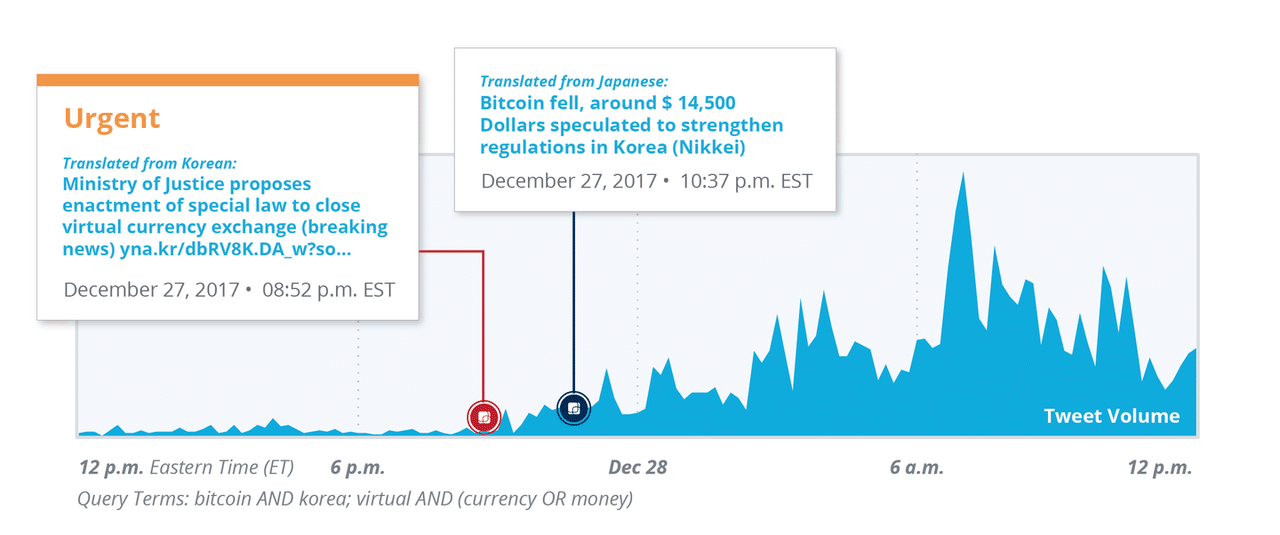

According to a case study from Dataminr’s website, the company helped alert their financial clients with cryptocurrency regulations before the value of Bitcoin dropped. The South Korean government had announced its plans to regulate the trade of cryptocurrency, and the value of Bitcoin dropped by 11% as a result. At this time, Dataminr sent an urgent alert to its clients shortly before the news broke which helped them reduce losses.

The graphic below shows how the software identified the event and sent the alert to customers nearly two hours before the news broke:

ZestFinance

Total Funds Raised: $262 MM

Technical Capabilities: Data analytics for weighting new data sources and calculating creditworthiness

Functions: Underwriting and credit modeling

ZestFinance offers a platform called ZAML, which the company claims can help banks process alternative data to generate credit scores for underbanked individuals. This alternative data can include customer spending patterns which are then used to create a relative score for customers with little to no credit history.

The company claims users can feed their ZAML platform information such as a customer’s location data, financial transactions, or data from credit bureaus to assess creditworthiness. The ML algorithm powering the software is trained to identify patterns within this customer data in order to determine the risk each customer poses to the client company should they loan them money. This allows banks to provide lending services to a customer population that were previously ignored.

The 2-minute video below from ZestFinance discusses how the ZAML platform works and how it can help banks and financial institutions:

The ZAML platform can also be used in other lending applications. In the case of auto lending, the software can take in information about the make, model, and mileage of the car.

Additionally, it can take in information about the customer, such as whether they have filed for bankruptcy in the past. The software can then predict a credit score for each driver, allowing the client auto lender to personalize pricing for each driver based on their perceived level of risk of defaulting on the loan.

In 2016, Prestige Financial Services had to make their lending application approval process more stringent due to a string of car loan defaults.

This resulted in a much higher loan underwriting threshold that only three out of every ten applicants could be approved for a loan. Prestige deployed ZestFinance’s ZAML platform to help improve the loan approval selection process while still keeping the risk of defaults at the same level.

ZestFinance claims they used data from customer loan history, the credit bureau, and alternative scoring statistics from Prestige. This allowed the software to identify over 2,700 unique borrower characteristics that were used to improve the loan underwriting process.

These characteristics were likely common trends amongst transactional data and customer behavior.

Previously, Prestige had only used 23 characteristics to underwrite loans. The company claims that the software helped improve the underwriting process over three months resulting in a reduction of credit losses by one third compared to the previous year.

Darktrace

Total Funds Raised: $230 MM

Technical Capability Anomaly detection

Functions: Cybersecurity

Darktrace offers the Enterprise Immune System, an anomaly detection software for cybersecurity in the banking and finance industries. Their solution can purportedly prioritize system breaches instead of locking them out, which allows the client company to prevent similar attacks in the future. Although new cyberattack methods are always being developed, frauds and hackers will always navigate the same types of network infrastructures to get to the data they want to steal.

The video below demonstrates how Darktrace’s software works. It shows software’s threat visualizer and user interface. The system also has a log of all network activity that users can search to investigate security threats for details on their methods and access points:

Darktrace describes how their software works by comparing it to the human body’s immune system. They claim the Enterprise Immune System is similar because it reacts to potentially dangerous changes in customer behavior in real time just as the body reacts to bacteria.

More advanced malware such as ransomware acts faster than a human employee can react to it, and leave them with very few options for combating it without a tool that can slow that process down.

Darktrace lists a case study in which they claim to have helped the South Korean company KB Life Insurance improve their security for their accessible database and protect against more advanced threats in the future. The company claims that KB Life Insurance used the Enterprise Immune System to gain an understanding of their “pattern of life,” or the broad list of acceptable network activities. This likely helped them understand where any false positives had been coming from, if any.

KB Life Insurance was susceptible to cyber attacks and malware because their database was shared between themselves and multiple third party companies.

The system scanned for “unknown unknowns,” or specific malicious network activities KB had not yet encountered. According to the case study, Darktrace’s software was able to identify real attacks within a few weeks of initial adoption. KB Life Insurance’s security team was able to stop the attack before they lost any important data.

Envestnet (Formerly Yodlee)

Total Funds Raised: $190 MM

Technical Capability: Conversational interface

Functions: Customer Service

Envestnet is a data aggregator and analysis company that offers numerous AI solutions for the banking industry. The company offers a software and service called Data+Intelligence which they claim helps banks and other financial institutions improve the customer experience through personalized service in lending applications.

The company claims their Data+Intelligence product is built from their large stores of financial data which they claim comes from tens of millions of customers.

This financial data may include information from various financial accounts such as cash, credit, loans, investments and bills. The Data+Intelligence software uses this data along with the machine learning algorithms that power it to predict how individual customers of the bank can improve their finances.

The software identifies patterns from the datasets provided from Envestnet that correlate with responsible financial practices from banking customers. It can then use these insights to provide recommendations to banking customers for managing their funds more effectively.

Envestnet acquired Abe AI, which was previously an AI firm selling conversational AI interfaces as a service. Envestnet now offers its own product they claim helps banks create these types of conversational interfaces such as chatbots. This type of chatbot can purportedly help banking and finance customers access their accounts, get product recommendations, or make payments through the chat.

Sift Science

Total Funds Raised: $107 MM

Approach: Anomaly Detection

Capability Offered: Risk Forecasting and Monitoring

Functions: Fraud and Cybersecurity

Sift Science offers a fraud detection platform called the Digital Trust Platform that the company claims uses anomaly detection to predict fraudulent behavior. This could allow merchants to monitor and get alerts of fraudulent activity such as chargebacks, fake accounts, spam, referral fraud, and possibly account takeover.

Sift Science’s software purportedly uses anomaly detection to detect the most probable instances of abuse from a global network of fraud data they have access to. The company claims to have helped over 34,000 websites protect against fraud while maintaining revenue growth.

The Digital Trust Platform’s software can be used to prevent several types of fraud such as fraudulent payments and chargebacks. This also includes other forms of content abuse fraud, which can prevent fraudsters from accessing websites and posting malicious content to them. The software can additionally detect and prevent account fraud to detect fake accounts or login breaches.

According to a case study listed on Sift’s website, the company worked with payments firm Curve to help cut down the time taken for fraud reviews and chargebacks management. Curve offers smart banking payments in the form of a card that consolidates all of the user’s credit and debit cards into one.

The company was already using large amounts of manual resources to review card applications and wanted to replace their rule-based fraud detection solution to improve efficiency in this area.

The company claims Curve was able to automate their review process by training the ML model within the software to identify which Curve card applications indicated fraud. This was based on customer transactional data. The case study states Curve saw an 80% reduction in chargebacks within weeks of deploying the Digital Trust Platform solution.

Header Image Credit: Opalwave