Our AI in Banking Vendor Landscape and Capability Map report details the state of various AI approaches and capabilities within specific banking functions, measuring them on their level of funding, evidence of ROI and adoption at large banks, and more. In this article, we discuss how and where banks are using natural language processing (NLP), one such AI approach—the technical description of the machine learning model behind an AI product.

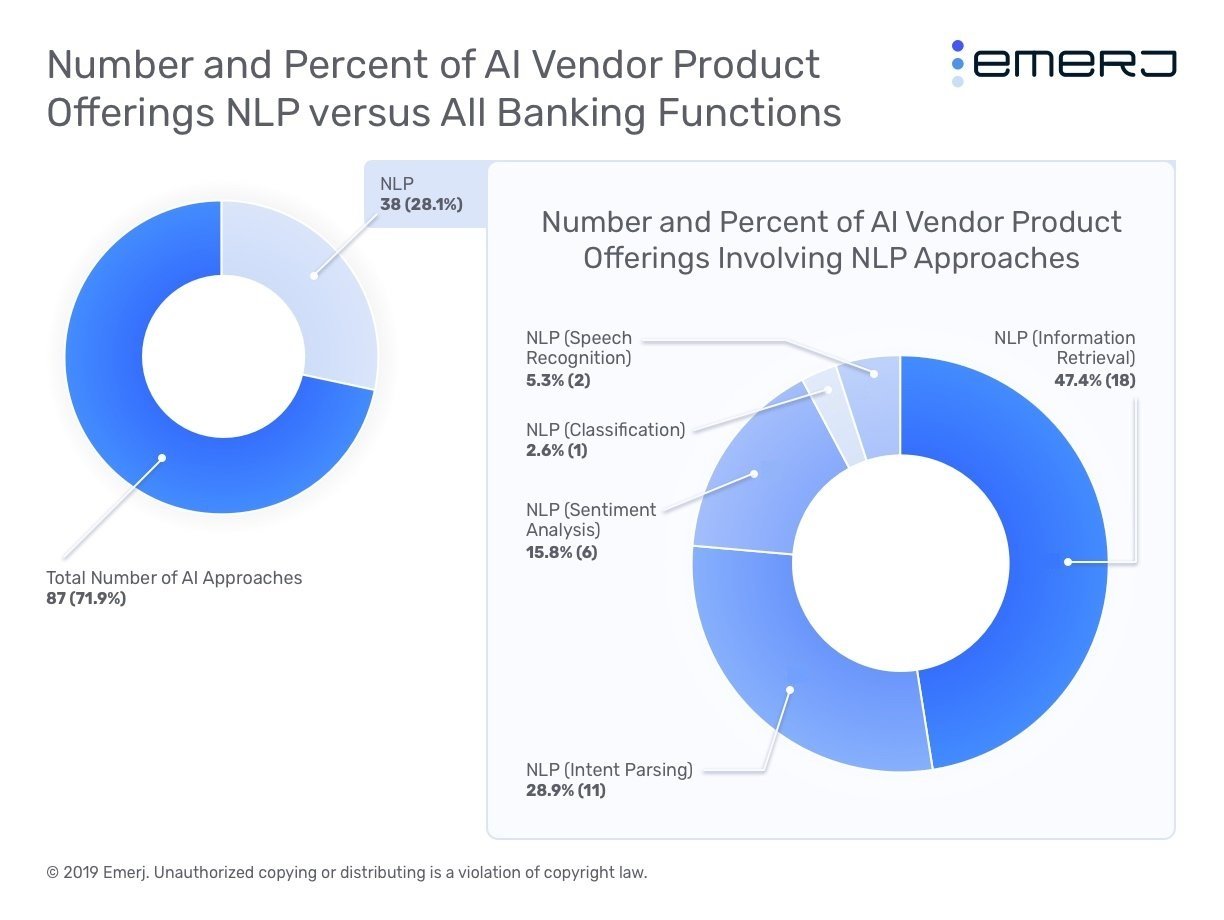

The graph below details NLP-based AI vendor products in banking compared to those of other AI approaches. In addition, it breaks down the percentages of each “sub-Approach,” such as Speech Recognition, Classification, and Intent Parsing:

There are more vendors selling NLP-based products to banks than any other single AI approach, making up 28.1% of the total AI Approaches count across vendor product offerings. The largest slice of these NLP products are for Information Retrieval, which often entails document search products.

The second-largest, Intent Parsing, often results in customer service applications, including chatbots. Interestingly, these two NLP-based sub-Approaches represent the two AI use-cases that are the most and least likely to be the focus of banks in the coming few years.

Banks are eager to automate compliance processes, and information retrieval/document search technology could help with this. Search capabilities could allow compliance officers at banks to find pertinent information amongst thousands of digital documents relatively quickly.

In turn, they can determine whether or not wealth managers are interacting with customers in accordance with regulations or find customer data and prove that it’s been deleted when a customer asks for their data to be purged as per GDPR.

These processes don’t generate revenue for the bank; they merely mitigate risk. As such, banks want to spend as little as they can on these processes.

On the other hand, customer-facing applications built on intent parsing algorithms will likely have to wait for compliance processes to be automated and for NLP algorithms to improve before banks start focusing on building them.

Although several banks have launched chatbots, these chatbots can only help customers in very small ways, allowing them to perhaps check their bank balance. The chatbots will route customer inquiries to human employees when they can’t satisfy a customer’s intent (which is often).

The banking experts we spoke to for our report downplayed the likes to which large banks are focusing on customer service, but this is in contrast to what banks are talking about in their press releases, where talk of chatbots is common.

In this article, we’ll discuss natural language processing algorithms for both customer service and document search applications in banking, illuminating two sub-Approaches of natural language processing that will play key roles in banking automation in the coming years.

To do this, we’ll dive into several vendors, as well as JP Morgan Chase, and their products’ use-cases, and we’ll close the article with a discussion about how these vendors shed light on the state of NLP in banking. We’ll start our analysis with document search technology.

Our readers can find more information on how banks can use and integrate NLP applications by downloading the Executive Brief for our AI in Banking Vendor Scorecard and Capability Map report.

Document Search

JP Morgan Chase

JP Morgan Chase launched COIN, machine learning software which they claim can help the bank’s legal teams review large volumes of legal documents using NLP.

JP Morgan claims employees of the bank’s legal team can upload legal contracts to the software to extract important data points and clauses that can speed their work. The bank’s legal team used to reportedly spend around 360,000 hours manually reviewing commercial loan agreements. The company claims this was highly repetitive and that interpretation of the contracts was prone to error.

The COIN software was reportedly trained to recognize attributes in the documents which were decided by the bank’s legal team as important for extraction and summarization. COIN analyzes a document to find words or phrases relevant to these attributes. The system then extracts these attributes from the contract and presents them to a human reviewer. The system can also reportedly route any contracts that it could not analyze to human reviewers so that they can search the document manually.

This initiative may help JP Morgan acquire important customer data that they may not have had otherwise. This could allow for a more detailed set of information on each customer and provide actionable knowledge that could increase customer retention. This idea was elucidated when we spoke to Gunnar Carlsson, co-founder of anti-money laundering AI firm Ayasdi in our podcast AI in Banking.

Our interview concerned how banks can succeed in the future through unsupervised machine learning. When asked about where he thinks the bulk of ROI from AI projects comes from in banking, Carlsson said,

“I think that the answer about ROI is more about knowing your customer. … I think in general there is a lot of understanding about where Ai is going and what’s important for it to address. But in terms of the things that are actually on the ground, we are at a fairly early stage. Customer intelligence is nascent, [but] there is nothing here that is absolutely huge.”

Despite some types of applications still developing in nascency, Carlsson stresses that a more detailed image of individual customers will invariably help banks succeed as AI becomes more prominent.

JP Morgan Chase claims that it was able to extract 150 relevant attributes from 12,000 annual commercial credit agreements in seconds using COIN, although we could not verify this claim because the company uses COIN internally. As such, there are no available case studies reporting success with the COIN software that don’t come from JP Morgan Chase themselves.

Jason Mills is Executive Director of Machine Learning & Advanced Analytics at JP Morgan. He holds an MS in Technology from Syracuse University. Previously, Mills served as Global Head of Risk Tech at Citigroup.

Sigmoidal

Sigmoidal is a machine learning consultancy that claims to have helped banks and investment firms with machine learning projects.

Sigmoidal claims to have helped an investment firm develop a trading software that uses machine learning to track patterns in how customers might spend, invest, or make financial decisions from their transaction history. The software then correlates patterns in customer investment with market developments obtained by scouting news and social media to offer personalized investment advice to customers.

Sigmoidal claims the investment firm could then automate data mining for information on market developments from news sites and social media using the software they helped them build, which the company claims can perform document classification and named entity recognition. Then, the software uses NLP to filter out the information that is most relevant to the investor’s specified needs. Sigmoidal claims that this software can also help extract details such as a person’s name and company from the text in the collected data. The system then provides the collected data on a dashboard.

Sigmoidal’s employees have individually worked on projects with NASA, DARPA, NVIDIA, Microsoft, PwC, Goldman Sachs, and Intel.

Marek Bardonski is Head of Artificial Intelligence at Sigmoidal, of which he owns 50%. He holds a Bachelor’s in Computer Science from the University of Warsaw. Previously, Bardonski served as a senior deep learning research engineer at NVIDIA Switzerland for one month. That said, Bardonski’s LinkedIn profile lists him as an advisor for multiple companies at present.

Marcin Mozejko is Principal Deep Learning Engineer at Sigmoidal. He holds an MS in Mathematics from the University of Warsaw.

Customer Service

Kasisto

Kasisto is a New York-based company founded in 2015. The company offers a chatbot called KAI, which they claim can help banks and financial institutions develop chatbots that can help their customers with making payments, fetching transactions and account details, and managing their finances using NLP.

Kasisto claims banks and financial institutions can deploy their chatbot on multiple channels, such as messaging apps and websites. The company claims the KAI Business Banking software is tailored to banks and includes a deep-learning analytics tool that can help with data collection and analysis, model training, testing, and deployment.

A bank could input KAI with historical customer transaction records, account details, and other facets of data in order to train the model behind the chatbot on the bank’s customer support standards within a few weeks, the company claims. Over the course of those few weeks, the chatbot learns to converse with customers in order to fulfill on services such as product discovery, loan applications, and customer support. The system then answers the customer’s question or fulfills their request in the chat interface. For example, the chatbot might prompt users with, “You Sent 100 US dollar wires to Singapore Yesterday. Did you know you could send a foreign-exchange ACH payment instead? Sign up here.”

According to Kasisto’s website, the chatbot can also rout conversations to human customer service agents when it cannot resolve a particular customer ticket.

Below is a short 3-minute video from Mastercard, which partnered with Kasisto, demonstrating how KAI works:

Kasisto claims to have helped JP Morgan build a chatbot that can answer customer queries sent to its treasury services division. JP Morgan deployed the chatbot and worked with several unnamed companies to train the model behind the chatbot. The project seems to still be in a pilot phase, however. Kasisto also lists DBS as one of its past clients.

Sasha Caskey is co-founder and Chief Technology Officer at Kasisto. He holds an MS in NLP from the University of Columbia in New York. Previously, Caskey served as a software engineer at IBM Research.

Personetics

Personetics is a London-based company founded in 2010. The company offers a chatbot called Assist, which they claim can help banks and financial institutions give their customers personalized banking services and aid them with product discovery using NLP.

Personetics claims banks can integrate the chatbot into their websites, mobile apps, and messaging platforms, such as Facebook Messenger and Amazon Alexa. The Assist chatbot uses historical customer interaction records to understand customer queries and fulfill requests such as sending or receiving payments, changing passwords, and setting up appointments at the bank. The system then resolves the customer’s query in the messaging interface or suggests new banking products that might be relevant for a particular customer.

This informational video featuring David Sosna, CEO of personetics, may help readers to better understand this application:

https://youtu.be/muEeMvE1VEA

Personetics claims to have helped Royal Bank of Canada integrate a chatbot into the bank’s mobile app. They called their chatbot NOMI Find & Save. The model behind the chatbot can reportedly learn customer transaction patterns and suggest recommendations for where customers might be able to increase their savings. According to Personetics, usage of Royal Bank of Canada’s mobile app increased 20% after integrating its chatbot. NOMI Find & Save also reportedly provided 100 million responses to customer queries within the first five months that the chatbot was available, although it was not mentioned if this number counted all of the responses that the chatbot gave, in which case it would not represent the number of customer tickets solved.

Personetics has raised $18 million and is backed by Carmel Ventures, Sequoia, and Lightspeed Venture Partners.

We were unable to find evidence of C-level executives with AI experience on the company’s team, although they claim that COO and Co-Founder David Govrin has expertise in machine learning and analytics algorithms. We could not verify this on David’s LinkedIn page.

SAS

SAS offers a software called SAS Platform, which they claim can help banks improve customer experiences and analyze customer feedback using NLP.

SAS claims users can integrate the SAS platform in the form of a cloud solution and that it includes data and model management so that data scientists at banks can develop additional AI models. Then, SAS Platform uses a text miner and contextual analysis tools to understand and categorize data that might be found in customer feedback forms. The system then provides insights in the form of notifications on a dashboard that help the bank create personalized connections with customers across communication channels.

SAS claims to have helped the Royal Bank of Scotland (RBS) help the company’s customer service representatives personalize the interactions they had with customers. The bank was using other SAS data collection products and wanted to develop an automated system to determine the top customer issues and complaints from historical customer conversation and feedback data.

To do this, RBS looked to NLP to extract the most relevant customer issues and interaction events, which it found included applying for a loan and making a payment. According to SAS, RBS was able to determine that many of their customer complaints were the result of interacting with customer service agents that were recently hired, and so they instituted special training programs for these employees to overcome their difficulties with the job.

SAS also lists ICA Banken, Turkiye Bankasi, Unicredit and Akbank as some of their past clients.

Takeaways for Banking Leaders

Natural Language processing might help banks automate and optimize tasks such as gathering customer information and searching documents. Chatbots also seem to be one of the more widespread NLP applications in banking. Many major banks have already launched some form of conversational interface that can assist customers with routine requests, such as making payments or getting details about their accounts.

Kasisto seems to have the most traction of the companies we covered in this report. They have raised a total of $28.5 million over 3 rounds. The company is also backed by venture firms New York Angels, Propel Venture Partners, and Oak HC/FT. The attention they’ve garnered might be due to the fact that their KAI platform seems to have several established use cases with case studies to bolster their claims, including work done for JP Morgan Chase.

In contrast, Sigmoidal seems to be the least established of the companies covered in this report. The individual with the most robust background in AI appears to serve an advisory role at the company as opposed to being a full-time executive steering the AI initiatives that the company claims they are.

What Banks should Prepare for when Working with AI Vendors

Banks can expect AI vendors to offer NLP solutions for extracting data from both structured and unstructured documents with a reasonable level of accuracy. Business leaders in banking might need to be mindful of the fact that although they may have access to historical data from transactions and loan documents, this data might not be useful for training machine learning models unless it is properly cleaned and tagged.

In the near term, banks should not expect to easily be able to automate their business processes or gain business intelligence from their data without embarking on a lengthy integration process starting with managing and organizing their data. This might additionally require discussions with vendor support representatives and large upfront costs. The largest enterprises may have the budget and staff to pursue the technology, but based on our research, it is as of right now only accessible to companies that would be able to afford AI applications and have access to vast reserves of data.

Header Image Credit: The Public’s Radio