MetLife is a leading global insurance company headquartered in New York City. It provides its customers various insurance and financial services, including life insurance, health insurance, retirement plans, and investment management.

In 2021, MetLife reported revenue of $71 billion, up from $67.8 billion in the previous year. The company had approximately 90 million customers in over 60 countries, making it one of the largest insurance companies in the world.

As a legacy company operating for 150 years, MetLife has primarily invested in AI initiatives by partnering with vendors and startups. Not just partnerships, MetLife has also gone ahead to invest in AI startups against equity. This article will examine three use cases showing how Metlife uses AI to innovate and support its business operations.

- Detecting fraudulent claims: Investigating and detecting fraudulent claims in real-time with machine learning to increase speed, accuracy and confidence.

- Advising contact center agents: Equipping agents with advanced natural language capabilities and machine learning-supported tools to analyze and predict customers’ emotions and tone to increase the call resolution ratio.

- Improving property risk assessment: Using deep learning to accurately assess property risk in wildfire-prone areas on 30 evaluating factors to offer improved risk assessment for customers.

Use Case #1: Detecting Fraudulent Claims

MetLife Japan used to manually handle fraudulent insurance claims by examining injuries, ailments and treatment information, requiring trained staff to balance speed and efficiency, making it a painstaking process.

MetLife Japan management decided to leverage machine learning to expedite the detection of suspicious claims with greater accuracy than relying on human labor. Partnering with Shift Technologies, the company launched Force, an AI solution to detect claims. MetLife Japan further claims in press releases that the solution uses machine learning to detect vast amounts of data, including records of previous fraudulent claims.

MetLife expected that implementing an AI-enabled system would help skilled examiners focus on complex cases to increase accuracy and efficiency.

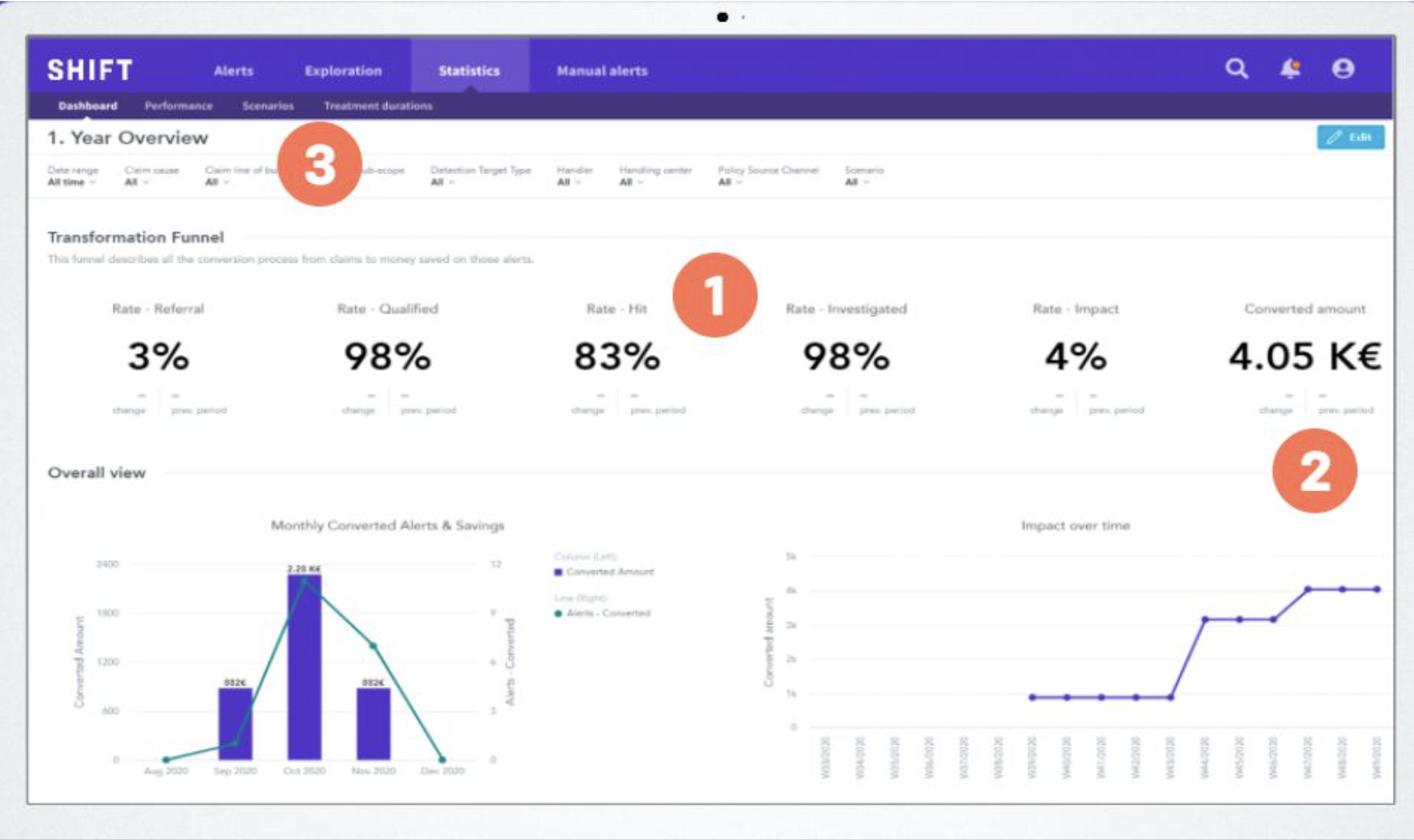

Per the vendor’s website, the main features of the software mentioned above are:

- Tracking hit rate: Provides the rate of screening out false positives from all the alerts.

- Measuring conversions: Real-time approximate cost figures saved by identifying and stopping fraudulent claims.

- Drilling down: Going into details by accessing multiple views, sorting and filtering alerts by origin, line of business and the assigned handler.

Screenshot highlighting the three main features mentioned above. (Source: Shift Technologies)

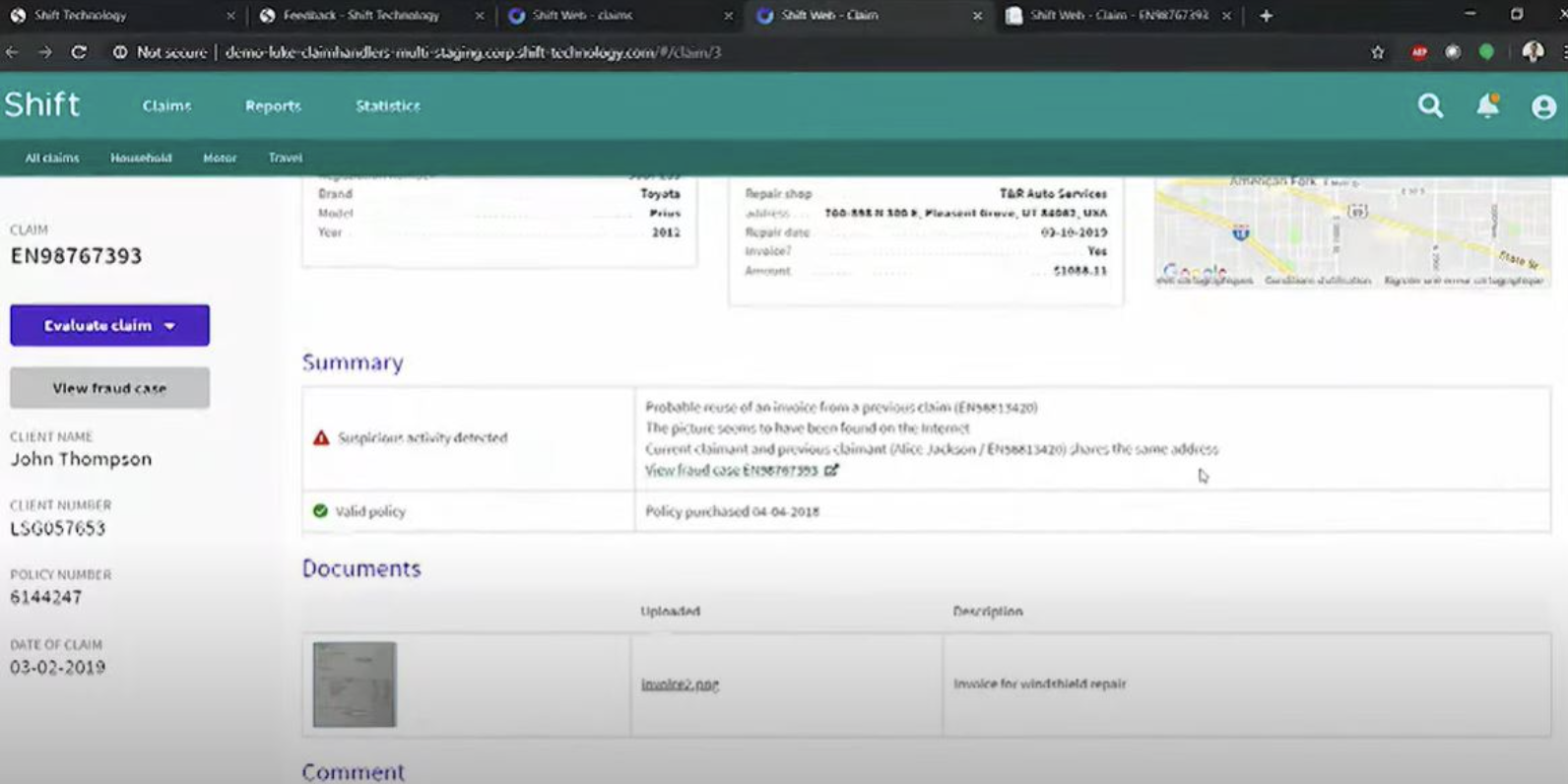

Using a real-life example in a demo video, an executive from Shift Technologies shares that to settle a claim, the customer has to file for it, mention the address where the incident occurred, and attach the supporting image and the invoice of the repairs if already done.

The system automatically accepts claims if the provided information ticks all the boxes. If not, it will raise an alert. If there is a potential fraud claim, the backend system will raise an alert and make the case as inspection awaited. The detailed view of such a case will summarize why the claim was not processed. It could be:

- The invoice matched a previous claim

- The picture of a car or the vehicle provided was found on the internet

- The address corresponded with an earlier claimant.

Screenshot from Force demo video. (Source: Shift Technologies)

Public information currently available does not show how the company’s partnership with Shift has helped MetLife’s business. However, another of Shift’s partner company claims the following benefits for one of its clients:

- Identifying 73 percent more fraud claims

- Processing more than 15,000 claims

- Generating 3x returns on investment in less than three months.

Use Case #2: Coaching Contact Center Agents

Humans may not have the upper hand on reading, understanding, and predicting emotions, but machines are a step ahead of humans in this paradigm. AI-backed systems and devices are proving to be better at analyzing human emotions, their tone and sentiments.

The contact center is where the customer’s emotions matter the most. Whether health, life, or vehicle insurance – customers need to feel understood and serviced at the earliest interaction with service funnels and online processes.

MetLife leveraged AI-based software to identify customer frustration and emotions during the calls. The company partnered with Cogito AI – an AI platform that analyzes conversations in real time.

Cogito AI applies advanced natural language capabilities, machine learning and behavioral science principles to analyze human emotions and assist contact center agents in improving their conversations with customers. It assesses how the call is going in real time and suggests the agents change or alter their tone while talking to the customer.

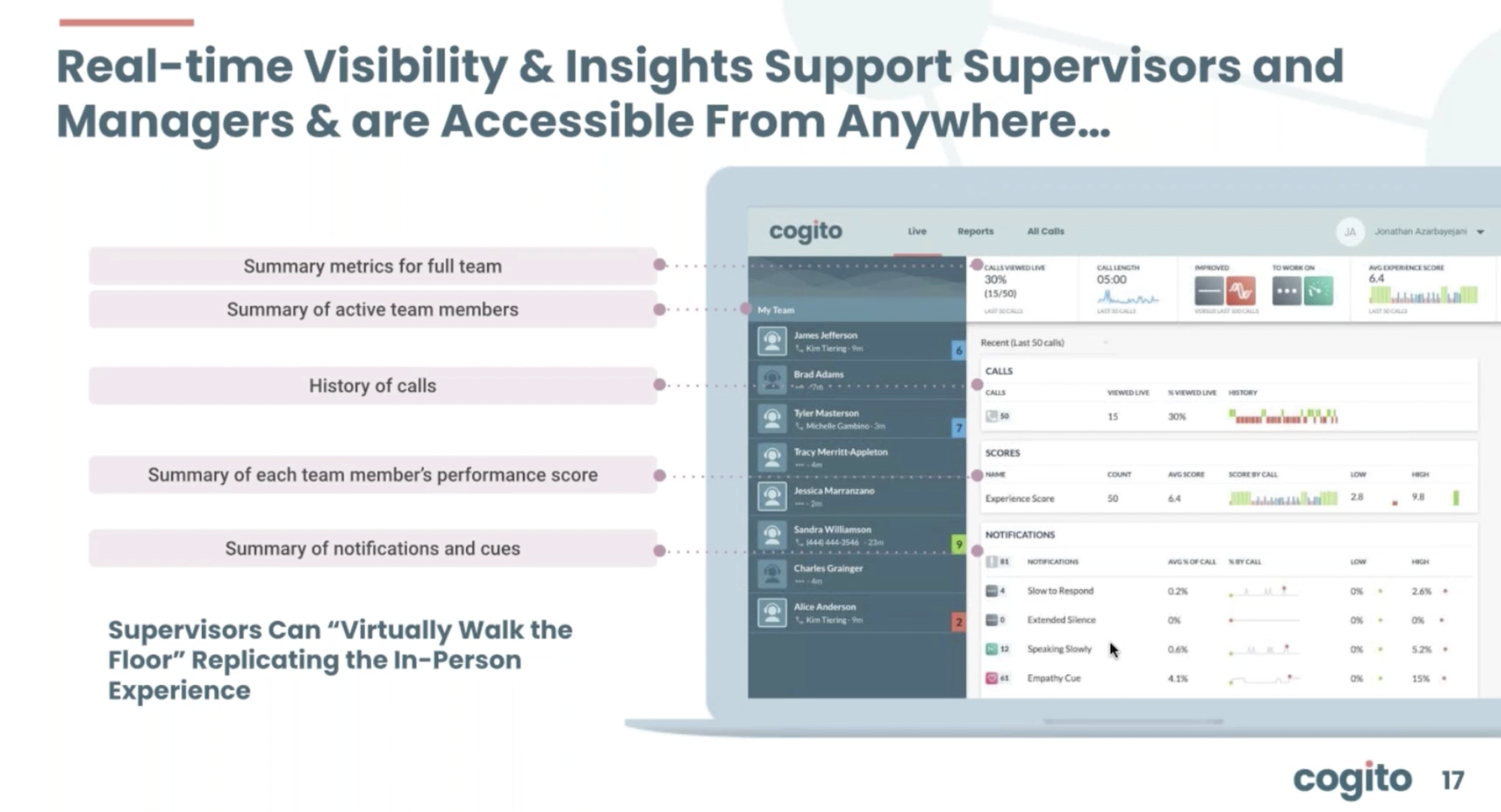

In a webinar, ‘The Power of Human Connections to Drive Call Center Engagement,’ the executive from Cogito shared that with the help of a web-based application, the managers can view how many agents are on call in a given moment and how those calls are going.

The software also ranks the call in real time so the managers can intervene if the score is low.

Screenshot from the webinar, ‘The Power of Human Connections to Drive Call Center Engagement’. (Source: Cogito)

Screenshot from the webinar, ‘The Power of Human Connections to Drive Call Center Engagement’. (Source: Cogito)

In an interview with The New York Times, executives from MetLife shared that the AI solution has helped them in the following ways:

- Improving first-call resolutions by 3.5%

- Increasing customer satisfaction score by 13%

- Cutting the average call time to half

Cogito, on its website claims that the insurers have:

- Improved net promoter score by 7%

- First call resolutions by 5%

- Increased claimant engagement by 15%

Use Case #3: Improving Property Risk Assessment

According to the Federation of American Scientists, from 2013 to 2022, there were an average of 61,410 wildfires annually and an average of 7.2 million acres impacted annually. As of February 24, 2023, around 3,500 wildfires have impacted 28,700 acres so far this year. These numbers made insurance providers think twice before expanding to wildfire-prone areas.

As Metlife expanded into the Midwest and Southeast US over the last same period, wildfire risk has made the company more conservative in approaching growth in the Western region.

Natural disaster risk more broadly further prompted MetLife to pursue emerging technology to accelerate underwriting operations, leading to their partnership with ZestyAI. Zesty AI is a software development company that offers property risk analytics via deep learning models.

Per the Zesty-published case report, the company needed more scientific tools to evaluate wildfire risk accurately.

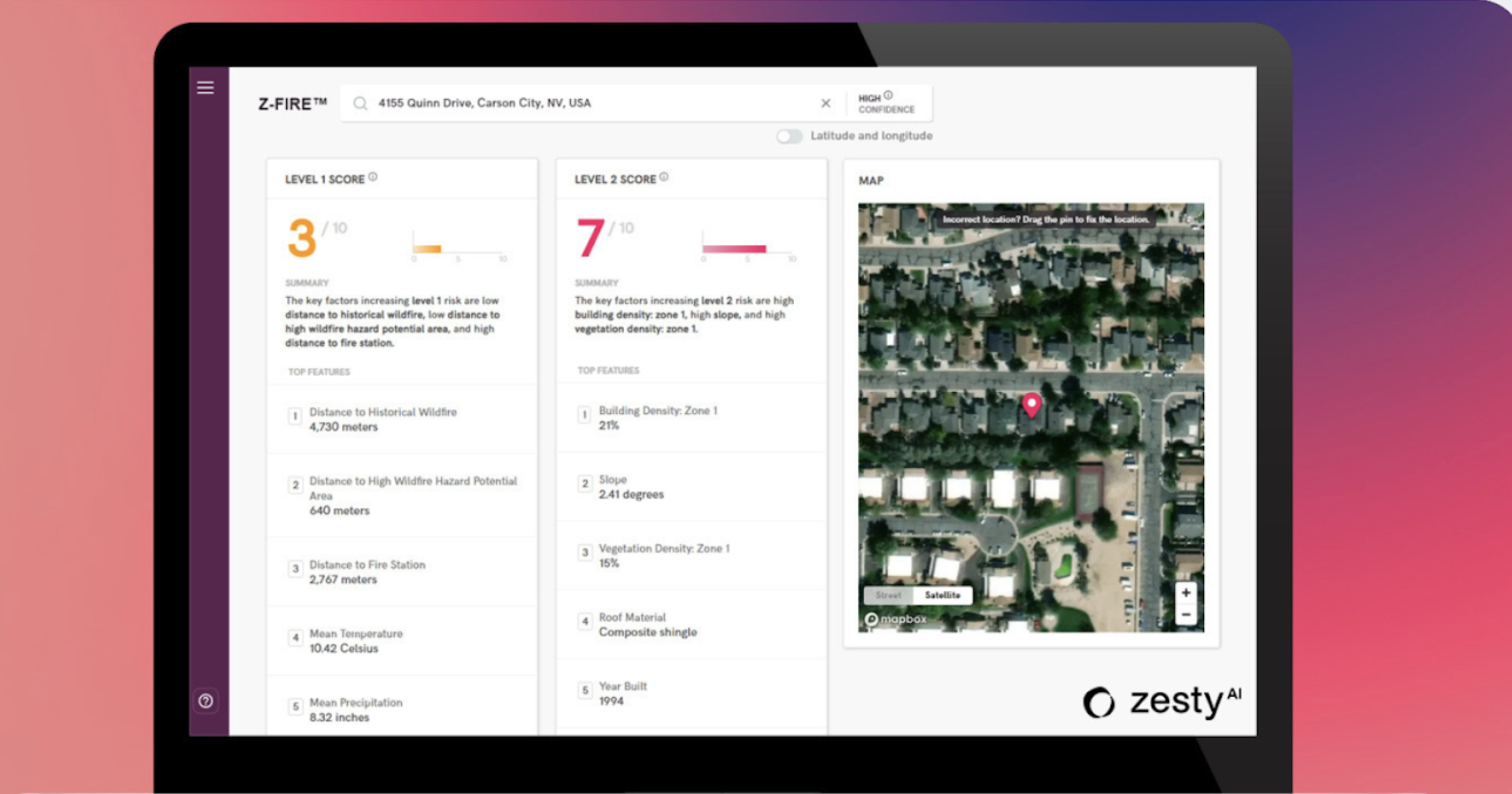

Metlife opted for ZestyAI’s Z-FIRE product, which the company claims uses deep learning algorithms to analyze high-resolution aerial imagery and other data sources to generate insights and predict future property risks.

The company claims that Z-FIRE can derive specific insights into an individual’s property. With these insights, Metlife could understand what mitigation activities the owner engaged in and if the property was constructed using less combustible materials, potentially mitigating fire damage.

The case report also mentions that the tools Metlife used before Z-FIRE only had a broad-brush approach to wildfire, but with ZestyAI, the company got in-depth details and insights.

ZestyAI claims that Z-FIRE can derive risk scores at various levels for an address using the insurer’s underwriting criteria. In addition to providing satellite imagery and merging that with third-party data, it helped Metlife understand what happened at that property over time, allowing for synthesizing that into a score.

It also uses 30 modifiers or evaluating factors, such as the surrounding vegetation and combustible propensity.

Screenshot from ZestyAi website (Source: ZestyAI)

ZestyAi claims the following benefits for its product- Z-FIRE:

- Improved Risk Selection

- Premiums Commensurate with Risk

- Decreased Loss Ratio

- Fully Compliant with Current Regulations from DOIs (e.g., California)

Though ZestyAi has not published any business results for Metlife, it has claimed that if Z-FIRE was used to completely re-underwrite an insurance provider’s entire California portfolio, in 2020, the insurance company would have prevented 95% of its wildfire losses in the state.