HSBC Bank is a British multinational banking and financial services company. The bank has 130 branches and serves over 40 million customers. By total assets, HSBC is one of the ten largest banks globally.

Per the bank’s 2021 Annual Report, HSBC earned approximately $49.52 billion in revenue and had total assets of over $2.9 trillion.

The bank has invested in various AI and machine learning initiatives to provide seamless customer experiences along with preventing money laundering and other financial crime. HSBC has appointed senior executives across multiple leadership positions to spearhead innovation and investments in modern technology.

In this article, we will examine two use cases showing how AI initiatives currently support HSBC’s business goals:

- Enhancing the personalized customer experience: Allowing retail and personal banking customers to observe and assess spending insights generated from machine learning that allow them to save more money with the bank.

- Increasing the speed of complex analytics: Delivering faster data pipelines and upgrading from descriptive to predictive analytics by centralizing the process in a single data platform.

Use Case # 1: Enhancing the Personalized Customer Experience

Banks are taking innovative and creative approaches to personalize their customer journey and banking experience. Per a research paper, personalization has helped banks improve customer relationship quality. In some cases, it has also helped the bank increase customer retention.

HSBC invested in analytics and AI-based solution to improve customer service and provide personalized banking services to its retail banking customers. With intelligent analytics, HCBS identified the behavioral spending and savings patterns among its retail and personal banking customers.

In an interview with South China Morning Post, an HSBC executive said the bank used transactional data created through HSBC’s banking operations and applied AI and machine learning methods. Machine learning algorithms helped the bank understand its customers’ behavioral patterns.

By understanding the customers’ spending patterns, HSBC wanted to deliver personalized insights like:

- View of wealth portfolios

- Highlights on gains and losses

- Level of insurance protection per the net assets, family size, and cashflow

One of the actionable insights on the platform is to suggest customers increase their insurance coverage per their financial position, which helps the bank to cross-sell. The bank also hopes to send personalized offers to credit card customers based on their spending patterns.

To help customers budget digitally without using spreadsheets, pens, and papers- HSBC launched a budget feature on its mobile application. It leveraged big data and AI to identify, understand and categorize spending patterns.

The budget tool was designed for the following:

- Automatically tracking spending across HSBC accounts and credit cards

- Breaking daily expenses into 18 categories

- Offering comparison in spending patterns over the past 12 months

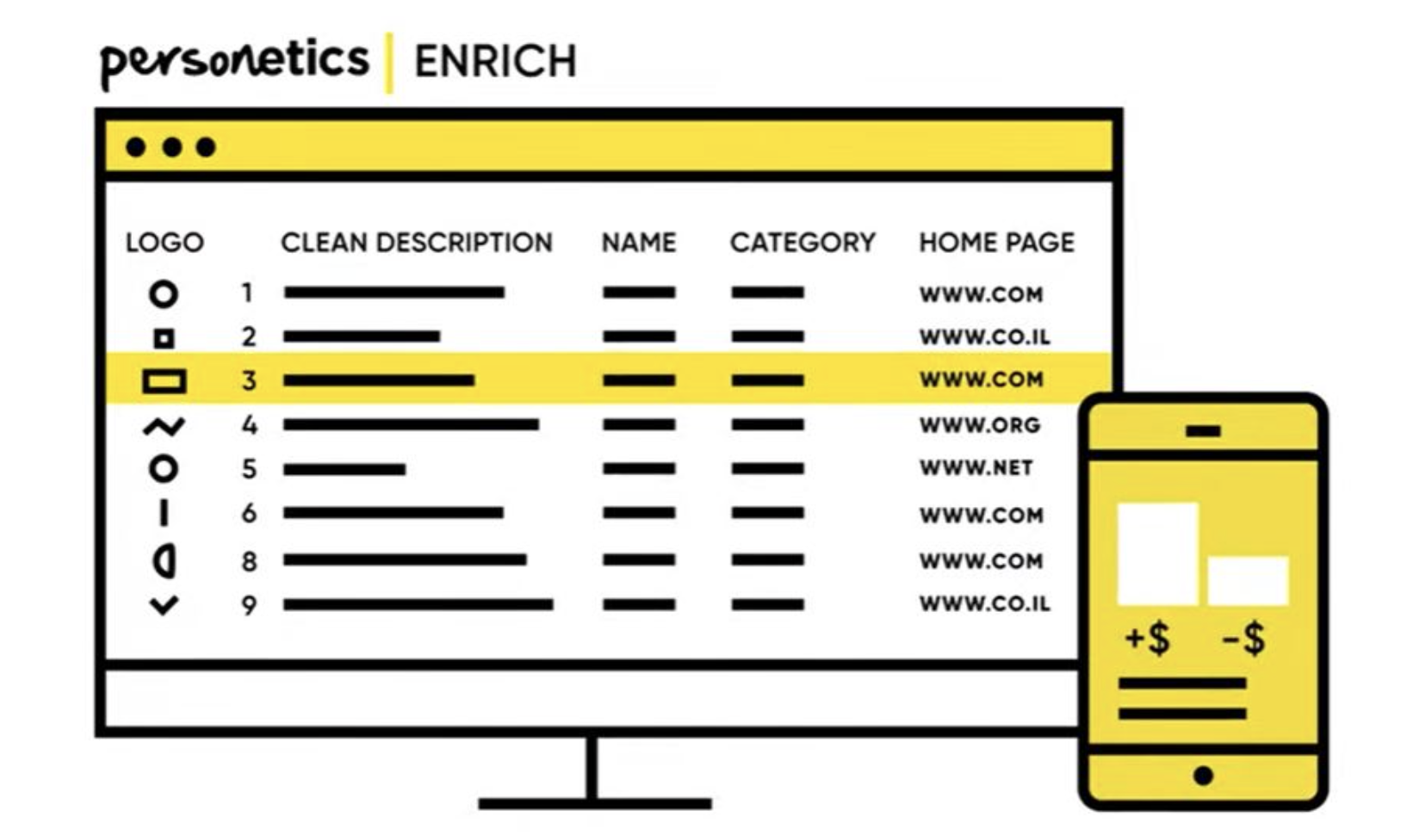

HSBC worked with Personetics, a data company, to provide this experience to its customers. The bank leveraged Personetics’ Enrich platform to make sense of transactional data.

Personetics Enrich is an on-premise Saas platform based on fintech infrastructure. The product returns identifiable information such as transaction descriptions, merchant logos, location information, and subscription information.

Per the Personetics’ website, the Enrich platform:

- Categories transactional data for cross-selling

- Automated mapping of multiple internal and external data sources for cross-channel customer experience

- Cleans data with AI

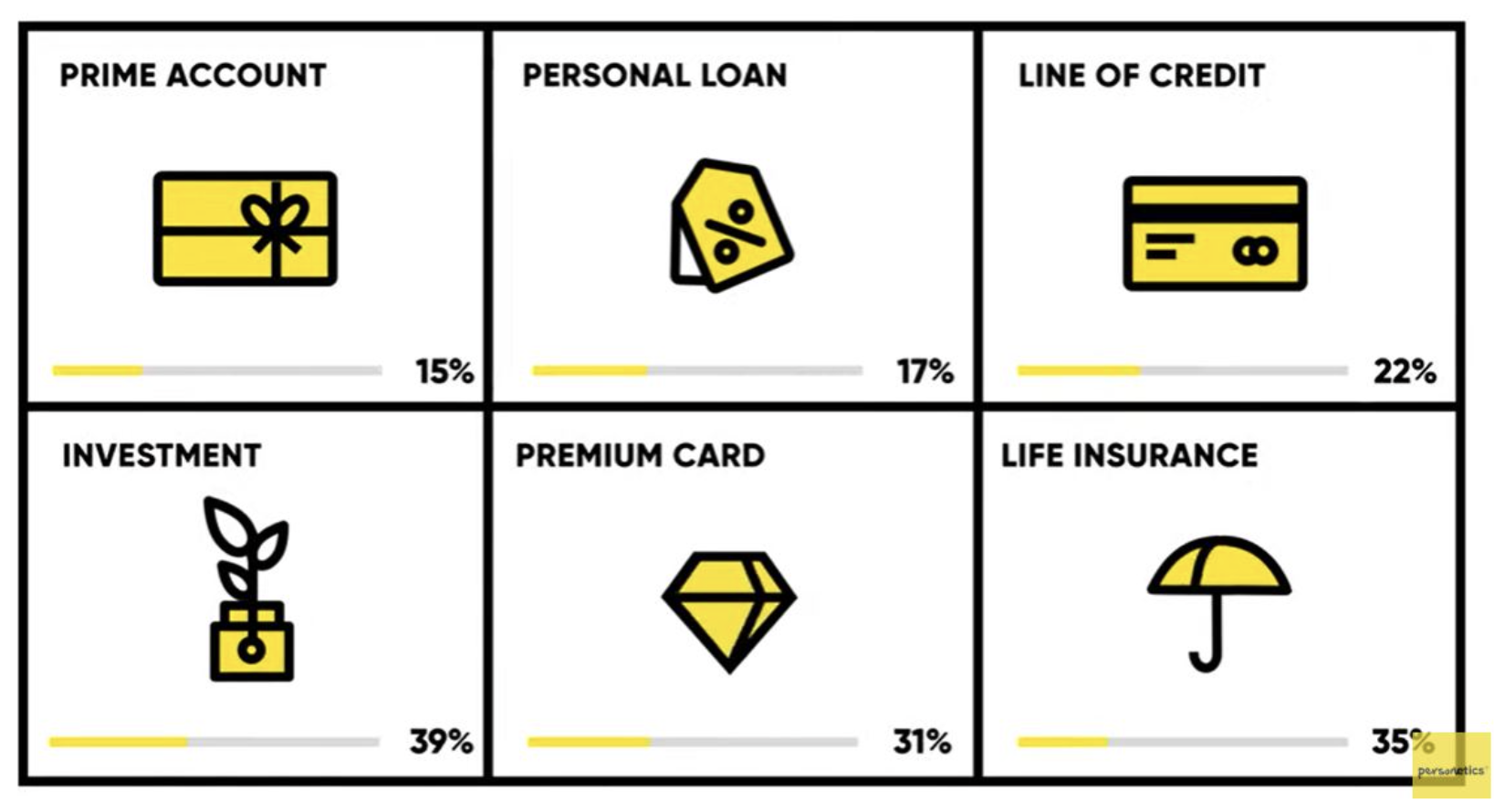

Screenshot from Personetics Enrich Video (Source: Personectics)

Screenshot from Personetics Enrich Video (Source: Personectics)

Screenshot from Personetics Enrich Video (Source: Personectics)

Screenshot from Personetics Enrich Video (Source: Personectics)

Personectics claims that Enrich platform:

- Reduces operational costs

- Improves cross-sell targeting

The bank has yet to share the business results of the above mentioned initiatives. However, the case report noted that after the fifth wave of coronavirus in Hong Kong, 98 percent of service transactions were made digitally, and one in two customers banked with HSBC using their mobile application.

Use Case # 2: Increasing the Speed of Complex Analytics

HSBC launched its PayMe application in Hong Kong, intending to reinvent mobile payments. However, reinventing and innovating payment processes with legacy systems was the biggest challenge for the bank.

HSBC wanted to use data and machine learning to enable various use cases per the case report, but existing systems needed to improve their ability to process and analyze data at scale. Further, legacy processes needed a manual approval form to be filled out for data requests.

Another challenge was data scientists’ limited ability to explore raw data and train models because they used to work in silos.

To address the above challenges, HSBC leveraged a unified data analytics platform and moved from various databases to one Delta Lake.

With Azure Databricks and Delta Lake, the bank securely provided anonymized production data in real-time to the data science teams. It also helped the bank centralize all aspects of its analytics process.

Azure Databricks provides tools for building, deploying, and maintaining data solutions.

Further, Databricks machine learning, an end-to-end machine learning platform, provided auto training of machine learning models with AutoML. AutoML enabled the business to automatically generate machine learning models from data and accelerate the path to production.

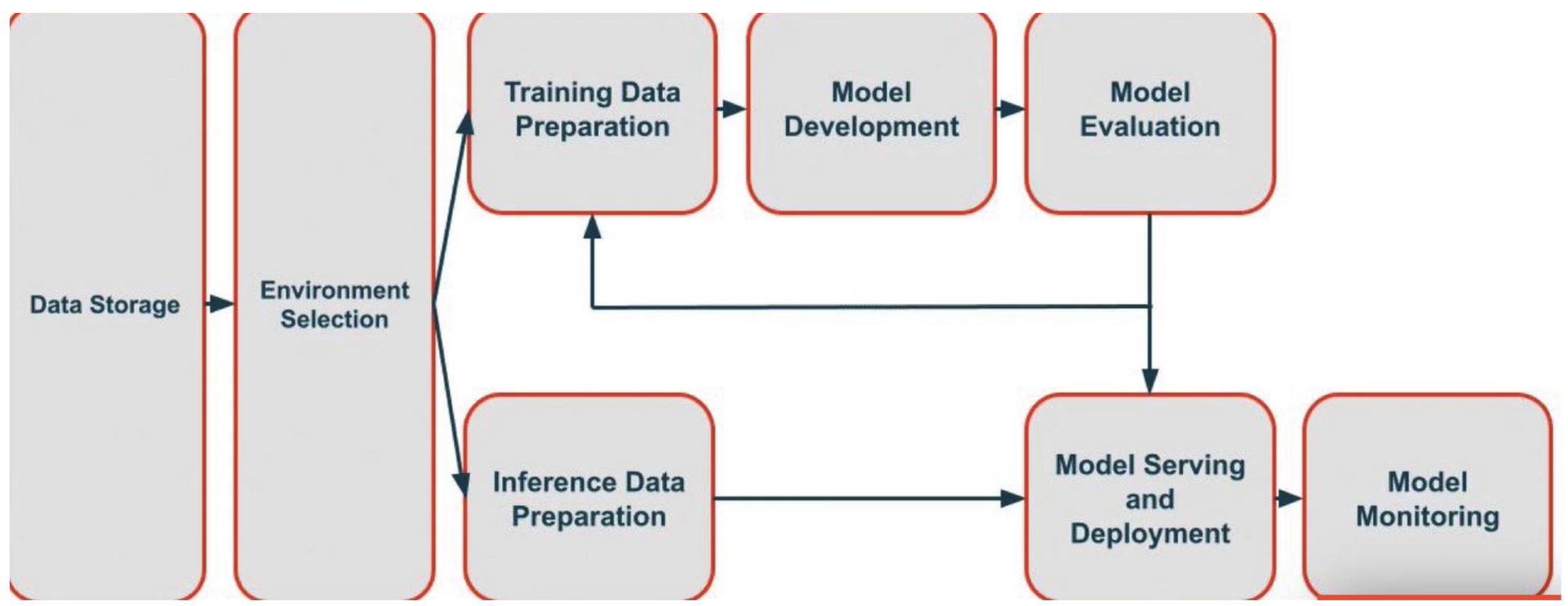

In a webinar by Databricks, the company claims that Databricks machine learning can solve all challenges associated with machine learning, such as data storage, environment selection, training data preparation, model development and others.

Challenges that Databricks machine learning solves

Screenshot from Webinar: Getting Started with Azure Databricks (Source: Databricks)

Below is a five-minute demo tutorial of the Databricks platform explaining its features like MLflow and analytics on Delta Lake.

- Faster data pipelines increased data processing time from six hours to six seconds

- Moved from 14 databases to a single unified data store with Delta Lake

- 4.5X improved engagement levels

- Deployed predictive data models