Banks and other financial institutions can be tight-lipped about how they implement AI technologies within their businesses. Citi, however, has been relatively open about their current AI initiatives. Since 2017, they have published press releases and other announcements of AI initiatives that are both internal and customer-facing.

In this article, we cover three of Citi’s AI initiatives and explain how they work:

- Document Digitization: Digitizing paper forms for a risk analytics platform.

- Customer Service Chatbot and Mobile App: Citi’s mobile app that features a conversational interface for customer service and account inquiries.

- Fraud Detection: Leveraging Feedzai’s anomaly detection platform for more accurate risk management.

Document Digitization

Citi announced a collaborative project with Ernst & Young (EY) and SAS to leverage AI for an advanced risk analytics scoring engine. The initiative is intended to help streamline the manual processes required to review large amounts of global trade transactions while keeping regulatory compliance intact.

Citi Global Trade has been progressively digitizing its platform. Part of this involves digitizing millions of trade-related documents each year using an optical character recognition (OCR) component which likely involves machine vision.

In order to create an AI-powered document digitization application, Citi would need to leverage natural language processing (NLP) and machine vision. This would allow the application to automatically recognize each character and copy them into a digital version of the document. The document could then be searchable with an NLP-based enterprise search application.

Customer Service Chatbot

In 2018, Citi released its first chatbot, called Citi Bot SG, for Facebook Messenger in Singapore. The chatbot was available for all consumer banking customers after a beta testing period involving 600 customers and employees. While the initial release was for Singapore customers exclusively, Citi claims they will be rolling out the chatbot for other markets such as North America and parts of China.

The company claimed Citi Bot is able to help customers with a variety of needs, such as account specific questions like account balances. This also includes inquiries about recent transactions, bill summaries, and reward point balances. In order to leverage natural language processing (NLP) with this kind of conversational interface, Citi would need to develop an ML model trained on hundreds of thousands of customer service questions and their correct responses.

Once the model and the NLP software are combined, the resulting chatbot may be able to offer “intuitive” answers to customer questions, as Citi states. An intuitive answer likely is one that the chatbot delivers in complete sentences that are intended to give the customer the feeling that a real person is sending them the message.

While Citi is unclear on the complete functionality of the Singapore version of the chatbot, we can infer that it can request the company’s account files and provide users with information about their accounts on request. It may be able to link or redirect users to a page of Citi’s website where they may be able to find or update that information, but the company has not confirmed this functionality.

In July of 2019, Citi Bot SG was replaced with Citigroup’s new mobile app aimed at global consumer banking customers. They claim this app features all of the same services Citi Bot SG users came to appreciate during its run. According to Citi’s website, users can now automatically offset their spending with their virtual points, find discounts, and withdraw cash from credit cards on this new version. However, it is unclear how much of this new functionality is accessible through the conversational interface itself.

Anomaly Detection-based Fraud Detection

Citi also partnered with Feedzai in 2018 in order to make use of their AI platform for risk management and fraud detection in banking. Citi claims they intend to integrate Feedzai’s platform f into its currently available services such as accounts payable. This may empower clients with more control over risk management for all their transactions.

Manish Kohli, Global Head of Payments and Receivables, Citi’s Treasury and Trade Solutions (Citi TTS), has stated that this strategic partnership is a good example of their commitment to using new technologies to drive innovation. In reference to this partnership, Kohli said, “With the help of Feedzai’s solution, we can scale rapidly in an effort to deliver value to our clients, allowing them to make payments securely, efficiently and without friction, across the globe.”

Citi may appear focused on providing risk management without slowing down their claims processing tech stack. In addition to the constant innovations of fraud detection and payment processing, cyber-attacks and other fraud methods are constantly improving. It is because of this that Citi’s clients expect progressively faster and safer transactions. They claim that their integration of Feedzai’s software will help these clients stay aware of new threats without taking more of their time.

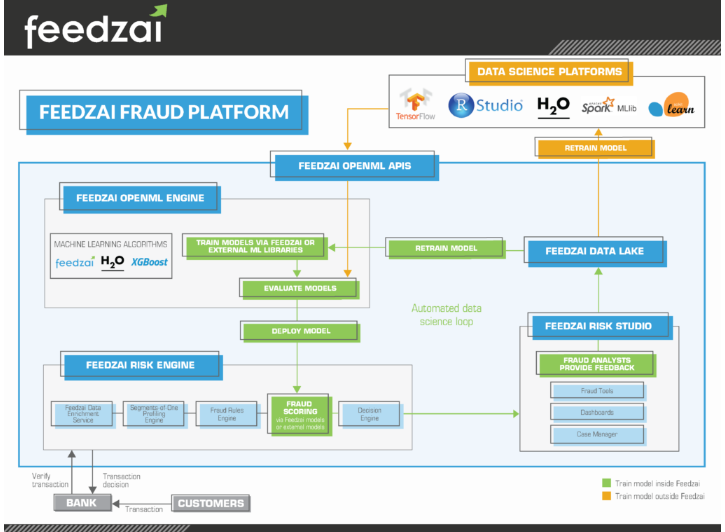

Feedzai has claimed their OpenML Engine helps banking data science teams create new ML models for fraud detections using provided sample models. It is likely that Citi has used some form of this to develop their models for banking and commerce customers. This offering may have helped Citi decide to partner with Feedzai, because the existing machine learning models indicated a higher chance of security and perhaps success.

The following image explains how the Feedzai’s platform works. The data flows from large storage units referred to as “data lakes” and APIs into the OpenML Engine platform. The platform then routes the data towards experiments and real-time analysis.

The data from this deployment also funnels into the “Feedzai risk studio,” which is likely a database Feedzai uses to improve future products. It is unclear whether Citi has access to the full Feedzai risk studio:

Feedzai’s software can purportedly accomplish this by monitoring all transactions for any discrepancies or unusual payment behavior. It would then analyze these anomalies before the transactions are cleared to continue through the system. Citi claims that they may have a new solution using Feedzai’s anomaly detection in 2019.

Header Image Credit: Fortune