Speech recognition is an AI technology that can allow software programs to recognize spoken language and convert it to text. A subset of speech recognition is voice recognition. Voice recognition is an AI-enabled capability that enables a software algorithm to match the identity of a customer to their voice.

There have been some studies that claim by 2020 over 50% of all online search queries might be done through voice-based search. Banks are testing security features using AI-based voice recognition which can automatically confirm the identity of a customer when they call in to customer service.

Using this verification technique, customers of the banks might simply ask out loud for a service they require such as making payments, transferring money and reporting stolen or lost ATM and credit cards and receive an accurate response from an assistant or on their smartphones.

Banks have launched voice-activated consumer banking as early as 2014, which has slowly taken off around the world. In 2018, several banks have introduced pilot projects or customer service interfaces with voice capabilities gained through integration with Amazon Alexa. Similarly, other banks and financial institutions are integrating their products and services with existing voice services such as Siri or Google Assistant.

In this article, we delve deeper into the current state of voice recognition technology in the banking and financial services sector with the help of real-world use cases in banks.

We recently launched our AI in Banking Vendor Landscape and Capability Map report where we worked with experts including PhDs in AI and corporate heads of AI at top US banks to categorize AI vendor products based on the technical type of artificial intelligence or machine learning behind an AI product.

In our report, we defined an AI approach as the technical type of artificial intelligence or machine learning behind an AI product. In other words, a product’s AI approach is a description of the AI algorithms that make its value proposition possible. AI Approaches include natural language processing, computer vision, anomaly detection, predictive analytics, and prescriptive analytics.

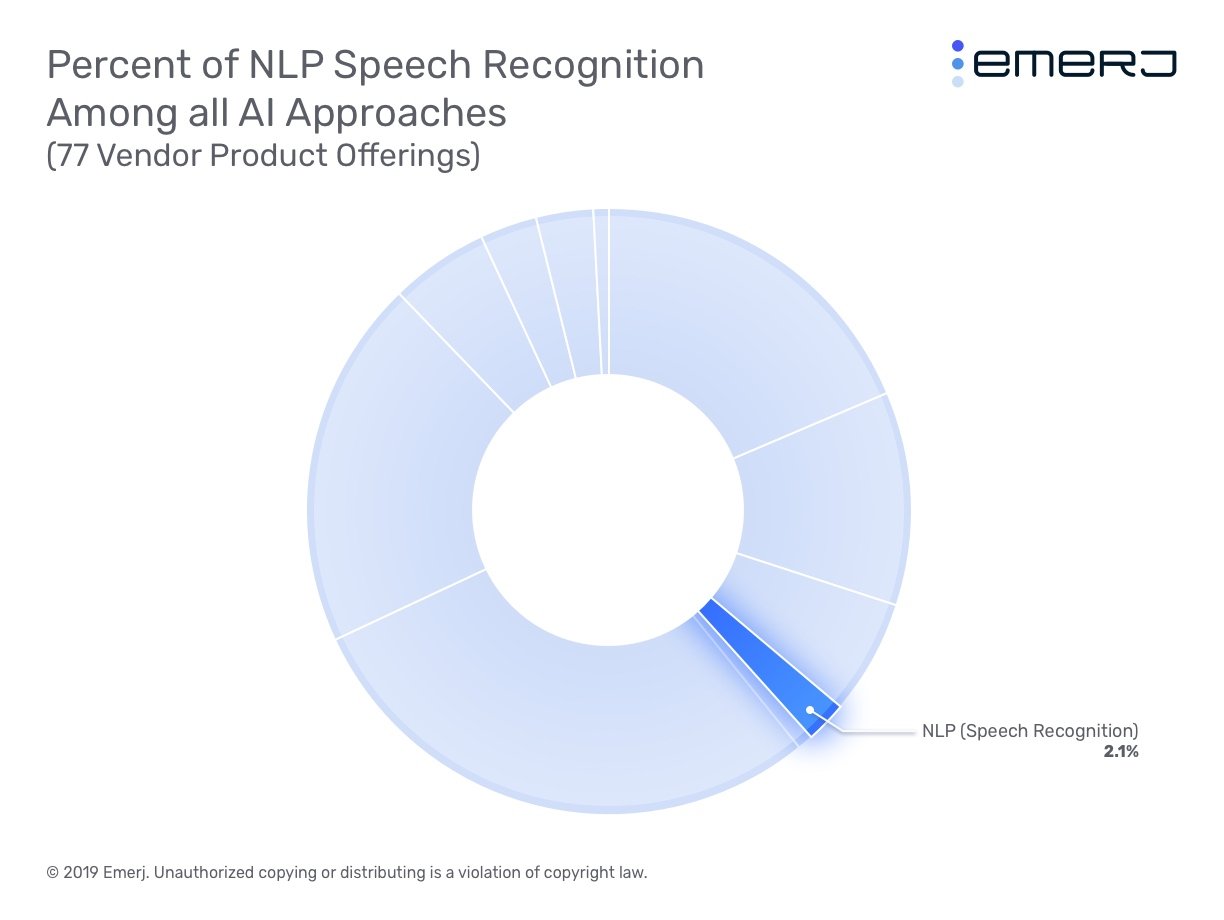

Among all the AI product offerings that we considered in our research, NLP (Speech Recognition) seemed to be highly nascent at the moment, accounting for only 2.06% of the vendor product offerings as shown in the figure below:

Along with Alexa, banks are also starting to make use of Siria in an effort to launch speech and voice recognition systems. Payments companies such as PayPal and Venmo and banks such as N26 and the Royal Bank of Canada allow for payments to be made through conversations with Siri.

AI vendors such as Nuance and Personetics are also helping banks establish speech and voice based services. For instance, Nuance has previously worked with the USAA to launch a voice-activated banking app, while Personetics has worked with Ally Bank to launch the Ally Assist customer voice interaction app. Similarly, AI vendor Kasisto has worked with TD bank to develop voice services for their mobile banking app.

Regardless of how they develop their solution, artificial intelligence will become essential for banks to increase revenue, lower costs, reduce risk, deliver better experiences, and gain a competitive edge. Machine learning is also critical for enabling voice assistants to learn from every customer interaction, relate it to the current context and provide relevant advice.

In the section below we look into the inner workings of some case-studies from banks that have added voice recognition features.

Voice-based Account Servicing

One of the most common use-cases for voice-based banking is to allow customers to use their voice to check their account balances, transaction history, and other account details. For instance, Westpac Banking Corporation in Australia launched a new Amazon Alexa Skill called the Westpac Live. According to the bank’s spokesperson, a team from the Westpac Digital Labs worked alongside a team from Amazon to integrate their services with Alexa.

The bank also claims their users can check their account details from Alexa-supported devices. In addition, the Westpac Alexa skill seem to include the ability to listen to financial news that the bank puts out on their website. The skill reportedly uses natural language processing to convert customer question from voice to text and to automate some of the back-end processes that are needed to get an accurate answer back to the client.

In addition to this Westpac has also worked to integrate the Google Assistant in its online mobile banking app. According to the bank, customers can also use the Google Assistant on their mobile devices to make payments to other users on the Android platform.

Westpac has also worked with Apple to allow iphone users to access voice-based banking services through the Siri assistant. The video below shows a demonstration of the service:

Voice-Activated Transactions

Apart from just allowing customers to ask for their account details, some banks have also added voice-activated features that allow customers to make financial transactions by simply talking to a voice-enabled home device.

For example, the global bank BBVA has a subsidiary in Turkey called the Garanti Bank. Garanti Bank launched a voice-based assistant called the Mobile Interactive Assistant (MIA) which allows customers to make financial transactions by simply saying “I need to transfer money to” and then the name of the establishment. The MIA answers questions about the latest account activity, performs transfers, lets customers buy or sell foreign currency or find out the exchange rate anticipate users’ needs by analyzing their habits.

For example, when customers say that they have lost their credit cards, MIA asks if the customer wants to cancel their credit card. When customers answer with a “Yes,” the app puts them in contact with customer service at the call center without having to log in again or identify themselves.Garanti reports that approximately 60% of customers who have the app are using MIA, and satisfaction rates are very high.

What Banking Leaders Need to Know

As with most AI projects, creating a successful voice-activated banking product from scratch that might make banking more seamless for customers is harder than it looks. This is the main reason that banks are tying up with companies like Amazon and Apple to add voice-activated banking based on the architecture of these assistants, which is far easier and relatively simpler to build.

Irrespective of which way banks go, AI projects are heavily capital intensive, and rolling out voice-activated banking needs a lot of resources. On the other hand, if a successful product is developed, banks might save costs in terms of the number of employees they have at branches that handle customer service requests and inquiries.

Banking leaders need to understand that this technology can be considered to be nascent at the moment in terms of the capabilities that can be offered through voice. In order to develop a successful product, banks will need to ensure that they have the required data infrastructure to support such solutions.

Early adopters of this technology might have an advantage in terms of the fact that these voice-based AI services get more accurate with more number of incoming calls and different voices from customers.

Strategic Recommendations

Many customers might be new to voice-activated banking services and any new client interaction channel needs to have an explainer or a guide where customers can know what types of questions they can ask and receive answers for.

When the speech recognition systems are faced with a question that appears challenging for the algorithm to process and understand, it seems to be better to suggest a probable answer rather than sending an error message in order to help customers continue to use the service.

Banks who are engaging in such projects need to start small, for example simply fetching account details in the beginning. Features such as predicting what questions customers might likely ask next can be added at a later stage and require a more deeper data competency from banks and financial institutions.

Voice and Speech Recognition services are regulated differently in different geographical regions. For example in the US and China, Banks are allowed to offer transaction services through voice-based services. In Europe services like Alexa and Siri are not allowed to enable financial transactions due to banking security standards established by supervisory bodies.

The large tech firms such as Google and Amazon have a data- and customer centric approach built into their business models and are far better than financial services firms at effectively leveraging speech and voice recognition. It might be imperative for banks to upgrade their customer service operations to compete on the same level as some of the large tech giants. This is a huge ask, but the data-first approach is the right way to go for such AI projects

The possibility of the tech giants getting into the banking space with their own speech and voice-based services is a distinct reality and banks need to gear up for this change by upgrading their own skills in managing and leveraging data. A common trend of investing from the tech giants lead us to believe this. For instance, Google set up the Assistant Investments program to fund startups, with the aim of advancing speech and voice recognition technology. Facebook has acquired several speech recognition startups while Microsoft has partnered with Amazon to potentially strengthen the chances of their assistant Cortana’s survival.

As a security measure, voice recognition is being hailed as being highly secure by the banks that have launched these speech-activated services. Yet, in our research for this article, we found that there have been instances of voice recognition failing to perform as marketed. For instance, we found reports that the HSBC voice recognition system wrongly accepted verification for a customer despite the actual voice being that of the customer’s sibling.

Truly achieving a secure voice recognition system that would function in most scenarios takes a lot of time, effort and capital. Customers might also prefer to perform relatively simpler banking tasks on their mobile devices through voice-based services.

Banking customers, especially millennials, are increasingly tech-savvy when it comes to mobile banking These new age consumers are looking for speedy, convenient and function mobile banking channels that can anticipate their needs and offer personalized digital services.

With customers becoming more used to conversing with digital assistants such as Alexa, Google Assistant, and Siri, the acceptance of this technology for banking services is likely to increase significantly in the future.

While using voice recognition as a biometric authentication factor, banks and financial institutions might find that the level of security might not be as secure as they believe it to be, simply because voice recognition systems that are not trained on massive amounts of spoken language data such as those that Google or Apple might have access to, are not accurate enough in every single scenario.

That being said, the biggest advantage in terms of customer experience that voice recognition brings is the fact that it completely changes the initial interaction with the customers. Before this technology was realized, customers who called into banks and financial services had to first verify their identity before they could go ahead and ask for their issues to be resolved.

With voice banking services, this initial interaction can now skip the verification step and move straight to resolving customer issues as soon as possible, thereby improving customer satisfaction levels.

Header image credit: Total Voice Technologies