Critical to the definition of robotic process automation (RPA) is the notion that the tasks a ‘robotic’ software automates are repetitive by nature, with exceptions in rare instances. While RPA cannot independently learn from and adapt to new contexts and workflow problems, it can if the RPA system is imbued with the correct AI capabilities.

The emerging set of new technologies that combine fundamental robotic process automation and artificial intelligence is Intelligent Process Automation (IPA). IPA mimics human activities and learns to handle them better over time. IPA also promises to enhance efficiency and improve turnaround times and customer journey experiences in ways that are not scalable through normal RPA.

The classic example of RPA is automating customer service tasks and answering frequently asked questions on customer support calls. RPA bots can handle these tasks because they are highly structured, and the decision logic is typically rules-based and repetitive with prescription instructions.

In contrast, IPA can be used to analyze customer feedback and sentiment data to improve customer service.

This article will explore two of the most prevalent real-world applications of intelligent automation for enhancing RPA in banking by exploring two use cases:

- Document processing: Improving and increasing employee efficiency by reducing time spent processing documents with machine learning, freeing staff to handle more critical and value-adding activities.

- Responding to supplier invoice queries: Using Conversational AI with RPA to answer standard, repetitive supplier invoices and queries so the service-desk teams can focus on answering more complex inquiries.

For each use case, we further discuss the business challenge said technology solves, the data being leveraged in the process, and the distinct benefit that AI applies to the operations therein.

Use Case #1: Document Processing

Processing documents with RPA is more technical because it only deals with structured documents. On the other hand, intelligent document processing is better suited for ill-defined and unstructured documents. Intelligent document processing uses OCR, machine learning, or deep learning to extract information from various document types.

Looking at the problem from the vantage point of data: intelligent document processing is merely a way of converting paper-based information into a digital format. For legacy organizations in language-heavy sectors like banking and legal, intelligent document processing can often include automating documentation-heavy processes like credit applications, financial documents or invoices.

In no uncertain terms, these capabilities are an integral portal into an organization’s 21st-century business strategies.

Intelligent document processing not only enhances the employee experience but also helps the business in the following ways:

- Streamlines document tracking

- Increases turnaround time

- Generates quick Return on Investment

- Improves customer satisfaction

- Improves accuracy with minimum manual intervention

Core technologies that provide intelligence to automation here are:

- Computer vision: It uses AI to enable automatic extraction, analysis and understanding of information from digital images

- Optical character recognition (OCR): It Converts images of documents into machine-encoded text.

- Natural language processing (NLP): It analyzes the running text in documents to understand context, consolidate the extracted data, and map the extracted fields to a defined taxonomy.

- Machine learning: It helps with document classification and extraction

Vendor example: UiPath

UiPath is a New York-based software development company. The company offers an automation hub for managing the automation opportunities pipeline.

The company claims its Automation Hub software helps companies centrally manage automation opportunities, increase automation programs’ ROI by better-prioritizing automation ideas and broaden the availability of automation. The company claims its solution fosters an open, transparent, collaborative automation community.

Alter Domus, a BFSI company in Europe, noticed its employees spending significant time on manual and repetitive tasks that provided minimal value to the organization’s core projects. In response, the company adopted an intelligent document processing-based system to increase employee efficiency and enable them to concentrate on more critical and value-adding activities.

Alter Domus leveraged intelligent automation with UiPath solutions, including Document Understanding, AI Fabric and UiPath Orchestrator.

UiPath claims its Document Understanding platform delivers IPA to extract and interpret data from different documents. As per the tool brochure, Forms AI employs no-code AI to process documents with similar formats and pre-trained machine learning models process the less structured documents.

The following brief, nine-minute video provides a full demonstration of UiPath’s Document Understanding interface and how the program helps employees work more efficiently via the following workflow:

Looking at the steps presented in the video sequentially:

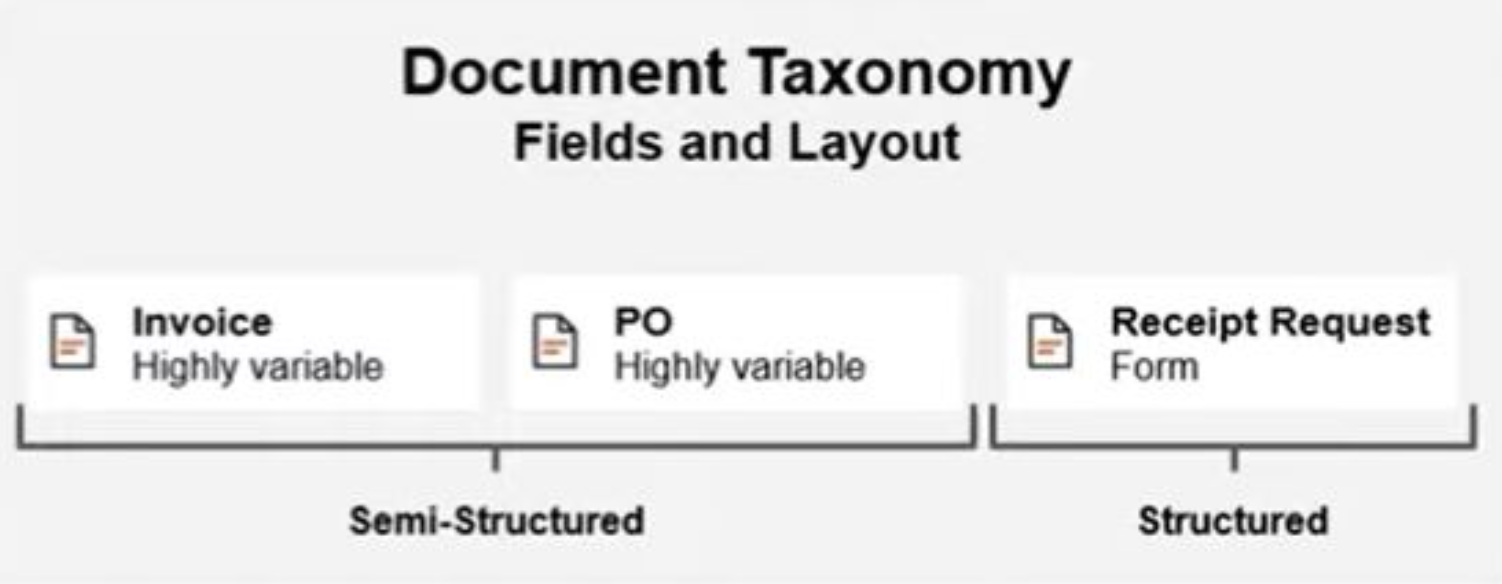

- UiPath divides documents into two main categories: semi-structured and structured.

Screenshot from UiPath Demo Video. (Source: UiPath)

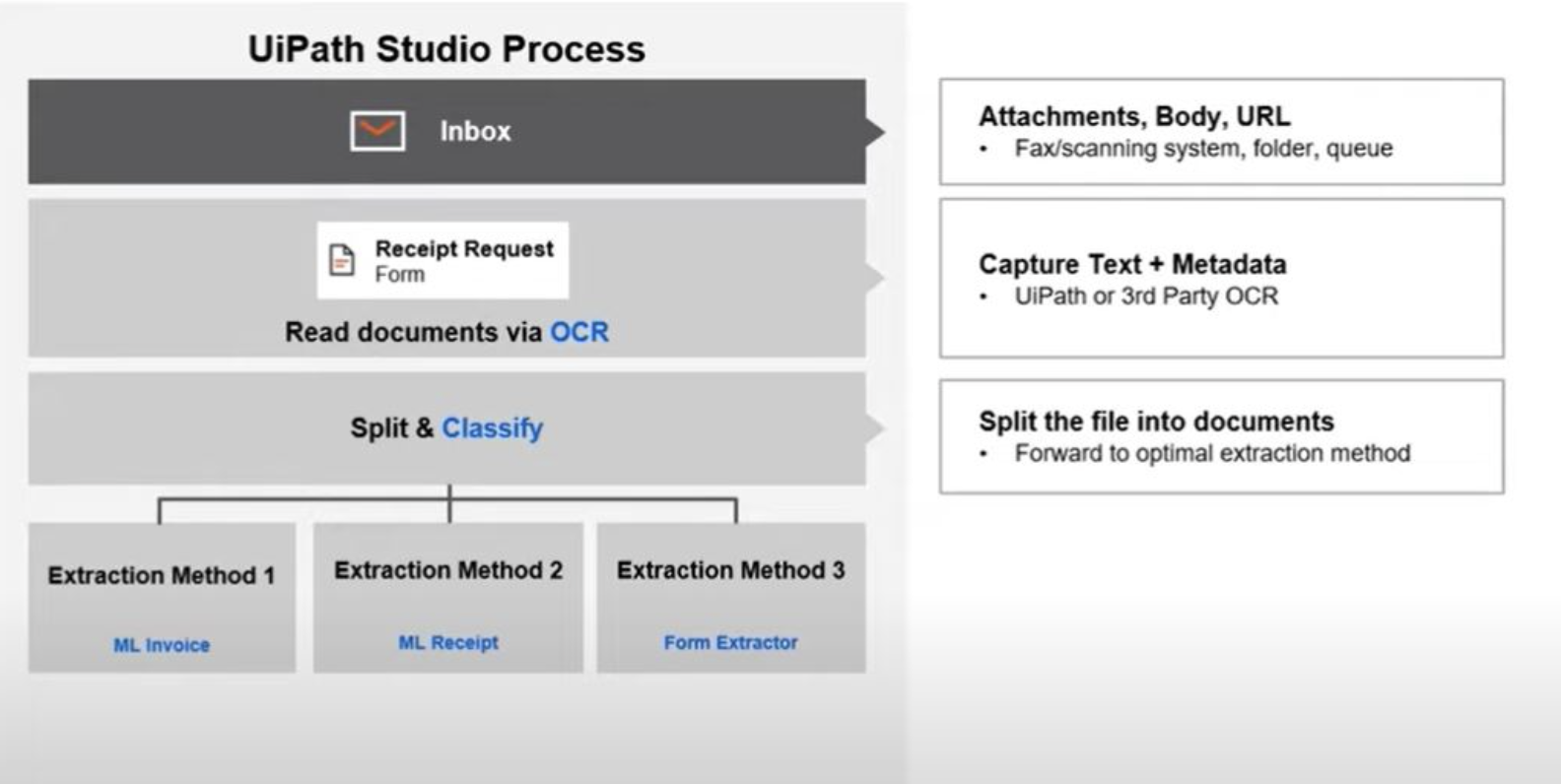

- After receiving the document, the tool begins to process it by capturing the text, page breaks and other primary elements. Further, it splits and classifies the document into its extraction type method.

Screenshot from UiPath Demo Video. (Source: UiPath)

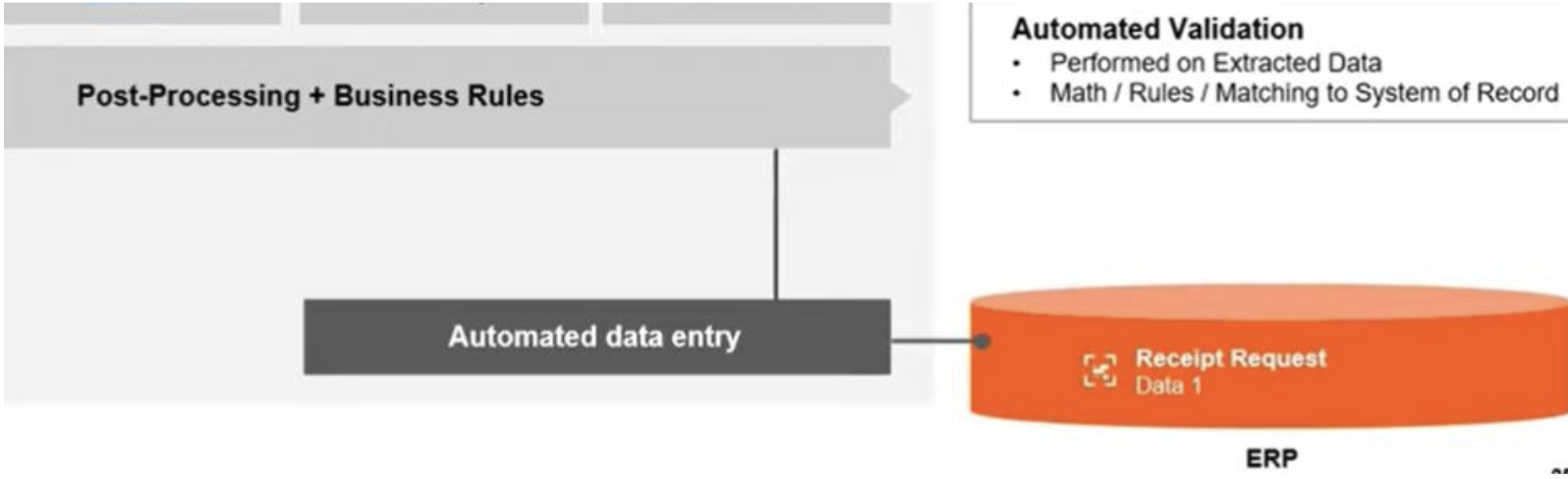

- If the document is detected as structured, it is processed automatically with pre-defined rules and a data entry is passed into the ERP.

Screenshot from UiPath Demo Video. (Source: UiPath)

- The studio passes the document to the AI center for semi-structured documents such as invoices. It has a machine learning package with the schema and training data.

Screenshot from UiPath Demo Video. (Source: UiPath)

- If the business rule fails to apply to such documents, the software will send a notification to take a human in the loop. The data is passed to enterprise resource planning (ERP) processes upon validation.

The case report claims Alter Domus’s automated processes include the following:

- Processing bank statements.

- Accessing the accounts software.

- Recording each transaction manually.

The UiPath case report also claims Alter Domus’s process possessed minor variations that were time-consuming and repetitive. Thus, deploying a software robot helped free the employees from repetitive work with no value added for customers.

Concerning business results, the case report claims UiPath was able to achieve the following for Alter Domus:

- 20 processes automated in 6 months

- Freed 1,000 hours for employees to concentrate on high-value tasks and add real client value.

The report also mentions that automation allowed the company to increase capacity to meet the increased volumes of work.

Use Case #2: Responding to Supplier Invoices

Companies are reshaping the old operating models by shifting their workloads to software that can handle their tasks automatically – many of which do not involve AI capabilities but simpler AI-adjacent robotic technologies, such as RPA. Messaging platforms are becoming the dominant communication channel worldwide.

Coupled with the increased customer demand for self-service, enterprises are still investing heavily in external communication channels such as chatbots.

According to testimony given in a webinar from the Institute of Finance and Management, it costs $21 on average to process an invoice manually. These costs stack up exponentially for large organizations and banks that process millions of invoices, but not if intelligent solutions are leveraged to enhance these processes at scale.

Manual invoice processing may involve several steps, such as data entry, approvals, and validation, each requiring significant time. As such, manual processing can often lead to errors and delays.

To reduce the cost of invoice processing, banks are increasingly turning to automation technologies such as Intelligent Process Automation (IPA), Robotic Process Automation (RPA), and Conversation AI, which can streamline the invoice processing workflow and reduce the time and resources required for manual processing.

Vendor example: SAP

SAP is a Europe-based software development company. It specializes in Enterprise Resouce Management and Supply Chain Management software. The company offers conversational AI capabilities to automate conversations with clients or customers.

SAP conversational AI is a collaborative platform where companies can build interactive AI chatbots. The platform offers a single intuitive interface to train, build, test, connect and monitor chatbots. It works on Natural Language Processing (NLP) and low-code features.

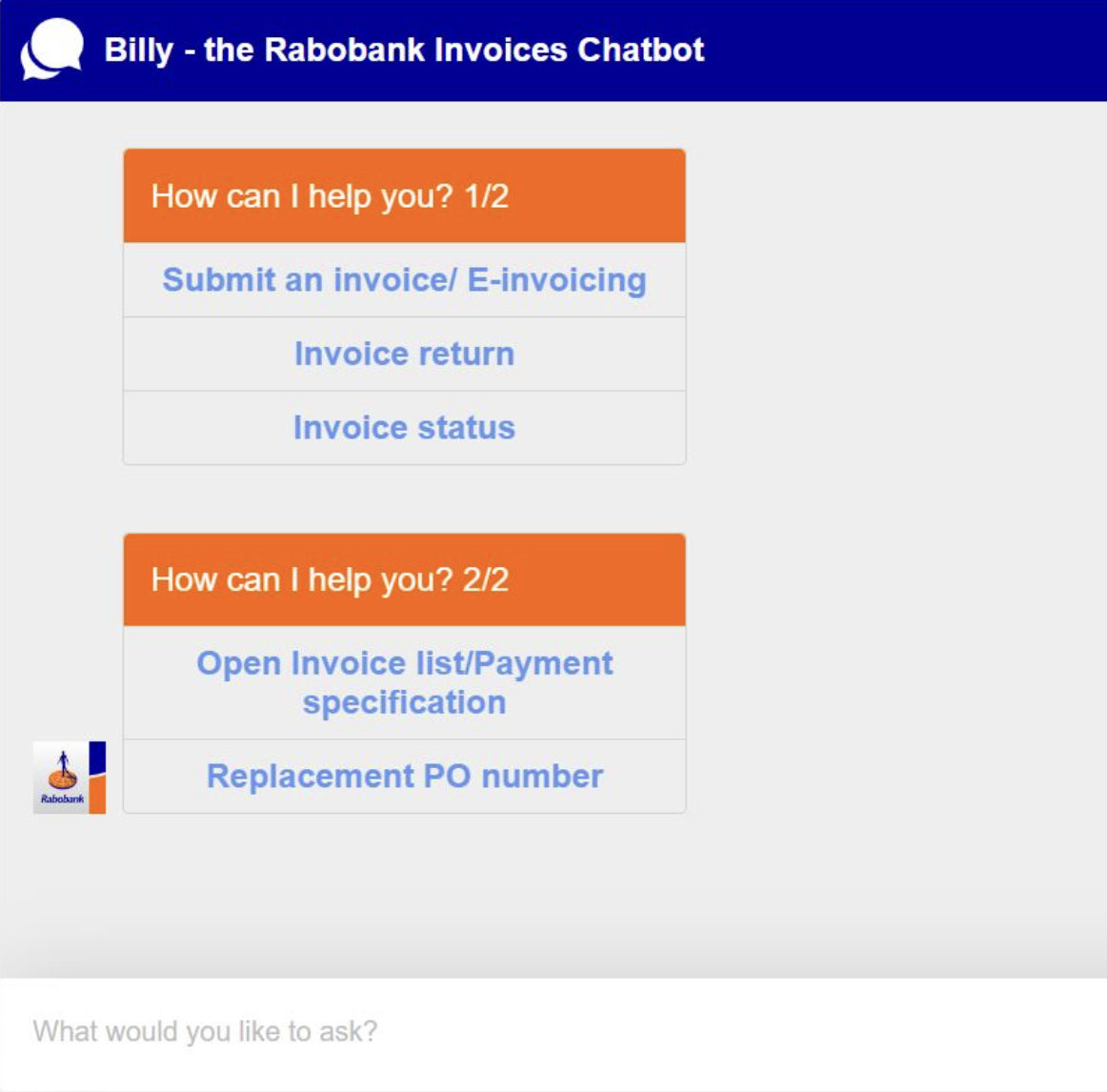

Rabobank, the Netherlands-based cooperative bank, saw its service desk teams overloaded with enquires about invoices from the suppliers. These queries were majorly about:

- Submitting an invoice

- Invoice return

- Invoice status and

- PO numbers

While the challenge for the desk team was to answer these repetitive questions, the opportunity for the company was to automate with an AI-based chatbot that could help get suppliers’ questions answered faster.

The bank began the initiative by leveraging conversational AI to answer standard, repetitive supplier invoice queries:

Screenshot from conversations with the SAP chatbot. (Source: Rabobank)

The case report claims the chatbot handled 100-150 conversations in the initial week after going live, resulting in higher employee and supplier satisfaction.

The report also claims SAP’s platform also provided better services for suppliers, and the chatbot was available to answer invoice queries 24 hours a day. These capabilities allowed staff to focus on more-specific, nonstandard questions during the COVID-19 lockdown as inquiries surged.