It seems that the majority of AI solutions for payment processing are focused on fraud detection and prevention. Some companies claim to offer straight-through processing software as well. Below, we detail four companies that all claim to offer artificial intelligence to banks and payment processors looking for solutions in two key areas:

- Fraud Detection

- Payment Optimization

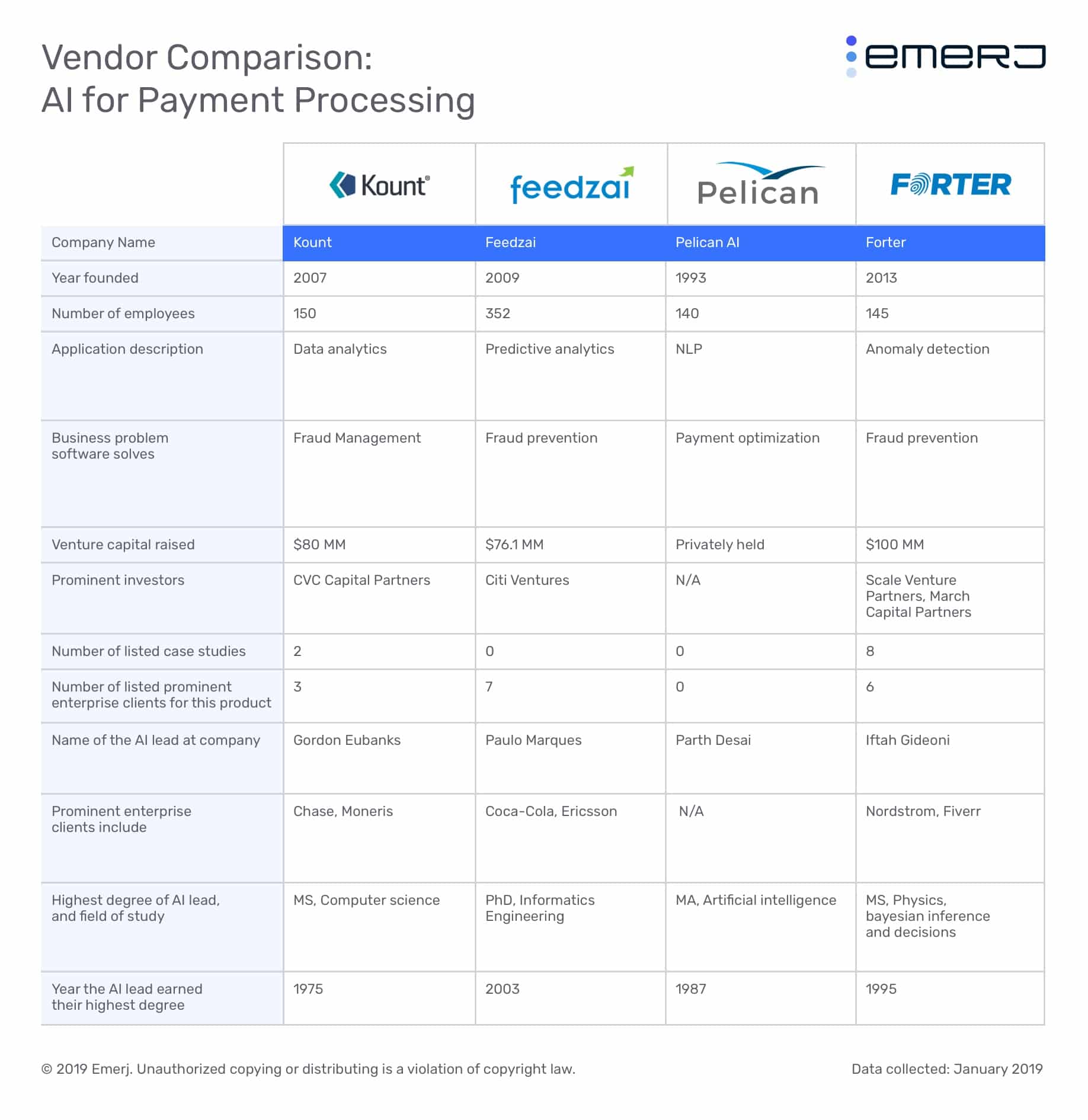

Here is a visual representation of the vendor firms analyzed in this article:

We’ll get started with background information about AI in payment processing, and then we’ll explore the vendor use cases in depth individually.

What Business Leaders at Payment Processors and Banks Should Know

The companies discussed in this report vary in their densities of AI talent, which is one of the three rules of thumb we use when determining whether or not a company is actually leveraging AI or using it more for marketing purposes. We look for companies with AI talent in their C-suites first and foremost, but perhaps equally important is the number of data scientists employed at the company.

If the company employs only one or two data scientists at most, it’s unlikely that its purported AI solution is at present based on machine learning. In some cases, a company might be using people to train its machine learning software, which is acceptable, but in many cases, the company really has no present intention of hiring the talent required to truly work with artificial intelligence.

Specifically, we like to see data scientists with Master’s or PhDs in artificial intelligence, cognitive neuroscience, computer science, or at the very least, a hard science or statistical field. A Bachelor’s in marketing or business management isn’t going to provide the education necessary to work with the amount of data that enterprises tend to have, let alone build a machine learning software intended to make sense of it all to some end.

With all that said, Kount is a company offering fraud detection and management software to payment processors and banks. They employ a few data scientists and “machine learning engineers,” although it’s worthy of note that their Senior Data Scientist joined the company in September 2018, 11 years after the company was founded and three months before this report was originally published.

He holds a PhD in Applied Mathematics, which indicates that he might be capable of building machine learning software and working with big data The company employs a few machine learning engineers with Master’s degrees in computer science as well. For this, we believe that Kount has a decent likelihood of offering genuine AI-based fraud detection.

Feedzai employs many data scientists with varying credentials. It seems as though they recently began hiring PhD-level talent in 2018, one of which holds a doctorate in auditory neuroscience/brain computer interfacing and the other a doctorate in cognitive neuroscience. Prior to this year, many of the company’s data scientists seemed to have been hired in 2016, and they were on average less credentialed than the recent hires. That said, these data scientists held Master’s degrees in statistics and computer science, one of which completed an internship that focused on machine learning in finance in 2014. This bodes well for the company.

The company’s CTO also was the Scientific Director at Carnegie Mellon University Portugal. He holds a PhD in Informatics Engineering from the University of Coimbra, which he earned in 2003; it’s not necessarily a degree indicating AI capability, but his position at Carnegie Mellon certainly does, as the university has perhaps the most renowned AI program in the world. As a result, we believe Feedzai has a very high likelihood of actually offering machine learning software. This bodes well for the company and those that choose to do business with it.

On the other end of the spectrum, Pelican.ai and Forter don’t seem to employ any credentialed data scientists at all save for one at Forter who holds a PhD in Theoretical Particle Physics. He joined the team in 2016, three years after it was founded, and he was brought on as the Data Science Team Lead, which means that there was likely a lack of data scientists at the company before his hire that could fill that position themselves. Forter claims to offer an AI-based fraud detection service, but their lack of data scientists might make this difficult. It very well could be handling fraud detection for its clients, but it’s possible that employees at the company are doing it—not a machine.

Pelican.ai, which offers a payment optimization solution, changed its name from Ace Software Solutions, an IT firm that was founded in 1993. Many IT firms rebrand themselves as specializing in AI in order to win business in the era of artificial intelligence hype. Many of them also put “AI” in their company names. Business leaders should be aware, however, that just because a company has “AI” in its name doesn’t mean that they employ the talent necessary to do AI. Pleican.ai may very well provide results for its clients, but it’s unlikely that they’re using AI to do it. They don’t seem to employ any data scientists according to LinkedIn.

Their CEO does have a Master’s in Artificial Intelligence from Georgia Institute of Technology, but this degree is from 1987, well before the development of machine learning. During the eighties, expert systems dominated the AI discussion, and although some researchers might still consider expert systems AI, they are fundamentally different from machine learning. It is very possible that their CEO has kept up with the developments of AI both in academia and in business, but the company as a whole still does not seem to employ the talent it needs to really leverage machine learning.

Fraud Detection

Feedzai

Feedzai offers a namesake software which it claims can help retailers and banks prevent fraud using fraud detection.

We can infer the machine learning model behind the software was trained on millions of bank transactions. Some of this data would have been labeled as fraudulent or suspicious. The labeled data would then be run through the software’s machine learning algorithm. This would have trained the algorithm to some degree to determine which transactions were possibly fraudulent.

Feedzai’s clients could then deploy the software, and the algorithm behind it would then be able to flag fraudulent transactions as they come into the client’s system. These transactions would continue to train the software’ algorithm as people accept or reject the software when it flags certain transactions. Thus, the software could “learn” new fraud methods as it runs.

Feedzai does not make available any case studies reporting success with their software, but they list lists Coca-Cola and Ericcson as some of their past clients.

Paulo Marques is CTO at Feedzai. He holds a PhD in Informatics Engineering from the University of Coimbra. Previously, Marques served as the Scientific Director at Carnegie Mellon University, Portugal.

Kount

Kount offers a software called KountCentral, which it claims can help payment processing companies detect and manage fraud using predictive analytics.

It’s likely that payment processors can integrate the software into their merchant portfolio, CRMs, and other large data repositories.

We can infer the machine learning model behind the software was trained on millions of bank transactions. Some of this data would have been labeled as fraudulent or suspicious. The labeled data would then be run through the software’s machine learning algorithm. This would have trained the algorithm to some degree to determine which transactions were possibly fraudulent.

Kount’s clients could then deploy KountCentral, and the algorithm behind it would then be able to flag fraudulent transactions as they come into the client’s system. These transactions would continue to train the software’ algorithm as people accept or reject the software when it flags certain transactions. Thus, the software could “learn” new fraud methods as it runs.

We could not find a video that demonstrates how KountCentral works.

Kount claims to have helped Bluesnap automate the fraud detection process. Bluesnap integrated Kount’s software into its entire customer portfolio. According to the case study, Bluesnap decreased their chargeback rate to 0.2% and an increase in transaction volume by 50%. However, it should be noted that this may not be a significant change because the percent decrease is unclear. Also, they were able to eliminate hundreds of daily manual transaction reviews.

Kount also lists Chase, Moneris, and Paypal as some of their past clients.

Gordon E. Eubanks is a member of the Board of Directors at Kount. He holds an MS in computer science from the Naval Postgraduate School. Previously, Eubanks served as a Board Member at Concur Technologies.

Forter

Forter offers a namesake software, which it claims can help retail businesses and restaurants prevent fraud using anomaly detection.

Forter claims users can integrate the software into their digital commerce platform.

We can infer the machine learning model behind the software was trained on millions of eCommerce transactions. Some of this data would have been labeled as fraudulent or suspicious. The labeled data would then be run through the software’s machine learning algorithm. This would have trained the algorithm to some degree to determine which transactions were possibly fraudulent.

Forter’s clients could then deploy their software, and the algorithm behind it would then be able to flag fraudulent transactions as they come into the client’s system. These transactions would continue to train the software’ algorithm as people accept or reject the software when it flags certain transactions. Thus, the software could “learn” new fraud methods as it runs.

Below is a short 2-minute video demonstrating how Forter’s software works:

Forter claims to have helped T.G.I.Fridays protect against fraud and improve their chargeback rate. T.G.I.Fridays integrated Forter’s software into its existing digital commerce platform. According to the case study, T.G.I.Fridays saw a 90% decrease in chargeback rates and a 6% increase in their approval ratings.

Forter also lists Fiverr and Nordstrom as some of their past clients.

Iftah Gideoni is CTO and General Manager at Forter. He holds an MS in Physics, Bayesian Inference and Decisions from The University of British Columbia. Previously, Gideoni served as Chief Data Officer at myThings.

Payment Optimization

Pelican.ai

Pelican.ai offers a software called PelicanPayments, which it claims can help corporate banks repair and route payments using natural language processing. The software could automate the process by which bankers would need to manually fix a problem with a declined payment. Such problems include a missing signature on a check, an incorrectly written payment amount, the customer’s account having been closed, or the customer having requested a stop-payment order.

We can infer the machine learning model behind the software was trained on hundreds of thousands of corporate bank transactions involving payments, exceptions, and routing. This text data would have been labeled as examples of legitimate payments or examples of payments with incomplete contradictory information. For example, a check could be lacking a signature or the written amount to be paid could differ from the numerical amount.

The data would also be labeled by routing number. The labeled text data would then be run through the software’s machine learning algorithm. This would have trained the algorithm to discern the chains of text that, to the human brain, might be interpreted as a payment with legitimate, incomplete, or contradictory information as displayed in a bank transaction. At this point, the algorithm would also be able to discern where the money needs to be routed.

The user could then upload bank transaction data that is not labeled into PelicanPayments. The algorithm behind the software would then be able to determine if the payment can be processed or needs to be declined. The system then rejects the payment if it is incomplete, or processes the payment if it is legitimate.

We could not find a video that demonstrates how PelicanPayments works, and Pelican.ai does not make available any case studies reporting success with their software. Also, Pelican.ai does not list any enterprise clients on their website. However, they have received certifications in Cash Management and Treasury solutions from SWIFT. As well as the title of Frontrunner solutions provider from EBAClearing.

Parth Desai is CEO and Chairman at Pelican.ai. He holds an MS in Artificial Intelligence from Georgia Institute of Technology from 1987. Previously, Desai served as Founder and Chairman at OneLinQ.

Header Image Credit: Square44.com