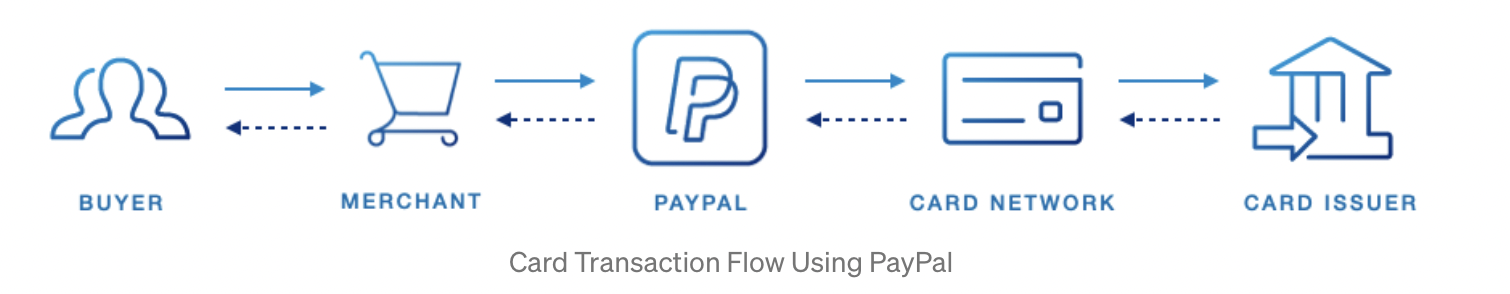

The company that would become PayPal Holdings first entered the electronic payments space in 1999, a year after being founded as Confinity. Confinity merged with Elon Musk’s x.com in 2000 and was renamed PayPal the following year. The company went public in 2002 shortly before its acquisition by eBay, through which it became “the site’s official payments provider.” eBay spun off PayPal as an independent company in 2015.

Today, PayPal processes more than 35,000 transactions every minute. In the last year, PayPal has processed some $1.2 trillion in total payment volume (TPV). On its website, the company claims to have grown to 416 million active consumer and merchant accounts and employs 27,700 employees. As of January 2022, PayPal trades on the Nasdaq with a market cap of approximately $210 billion. For the fiscal year ended December 31, 2020, PayPal reported total revenues of $21.5 billion.

In this article, we’ll look at how PayPal has explored AI applications for its business and industry through two unique use-cases:

- Payment Authorization Rate — PayPal uses machine learning models to improve the authorization rates of valid transactions on its platform by predicting and addressing the issuer declines that interrupt user payment requests.

- Fraud Prevention — PayPal uses machine learning and graph technologies to form connections and evaluate relationships within its data that help identify and stop fraud.

We will begin by examining how PayPal has turned to machine learning technology to help valid transactions get processed more efficiently by anticipating and remedying card declines that slow online purchases.

Improving the Payment Authorization Rate

False credit and debit card declines cost real money. A 2020 study conducted by checkout.com in partnership with Oxford Economics found that false card declines cost merchants in the UK, US, France, and Germany some $20.3 billion in 2019. More than sixty percent of that amount—$12.7 billion—went to competing sites. The rest, $7.6 billion, was just lost.

In eCommerce, card authorizations unlock revenue for online merchants. Even small advances in preventing false declines and ensuring efficient approvals can mean significant gains in sales, and savings on the expense side.

As a processor of more than $1 trillion in payments last year, PayPal set out to find a solution that could improve the efficiency and effectiveness of its payment authorization process.

The solution that PayPal architected, the payment processor claims, offers “higher than industry average” merchant approval rates by relying on a combination of the company’s AI and machine learning capabilities and expertise, extensive data sets, network tokenization, partnerships with issuers and networks, and various funding instruments.

In the machine learning component of its solution, PayPal built algorithms that could:

- Predict issuer declines, by creating models that consider, for example, recent issuer decline ratios and patterns as well as approval and decline history on different days and at different times.

- Remedy declined transactions, by prompting users to try different payment methods, supply another form of authentication like a CVV, or add funds to their account.

- Design effective retry strategies, that help determine the best way to retry payment by considering factors like the card used, the parameters of the transaction, and the optimal time to retry.

- Detect fraud in real-time, by identifying red-flag patterns like carding attacks and drawing on the insights of PayPal’s vast, two-sided data sets.

In deciding which model to apply to the data, PayPal claims to have considered both tree-based algorithms such as Random Forest and more complex models like neural networks before deciding to move to production with the tree-based Gradient Boosting Machine (GBM) model, which provided the best results during testing.

From 2017 to 2020, PayPal claims to have improved global authorization rates for its branded processing by over 300 basis points, says its SVP of Omni Payments, Jim Magats, in a company newsroom article. He goes on to state that new users have experienced 600-bp increases in their authorization rates after signing up for PayPal.

PayPal’s research also indicates that its payment authorization results have improved by 30 bps as a result of its smart retry strategies alone, and its decline prediction algorithms and resulting remedies have improved authorization rates by up to 240 bps at some merchants.

Fraud Prevention

Payment fraud is on the rise. In 2020, nearly one in four fraud examiners reported seeing a significant increase in the risk of payment fraud. And forty-seven percent of examiners predicted that payment fraud risk would significantly increase during the next year.

The growth of eCommerce sales is one factor driving the increases we are seeing in payment fraud. According to eMarketer research, US retail eCommerce sales will grow from $598 billion in 2019 to more than $1 trillion by the end of 2022.

As a global payment services provider, PayPal is looking for new solutions to address its fraud prevention needs. While these solutions must protect against the financial and reputational impacts that payment fraud can bring, they must also avoid the added costs and lost business that can come from unnecessarily slowing the transaction process through inappropriate declines, human intervention, and unneeded customer checks and controls.

To combat payment fraud, PayPal designed PayPal Fraud Protection, an “adaptive machine learning solution that helps merchants protect against evolving fraud.” PayPal claims that the strength of the solution in detecting fraud comes from the company’s vast stores of data, generated from its 2-Sided Network, the name PayPal uses to indicate the two sides of each transaction. (PayPal both processes payments and can act as a payment method, through its PayPal Wallet service.)

With the data generated from its 15 billion payment transactions generated by millions of accounts, in 2020 alone, PayPal claims that adding its digital wallet data “helps [PayPal] to notice anomalies or suspicious patterns … [that are] incredibly powerful in helping to stop fraud.”

In its Technology Blog, PayPal admits that the number of relationships in its data is “too huge to traverse and analyze if they were to be stored in a relational database.” Consequently, the company has turned to graph analysis, which enables PayPal to “build a payments graph that maps transactions between buyers and sellers.”

PayPal claims that its real-time graph database allows the company to connect different relationships in (near) real-time, which supports its fraud detection activities.

“Graph technologies have proven to be very effective in fraud detection and prevention,” PayPal concludes in a December 2021 post on its Technology Blog. Indeed, PayPal’s Fraud Protection service aims to:

- Reduce losses to merchants and buyers

- Decrease false positives and unneeded inconveniences to customers

- Minimize fraud prevention costs

As a percentage of its total payment value, or TPV, PayPal’s transaction losses (which includes fraud losses, chargebacks, and protection program expenses) have decreased from 0.18% in 2018 to 0.12% in 2020. According to LexisNexis data reported in an Intel case study, PayPal’s fraud rate is “well below the industry average of 1.86% [but] still represents over 1 billion dollars a year in losses for the firm.”