The applications of AI in pharma are building momentum, but we wanted to look beyond the hype and find the underlying trends that matter in business.

A Emerj study on healthcare industry executives currently using AI revealed that over 50 percent anticipate broad scale AI adoption by 2025 and nearly half of participants expect that initial AI applications will target “chronic conditions.” With an estimated 50 percent of Americans suffering from at least one chronic condition, the pharmaceutical segment of the healthcare industry is poised to be impacted by the expected trend of AI adoption.

It seems that no sources have taken a comprehensive look at artificial intelligence applications at the top pharmaceutical and biotechnology companies – and that’s exactly what we set out to do with this article.

In this article we aim to answer questions that business leaders are asking today:

- What types of machine learning applications are currently in use and in development at the top pharmaceutical and biotechnology companies, such as Johnson & Johnson and Pfizer?

- Are there any common trends among their innovation efforts – and how could these trends affect the future of the pharmaceutical drug industry?

- How much has been invested in machine learning and emerging tech innovation across leading pharmaceutical companies?

This article aims to present a comprehensive look at the implementation of machine learning by the five leading pharmaceutical and biotechnology companies ranked by total 2016 revenue.

Through facts and figures we aim to provide pertinent insights for business leaders and professionals interested in how these top five pharmaceutical and biotechnology companies are being impacted by AI.

Before presenting the applications at each of the top five companies, we’ll take a look at some common themes that emerged from our research in this sector.

AI in Pharma – Insights and Facts Up Front

Some of you will be eager to read this entire article and dive into individual use-cases, others are just looking for a handful of trends to consider. In this short “insights up front” section, we’ll dive into the general trends that we found at a high level. Readers with a deeper interest can read beyond this section into the individual use-cases from the top 5 drug companies.

In 2016, total U.S. prescription drug expenditures were estimated at $450 billion. The most recent data from the CDC provides context with a reported 48.9 percent of individuals in the U.S. taking at least one prescription drug within the last 30 days.

Bringing a new pharmaceutical drug to market takes about 12 years and can reach into the billions in R&D expenditures, industry leaders are now seeking more efficient methods of approaching this process and machine learning is emerging as a potential solution.

The current machine learning initiatives of the top five pharmaceutical and biotechnology companies reveal trends in the following areas:

- Mobile coaching solutions – The ability to advise patients and improve patient outcomes using real-time data collection (see Johnson & Johnson’s Patient Athlete™ program)

- Personalized medicine – The ability to analyze large amounts of patient data to identify treatment options using a cloud-based system that can process natural language (see Johnson & Johnson, Pfizer and Novartis’ applications of IBM Watson)

- Acquisitions galore – Pharma giants haven’t historically been flush with data science and AI talent, and as new startups combine the world of AI and healthcare, acquisitions will continue to feed to innovation needs of large (and old) biotech firms like those covered in this article

- Drug discovery – Doctors may feel threatened by the advent of an AI tool with the purpose of “augmenting” their abilities. Unlike doctors, pharma companies have every reason in the world to adopt the most cutting-edge technologies in the expensive and lengthy process of drug discovery. Unlike other applications within healthcare facilities, drug discovery seems to have a clearer path to adoption (for more insight into healthcare AI adoption, listen to our interview with investor Dr. Steve Gullans with Excel VM in Boston)

In the full article below, we’ll explore the AI applications of each company individually. It’s important to note that the top five pharmaceutical companies are early adopters of AI. As a result, limited data on the outcomes of these applications can be reported at this time and we clearly specify this for each company.

We’ll begin with Johnson & Johnson, the top-ranked pharmaceutical company based on 2016 revenue.

Johnson & Johnson

Mobile Platform to Improve Health Outcomes

In April 2015, Johnson & Johnson announced a collaborative effort with IBM’s Watson Health.

IBM Watson is an AI cloud-based system capable of processing high volumes of data and offers evidence-based answers to questions posed in natural language.The collaboration would initially concentrate on virtual patient coaching for individuals undergoing joint replacements and spine surgeries and rehabilitation support to improve patient outcomes. Coaching would be accessible through a mobile app designed to monitor and guide patient behavior throughout the pre- and post-operative experience.

The platform would enhance the Patient Athlete™ program launched by Depuy Synthes Companies of Johnson & Johnson and the Johnson & Johnson Human Performance Institute. To date, the company has not yet reported results on the impact of the Watson system on the Patient Athlete™ program.

Anesthesia

This is not Johnson & Johnson’s first initiative involving machine learning technology. The company combined automation and anesthesia in the operating room through the SEDASYS System which received a premarket approval from the FDA in 2013. SEDASYS is known as the “first computer-assisted personalized sedation (CAPS) system.”

Results from the initial study demonstrated a reduced risk of over sedation and faster patient recovery time; “99 percent recovered from the effects of sedation within 10 minutes.” However, amid safety concerns from members of the medical community and flat sales, Johnson and Johnson ultimately pulled the SEDASYS system from the market in March 2016 and reassessed its medical devices strategy.

Surgical Robotics

The company announced its move into the surgical robotics space in March 2015 through Verb Surgical. Johnson & Johnson’s medical device company, Ethicon, is collaborating with Google on this initiative which aims integrate data analytics capability into a digital surgery platform.

Surgical robots typically provide surgeons with a video feed of their patients during procedures. Verb Surgical aims to leverage AI to help surgeons interpret what they see during surgery. No additional updates have been reported since January 2017 when Verb Surgical presented a demonstration of its “first digital surgery prototype” to collaboration partners.

According to Johnson & Johnson’s 2016 annual report, while the budget is not itemized, the company spent $9.1 billion in R&D expenditures, representing 12.7 percent of company sales. As of 2012, Johnson & Johnson has made a reported 10 acquisitions but none appear to be AI entities.

Roche

In June 2017, Genentech, a member of the Roche group announced a collaboration with GNS Healthcare (a precision medicine company) focused on cancer therapy. The companies aim to use machine learning to convert high volumes of cancer patient data into computer models that can be used to identify novel targets for cancer therapy.

Strategic partnerships are reflected in the company’s larger business strategy with 45% of its pipeline derived from partnered products. Though the budget breakdown is not itemized for the public, Roche invested 9.9 billion Swiss francs in R&D in 2016.

In December 2014, Roche acquired Bina Technologies, a biotech company targeting the personalized medicine sector by providing a platform for large-scale genome sequencing. In its description of services Bina Technologies mentions that experts in machine learning are part of its interdisciplinary team but no additional specifics are provided. At this time there is no evidence of additional investments in AI by the Swiss company.

According to Reuters, Roche is among a handful of initial pharmaceutical partners for Boston-based Berg Health, a company focused on applying AI in for the discovery and development of drugs, and diagnostics and healthcare applications. We were unable to find mention of this partnership on either Berg or Roche’s websites, and we do not now know whether “partnership” implies ownership steak in Berg, a pilot program of some kind, or otherwise.

Pfizer

Drug Discovery

In December 2016, IBM announced that Pfizer would be one of the first organizations to utilize the Watson for Drug Discovery cloud-based platform. The collaboration targets cancer therapies and aims to “help sciences researchers discover new drug targets and alternative drug indications.” To provide context Watson for Drug Discovery has accumulated data from 25 million Medline article abstracts and 1 million medical journal articles compared to the 200-300 articles a human researcher can read in a single year.

Watson for Drug Discovery allows users to analyze “private data such as lab reports” and provides researchers with the ability to identify potential relationships between disparate data sets through “dynamic visualizations.”

“There are many hidden patterns in a patient’s cancer data that can impact the entire course of diagnosis and treatment and which can benefit from the benefit AI and ML.” – Nathan Buckbinder, Co-Founder + VP Operations, Proscia Inc.

The company’s R&D expenditures totalled $7.872 million in 2016. Less than one year into the IBM collaboration, results on the research effort have not yet been announced. Since 2012, Pfizer has made a reported 11 acquisitions but none appear to be AI entities.

Novartis

Breast Cancer Treatment Improvement

In June 2017, Novartis announced its collaboration with IBM Watson Health for the purpose of improving health outcomes and for breast cancer patients. The collaborators seek to develop a cognitive solution using real-time data to gain better insights on the “expected outcomes of breast cancer treatment options.”

“Through this collaboration with IBM Watson Health, we will use real-world breast cancer data and cognitive computing to identify solutions that may help physicians better understand which therapy may be best for which patients or advise clinical practice guidelines, with the goal of improving patient outcomes and experiences…we hope this collaboration also uncovers care efficiencies that can be applied beyond breast cancer.” – Bruno Strigini, CEO, Novartis Oncology.

Interestingly, a few months prior to the Watson Health announcement, Novartis entered into a similar collaboration with Cota Healthcare (data and technology platform for value-based precision medicine) in March 2017. The multiyear agreement aims to use Cota Healthcare’s cloud-based platform to “accelerate clinical development of new therapies for breast cancer and identify which patients will benefit most.”

Novartis reports $9 billion in 2016 R&D expenditures and not surprisingly, a large amount of the company’s pipeline projects appear to fall under the category of Oncology. This finding is based on a chart featuring major development projects which accompanies Novartis’ 2016 annual report.

Bayer

Acquisitions Focused on Cancer and Preventable Diseases

Bayer’s reported 2016 R&D budget totalled €4.67 billion (roughly $5.32 billion USD), and represented 9.8 percent of total company sales.

Aside from potential applications in the digital farming space, there is evidence of Bayer’s interest in AI in its 2016 Grants4Apps Accelerator.

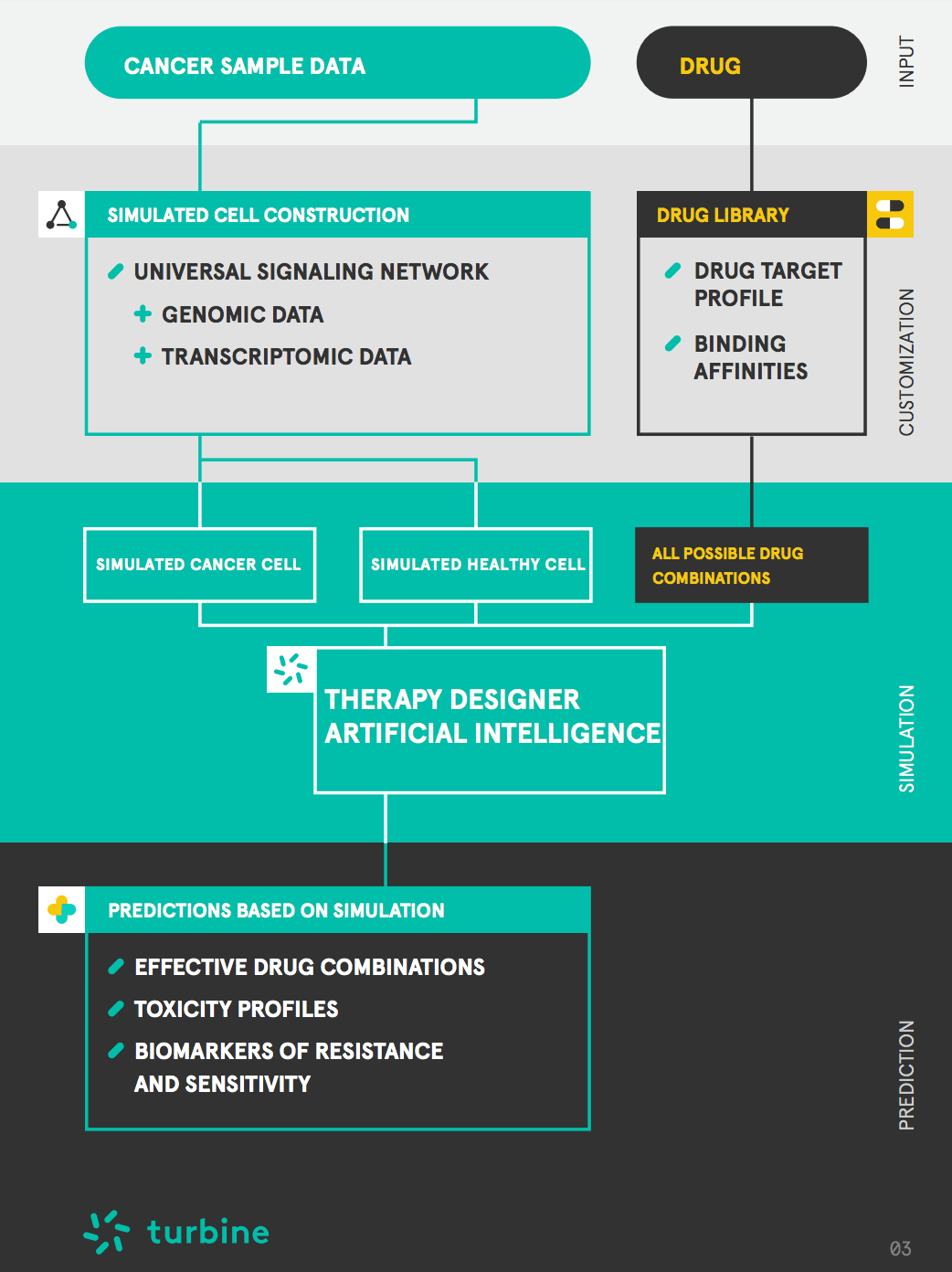

Through its accelerator Bayer offers digital health startups free co-working space, coaching and up to 50,000 Euros in funding. Two out of the four 2016 participants, Turbine and xbird were AI medical startups focused on cancer and preventable diseases, respectively.

“Combination therapies may be the best weapon against cancer, but their current design is costly and haphazard. We want to predict how any type of cancer responds to treatment by combining the latest research with AI to reliably simulate complex interventions.” – Szabolcs Nagy, Chief Operating Officer, Turbine

xbird aims to help users “survive preventable diseases.” Its platform tracks real-time user data via smartphones and other wearable technology and combines these data points to help “identify patterns leading to critical health events.” Time will tell if more company-centric adoption of AI will occur at Bayer.

Concluding Thoughts on AI Initiatives at the Top 5 Pharma Companies

Four out of the five leading pharmaceutical and biotechnology companies are currently leveraging AI solutions for chronic disease management in the areas of cancer and diabetes. From an economic perspective, initiatives to improve the patient and clinician experience of chronic disease management is smart business.

It should be noted that there’s nothing more hip and trendy than the inclusion of “artificial intelligence” on a company’s “about” page. While the AI startups we mentioned do seem to fit our criterion for AI expertise (i.e. they employ persons with advanced degrees and robust experience explicitly in AI), it’s safe to say that a large portion of drug discovery and biomedical startups will use the buzzword for it’s sex appeal – even without having any genuine focus on AI. At Emerj, we’re always skeptical, and we recommend our business readers do the same.

IBM has strategic collaborations with three out of the five leading pharmaceutical. However, the effect that IBM’s technology will have both on patient outcomes and the specific goals of each company has yet to be determined. According to IBM’s 2016 annual report, “Cognitive Solutions” (which includes Watson Health, Watson IoT, and related services) accounts for $18.2 billion in revenue, a 1.9 percent increase from 2015.

Watson takes a lot of flack for not substantially improving the overall financials of IBM itself – which has been on a slow and steady decline in revenues since late 2012. The firm’s massive push into healthcare might be seen as their best bastion for competitive advantage in the massive global healthcare market. As of today, we see very little traction in AI initiatives at top US hospitals and pharma companies.

Adoption and innovation are slow in healthcare, and IBM will need much more than 1.9 percent annual growth in Watson Health revenues to make up for it’s present losses. There’s no reason to give up on Big Blue, however, and time will tell if their massive investments in healthcare data and startups will translate to an industry advantage.

It is also important to consider how this trend may influence the growing field of precision medicine. This is a complex endeavor and specific interpretation of data will become increasingly crucial as the field evolves. The ability of machine learning technology to “learn” the patterns and differences across patient data offers many possibilities going forward.

We’ll be following healthcare closely in the months ahead, and we suspect that pharma and drug discovery applications will be active areas for development in the near term.

Related Healthcare Research on Emerj

Readers with a deeper interest in the applications of AI and machine learning on healthcare may want to explore our full machine learning in healthcare executive consensus from earlier this year:

Image credit: Memorial Sloan Kettering Cancer Center