This article was a request from one of our Catalyst members. The Catalyst Advisory Program is an application-only coaching program for AI consultants and service providers. The program involves one-to-one advisory, weekly group Q-and-A with other Catalyst members, and a series of proprietary resources and frameworks to land more AI business, and deliver more value with AI projects. Learn more at emerj.com/catalyst.

Last week we discussed business models through the lens of AI transformation (Comparing 5 AI Business Models – Part 1 – Transformation or Near-Term Value?).

This week, we’ll examine them through the lens of AI product development and entrepreneurship.

If you help to lead an AI product or services firm – or you’re thinking about developing an AI product or service – this article should help you think through the pros and cons of different business models across key criteria, including: Startup cost, switching cost, adaptability, and more.

AI Business Model Comparisons

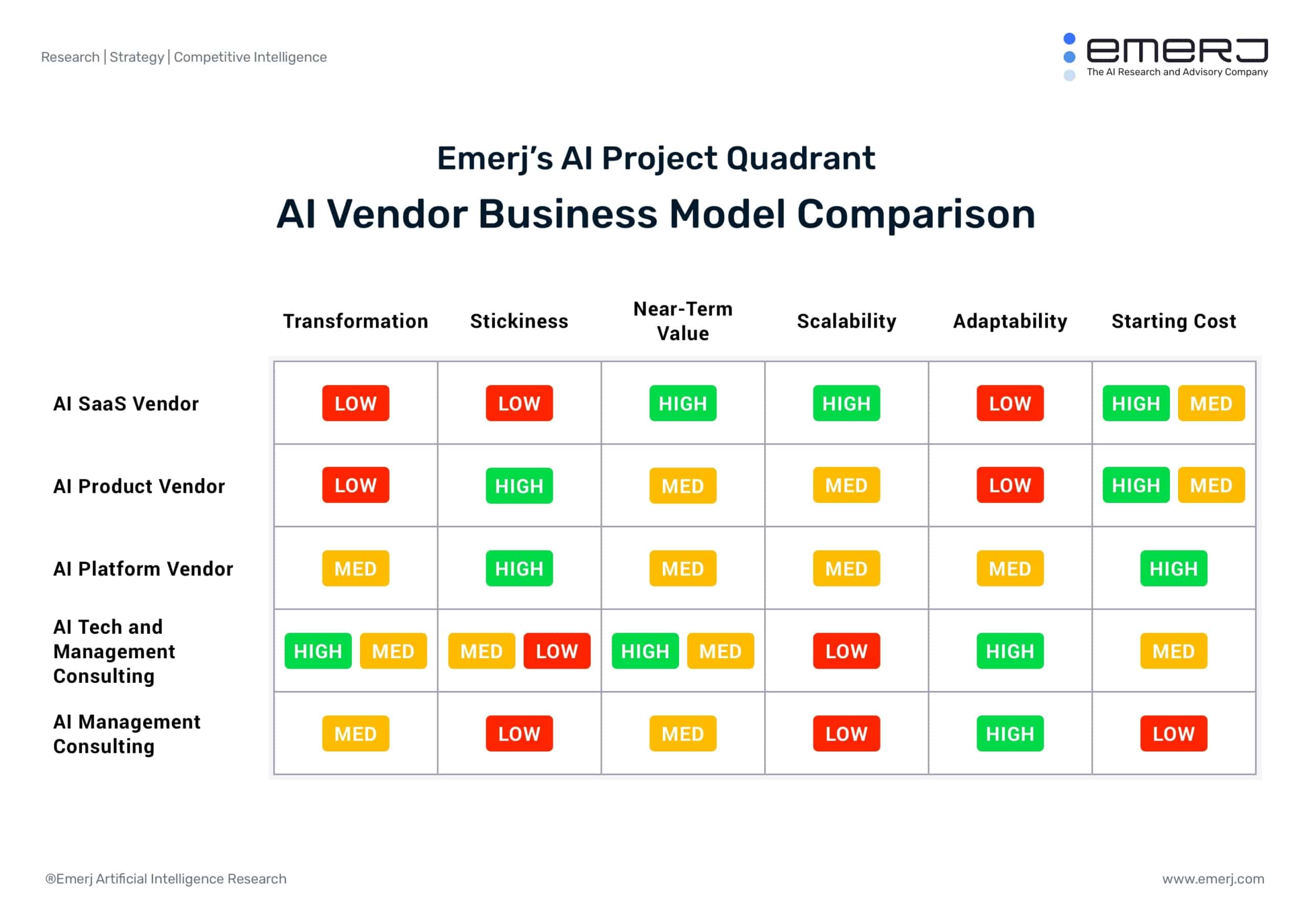

We’ll begin with a graphic that represents the pros and cons of the AI business models from our last article:

It’s important to note that the “Low”, “Med” (Medium), and “High” rankings here are general rankings. There are certainly some AI platforms that are – in some circumstances – less “sticky” than a traditional AI product, and there are some kinds of services and consulting firms that may be more focused on near-term value than others.

This graphic is intended to serve as a general guide to the typical strengths and weaknesses of these respective business models.

It might be a starting point for teams to select the business model they’re aiming to build, or a starting point for teams to talk about maximizing the natural strengths – or minimizing the natural weaknesses – of their business model of choice.

We’ll break down the key insights from each of the six qualities we explore in the graphic above:

Transformation

Definition: The AI maturity that this vendor type is likely to encourage and deliver on.

- AI SaaS and AI Product have the potential to involve very little by way of core AI maturity and transformation. If AI maturity is necessary, they will only build it to the level at which a client can use their product, they are incentivized to go no farther. This isn’t a balanced or complete view of AI maturity. Especially when it comes to AI and IT infrastructure, AI maturity should be considered from a company level, and invested in strategically where it will have the highest return.

- AI platforms can enable broad transformation, but build on their own proprietary tech.

Stickiness (Switching Cost)

Definition: The difficulty with which clients can switch to alternative services. High stickiness implies a higher switching cost – and generally – a greater embeddedness into the client’s operations.

- Consulting is inherently low in terms of switching costs, which is why consulting firms must focus on building trust and relationships for the long-term. Technology vendors can do this with the value of their solution, and the pain required to pull their solution out of a living workflow.

- AI SaaS which involves no integration is easily switchable (the opposite of “sticky”). Integration at the level of APIs only is also easily switchable.

Near-Term Value

Definition: The ability for a product or service to generate a quantifiable return on investment.

- AI SaaS and AI Tech and Management Consulting firms both have the opportunity to put surface-level AI applications in operation, potentially delivering AI value – but usually leaving out any meaningful AI maturity and learning.

- While AI Management Consulting firms might help with near-term priorities (creating an AI strategy, selecting the right vendor), they can’t deliver technical AI value by themselves, and so lack some of the near-term ROI lure of more technical consulting firms. That said, promises of near-term ROI value are often false, and not always best for the client.

Scalability

Definition: The ability of the vendor type to expand their offering to many clients quickly.

- AI SaaS companies that don’t require any integration at all (like Drone Deploy or EDITED) can scale as quickly as SaaS companies – at the expense of (a) gambling to find product-market fit, and (b) possibly being less sticky than more embedded solutions.

- Consulting is notoriously challenging to scale – and we can expect many AI consulting firms to spin up AI products in order to add more scale and consistency to their revenues (as of yet I don’t have many examples of firms successfully making this transition).

- AI product and platform firms give up a bit of scalability (white-glove integration and AI maturity building is hard) in order to gain more stickiness, and potentially, a greater ability to expand with more lucrative offerings into their existing clients’ businesses.

Adaptability

Definition: The ability for a vendor to change their offering to suit the unique needs of the client. (Might also be defined as: “The number of different client problems and industries that this vendor product can serve.”)

- Consulting firms can (ethically or unethically) claim to be a fit for almost any customer need. This is one of the many factors that makes them versatile, and generally a lower-risk business to start (at the cost of less stickiness, and less scalability).

- AI product and AI SaaS firms are least adaptable, and so most limited in the kinds of clients they can work with. This has the upside of a potential for strong fit with a specific market, and the downside of failing miserably if that market doesn’t buy and the product can’t be repurposed to suit other needs.

Startup Cost

Definition: The relative initial funding needed to offer a service or product from each vendor type.

- Many AI Management Consulting firms begin with a single founder (that’s what I did here at Emerj, for example). Technical consulting firms often need to sell enough work to hire (or initially contract) AI talent, which isn’t cheap. Still, essentially any consulting business model has a lower startup cost than an AI product firm.

- AI platform and product firms often have the highest startup cost, as they need to build more functionality than AI SaaS firms, and they require a much longer process of experimentation and pilot projects to find product-market fit.

Business Model Considerations for Aspiring AI Entrepreneurs

- In the COVID-19 Era, AI SaaS Has Advantages. I made the prediction in March of 2020 that AI vendors would shift away from heavy integrations and AI maturity, and towards streamlined AI value without integration requirements (AI SaaS). With pinched budgets and limited AI fluency at many enterprises, the next 2-3 years is likely to be rife with opportunity for RPA firms and AI SaaS firms. That isn’t to say that other AI product types are bad business models, but they’ll need a good reason (and strong sales skills) to sell maturity to firms who might be economically hurting, and dealing with existential issues that bar them from focusing on team and culture change for AI’s sake. I explored this in-depth in my March 2020 article titled The Survival of AI Startups in the COVID Crisis.

- The Best AI Product Firms Know Their Problem-Space. In 2015, AI firms began with an AI PhD and an almost non-existent value proposition (“AI” was exciting enough). The most successful AI firms involve founders who know their problem space, including:

- The data needed to solve the problem.

- The IT and integration environment.

- Details about the workflows that would be disrupted, and the roles impacted by this disruption.

- An understanding of the most pressing priorities of their sector or workflow.

- Etc…

- AI Platforms and AI Products are Risky but Transformative. Bigger dice roll as to whether they’ll work out, as they rely on client data, and some level of client maturity improvement… which is hard. If they stick, though, they might genuinely encourage AI transformation as teams work with – and get results with – real AI tools and workflows. Harder to sell in COVID-19 era. Is it any surprise these firms are usually venture-backed?

- AI Consulting is Proliferating. We’ve seen more of this from our subscribers, our Emerj Plus customers, and more. We’re seeing a common pattern where AI leaders within large organizations either (a) get frustrated with the slow pace of change, or (b) believe that their early AI experience in their industry is setting them up for bigger opportunities as a consultant or entrepreneur than as an employee. We believe this is part of the growing AI career gap, and that any enterprises will struggle to hang onto talented internal AI leaders – given the possibilities for them to spin out and create their own firms, or find new opportunities.

For AI Services and Sales Leaders

If you run an AI product or services firm, consider applying to our Catalyst Advisory Program. Catalyst is a one-to-one and group coaching program for owners and sales leaders of small AI services firms – with a focus on four key aspects of business success:

- Reaching the right AI services buyers

- Selling AI services

- Delivering value to clients

- Expanding existing AI services clients into long-term relationships

With proven frameworks and hands-on guidance, we help leaders become trusted AI advisors in their industry.

Learn more at emerj.com/catalyst.