Nike was founded as Blue Ribbon Sports in 1964 and originally operated as a distributor for athletic shoes made by a Japanese firm. By 1971, Nike sold its own line of shoes and began using the company’s iconic Swoosh design. By the time Nike went public in 1980, the company had achieved a 50% market share in its domestic athletic shoe market.

As of 2021, Nike trades on the NYSE with a market cap that exceeds $245 billion. For the fiscal year ended May 31, 2021, Nike reported revenues of $44.5 billion, according to its Fiscal Year 2021 10-K.

This article will examine how Nike has applied AI technology to its business and industry through two unique use-cases:

- Finding the Right Fit — Nike uses a combination of artificial intelligence technologies to help its customers quickly find the right fit and to save time and money in return processing and restocking expenses.

- Customizing the Customer Experience through Data Mining — Since 2018, Nike has acquired technology, tools, and expertise in data science and analytics to drive a more personalized experience for its customers.

We will begin by examining how Nike has turned to computer vision, machine learning, data science, artificial intelligence, and recommender models to help customers buy its shoes with increased confidence that they will find the right fit.

Finding the Right Fit

Sixty percent of people wear the wrong size shoe, according to Nike, and, every year, some 500,000 people say they’ve purchased their shoes in the wrong size. Nike blames this uncomfortable problem on antiquated, two-dimensional shoe sizing. Sizing a shoe is a “gross simplification of a complex problem,” the company writes in a May 2019 press release.

That’s why Nike created its Nike Fit tool. Nike claims that the solution, integrated within its larger Nike app, will find the right fit for its customers and show them what products will look like on their feet by combining:

- Computer vision

- Machine learning

- Data science

- Artificial intelligence

- Recommender models

- Augmented reality

Planning for the tool had been in the works since at least 2018. In its Q1 2020 Earnings Call, Mark Parker, then the company’s President, Chairman, and CEO, credited the April 2018 acquisition of Israel-based Invertex Ltd. with bringing to Nike the computer vision capabilities used in Nike Fit.

The Nike Fit tool, said Parker on that earnings call, “scans the foot, eliminating a significant consumer friction point by providing an accurate read of a user’s shoe size.” At that point in late September 2019, the tool had expanded to all locations in North America and was being implemented in Europe and Japan.

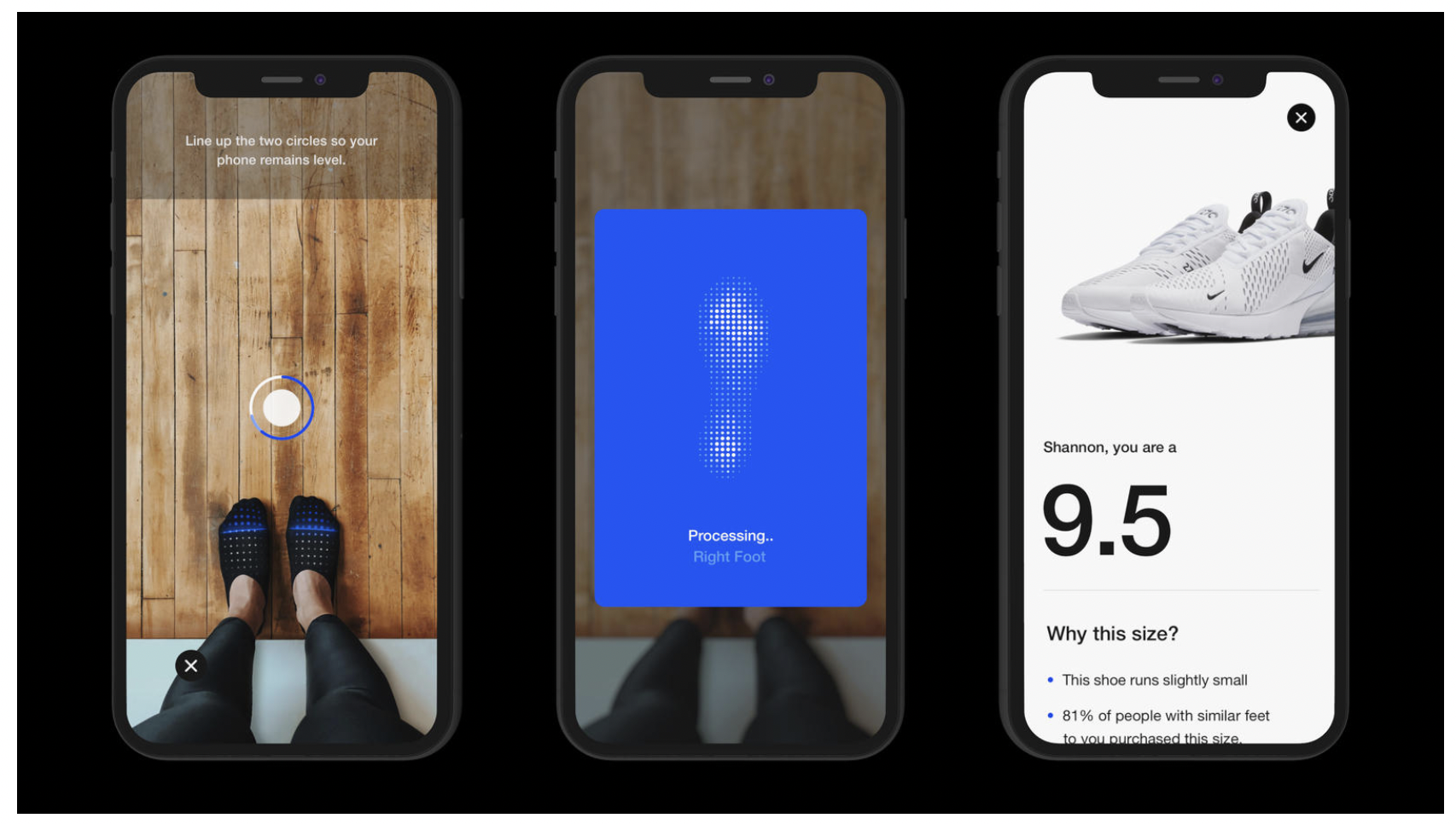

The Nike Fit app instructs users to stand against a wall while they line up their feet with the guides on their smartphone’s screen using the tool’s augmented reality (AR) technology. When the app gives the go-ahead, the user takes a photo and Nike Fit then uses computer vision to scan the customer’s feet and collect 13 visual data points, using their smartphone’s camera, Nike claims. Earlier Invertex documentation suggests that the tool “build[s] an accurate 3D model and extract length, width and height measurements.”

The tool then stores that data within the Nike app so that it is available to help with sizing future potential purchases. When customers explore new styles, Nike claims that the tool will offer a “best fit for you” option. The technology is also available in-store where users stand on a mat while a Nike sales associate scans their feet with a handheld device. The tool’s size and fit predictions will improve over time as its machine learning capabilities benefit from experience.

Nike does not share data that show whether the Nike Fit app has reduced return rates resulting from customer purchases or improved efficiency among sales associates who, presumably, might not have to make as many trips back and forth to its storerooms to find the right-sized shoe for each customer.

However, Nike, explaining its vision for the tool, says: “In the short term, Nike Fit will improve the way Nike designs, manufactures, and sells shoes — product better tailored to match consumer needs. A more accurate fit can contribute to everything from less shipping and fewer returns to better performance.”

Customizing the Customer Experience through Data Mining

Consumer data comes to Nike from many sources—its app ecosystem, enterprise data, and data from its supply chain. Generating and harnessing this data can be a great boon to companies like Nike with its global omnichannel marketing strategies and capabilities. However, when companies turn to analyzing this data and forming actionable conclusions, they sometimes fail in extracting useful insights and developing next steps.

This can be especially true for Nike as the company expands beyond the retail and wholesale partnerships that have brought the footwear manufacturer expansive growth in past decades. Today, the company moves ahead with a new strategy, Nike Direct—its rapidly developing direct-to-consumer sales channel, and part of its Consumer Direct Offense strategy, announced in 2017.

As with many other direct-to-consumer retail firms, some of Nike’s biggest opportunities for offering a personalized shopping experience lie in product recommendations and the results generated by product search. In back-office operations, Nike looks to build on its abilities to predict customer behaviors and optimize its inventories.

To deliver on these objectives, Nike set out to obtain the talent and tools it needs, acquiring four data science and analytics firms since 2018, says John J. Donahoe, Nike’s President and CEO on its Q3 2021 Earnings Call:

“Datalogue is our fourth data and analytics acquisition over the past couple of years and they use machine learning to help automate, translating raw data into critical and actionable insights and doing it real-time at enterprise scale.”

The other firms included:

- Invertex, an Israeli computer vision company,

- Zodiac, a consumer data analytics firm in 2018, and

- Celect, a Boston-based predictive analytics and demand-sensing firm, in 2019.

Invertex brought Nike “powerful 3d scanning technology that creates accurate models of one’s anatomy” according to its archived website and this led directly to the creation of Nike Fit (detailed above). The Zodiac platform projects revenue streams at the individual-customer level by applying predictive behavioral models and customer analytics to target data. Meanwhile, Celect aimed to optimize inventories by predicting future demand through the application of machine learning algorithms to a firm’s existing data, according to the company’s archived website from late 2018.

Below, a video from Nike acquisition Celect explains how the platform claims to better predict shopping behavior:

Add to this an internal reorganization initiative that has joined data teams with their design counterparts and you begin to see Nike’s vision of building their Nike Direct business through the insights, talent, and tools the company hopes to gain through these strategic acquisitions.

By integrating the technologies they’ve acquired through these strategic acquisitions, Nike aims to put their vast stores of data to work in creating personalized recommendations that resonate with its customers and in enhancing internal product design and logistics strategies to support demand. Ultimately, Nike hopes to grow revenue and market share through both organic and acquired skillsets and tools.

Although he did not go into specific financial results during the Nike Q2 2021 Earnings Call, Matthew Friend, Nike’s Executive Vice President and Chief Financial Officer, responded to an analyst’s question by elaborating on Nike’s predictive demand and inventory strategies:

“Getting consumers what they want, where they want and how they want. We’re investing in technology in the supply chain, so that we can better predict where to put inventory, where we think consumers want the inventory, and the benefits for us in that are in gross margin. It’s more full-price realization, it’s lower cost to fulfill, and frankly, it’s better for the environment because it’s less shipping and it’s less moving stuff. We’re investing in technology, to create O2O (online to offline) capabilities in the marketplace.”

Elaborating on Nike’s customer acquisition strategies, Matthew Friend continued:

“We’re investing a lot of money in digital marketing today, but the marketing, the opportunity that we see with greater acknowledgment of who our consumers are and how they shop across the marketplace is more personalization and it’s a greater return on those marketing dollars because we’re moving deeper into the funnel, we know who those consumers are, and we have the ability to react and reengage them at a lower cost to us or a lower acquisition cost.”

In the area of its business most targeted by consumer personalization, “NIKE Direct grew 30% [in Fiscal 2021] on a currency-neutral basis, driven by 60% growth in Digital,” the company writes in its 2021 10K.

In the last three years, Nike Direct sales have grown considerably, from $11.7 billion in Fiscal 2019 to $16.3 billion in Fiscal 2021. Nike Direct revenues now represent more than a 38% share of Total Nike Brand revenues, up from 31.5% two years ago.