While tech giants tend to hog the limelight on the cutting-edge of technology, AI in banking and other facets of the financial sector is showing signs of interest and adoption even among the banking incumbents.

Discussions in the media around the emergence of AI in the banking industry range from the topic of automation and its potential to cut countless jobs to startup acquisitions.

But the conversation in the C-suite is a little different. At Emerj, the AI Research and Advisory Company, we’ve spoken to dozens of banking executives as part of our AI Opportunity Landscape work, and one thing is clear: executives are eager to leverage AI for automating risk management processes, such as fraud detection and regulatory compliance.

We discuss our research further in the “Insights Up Front” section of this article. Then we set out to study the AI applications and innovations at the top US banks, helping you to answer the following questions:

- What types of AI applications are currently in use by customers and employees and what applications are in the works at banking leaders JPMorgan Chase or Wells Fargo?

- What common trends do their innovation efforts point to, and what does that mean for the future of banking?

- How much has been invested in AI and emerging tech innovation across leading US banks?

Through quotes from company executives and data from our AI Opportunity Landscape in banking, this article serves to present a concise look at the implementation of AI at seven of America’s top commercial banks by revenue.

Changes in the banking industry directly impact businesses and commerce, and we sought to provide relevant insights for business leaders and professionals interested in the convergence of AI and financial technology.

First, we’ll provide some insights about the state of AI in banking we discovered through exploring our data and interviews with banking executives

Readers with a broader interest in AI’s applications across the financial sector may be interested in reading our article Artificial Intelligence in Finance, which covers a wider array of applications beyond the top US banks.

Insights Up Front – Emerj Data Analysis

The seven leading US commercial banks have prioritized technological advancement with investments in AI applications to better service their customers, improve performance and increase revenue.

The future of finance will be heavily influenced by emerging fintech and AI applications setting the stage for increasing competition among the industry’s leading giants.

Banks Will Have Trouble Acquiring AI Talent

From our analysis of the top seven US banks, we’ve found an interesting but not surprising trend: it seems that larger banks (at the time of this writing) seem to have more robust AI applications in development and in use. This may reflect the tremendous difficulty of obtaining and retaining machine learning and AI talent.

Companies like Amazon, Google, and Facebook not only have a more alluring reputation for innovation, but they also have much higher profit-per-employee ratios, allowing them to shower top talent with higher salaries and excellent perks.

It’s unlikely that even behemoths like JPMorgan Chase or Wells Fargo will be able to compete well against the tech giants in the AI talent war of the next decade.

Banking Chatbots Are Hype

In researching these seven firms, “chatbots” and “conversational interfaces” emerge as trends that seem to inspire enthusiasm and excitement in the banking world. That said, conversational interfaces (chatbots) make up roughly 13.5% of the AI vendor product offerings in banking, less than we would expect given that they make up nearly 39% of the AI use-cases across top 100 banks.

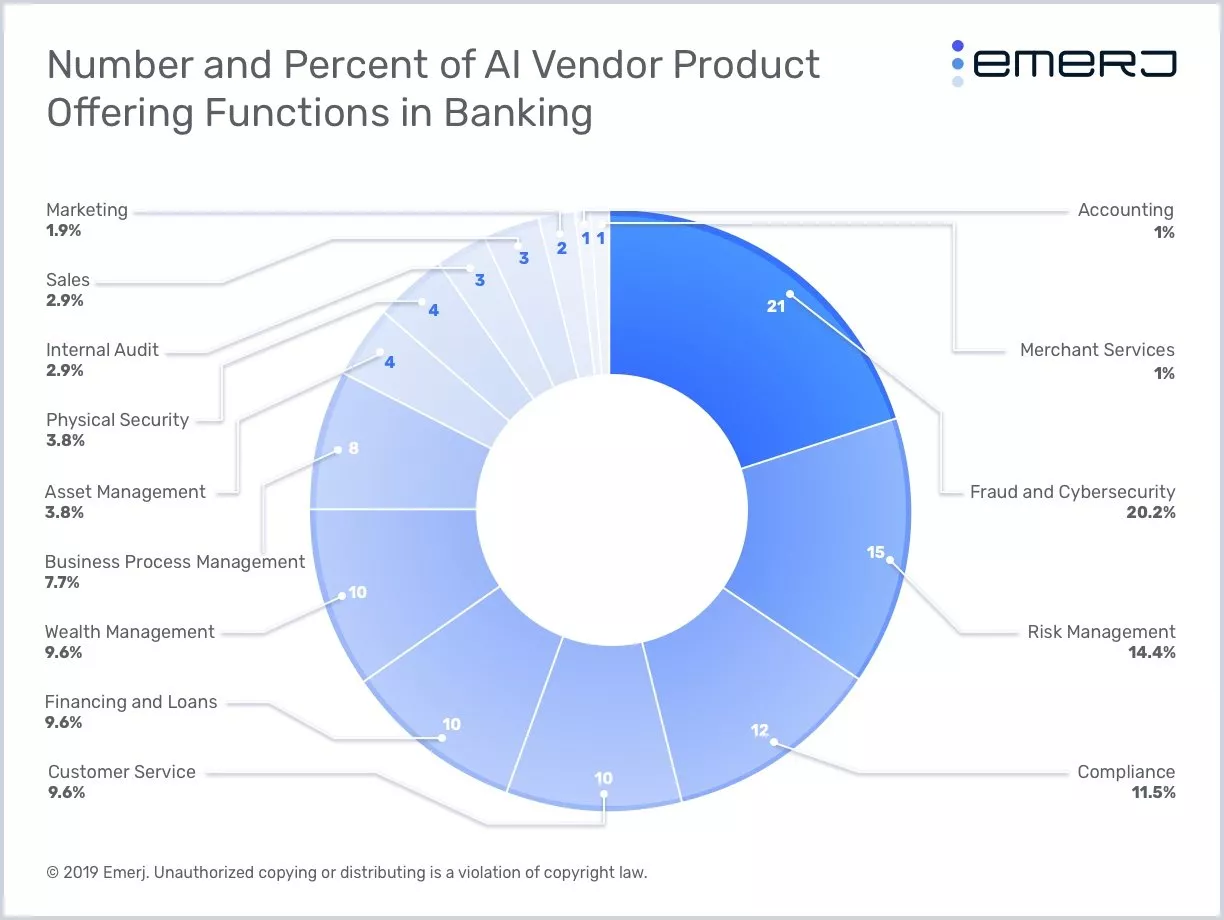

More broadly, customer-facing Functions (Customer Service, Wealth Management, Marketing, and Sales) made up only 25% of the total AI vendor product offerings in banking. In contrast, risk-related Functions (Fraud and Cybersecurity, Compliance, Risk Management, and Financing and Loans) made up 56%. The full breakdown of AI vendor product offerings by function is provided in the graph below:

We should note that banks are likely understating their use of AI for other use-cases, and the banking experts we interviewed for our research and our AI in Banking podcast all agree that banks are investing in AI for compliance and risk monitoring more than any other business area.

This plays out in the numbers; AI vendors selling products for Fraud and Cybersecurity, such as Feedzai, raised more money than any other AI vendors as a category (roughly 26% of the funds raised across AI vendors in banking). Compliance trailed at ~17%.

At the same time, banks are likely overstating their use of AI for customer service applications, including chatbots because:

- Chatbots are unlikely to deliver any kind of easily-measurable ROI

- The natural language processing technology behind them is still relatively nascent

- Even the best banking chatbots, such as Bank of America’s Erica, are still only able to handle rudimentary requests from customers

It will be a while before the technology has advanced enough for chatbots to generate natural language and hold conversations with customers more often than they’re routing customers to customer support agents.

It may very well be that more mundane business intelligence or cybersecurity will eat up most of the AI budget for these large banks, but it’s clear that chatbots have garnered the most excitement from the PR departments and spokespersons of the banking giants we researched.

This is likely due to the fact that most banks want to appear on the cutting edge of technology and want to appear convenient for their customers. However, banks tend not to have any real AI strategy in mind when they’re publishing their chatbot efforts. According to Ian Wilson, former Head of AI at HSBC:

The key question you’ll be hearing at the c suite in a bank particularly is ‘Whats next? What comes next? Where is the ROI?’ And often there is no answer to that question. There is no what’s next because there was nothing strategic put in place. It was just throw some mud at the wall and see what sticks. Which is fine to learn, but…I think you will see transitioning there is the recognition that we need to put some structure around this; we need to do this strategically.

Banks Are Downplaying Disruption (Including Job Loss)

Lastly, our research found a number of top banks referring to AI as an “augmenting” force for their employees, not a “replacement.”

To us, this seems to be a necessary move of the communications department, but a disingenuous way to describe AI’s potential impact on jobs, which will most likely involve both “augmenting” and replacing human beings outright.

Unlike many modern tech giants, old banks often have thousands of employees performing mundane paperwork and “legacy” processes, many of which may require complete elimination once machines can replace humans at the desk. Staff-heavy firms (including Accenture, who mostly echoed the same “augmentation” statement in our interview with their CTO) almost unanimously speak of AI in black-and-white terms.

We believe that the future involves a number of disruptive changes that banks (and indeed all modern economies) will have to prepare themselves for.

Next, we’ll explore the applications of each bank one-by-one, starting with JPMorgan Chase, the largest bank in the country by revenue.

JPMorgan Chase

JPMorgan Chase upped its technology budget to $11.4 billion in 2019. In the video below, Manuela Veloso, Head of the Machine Learning Department at Carnegie Mellon University and Head of AI Research at JP Morgan Chase and Samik Chandarana, Head of Analytics and Data Science at JP Morgan, discuss some of what JPMorgan Chase is doing with artificial intelligence: T

Internal Document Search – Contract Intelligence (COiN)

JPMorgan Chase invested in technology and introduced a Contract Intelligence (COiN) “chatbot” designed to “analyze legal documents and extract important data points and clauses” in 2017. Manual review of 12,000 annual commercial credit agreements normally requires approximately 360,000 hours.

Results from an initial implementation of this machine learning technology showed that the same amount of agreements could be reviewed in seconds. COiN has widespread potential and the company is exploring additional ways to implement this powerful tool, although further information on the rollout is sparse.

Predictive Analytics – Emerging Opportunities Engine

The Emerging Opportunities Engine, introduced in 2015 and discussed in a letter to shareholders, purportedly uses machine learning and natural language processing to help “identify clients best positioned for follow-on equity offerings.”

The technology has proven successful in Equity Capital Markets and the company stated their intentions to expand it to other areas, including Debt Capital Markets, but it’s unclear if this has happened yet.

Chatbot

First successfully piloted in 2016, the bank also made plans to officially roll out a chatbot “to respond to employee technology service desk requests.” Initially, the bank set a goal for the chatbot to handle 120,000 service tickets, but like COiN, further information does not appear publicly available.

Wells Fargo

Chatbot

Wells Fargo hasn’t publicized many artificial intelligence initiatives, but Steve Ellis, head of the bank’s Innovation Group, seemed eager to leverage AI in a 2017 press release for a chatbot pilot:

AI technology allows us to take an experience that would have required our customers to navigate through several pages on our website, and turn it into a simple conversation in a chat environment. That’s a huge time-saving convenience for busy customers who are already frequent users of Messenger.

The chatbot was piloted on Facebook Messenger and made available to 5,000 customers and employees. AI vendor Kasisto built the chatbot; the company was among the conversational interface vendors that scored highest on its Overall Score in our AI in Opportunity Landscape research, indicating relatively high funding, robust AI talent on its leadership team, and a history of success with its clients.

As a result, Wells Fargo’s chatbot was likely capable in comparison to others, but it’s unclear if the bank decided to roll out the chatbot to all of its customers.

Predictive Analytics – Predictive Banking

However, customers do have access to Wells Fargo’s artificial intelligence-based Predictive Banking application via smartphones. Below is a brief video providing an overview of the software:

Predictive Banking includes features such as:

- Alerting customers of higher-than-average recurring billing payments

- Reminding a customer to transfer money into their savings account if they have more money than average in their checking account

- Prompting customers to set up a travel plan for their account after they’ve purchased a plane ticket

Wells Fargo claims Predictive Banking can provide mobile app users with over 50 different prompts for various scenarios. Katherine McGee, Head of Digital Product Management at Wells Fargo, elaborated on one of these prompts in an email to Bank Innovation:

If a customer receives an incoming deposit which is not in their usual pattern of transactions and is not needed to meet their normal expenses or scheduled payments, we can highlight the deposit and suggest the customer save the funds.

McGee also said that Wells Fargo had planned to offer Predictive Banking to credit card and small business mobile customers in late 2018, but it’s unclear if they did so.

Bank of America

Chatbot – Erica

Bank of America piloted its popular chatbot, Erica, with company employees in late 2017.

The bank made the chatbot available to Rhode Islanders several months later, and by June 2018, all of Bank of America’s customers could download the Erica app on the company’s website.

Erica can purportedly:

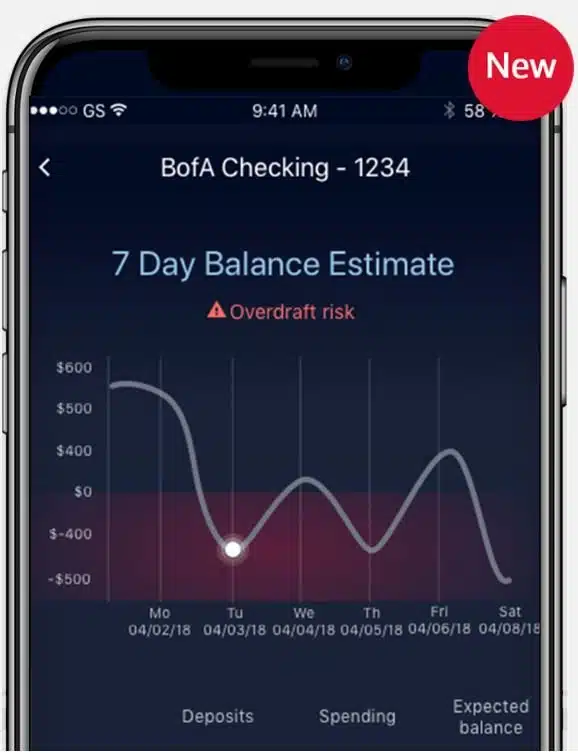

- Alert customers if their spending habits for the month will likely bring their balance to zero up to seven days in advance. This is likely done using predictive analytics and based on the customer’s average monthly spending, perhaps even what the customer purchases every month.

- Remind customers of recurring payments and whether or not they’re payment is scheduled after their due dates

- Flag recurring payments when they are higher than expected. This may be possible with anomaly detection, an AI approach used to detect deviations from the norm within real-time data.

- Lock and unlock a customer’s debit card on request

When it comes to chatbots, Bank of America is leading its competitors. Erica boasts 6 million users as of March 2019. According to David Tyrie, the bank’s Head of Advanced Solutions and Digital Banking:

Since launching Erica’s proactive insights [in late 2018], daily client engagement with Erica has doubled. Consistent with our high-tech, high-touch strategy, we’ll continue evolving our best-in-class digital banking capabilities, including Erica, to provide clients relevant, timely guidance and help make managing their finances easier.

CitiBank

Fraud and Anti-Money Laundering

According to our research, CitiBank has publicized its interest in artificial intelligence more than any other bank. We found 7 AI-related press releases across Citi’s assets. Through its investment and acquisitions wing, Citi Ventures, the bank boasts a global network of tech companies that participate in its six Citi Global Innovation Labs. In its portfolio of startup investments, particular attention has been given to eCommerce and cybersecurity.

It’s made numerous investments in AI firms, including Feedzai, a fraud and anti-money laundering vendor, in 2016. Recently, Citi announced a strategic partnership with Feedzai to integrate its software into the bank’s fraud detection processes.

Although the demo video below shows how Feedzai’s software works for eCommerce companies (and is admittedly a little corny), the principles it describes can certainly apply to banks:

Feedzai’s software will purportedly monitor customer payment behavior for deviations from that customer’s normal payment activity. These deviations might include an unusually large funds transfer or a payment made in a location that the customer isn’t known to frequent. The software would alert fraud analysts before the transaction clears.

Manish Kholi, Global Head of Payments and Receivables at Citi’s Treasury and Trade Solutions, said this of the partnership:

With the help of Feedzai’s solution, we can scale rapidly in an effort to deliver value to our clients, allowing them to make payments securely, efficiently and without friction, across the globe.

Although the press release states that Citi is looking to launch the software in 2019, it’s unclear when or if it’s already happened.

Citibank also purportedly worked with Ayasdi to pass the Federal Reserve’s Comprehensive Capital Analysis and Review (CCAR) process. Feedzai and Ayasdiare both employ genuine AI talent on their leadership teams, indicating a high likelihood that the companies’ software are legitimately using AI.

Ayasdi in particular is one of two companies that scored the maximum possible on its Overall Score across our AI Opportunity Landscape research in banking.

US Bank

Predictive Analytics – Expense Wizard

US Bank recently launched Expense Wizard in collaboration with vendor Chrome River. Expense Wizard is an artificial intelligence-based expense management mobile app that allows users to charge businesses for travel expenses without having to pay up-front themselves first.

The bank claims Expense Wizard is a chatbot that integrates into Chrome River’s expense reporting software. The software is explained further in the video below and a promotional video can be found on US Bank’s website:

According to US Bank, using Expense Wizard, a hiring manager can provide a virtual card to a candidate via the app, setting a card limit via US Bank.

The candidate would then receive access to the card through the Expense Wizard app, allowing them to buy plane tickets and book a hotel. They can also access details about the flight and hotel in the app.

The candidate can then use the app to make other travel-related purchases. All of these purchases are recorded and sent to the business for final approval. At the end of the candidate’s trip, they can submit the expense report to the business.

Bradley Matthews, Senior Vice President, Head of Product Management and Marketing at US Bank, had this to say about the software:

While talking with customers, we found consistent frustration around managing expenses for both non-employees and employees who travel without a corporate card. They needed to eliminate manual processes, make payments easy and control expenses. We worked closely with our innovation team and Chrome River to develop something completely revolutionary that brings mobile wallet technology and AI to the process, creating efficiency in a system that has been largely unchanged for years.

PNC

Data Infrastructure Overhaul

PNC invested $1.2.billion over five years, according to its 2016 annual report, into modernizing its “core infrastructure and build[ing] out key technological and operational capabilities,” with the objective of faster, more secure and more stable operations and services.

Still in the early stages of its tech strategy, the company’s initial focus has been on the consolidation of its data centers and a major shift to an “internal cloud environment.”

We can presume that the company’s infrastructure upgrades will help them leverage data and implement artificial intelligence and machine learning.

PNC seems to have worked with AI vendor Anaconda to start this, working with the vendor to overhaul its data science infrastructure for Python and R. As a result, Anaconda claims PNC is currently able to build machine learning models in-house, and as of summer 2018, the bank was purportedly looking to migrate their infrastructure into Anaconda Enterprise 5.2. It’s unclear if they’ve done so at this time.

Bank of NY Mellon Corp

Robotic Process Automation

The 233-year-old financial institution is banking on “bots,” specifically robotic process automation (RPA), to improve the efficiency of its operations and to reduce costs. Although RPA is not AI, RPA software sometimes integrates artificial intelligence. In addition, contrary to its name, white-collar processes are carried out not by physical robots, but by software applications.

These applications, known as web robots or Internet bots, are programmed to process automated tasks. In May 2017, the bank announced that over the past 15 months, the company has rolled out more than 220 bots developed by Blue Prism for handling tasks that are often repetitive in nature and normally handled by staff.

Examples include “data requests from external auditors” and “funds transfer bots” which help “correct formatting and data mistakes in requests for dollar funds transfers.”

The video below provides an explanation for how Blue Prism’s AI software works:

Former Senior Executive Vice President and Global Head of Client Service Delivery at BNY Mellon Corp, Doug Shulman, said this about the bank’s investment in RPA:

If you think about smart automation, robotics is a piece, workflow is a piece, and we’re combining smart forms, optical character recognition, workflow and robotics to get momentum around automating tasks.

BNY Mellon reports that the implementation of RPA has led to the following results:

- 100 percent accuracy in account-closure validations across five systems

- 88 percent improvement in processing time

- 66 percent improvement in trade entry turnaround time

- ¼-second robotic reconciliation of a failed trade vs. 5-10 minutes by a human

From a financial perspective, the corporation estimates that the activity of its “funds transfer bots” alone is responsible for $300,000 in annual savings. These bots cut down on the time employees spend processing payments and resolving data errors. In addition to increased efficiency and reduced costs, in their 2016 annual report, industry competition is emphasized as another reason behind the bank’s increased integration of AI technology.

Related Interviews on AI in Banking

Readers with a keen interest in the applications of AI in banking and finance may enjoy our AI in Banking podcast with episodes every week. Our guests have included the former head of AI at HSBC and top executives at Visa, CitiBank, Ayasdi, and other AI startups selling into banking. Below are links to our analyses of these interviews, which we release every month:

- The Future of Banking – AI, Fintech, and How Banks Can Survive Disruption – An analysis of interviews on how banks will need to respond to disruption from fintech firms and best-practices or adopting AI in the near-term.

- AI and Financial Risk Management – Critical Insights for Banking Leaders – An analysis of interviews about how AI is automating and improving fraud detection and compliance processes.

- Machine Learning for Credit Risk – What’s Changing, and What Does It Mean? – An interview with Sanmay Das, PhD, at Washington University in St. Louis, about how creditors can leverage new data sources and machine learning to build more nuanced credit models and approve more loans with less risk.

Subscribe to the AI in Banking Podcast wherever you get your podcasts:

[podcast-banking]

Emerj for Banking Professionals

Financial services leaders use Emerj AI Opportunity Landscapes to assess where AI can drive revenue, reduce costs, and mitigate risks.

We help banks and financial services firms build powerful AI strategies and select high-ROI machine learning projects in fraud detection, wealth management, underwriting, and more. Contact us to learn more.