AXA is a multinational insurance company founded in France in 1816. AXA offers a range of individual and business insurance solutions in over 50 countries. Aside from insurance, AXA also has businesses specializing in investment management and other financial services.

AXA is one of the largest insurance companies in the world by market cap and revenue. The company ranks as one of the top three insurers in Europe, Asia-Pacific and Latin America and is the leading insurer in both France and Switzerland.

In 2022, AXA reported revenues of €96.7 billion. The insurer employs 149,000 and serves 95 million clients worldwide.

According to an AXA article on artificial intelligence, the insurer uses AI to improve its products and services, optimize claims management, detect fraud, and personalize insurance offers. The article also notes AXA’s use of AI in non-business endeavors that align with the company’s views. For example, the company reports using AI to advance financial inclusion, reduce its carbon footprint, support sustainability efforts, and promote health and well-being.

In this article, we will examine two timely AI use cases at AXA, including:

- Workforce upskilling: Providing employees with personalized and adaptive learning experiences, reducing staff attrition, and increasing employee engagement using machine learning and natural language processing (NLP)-based systems.

- Predicting significant traffic accidents: Predicting large traffic accidents with deep learning models to lower claim costs and achieve improved price optimization.

Use Case #1: Workforce Upskilling

AXA Switzerland faced a familiar workforce challenge: how to upskill its employees to address current and future skills gaps. According to the World Economic Forum, half of all employees worldwide will require upskilling by 2025 to boost GDP by $6.5 trillion over the next decade.

According to a case study published by Learning Pool, AXA Switzerland’s partner in the endeavor, the insurer first had to identify the skills already present within the company. Next, AXA sought to project future skills their workforce would need to acquire as the business and industry changed.

Per Learning Pool, the way forward was to design a platform for AXA and its employees an AI-powered Skills Platform that could:

- Assess employees’ current skills and identify their skills strengths and gaps

- Access personalized learning content to close employees’ existing skills gaps, add new skills, and enhance their employability within AXA

- Connect with experts and peers in the organization for cross-discipline training

- Discover future-oriented roles that match their skill profile and interest

- Share feedback and guidance with learners

- Track learner progress and achievements

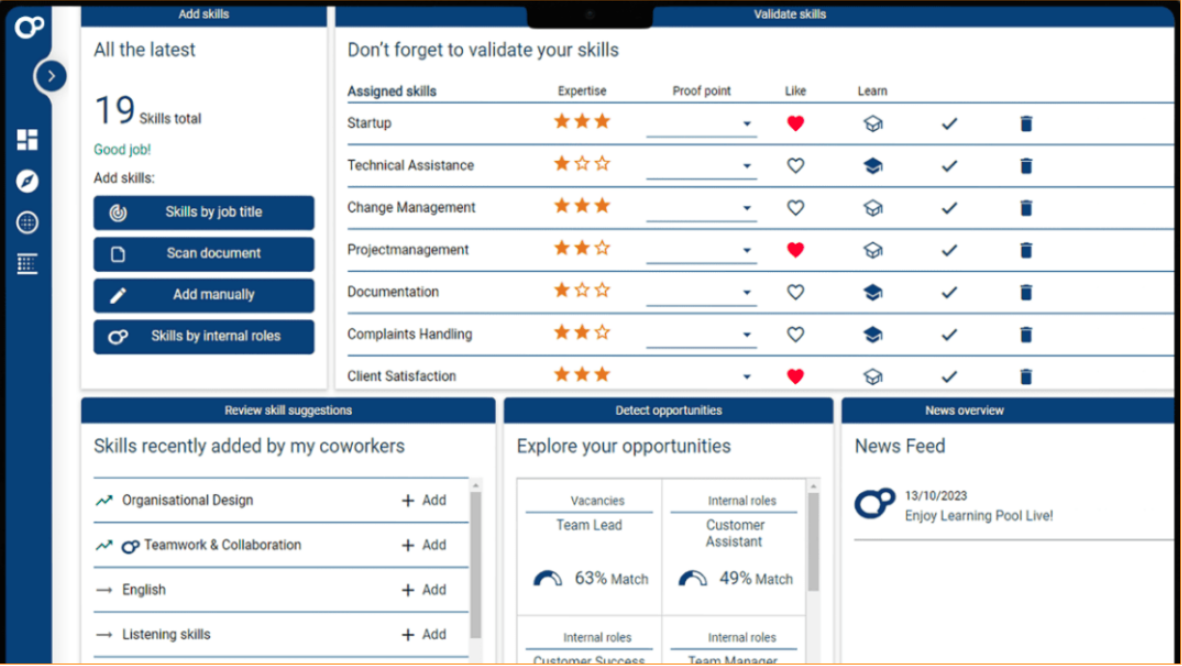

The input data is acquired by the employee logging into the learning platform and creating or updating a profile with their current goals, interests, roles and skills. The platform uses a combination of AI, machine learning algorithms, and NLP to analyze and match the employee’s skills and interests with relevant AXA career opportunities and learning content.

Then, a dashboard populates that displays the employee’s current skill levels, gaps, learning progress and recommended actions. From there, the user can access various learning content, including courses, projects, quizzes and simulations. The adaptive learning engine automatically adjusts the platform to the learner’s learning needs and preferences.

User Dashboard. (Source: Learning Pool)

The AI within the platform also empowers AXA to identify the trends occurring in its market and industry to “shape and outline the skills and roles that may be required in the future.” For example, the platform has created a new health underwriter role profile emphasizing “more communication skills … negotiation competencies and international focus.”

Concerning results, the Learning Pool article reports the following:

- Over 35,000 employees completed their skills profile

- 72% satisfaction of overall users

- A reduction in staff attrition

- A “dramatic” growth in employee engagement with skill development

Use Case #2: Predicting Large Traffic Accidents

Like every other company in the hypercompetitive insurance industry, AXA has a vested interest in optimizing policy prices. A key influencer of policy prices is large-scale accidents. Approximately 1% of all accidents at AXA fit this category. Large-scale accidents are pricey, requiring the company to pay $10,000 or more.

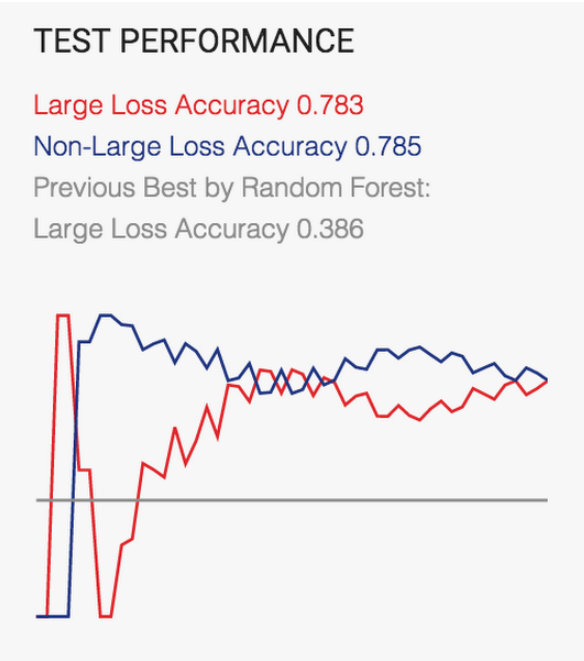

AXA’s team in Japan was researching the capabilities of machine learning to predict large-scale accidents, but the prediction accuracy of 40% was deemed “inadequate.” A developmental deep-learning model powered by Google’s TensorFlow platform was conceived to improve prediction accuracy.

TensorFlow Model Accuracy Versus Random Forest Model. (Source: Google Cloud)

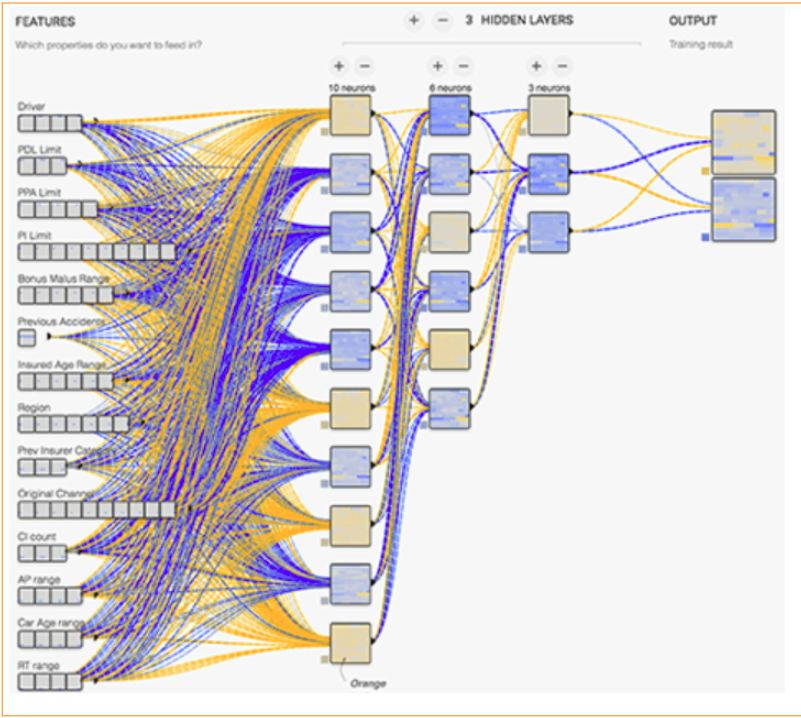

AXA used historical data from 1.5 million customers to train the deep learning model. This input data comprised over 70 fields, including customer claims history, driving behavior, personal information, and vehicle details. An algorithm that consisted of multiple computational layers was used to parse this array of data.

The model’s output is a customer risk score used to predict the probability of the customer having a significant traffic accident.

AXA’s deep learning model demo UI. (Source: Google Cloud)

AXA uses this risk score to adjust the customer’s insurance price. According to an article published by Google (AXA used Google’s TensorFlow to build and train the model), the risk score also provides feedback based on the customer’s driving habits and behavior.

The feedback likely suggests ways that the customer can improve their driving habits, helping to potentially reduce the risk of the customer having a significant traffic accident and lowering their insurance premium.

Per the article published by Google, AXA increased the model’s predictive power from 40% to 78%. External sources state the solution was indeed able to optimize product pricing. In addition, it is reported that the deep learning model reduces claims costs. We were unable to find any quantitative data to substantiate this, however.