Asset and wealth management firms are exploring potential AI solutions for improving their investment decisions, and making use of their troves of historical data. In fact, according to our AI Opportunity Landscape research into the banking industry specifically, approximately 13.5% of the AI vendors in banking offer solutions for wealth and asset management.

Asset management for digital assets (like an investment portfolio) or distributed industrial assets (like factory machinery or a fleet of transportation trucks) are applications where voluminous data about the assets (like the historical performance of a particular fund or the historical maintenance data for a fleet of trucks) is already being recorded, making them ripe for automation through AI.

Unsupervised learning techniques applied to financial data, news, industrial sensor data – or even social media data – hold the promise to inform investment decisions in new and exciting ways, potentially giving investment firms an edge in the market.

According to a 2017 report by the Financial Stability Board, pure-play AI and machine learning firms have managed assets of over $10 billion till 2017, and that number is projected to grow rapidly in the next five years.

In this article, we’ll explore the current landscape of artificial intelligence applications in asset management and investment management. We’ve segmented these applications into three broad groups, and we will provide examples of each:

- Physical Asset Management

- Industrial Predictive Asset Management and Monitoring

- Digital Asset Management

- Portfolio management

- Investment Advisory Consumer Applications

Industrial Predictive Asset Management and Monitoring

Simularity

Based in Point Richmond, California, Simularity has launched an AI powered predictive maintenance and remote asset management software which the company claims can automatically detect anomalies from industrial sensor data in real-time.

For example, in a recent case study from Simularity and Intel, Simularity worked with an oil and gas enterprise which had faced an unexpected parts failure. Simularity claims that their platform examined six months of historical sensor data from a particular oil well that had the failure. The software then coaxed out the abnormal patterns in the data based on correlations between all the sensor variables. We explain the case study in more detail below:

- A Progressive Cavity Pump (PCP) driven oil well in Oman suffered an unexpected breakdown and replacement parts and outsourced services cost the oil refinery over $75000.

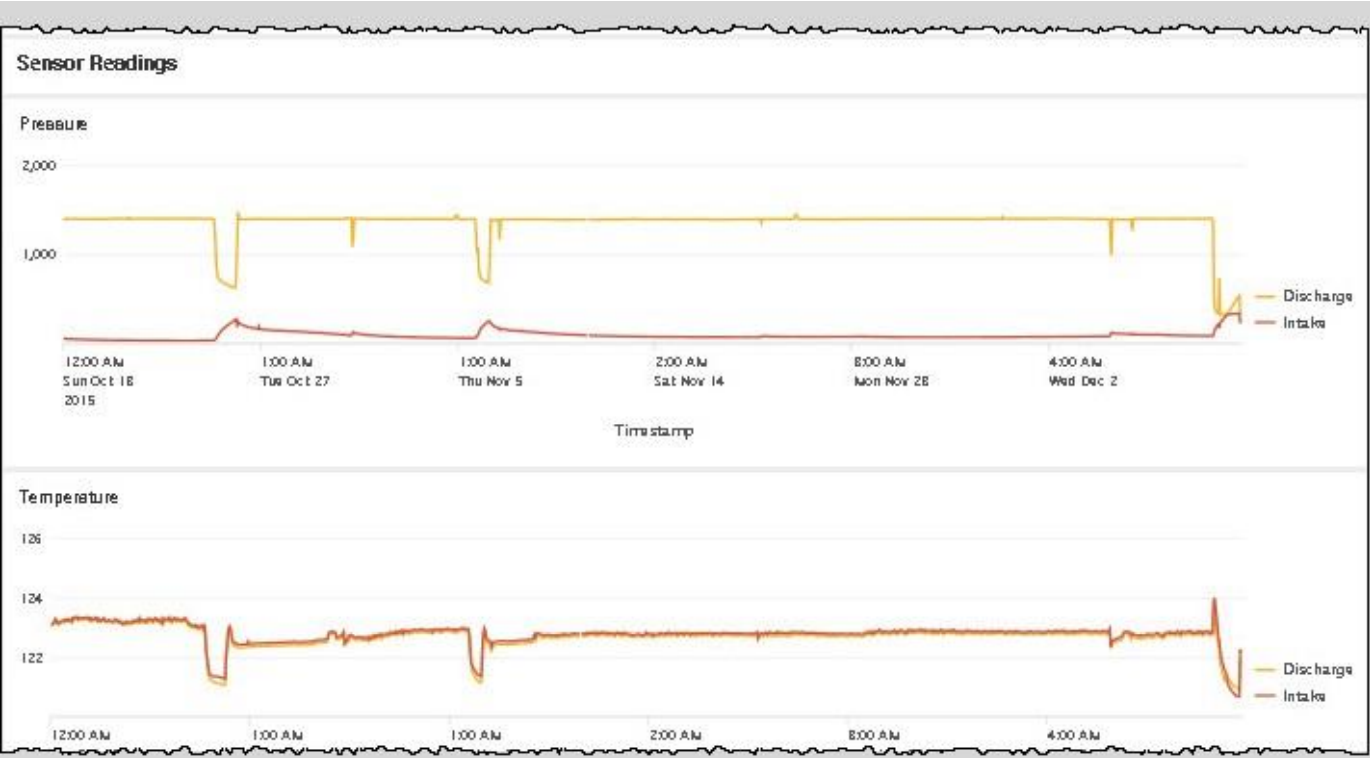

- Simularity’s platform was used to analyze the historical data from the GeoPSI (which can measure factors like vibration in the pump and pressure and temperature levels) sensor data. Simularity claims that the platform could automatically establish a ‘baseline’ reading for each of the sensor reading and ‘learned’ what constituted an abnormal reading. (See repeated drops in pressure and temperature in the figure below before the accident occurred)

- Simularity also claims that after the integration the client was able to reduce unplanned downtime, but from our initial research, we could find no further evidence of any measurable results for this case study.

From our initial research, we found only one case study of Simularity’s platform being applied to predictive asset maintenance (example discussed above).

The 2-minute video below is a demo of the Simularity platform for real-time anomaly monitoring for industrial equipment sensors.

Given below is a 3-minute video where Peter Koning the VP of sales at Simularity demos how their platform can aid in industrial asset management and predictive maintenance.

Simularity’s AI platform was developed under the leadership of CTO, Ray Richardson who has previously attended the Florida Institute for Human and Machine Cognition at the University of West Florida before going on to become the CTO of Wind River Systems, a California-based embedded systems software provider.

Readers with a broader interest in industrial asset management may be interested in our interview with Predii’s CEO about predictive maintenance for machinery and equipment.

Presenso

Israel-based startup Presenso has launched a cloud-based software aimed at predictive maintenance and management of industrial assets. Presenso’s niche seems to be in assisting industrial manufacturers make more effective use of the sensor data in their factories and assembly lines (a similar value proposition to firms like Uptake).

The company claims that its predictive asset management platform uses deep learning and machine learning techniques on sensor data to identify and detect abnormalities in the data, finding deviations from standard sensor patterns. Presenso also claims that its unsupervised platform can prompt alerts to facility managers in case of potential breakdowns in the machines.

For example:

- Using predictive maintenance platforms like Presenso, automotive manufacturers can potentially monitor the performance of industrial machinery in their factories (using data from a variety of sensors like pressure, temperature, vibration, gas detection etc.)

- The platform uses unsupervised machine learning algorithms (see video below) to establish baseline readings for standard operating conditions and might be capable of identifying anomalies (like very high or very low pressure or excessive vibration).

- The platform then alerts the maintenance engineers to the abnormal readings along with possible recommendations. The automotive manufacturer’s maintenance team might get alerted by the platform about excessive vibration being caused in a particular robot due to a faulty motor. The platform might also suggest a list of suitable replacement parts eventually leading to fewer downtimes in the manufacturing process.

Below is a 7-minute video from Presenso where Eitan Vesely, CEO of Presenso explains how their platform uses unsupervised machine learning for asset maintenance

In a 2017 case study, Presenso claims to have worked with Bax Energy in a project where their platform was used to predict failures in Bax’s wind farms (On average operational and maintenance costs in wind turbines account for a high percentage of the cost of production). We discuss the case study in more detail below:

- Bax Energy maintenance engineers kept detailed records of historical data from IoT sensors in one of their wind farms which had 14 wind turbines of 2MW each. Presenso’s platform had access to one whole year of maintenance data from around 60 different sensors (mounted on each of the 14 wind turbines) measuring temperatures, vibrations, wind speeds and electrical performance.

- Presenso was tasked with predicting failures before any alert was activated on the traditional SCADA (industrial automation monitoring software which creates alerts only when a failure has occurred) systems

- Presenso claims that using the historical data, their platform was used to monitor the wind farm (although from our research it is unclear how long this project lasted) and reported 40 alerts to maintenance engineers at Bax. This could be alerts such as identifying patterns in abnormal historical sensor readings in one turbine which previously lead to a particular part being replaced and alerting the engineers to a potential need for spare parts.

- Presenso claims that during the project, the platform identified 38 alerts which resulted in actual maintenance issues being identified and two false positive results where. Additionally, the software failed to alert engineers to 8 failures that were otherwise reported by the SCADA system.

- As per Presenso’s claims, the project helped Bax predict maintenance issues 52 hours (on average for the 40 alerts) before they were reported by the SCADA system although further details on the time-scale of the project or what other preventive measure that Bax took during this time were unclear from our research.

Deddy Lavid, the current CTO of Presenso earned a master’s degree in computer science and information technology at the University of Haifa in Israel where his thesis focused on machine learning, text mining, and information retrieval. Deddy was also the Software Team Lead at the Rafael Advanced Defense Systems.

Portfolio Management

Aladdin Platform by BlackRock Solutions (BRS)

BlackRock, one of the world’s largest investment management firms, offers the Aladdin Risk Platform which is an operating system tailored for investment managers. The company claims that Aladdin can uses machine learning to provide investment managers in financial institutions with risk analytics and portfolio management software tools.

According to BlackRock the platform enables individual investors and asset managers to assess the levels of risk or returns in a particular portfolio of investments. The company claims that Aladdin can automatically monitor over 2,000 risk-related factors per day (like interest rates or currencies rates) and test portfolio performance under different economic conditions.

For example:

- An investment management firm might find it possible to augment the capabilities of human investment managers using Aladdin by giving them the capability to predict the performance of portfolios (much faster than if done manually) in real-time. The platform can potentially be fed with input data in the form of historical trading performance of securities in a fund, and data on risk factors to predict future performance under different economic test conditions.

An article in Financial Times reported that BlackRock is in the process of setting up a new BlackRock Lab for Artificial Intelligence in Palo Alto, California focused on applications of AI and ML in asset and investment management.

In 2014, the Oregon State Treasury (OST) recommended that the Oregon Investment Council (OIC) contract BRS to acquire the Aladdin platform’s asset risk management services. This was aimed at proving the OSTs staff with risk analytics and portfolio management tools to support the state’s $90 billion investment portfolio, enabling staff to generate customized risk reports (e.g., duration, geographic and sector exposures, scenario analyses, etc.)

A 2015 report from the Oregon State Legislature states that the implementation required six months and went live in September 2015. Results captured in December 2015 in the same report state that a majority of the $42.2 billion of the Oregon Public Employees Retirement Fund (OPERF) investments were being monitored using Aladdin. Investment staff at the OST engaged with systems experts from BRS and independent consultants to build a risk model for OPERF’s $25.8B portfolio of illiquid/alternative investments

David Xi Li the head of advanced analytics at blackrock has earned a master’s degree in Computer Science from McGill University and was previously the VP of Institutional Clients Group at Citi.

StocksAnalyst by AXYON AI

[[Update: As of December 12th, 2018 it seems Axyon AI has changed the name of its product to Axyon SynFinance. Some of the data taken from this vendor’s website is no longer available or potentially relevant.]]

AXYON AI is an Italian fintech startup, and maker of StocksAnalyst, a predictive modeling tool specifically designed for asset management in financial services. The company claims that it’s platform can integrate a wide variety of data including market and financial data, news and economic indicators to find pattern and trends which form the basis of the prediction.

Apart from its purported predictive modeling capabilities, the platform was also designed to automatically rebalance portfolios and prompt investment advice. It should be noted that this technology still seems to be in a somewhat nascent stage, and there doesn’t seem to be much evidence as to the effectiveness of said advice.

For example:

- An investment management firm might apply the StocksAnalyst platform to potentially predict the performance of the stocks in a particular fund. This is done by applying machine learning to find patterns on a combination of the investment firm’s internal trading data, public trading datasets and news articles.

- The platform might be able to coax out correlations among certain news events (like a government regulation being enacted in the automotive industry) and potential impacts on stock prices of automotive companies in that segment using historical trends – eventually distilling the alert to a buy or sell prompt.

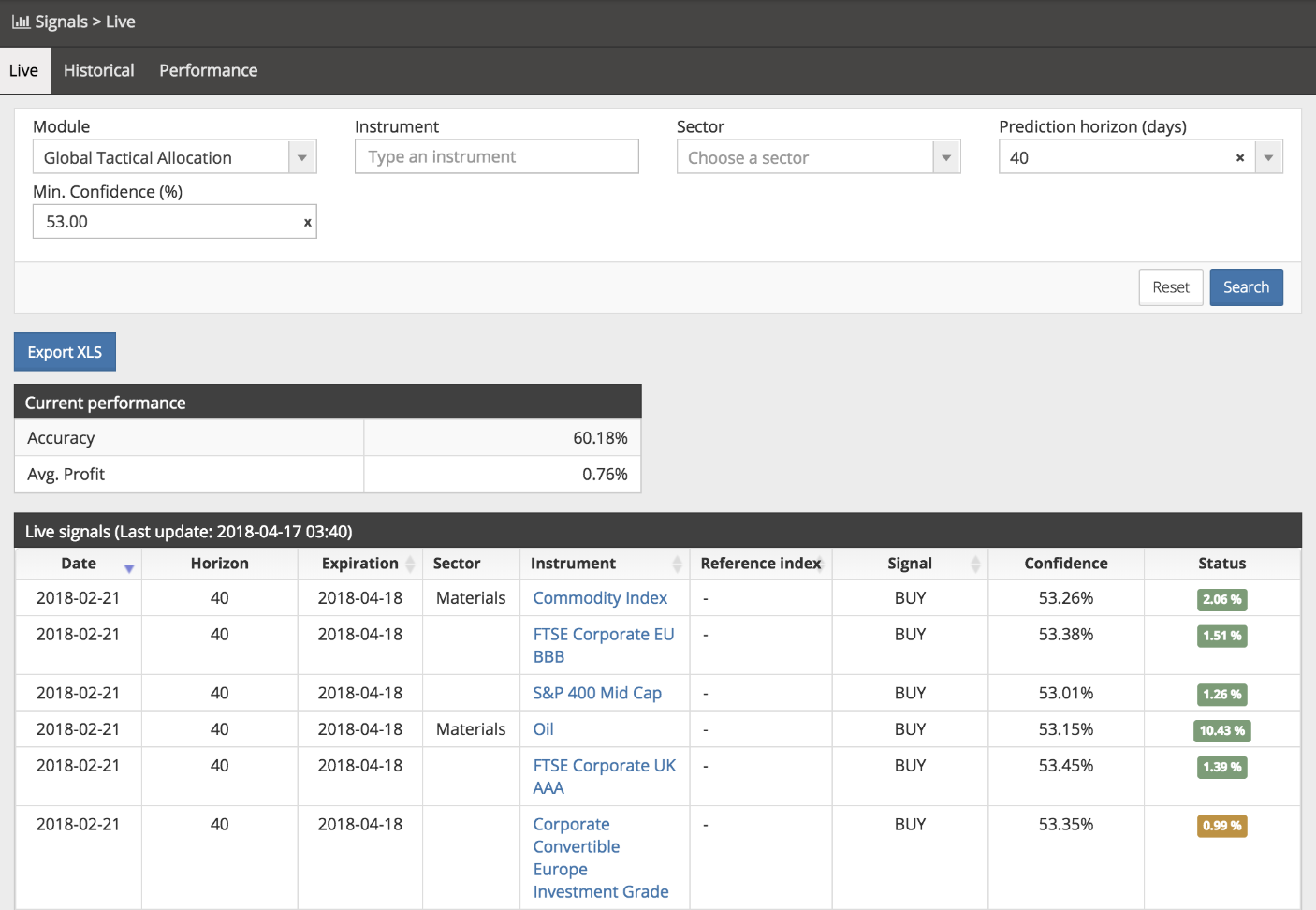

The screenshot below shows the dashboard of the Axyon’s platform. The screen features predictions in the confidence levels for a particular “buy” or “sell” signal:

From our preliminary research we were able to find case-studies of Axyon’s deep learning platform being applied to foreign exchangee trading and to predict credit risk scores although we could not find any robust use-cases for the platform in digital asset management applications.

Jacopo Credi the Chief Scientist at Axyon AI has previously earned two master’s degrees in complex systems science and complex adaptive systems from the University of Warwick and the Chalmers University of Technology after which he serves as a Machine Learning Specialist at DM Digital in Italy.

Sentient Investment Management

Sentient Investment Management (a division of California-based Sentient Technologies) claims to be developing an investment strategy for quantitative trading based on an AI platform. The company claims that its platform uses genetic algorithms and deep learning to scour through historical and current trading datasets to arrive at successful investment strategies. For example, Jonathan Epstein, Senior VP at Sentient explains in an article:

- Sentient Investment Management is a hedge fund that uses AI algorithms to identify the best trading strategies. The sentient platform first generated ‘virtual traders’ which were initially randomized in their trading strategies and their performance was recorded a period of one year. (No information on how many virtual traders were created at the beginning was available at the time of writing)

- Each Virtual trader could enact a certain number of actions like choosing to buy or sell a stock for the fund. The best performing virtual traders were chosen as a foundation for generating the next batch of virtual traders and eventually over a number of ‘generations’ the best trading strategies were combined and ‘transferred’ to the next generation.

- Sentient claims that after a year of testing over 40 trillion such virtual trading strategies, the top 2 best performing virtual traders were chosen to represent the fund’s trading strategy.

Sentient claims that their investment management platform was designed to be a distributed system where the actual computing work takes place the individual devices of customers who are investing in the fund. The company’s patented technology might potentially enable processing of stockpiles of historical investment data (like the trading strategies employed by famous traders like Warren Buffet or the best performing hedge fund related to a particular industry) to find patterns that might otherwise be beyond human capacities to identify.

Although there seems to be evidence of Sentient technologies having collaborated with MIT’s Computer Science and Artificial Intelligence Laboratory team (CSAIL) for a one-year period in a project in the healthcare space, we could find no records of actual use-cases for Sentient’s platform in the investment management space.

Sentient was founded by current CEO Babak Hodjat who has previously earned a PhD in Machine Intelligence from the University of Kyushu University.

Investment Advisory Consumer Applications

Personal Advisor Services by The Vanguard Group

The investment firm Vanguard Group recently launched its Personal Advisor Services (PAS), which can potentially prompt customers with investment advice based on automated algorithms combined with insights from human advisors. A brochure for the PAS list the following possible steps for a typical investing customer:

- First Vanguard’s human investment advisors gather information on the clients through a questionnaire regarding factors like age, risk tolerance, the investor’s financial goals, time-scale of the investments, existing investments, tax status, other assets and sources of income, investment preferences and so on to create a list of financial objectives (Like earning $100,000 with risky investments in the next 1 year)

- Then, Vanguard’s data science algorithms can potentially analyze the investor’s data and recommend a trading track that fits all the objectives (like level of risk, asset allocation and time-horizon)

- Vanguard says that the recommended investing tracks can range from very conservative, conservative, moderate, aggressive, and very aggressive. The PAS algorithms might also be capable of prompting adjustments to parameters like risk tolerance in accordance with the time remaining for a specific financial goal.

- Human advisors are also available at any stage in the process to help with choosing the different investment tracks suggested by the algorithm.

According to an article in the Harvard Business Review, PAS uses cognitive computing to aid customers with portfolio construction and rebalancing them and tax-efficient investment plans. According to Vanguard the system uses human advisors as a part of its cognitive technology to serve as ‘investment coaches’.

Given below is a short 2 minute video explaining how Vanguard’s PAS system purportedly adjusts its advice based on an individual investor’s unique goals:

A 2017 article, seemed to suggest that the Vanguard Personal Advisory Services was managing over $65 billion in total investment funding.

(Readers with a deeper interest in robo-advisors might be interested in our head-to-head comparison article titled: Chatbots in Banking – Comparing 5 Current Applications.)

Schwab Intelligent Advisory by Charles Schwab

With BlackRock and the Vanguard backing their own AI projects, another of the top investment management firms in the world, Charles Schwab, have launched the Schwab Intelligent Advisory – an automated investment advisory service.

The company claims its platform uses machine learning algorithms to automatically monitor and rebalance the customer’s portfolios , while simultaneously improving the strategy with human guidance from investment experts periodically.

In their brochure for Schwab Intelligent Advisory, the company details the following:

- Schwab Intelligent Portfolios offers investors automated investment advice for portfolios of ETFs by initially gaining an understanding of the client’s financial objectives and risk tolerances from questionnaires.

- The service is also designed to use algorithms that monitors client’s accounts everyday to identify rebalancing and tax-loss harvesting opportunities as well as to initiate buy or sell orders.

- The trading orders sent to human investment managers at Charles Schwab for review before being executed.

According to Charles Schwab, their platform was designed for clients who are comfortable with online access but also want to receive periodical guidance. They also seem to suggest their platform was designed for everyday investors and not investors with extravagant needs.

The 5th edition of The Robo Report published in the third quarter of 2017 by Backend Benchmarking claimed that Schwab Intelligent Portfolio was the best performing robo-advisor in the third quarter as compared to similar portfolios of 19 other robo-advisors. Although more detailed results of long-term performance were unavailable at the time of writing.

IBM Watson Wealth Management Chatbot Starter Kit

IBM has launched a chatbot starter kit for companies in the investment and wealth management sector. The offering reportedly helps companies get started on the path to creating a chatbot that will enable users to query portfolios and associated holdings and also offers a simulated analytics service for securities performance under a given scenario. For example IBM claims that users with this chatbot could receive answers to questions like:

- What shares are in their portfolio currently?

- What is the value of my portfolio?

- What are my top holdings?

- What is in my portfolio?

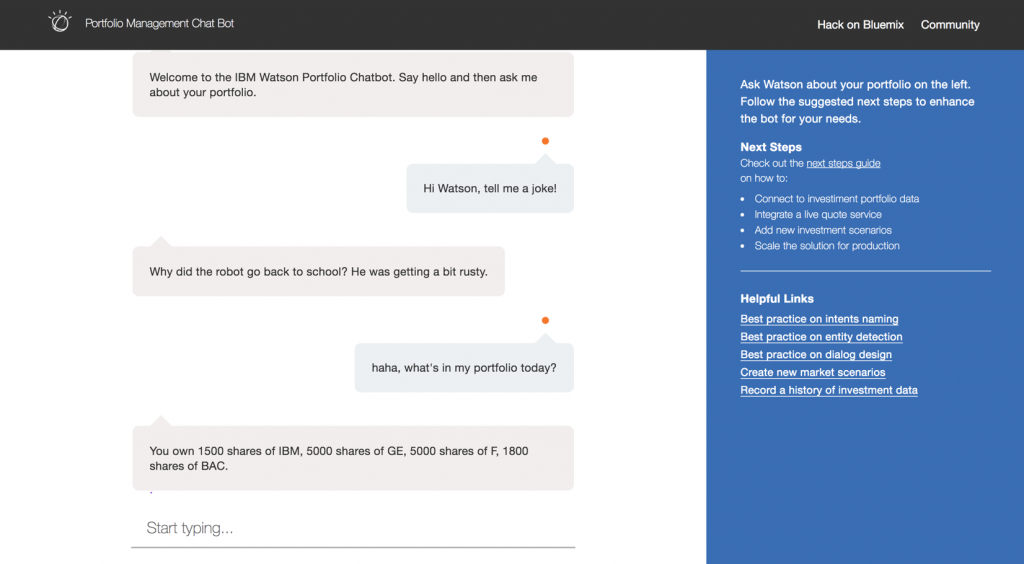

Interested readers can test the demo of IBMs Wealth Management chatbot and see the responses for themselves here. A snapshot of the conversational interface in action is provided below:

In a 2017 blog post, IBM claims that the starter kit is embedded with components of Watson required for building a chatbot for any other industry sector, but with an additional The Portfolio Investment API which can automatically retrieve answers for questions around the holdings or portfolio the results of which are sent back to the Conversation interface.

Concluding Thoughts

Physical asset management AI applications like predictive maintenance are now reasonably well established with numerous case-studies across industry sectors and a growing number of manufacturers have started adopting the technology.

Investment and portfolio management sectors have AI applications in predicting the performance of hedge funds or in modeling risk. There also seems to be a growth in the number of startups offering AI managed hedge funds. The positive performance of these AI hedge funds seems to be questionable since we found evidence both for and against these funds outperforming human traders – and there seems to be no strong consensus on the matter.

Portfolio management service providers also seem to be adopting low hanging fruit applications for AI like chatbots and data science algorithms. Robo-advisors are other similar basic applications for AI in this space which could potentially impact the customer’s experience in the next two to five years. Although there seems to be a trend of the largest investment management firms in the world like BlackRock, Vanguard and Charles Schwab being relatively most successful in this approach.

Emerj For Investment Firms

There are numerous opportunities for large investment firms to benefit from AI applications, from increasing customer lifetime value to reducing the time it takes wealth managers to prepare to speak with a client. Emerj helps wealth management and investment firms find the biggest areas of AI opportunity at their companies through our AI Opportunity Landscape service. AI Opportunity Landscapes help investment firms determine where to spend their innovation and IT budgets to increase the success rate of AI projects and prevent investment firms from starting AI pilots with vendors that are unlikely to deliver an ROI. Contact us to learn more.

Header image credit: Lomond Capital