To some, facial recognition may feel like an AI technology with one chief use case and numerous niche ones that are not helpful outside of the client company that requested it. While security and anti-fraud solutions tend to dominate the conversation, there are many actionable possibilities for facial recognition software.

This is especially true in the finance industry, where identity verification plays a significant role in nearly all aspects of the business. Sectors such as law enforcement also require innovations in identification, though security and public safety remain their main motivators.

In this report, we’ll investigate AI facial recognition software for the most prominent types of applications in the finance industry. We will discuss the business problems financial institutions are looking to solve with facial recognition and possible innovations for future companies.

The applications for machine vision-based facial recognition software we will go over are as follows:

- Verifying Customer Identity for Loan Approval

- Accessing Cryptocurrency Wallets via Blockchain Apps

- Matching Similar Faces for Marketing Campaigns

Before we begin our overview of facial recognition applications in the financial industry, we’ll detail the most important insights from our research into the space:

Facial Recognition in Finance – Key Insights

People living in underbanked areas or remote locations can identify themselves in a loan application using facial recognition. This is even more useful for those with little banking history because the ability to identify them and their employer would be invaluable to getting their loan application approved. Amazon Web Services facilitated this for a company in West Africa, and the technology is made available across desktop and mobile apps.

Facial recognition technology has the potential to play a big role in future crypto economic developments. Companies like Ubanx are already looking to AI vendors to help them with authentication for digital wallets and blockchain enabled applications.

In addition to added security for customer cryptocurrency portfolios, it may be possible to integrate the technology with the blockchain itself. Specific datasets for secure authentication could be saved on an immutable blockchain to prevent fraud.

Financial institutions may need to explore the areas in their company that could benefit from AI technology more thoroughly. This is because in some rare cases facial recognition is being used to drive marketing campaigns and increase company website traffic.

While it may not be a permanent solution to all marketing needs, especially for finance, the application in the creative aspect of marketing campaign development has far-reaching possibilities.

These could range from simple demos and free trials on web advertisements to a dedicated page on the company website where potential customers come to engage with the viral aspect of the campaign. Or perhaps this could be a call to action such as uploading a selfie to see how closely you resemble the company’s mascot, for example.

Our investigation begins with facial recognition for identity verification within loan applications:

Verifying Customer Identity for Loan Approval

Financial institutions can use facial recognition technology to identify customers and approve loan applications from them. To confirm that an application was truly sent by the customer whose name is attached, the customer would use a mobile app to take a picture of their face and allow the machine learning model to verify it.

This expedites the identification process and could potentially prevent customers from needing to schedule in-person appointments with the financial institution.

This could also help financial institutions in areas with largely underbanked populations, where large groups of new customers with little banking history are onboarding each day. Efficient customer identification would be imperative for a situation like this, in addition to increasing cybersecurity and making it easier to recognize fraud.

When there is a relative lack of banking history to refer to when analyzing an application for fraud, alternative channels such as facial recognition may become more important.

Biometric data from images of customers’ faces can also be linked to financial data that a financial institution would want to verify before approving a loan application. This would include banking history and credit score, but could also include history of employment or social media information.

Connecting biometric data to individual customer datasets in this way could make it easier for financial institutions to quickly review loan applications. It may also help identify the customer that sent the application which would improve the customer experience and allowing personnel to focus on other tasks.

Below is a demonstrational video showing how a user can create a .net application with Amazon’s “Amazon Rekognition” platform. This type of application allows users to access features and services powered by Amazon’s facial recognition technology with both web browsers on desktop and mobile apps. The demonstration begins at 6:18:

Amazon Web Services claims to have helped Aella Credit verify the identities of their clients at the end of loan applications. Aella Credit’s mobile app allows underbanked individuals in West Africa to apply for loans with little to no banking history. They approve requests based on biometric and employer data used in conjunction to verify a stable income and low-risk threshold.

According to the case study, Amazon Web Services was able to help Aella credit save and organize their biometric data into categories such as images, videos, and government-issued IDs. Amazon claims Aella credit improved their facial recognition accuracy by 40%. Wale Akanbi, CTO at Aella Credit, had this to say about her company’s experience with Amazon Rekognition:

This technology is very good at identifying customers based on their eye color or facial expressions, and we are using data analysis to recognize patterns that can help us better protect customers and their data…Identity verification is a major problem for financial services companies in Nigeria, and we can overcome that challenge by using Amazon Rekognition. That gives us a competitive edge as a startup.

It is clear that facial recognition could offer unique value to lenders in areas that require alternative data sources and verification methods. In approving loans with a more typical amount of data to reference, facial recognition would still offer added security and identification for each transaction.

Accessing Cryptocurrency Wallets via Blockchain Apps

Facial recognition can also be used to access digital accounts such as wallets for cryptocurrency. Similar to a mobile banking app, a user would log in by holding their smartphone’s inward-facing camera at eye level. This would allow the app to scan and recognize the user’s face and allow them access to their cryptocurrency balance and account information.

Cryptocurrency platforms can benefit from this by offering added security and convenience to their clients when using their mobile apps. Some machine learning models may also be able to detect and categorize faces according to age and gender, which could offer another channel of security by using that biometric data.

Another security opportunity is in the storage of the data set of users’ faces on an immutable blockchain. This could prevent the verification data from being tampered with or otherwise falsified. While the implementation of AI for security on this level is yet to be seen, we can infer that facial recognition would be one of numerous compatible applications.

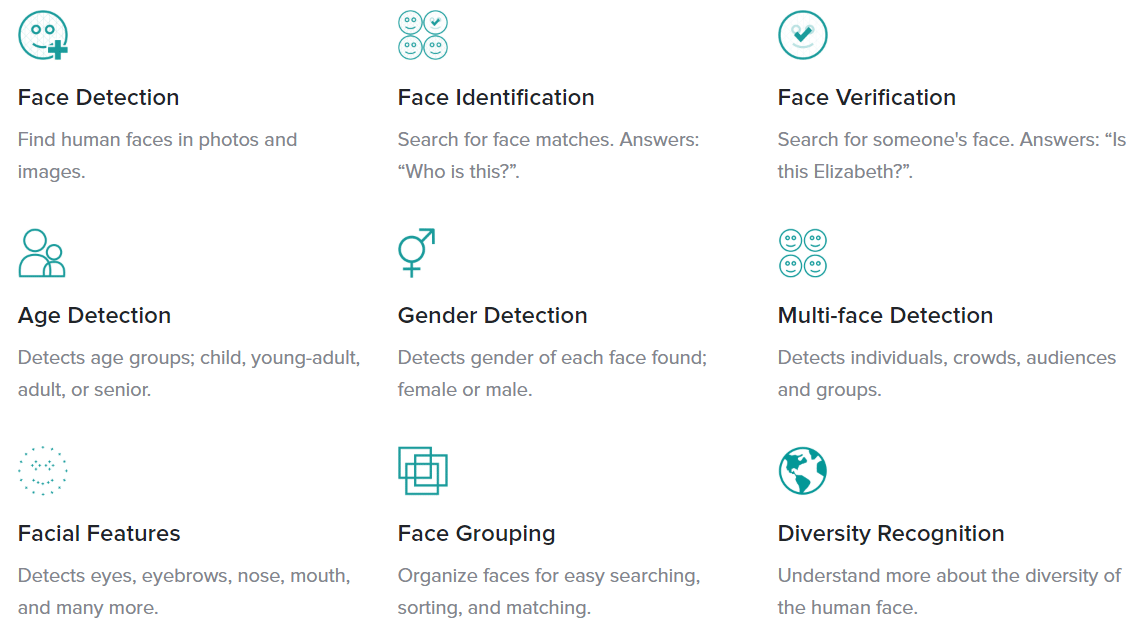

Kairos is a New York-based facial recognition company that offers facial recognition services for identity verification to financial institutions including cryptocurrency platforms. They claim to use diverse data sets in order to prevent misidentification of people of color as well as different age groups and genders.

Below is a screencap from Kairos’ website that details the features of their software:

Kairos claims to have helped mobile cryptocurrency platform Ubanx offer facial recognition-based account verification to their clients. In addition to continuing verification processes, the company also wanted to implement facial recognition for customer onboarding and regulatory compliance.

According to the case study, Ubanx implemented Kairos’ facial recognition software within their decentralized information asset (DIA) protocol. This allowed them to verify identities of new and old customers from a single data source.

Stephen Moore is Chief Scientific Officer at Kairos. He holds a PhD in Computer Vision from University of Surrey. Previously, Moore served as Co-founder and Chief Technology Officer at the Kairos-acquired Emotion Reader.

Ubanx’s blockchain platform is an example of a digital platform that could benefit from storing its sensitive facial data in the blockchain itself. The company offers multiple blockchain platforms for crypto banking, exchanging, and shopping, and they market them as the Ubanx ecosystem. Their website states that users have a say in how the platform is run by allowing discussion within the app.

This is similar to an idea presented by Ben Goertzel, CEO of SingularityNET, an open source blockchain network for identifying, buying, and selling AI applications. In an interview, Goertzel outlined AI “ecosystems” as a factor that could help democratize the AI industry, where vendors and customers alike would offer their insight on different AI applications with a rating system.

In reference to the user-friendliness and accessibility of each application, Goertzel said, “you need a democratic sort of governance and rating mechanism for the actual interfaces of the AI.”

In the case of Ubanx, they offer an open discussion platform for blockchain and financial operations, but not necessarily for the AI applications they use. Although this may not be the original reason the discussion exists, Ubanx appears to have the infrastructure that could make a greater ecosystem possible.

Matching Similar Faces for Marketing Campaigns

A somewhat nascent but still possible application of facial recognition for financial institutions is matching faces within a database to find ones that are similar. This use case may serve other industries for the purpose of fraud detection, but the most prominent use case for financial institution is in creative marketing campaigns. Companies can use their facial recognition data to create interactive advertisements involving finding faces that closely resemble that of the user.

Financial institutions can benefit from these marketing initiatives in numerous and possibly unforeseen ways. If a campaign such as this got popular very quickly, a company may see an increase in website and social media traffic. This can build customer engagement during the campaign and can lead to more opportunity for future engagements if the campaign leaves a lasting impression.

A marketing campaign using facial recognition software would be a similar business application to creating a filter, a graphic overlay usually used for selfies, for a social app such as SnapChat. Filters can be static graphics that may identify where the photo was taken, as well as facial overlays that augment the user’s appearance.

Companies can create a filter that overlays a user’s face within the camera view, and users can send images to each other with the overlay augmenting their image.

Whether it is a photo filter or an internet advertisement, the company’s name is shared every time a user interacts with the project. Here, facial recognition technology is the vehicle for customer engagement while the rest of the project serves to reinforce the connection between the fun of the advertisement and the company being advertised.

This type of campaign requires a unique degree of creativity and originality though, so it follows that this application is relatively nascent at the time of publishing.

That said, Aurora Computer Services is a software vendor who is offering facial recognition solutions to financial institutions. They claim to be the leading UK provider of biometric face recognition systems and to have more systems deployed than any other company in their country.

According to a case study listed on their website, Aurora Computer Services partnered with RAPP UK, a large marketing services agency, to develop a marketing campaign for a leading financial institution. Unfortunately, the financial institution was not mentioned by name. The campaign, called MyPlayerTwin, consisted of a webpage where users could submit a picture of any human face.

The facial recognition software connected to the webpage would then compare the uploaded image to a large database of soccer players from 2012 and 2013. The software would find the soccer player that most closely resembled the face in the uploaded image, and the webpage would show the user a picture of that player. Users could then share this information with other soccer fans and discuss likenesses.

The case study states that the financial institution saw nearly two million hits to their website across a six week period, as well as attracted 372,000 unique visitors. It is important to note that Aurora Computer Services lists RAPP UK as the client for this case study. However, this fact is unclear as the case study states that both companies were serving a client financial institution in the creation of this marketing campaign.

Thomas Heseltine is CEO at Aurora Computer Services. He holds a PhD in Biometrics from the University of York. Previously, Heseltine worked as a Biometrics Consultant at a private practice.

Header Image Credit: Medium