Banks and financial institutions are particularly opaque when it comes to how they implement and leverage AI for their business. Mastercard is a key example of this because they use most of their AI applications internally and have only recently begun to make their technology more transparent to the greater financial industry.

Since their initial adoption of AI and machine learning in 2016, Mastercard acquired Brighterion in 2017 and has continually expanded their AI capabilities.

In this article, we give an overview of three AI initiatives from Mastercard. We detail the use cases for each one and highlight other possibilities in those areas. Mastercard offers the following AI services:

- Credit card fraud detection

- AI consulting services

- Biometric authentication for purchases and account access

Before we start our overview, we discuss the most important insights from our research into Mastercard’s AI projects:

AI at Mastercard – Key Insights

It is clear that Mastercard’s most refined application of artificial intelligence is in their fraud detection solutions. Using predictive analytics technology to detect and score transactions on how likely they are to be fraudulent allows for continued learning of new fraud techniques. In addition, their solution allows for the detection of abnormal shopping behavior based on a customer’s spending history.

Our research led us to Mastercard’s artificial intelligence consulting service, an AI development crash course called AI Express. The service is for businesses with little experience in AI that are looking to get acquainted with machine learning quickly.

AI Express is intended to allow businesses to get a closer look at the machine learning algorithms MasterCard uses for various services to learn from their work so that they might develop their own machine learning models. It is also likely that MasterCard provides AI consulting with the data science and machine learning talent at their company, many of whom they hired when they acquired AI consulting firm Brighterion.

Mastercard claims that through AI Express they can help companies create tailor-made machine learning models for their specific business problems, but the exact degree of specificity is unclear. It’s also likely that data science expertise is required to make sense of Mastercard’s machine learning, and so business leaders should not expect to look “under the hood” at Mastercard’s AI and easily understand how to implement something similar at their own business. Businesses will likely need to have their own in-house data scientists work with Mastercard’s in order to build a model for use in business.

Mastercard’s AI-based biometric authentication software, Mastercard Identity Check, seems capable of facial recognition and analyzing live video. The software enables two-factor authentication which resembles taking a selfie. First, it verifies the face of the account owner, then prompts the user to blink. The software then detects the blink and uses it to confirm the authenticated face is alive.

We begin our overview of Mastercard’s AI initiatives with their predictive analytics approach to detecting and preventing fraud:

Credit Card Fraud Detection

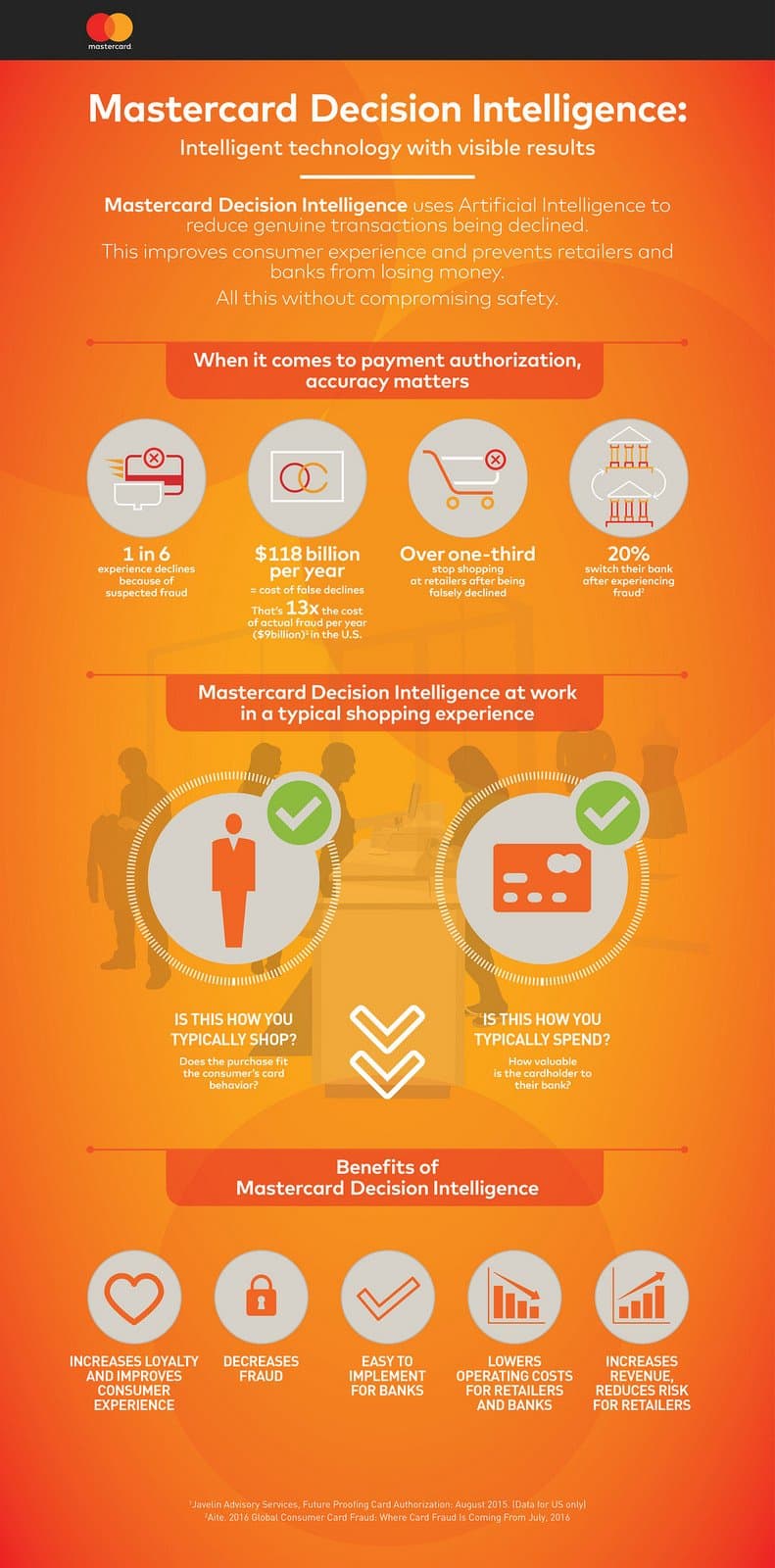

Mastercard’s most prominent use of artificial intelligence is their fraud detection solution called Decision Intelligence. The software uses predictive analytics to analyze customer and transaction data to determine a score of how likely a transaction might be fraud or not. These scores could help Mastercard both decline fraudulent transactions in real time and prevent false declines of legitimate transactions.

“We are solving a major consumer pain point of being falsely declined when trying to make a purchase,” said Ajay Bhalla, President of Cyber and Intelligence Solutions at Mastercard, regarding the first implementation of Decision Intelligence. It is clear that false declines and fraud prevention were among Mastercard’s chief concerns while developing the model behind Decision Intelligence.

Mastercard’s predictive analytics algorithm intakes data from credit and debit card transactions in real time. The software then determines the likelihood that the transaction is fraudulent based on correlations formed between data points from previous transactions. It then scores the transaction on the confidence that it is a legitimate transaction or not.

When a transaction receives a score below the client’s designated threshold, the customer’s card will be declined. This way, a transaction is only declined when the software determines that the data within that transaction has outstanding differences with what it has been trained to recognize as a legitimate transaction.

This allows Mastercard to reduce their rate of false declines because the software is able to detect when a transaction carries less that is out of the ordinary.

The machine learning model behind Decision Intelligence seems able to detect abnormal shopping behaviors based on diverse data sources within a single account. These include risk assessment data, geolocational data, merchant information, device data, time of day, and the type of purchase. The software also leverages customer value segmentation, or the grouping of customers into tiers based on the amount of potential value they offer the company in the future.

Below is a graphic from Mastercard that details the capabilities and benefits of decision intelligence:

Mastercard lista ATMs and gas stations are two places that could leverage Decision Intelligence.

AI Consulting Services

Since the implementation of Mastercard’s Decision Intelligence solution across its global platform, the company acquired AI developer Brighterion and created an AI technology service called AI Express. The company claims AI Express allows businesses to start building an accessible and tailored artificial intelligence solution based on Mastercard’s AI algorithms. With Brighterion’s capabilities, Mastercard could help expedite the adoption of AI technologies across the financial industry by opening their code up to more companies.

Mastercard’s AI Express service seems to be a consulting service made possible by the data science and machine learning talent Mastercard acquired when they purchased Brighterion.

The company claims it can provide answers to clients’ AI adoption questions as well as teach them how to develop a machine learning model for use at their business. More specifically, Mastercard claims it can help companies build machine learning models for the following:

- Anti-money laundering

- Credit risk prediction

- Cybersecurity

- Fraud risk management

The applications of anti-money laundering and cybersecurity would likely deal with anomaly detection or predictive analytics built for fraud detection. These technologies serve a similar purpose but are distinct in how they come to conclusions.

Mastercard lists Mastercard Early Detection System as one machine learning model that AI Express customers can work from when building their own models. This software uses predictive analytics to determine if a card is at risk for identity fraud and issues alerts to the card issuer when risk reaches a predetermined threshold. Details about the capabilities and benefits of this solution are included in the graphic below:

Although improved identity theft detection does come with some societal benefits, machine learning for fraud detection in finance raise concerns for some. We spoke to Sanmay Das, Associate Professor of Computer Science and Engineering at Washington University at St.Louis, about the growth and possible ramifications of improved credit risk prediction.

With regards to the increasing granularity with which we approach analysis of our world with AI, Das said:

It could affect society in ways that we don’t fully understand. For example, … what if banks were micromanaging [credit risk] and it turns out to have a severe disparate impact on one community versus the other. And so credit to a particular population really dries up. Now that may be the right thing to do in terms of prediction accuracy, but that may be completely the wrong thing to do in terms of the societal goal.

It is clear that more financial institutions will adopt AI-based fraud detection and credit risk solutions, but the implications of the overuse of such tools may be beyond our current foresight.

Biometric Authentication for Purchases and Account Access

Mastercard also offers an identity authentication service called Mastercard Identity Check, which uses machine vision to identify customers using biometric data to approve transactions and grant account access. Biometric data such as a customer’s thumbprint, face, or the motion of their eyes blinking might be enough to authenticate a payment with Mastercard Identity Check.

Mastercard states the solution can be applied to various financial services where authentication is necessary. They offer the service to merchants that are concerned with digital payment security or eCommerce. A merchant implementing Mastercard Identity Check would be able to see the approval of each customer’s biometric data as they attempt to check out.

Mastercard also offers their service to card issuers and other financial institutions.

A static image of the customer’s face and a subsequent video of them blinking may make two-factor authentication more convenient for customers because it only requires them to look into their smart device’s camera for a moment and blink when prompted.

The short 4-minute video below provides more information about Mastercard Identity Check. The video features Ajay Bhalla detailing the use of biometrics, as well as the steps one takes to sign up:

The Identity Check solution is backed by EMVCo’s 3-D Secure authentication messaging protocol. Three-Domain Secure, also known as 3DS or 3-D secure, allows customers to authenticate their identity when making card-not-present (CNP) eCommerce purchases. This protocol provides an added layer of security across three key financial domains that are involved during transactions.

These domains are those of the merchant, the issuer, and the payment systems moving the customer’s money from the issuer or their bank to the merchant. As the transaction passes through each of these domains, or the computer systems of the aforementioned parties, the results of the customer’s biometric authentication are passed along as well.

This helps prevent the merchant from incurring a fraudulent payment and a possible chargeback. It also helps the issuer make sure they only decline fraudulent payments to prevent the customer from requesting that their card is canceled in case of fraud.

Header Image Credit: Engadget