Artificial intelligence is likely to affect the entire landscape of insurance as we know it. Change is here, more is coming. Today, the insurance market is dominated by massive national brands and legacy product lines that haven’t substantially evolved in decades. This kind of stagnation has historically suggested that it is an industry ripe to be disrupted.

Insurance enterprises know this. At Emerj, the AI Research and Advisory Company, we advise insurance leaders that want to leverage their extensive backlogs of customer and claims data to win market share and achieve data dominance. Our AI in Insurance Opportunity Landscape has grown significantly over the last three years with increased AI investments from global insurance giants.

In fact, insurance is an industry that venture capitalists consider so ripe for disruption that the founders of Lemonade, a New York-based insurtech company, raised one of the largest seed rounds in history simply by talking. It’s not just the venture crowd. Warren Buffett has gone on the record saying that the coming of autonomous vehicles will hurt premiums for Berkshire-owned Geico.

Buffett may have been referring to a 2015 KPMG report which predicts that “radically safer” vehicles, including driverless technology, will shrink the auto insurance industry by a whopping 60% over the next 25 years. Readers should note that auto insurance is more than 40% of the insurance industry as a whole.

(For readers with a strong interest in other financial applications of AI, please refer to our full article on machine learning applications in finance.)

Artificial Intelligence in Insurance – Insights Up Front:

Trends that business leaders should know about. In this article we look at three key ways that AI will drive savings for insurance carriers, brokers and policyholders, plugging into existing transformations within the insurance industry:

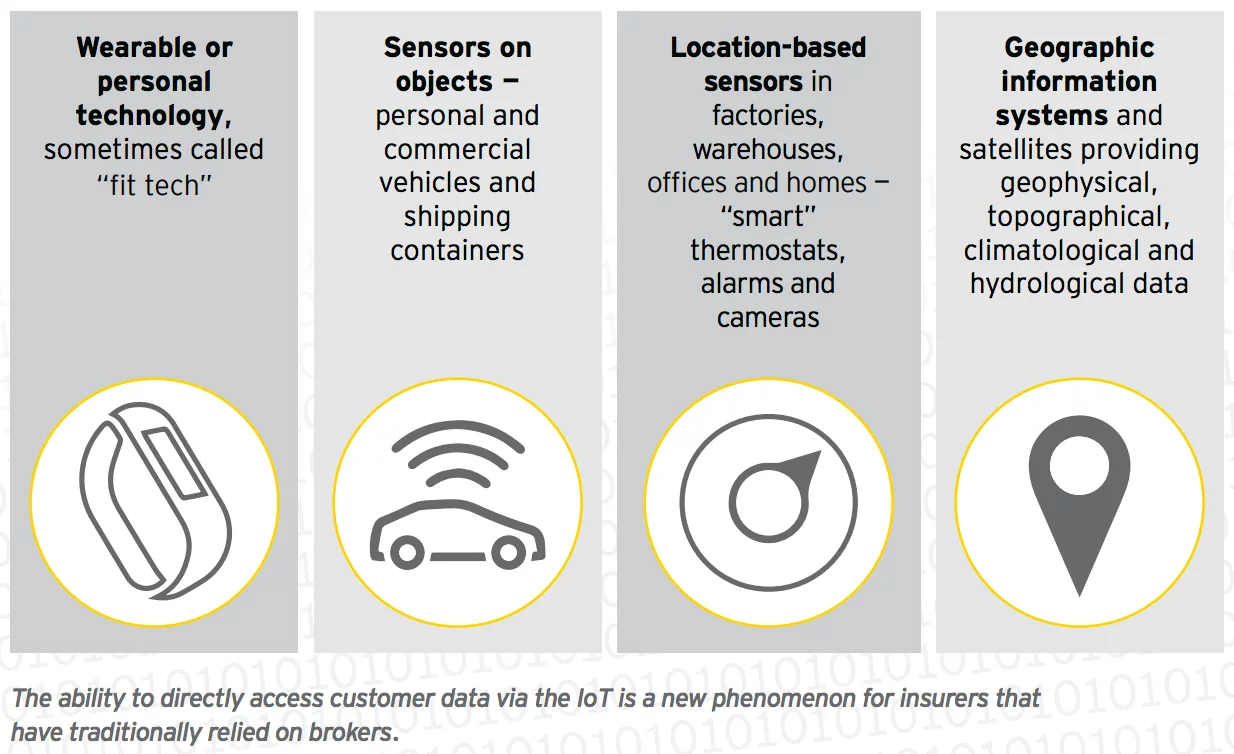

- Behavioral Policy Pricing: Ubiquitous Internet of Things (IoT) sensors will provide personalized data to pricing platforms, allowing safer drivers to pay less for auto insurance (known as usage-based insurance) and people with healthier lifestyles to pay less for health insurance

- Customer Experience & Coverage Personalization: AI will enable a seamless automated buying experience, using chatbots that can pull on customers’ geographic and social data for personalized interactions. Carriers will also allow users to customize coverage for specific items and events (known as on-demand insurance)

- Faster, Customized Claims Settlement: Online interfaces and virtual claims adjusters will make it more efficient to settle and pay claims following an accident, while simultaneously decreasing the likelihood of fraud. Customers will also be able to select whose premiums will be used to pay their claims (known as peer-to-peer (P2P) insurance).

Insurance as a global marketplace tends to be associated with public distrust (one Australian poll ranked sex workers as more trusted than the insurance industry), and this may present unique challenges to technology innovations – through AI or otherwise.

Therefore, a key concern introducing new technologies will be in convincing the public that automation isn’t simply a Trojan horse for denying their claims — a worry that 60% of consumers have expressed about purchasing coverage via chatbot, according to a recent survey by Vertafore.

Emerj AI Research has written extensively on the landscape of AI in insurance. Interested readers are recommended to explore the our report on the current use cases of AI at the US’s largest insurance companies.

Three Current AI Application Trends in Insurance / Insurtech:

We’ll take a look at all three major AI insurance trends one by one, examining at the current state of the technology, the changes underway, and the potential resulting shifts in the industry. We’ll begin with “behavioral pricing”:

1 – Behavioral Premium Pricing: IoT Sensors Move Insurance From Proxy To Source Data

IoT data is opening a slew of are three key ways that IoT data will enable personalized insurance pricing:

- Pay What You Risk: Telematic and wearable sensor data enables lower premiums for less risky behavior, including driving less and exercising more

- Bundle Policy and Loss Prevention Hardware: Smart home companies will offer policy discounts to users of sensorized loss prevention technology, enabling cross-selling of devices and insurance

- Verify and Settle Claims: IoT data markets will enable carriers’ faster access to verified risk management information, rather than relying on costly assessments and audits

Hypothesis: IoT disrupts insurance the same way that data science has been disrupting finance: moving analysis from proxy to source data.

In the old world: Financial models were once dependent upon statistical sampling of past performance to forecast future outcomes.

Today: Data science has enabled predictions based on real events, in real time, using large datasets rather than samples to make the best guess.

In the old world: Insurance carriers relied on risk pools constructed using statistical sampling.

Today: IoT sensors allow insurance carriers to price coverage based on real events, in real time, using data linked to individuals rather than samples of data linked to groups.

Big picture: In each industry we are moving from proxy data (about categories) to source data (about individuals).

See a pattern? Whether the asset is a stock portfolio or an ‘09 Honda Civic, a bond or a cargo ship, the shift in how the value of the asset is forecasted is driven by the type of data that technology can offer analysts.

Here’s an example: Usage-based or pay-per-mile car insurance demonstrates this logic. Telematics sensors allows real-time tracking of an underlying asset (cars) allowing for the roll-out of a new product line in the related insurance market (auto insurance) by personalizing the risk of the event being insured (a car accident).

What does this actually mean? Safer drivers can pay less for policies, and any driver can pay by the mile. Policyholders aren’t part of a risk pool any more — they are paying what they risk. This is a fundamentally new type of insurance product, enabled by the underlying technology of telematics.

The only catch? You have to install a telematics sensor in your car. And you have to drive safer than average, and less miles than average. For some, it’s a great bargain. For others, not so much.

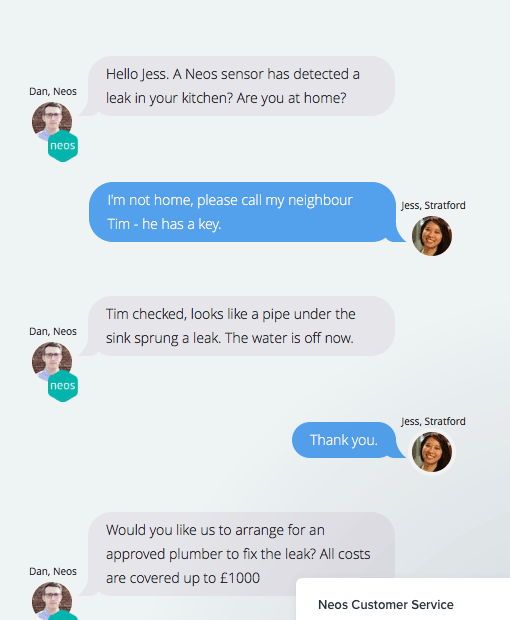

This is why insurance companies are becoming hardware companies: sensors. Take Neos Ventures, a company that provides smart home monitoring and emergency assistance IoT along with a home insurance policy. The idea is that if Neos can provide tech that makes gas leaks, water damage and home intrusions less likely, then they’ll be able to pass along those savings in the form of lower premiums to their customers.

The only catch? You have to install Neo’s camera and sensors in your home.

Hypothesis: To succeed in the next decade’s markets, insurance companies will have to rapidly move from pricing based on the likely behavior of categories to pricing based on the actual behavior of individuals. This is how consumers will experience the move from proxy to source data.

Wearables and GPA are likely to drive the change. As Vikram Renjen, SVP of Insurance for Sutherland notes: “With supplemental GPS data, wearables could monitor and report on compliance to the rehabilitation protocol of a disability claimant. Improved compliance would shorten the time until return to work.” (This is about workplace comp).

Surveys show consumers want this change. Consumers have shown willingness to turn over facial and even biometric data for cheaper products, with one survey by Troubadour Research & Consulting finding that nearly half of consumers would turn over data from wearables to insurance companies. BioBeats and Fitsense are two startups tackling wearables data for health insurance, with a focus on personalizing employee health plans.

There’s still a lot of uncertainty on the back end of usage-based insurance. A 2017 report from the National Association of Insurance Commissioners noted: “…UBI is an emerging area and thus there is still much uncertainty surrounding the selection and interpretation of driving data and how that data should be integrated into existing or new price structures to maintain profitability.”

But most customers who tried it seem to have loved it. A 2016 survey by JD Power & Associates found: “…UBI participants provided more positive recommendations and more often indicated that these recommendations resulted in a friend, relative or colleague purchasing from their insurer compared with those customers who did not use a UBI program.” Some insurers offer discounts for participation in usage-based insurance programs to collect thousands of miles worth of monitored driving data. They can then use this data to benchmark their own risk scoring models on other business lines.

And roughly a fifth of the market isn’t even interested. 21% of customers declined to participate in a UBI program when it was available and 81% of those respondents did so because they didn’t want their driving monitored, didn’t think they’d save money, or didn’t think their premiums would decrease. People with long commutes, who frequently drive long distances or who savor speeding on the open road would hardly benefit from their insurance company tracking their behavior.

Just because some carriers are getting sensor data doesn’t mean they are using it. As we’ve seen with many enterprise applications of machine learning, the reliability, richness and latency of the source data – alongside the proficiency of the analytics – becomes vital. That’s where platform marketplaces like Next Generation Platform (NGP) by Octo Telematics comes in, providing auto insurance carriers with an Application Platform Interface (API) for driver behavior scores, crash and claim analysis alongside specialized risk analytics for fleet managers and car rental companies.

Legacy players are slow to change. The 2017 Excellence in Risk Management report found “…an apparent lack of awareness among many risk professionals on existing and emerging technologies including telematics, sensors, the Internet of Things (IoT), smart buildings and robotics, and their associated risks.”

Markets could start moving fast as consumers trade IoT data for lower premiums. As managing director of Corporate Finance for KPMG Joe Schneider wrote, detailing the shift in the auto insurance industry: “Once the massive market disruption begins and traditional insurance business models are flipped upside down, we expect significant turmoil.”

It’s all about the sensor data. Anyone trying to benchmark legacy players versus newcomers should answer this question: How well are a company’s business lines positioned to take advantage of sensor data originating from their policies’ underlying assets?

With any new tech there are risks, which can be a good thing. Sensor data decreases risk in many ways, but of course it also introduces some novel vulnerabilities. Pretty much anything with a sensor may be vulnerable to hacking, and anything vulnerable to hacking may trigger penalties under data breach laws. Such vulnerabilities may allow carriers to develop new business lines that underwrite emergent risks, as the bull market for cyber insurance is already demonstrating.

2 – Customer Experience & Coverage Personalization: AI Interfaces Allow Better Customer Onboarding

Here are the three key ways that AI will enhance the insurance buying experience:

- Chatbots Will Recognize You: Advanced image recognition and social data can be used to personalize sales conversation

- Platforms Will Verify Your Identity: Automated personal identity verification can speed authentication necessary for quoting and binding

- Carriers Can Customize Your Coverage: Machine learning can allow fully online or app-based shopping experience

(Readers with an explicit interested in conversational interfaces may want to read our full article about 7 chatbot use cases that are working now.)

You can now buy insurance with a selfie. In January 2017, the life insurance startup Lapetus made headlines by offering a service for people to buy life insurance using a selfie. Since habits such as smoking cigarettes are strong predictors of lifespan, Lapetus can use facial analysis to rapidly assign risk scores without a lengthy or onerous medical examination. The SMILe (smoker indication and lifestyle estimation) approach is explained on the company’s “about” page:

Everything is numerically larger in China. Image recognition is also at the core of insurtech startup Zhong An’s business model. Zhong An is the first online-only insurance provider in China, and since 2013 has sold 7.2 billion insurance products to 429 million customers. Because they only ever meet their customers online, they rely on machine learning to prevent fraud and ensure a personalized customer experience.

Successful e-commerce is all about the customer. The most personalized customer experience is the one most directed by the customer. That’s the thinking behind Allianz1, a web interface in the Italian marketplace that allows buyers to create their own coverage products by mixing and matching from Allianz thirteen distinct business lines.

Insurtech likes chatbots. According to an Accenture survey, 68% of respondents in the insurance industry use chatbots in some segment of their business.

Chatbots like branding and human names. Famous insurance chatbots now include Geico’s Kate and Lemonade’s AI Jim, who settles claims. There’s also chatbots from Next, who sells commercial insurance to personal trainers via Facebook Messenger and Trov, who sells on-demand to individuals for personal property coverage.

3 – Faster, Customized Claims Settlement: AI Settles Claims Faster While Decreasing Fraud

Speed and success in settling claims is a critical factor for insurance business efficiencies, as well as for Here are two key ways that AI will improve customer satisfaction after filing a claim:

- Speed in Settling Claims: This time-to-settle metric will end up being important for which business lines customers prefer using.

- Decrease Likelihood of Fraud: This decreasing-fraud metric will end up being important for which solutions insurance companies prefer using.

AI’s advantage seems to be most obvious in claims settlement. Lemonade’s AI Jim made headlines in January 2017 by purportedly settling a claim in less than three seconds. This time-to-settle is the performance metric that customers care about most, according to surveys by JD Power & Associates, whose No. 1 ranked insurer clocked in at eleven days.

That’s a delta of several orders of magnitude. That means the No. 1 ranked insurer’s claims department took 316,800 times longer to settle a claim than Lemonade’s AI Jim. Again, time-to-settle is consistently the metric that customers most care about.

Most insurance executives already understand that AI will drastically change their industry. An April 2017 Accenture survey found that 79% of insurance executives believe that: “…AI will revolutionize the way insurers gain information from and interact with their customers.”

AI will likely bring faster claims settlement with decreased fraud. These two areas of focus are potentially among the biggest “low hanging fruit” opportunities for AI in insurance. Since there is limited digital information flow between insurance companies and hospitals in China, Zhong An relies on AI solutions to process vast quantities of paper information on policyholders. As Wayne Xu, chief operating officer of Zhong An explains: “We have been using machine learning to do fraud detection, to process hard copies and digitise information.”

This is a massive savings opportunity – with or without chatbots. Insurance carriers routinely report $80 billion in fraudulent claims. The most common form of insurance fraud is identity theft, where insurance and identity data is stolen for the purpose of filing a claim without the knowledge or consent of the policyholder. Fraud is already being detected in data security and payment / transaction fraud, and similar applications will continue to make their way into the insurance industry.

Fraud detection is the one AI tech trend that no one has ignored. That’s one reason why fraud detection is among the fastest areas of tech adoption in the insurance industry, with over 75 per cent of the industry reporting to have used an automated fraud detection technology in 2016. Shift Technology is one startup helping insurance companies prevent fraud, recently crossing 82 million claims analyzed.

Conclusion: Benchmarking AI Solutions in Insurance

Customers evaluate the performance of insurance products when they need to be paid, not when they make their purchase. Unlike other products or services, customers are only able to form a judgment about the value that an insurance carrier delivers when the event being insured against takes place. Therefore, as Alex Polyakov, CEO and founder of insurtech company Livegenic writes: “The most important metric in insurance, hence, is customer satisfaction measurement of the customer post claim.”

That should be the core metric for disruptive AI. Since many such as Lemonade and Next are only a few years old, we currently lack sufficient data to determine whether these companies will be able to deliver a superior customer experience at scale. There is no denying that much of the customer journey with insurance companies is “stodgy”, and potentially in need to major refinement and streamlining. Time will tell how those changes will manifest for the customer experience.

Buying insurance or filing a claim with only a few clicks has undeniable appeal. So much so that Mike LaRocca, CEO of State Auto Financial (STFC) had this message for fellow insurance executives in January, 2017: “The power of change is coming, and if we fail to see it, we could be dead too.”

There seems to be a consensus: The status quo insurance business’ days are numbered. The April 2017 Accenture survey found that this opinion is widespread: ”Insurance executives believe that artificial intelligence (AI) will significantly transform their industry in the next three years.” Whether telematics, autonomous vehicles, chatbots or customization platforms, the market will likely move towards firms that are able to best harness AI to improve the customer on-boarding and claim management process.

Emerj for Insurance Leaders

Insurance enterprise leaders use Emerj AI Opportunity Landscapes to discover how they can use their data to develop and buy AI applications that win more business from millennials, win overall market share, and reduce risk. AI Opportunity Landscapes help insurance enterprises assess where AI is already driving value in the industry and help them find the AI vendors most likely to deliver an ROI.

Our insurance clients trust Emerj to help them create long-term AI strategies that will ensure they maximize the value they can get out of their data well into the decade. Contact us to learn more.