Chatbots are one of the most talked-about uses of natural language processing (NLP) software in business. Some of the most common application areas for chatbots include customer service, healthcare, and financial advisory.

We compiled a list of 20 chatbot applications currently being used across multiple industries. We explain what the chatbot software vendors offer their client companies and how that translates to customer satisfaction. This also includes internal chatbots made to help customer-facing employees work with their clientele.

This article covers chatbot software sold into the following industries:

- Healthcare: Chatbots for help with diagnosis, tracking symptoms, and treatment recommendations. Solutions for healthcare providers and individual patients.

- Insurance: Conversational applications for finding the correct policy, performing transactions without a human employee, and customer service questions.

- Banking: Customer service chatbots with functionality such as checking one’s account balance, credit card applications, loan applications, and accomplishing these in more than one language.

- Financial Services: Chatbots for financial advisory and business trip planning. This type of solution includes budgeting and budget adherence, and hotel and flight recommendations.

We begin our list of enterprise chatbot solutions with Ada Health’s app for personal medical guidance.

Chatbots for Healthcare

1. Ada Personal Health Guide

Ada Health offers an AI-powered telemedicine service in the form of a chatbot app called, “Ada – Your Health Guide.” The app helps users or patients identify their symptoms by asking for details about how they are feeling and where they are feeling pain.

Once the patient has provided enough information for the app to narrow down the most possible ailment, it will provide information on that ailment along with recommendations on how to treat it.

Below is a short demonstration of how the chatbot app works:

Before the app can begin helping a patient, they must fill out a health survey to create a distinct profile. Then, the app compares the patient’s symptoms to their health profile as well as previous patient data regarding similar symptoms. Ada Health’s machine learning algorithms are trained on a database of thousands of medical symptoms and ailments, and expands that information over time using responses collected from each customer.

As of March 2019, the Ada health guide app has reached 6 million users and has positive testimonials from Vivantes Hospital and the Charité.

2. Ask Babylon

Babylon Health offers a similar chatbot to the Ada guide in that users can also input their symptoms in order to gain a possible diagnosis along with treatment recommendations. However, Babylon claims to have created its medical database using information from its own team of scientists and doctors.

Additionally, patients can input as much of their own medical information as they want to in order to give the app a clearer image of their health.

Once this app provides the user with information regarding their symptoms and their most probable causes, the user can also seek professional advice directly through the app’s window.

In cases where there is very little information on a patient’s symptoms or the information found could be of major importance, the chatbot can recommend the user contact their doctor or consult with one from Babylon.

Below is a short demonstration of how Ask Babylon can help patients:

3. Symptomate

Symptomate is a chatbot from Infermedica which purportedly uses AI to analyze patient symptoms and provide them with an accurate evaluation of their health. Their user base consists of over 3 million people, and they can access Symptomate on a variety of channels.

For example, a patient can use the iOS or Android app to input their symptoms or access the app using a voice assistant such as Alexa. Additionally, users can write to the chatbot from the Symptomate website if they are at a desktop computer.

The Symptomate chatbot can be sold to healthcare companies as a standalone product for medical facilities. This product is called Symptom Checker, and it would allow a healthcare company to process patient information and questions digitally. Doctors within the client company would have a bit of a head start on their diagnoses and pertinent information regarding them could be easily accessed within their network.

This video below shows an Infermedica representative using the Symptom Checker through his Alexa:

4. NextIT

Next IT is an AI vendor that offers NLP chatbot software that they claim can help numerous types of businesses cut costs on customer service while continuing to provide value to customers.

The software is likely trained on the client company’s backlog of text conversations between customers and customer service agents. Because of this, the end product is usually more suited to handle the client’s customer base than if the software came pre-trained.

NextIT’s healthcare offering includes administrative and clinical assistance, which serve to help manage the various responsibilities of different healthcare providers. Administrative professionals can use services such as:

- Automated scheduling

- Appointment reminders

- Sending texts and emails

- Simplifying procedures

- Showing health member benefits and claims

- Amplifying productivity in sales.

Physicians and other clinical professionals can use the chatbot service for:

- Answering questions about conditions or medications

- Medication or appointment reminders for specific patients

- Tracking symptoms

- Combining patient programs

- Facilitating prescription refills

- Providing health assessments.

This is how the NextIT chatbot works with Facebook messenger, including voice commands. Note the further options the chatbot offers the user after answering their initial question:

5. Woebot.io

Woebot is a mental health chatbot app that tracks the user’s mood based on the information the user provides, as well as creates a safe place for the user to express their feelings. Woebot operates on the basis of Cognitive Behavioral Therapy (CBT) and uses NLP to weave together clinical information and a light-hearted tone that patients can appreciate.

CBT is a form of therapy that includes managing mental health by reframing negative thoughts into positive or less self-critical ones. It is because of this that the chatbot is likely built to attempt to find a positive “version” of the user’s outlook and recommend it in a non-threatening way.

The Woebot company claims their chatbot can have conversations about mental health with the patient and can send videos and other helpful materials depending on their needs.

They also say that the more someone uses the chatbot, the better it will be at determining their mental health needs. This could provide an immediate line of defense against mental health ailments until the patient can find a human professional or reach a healthy state of mind to do so.

The following promotional video for Woebot features a conversation in which the chatbot asks the user to look inward as to why their intrusive thoughts may be causing them stress:

Chatbots for Insurance

6. Allstate Business Insurance Expert (ABIE)

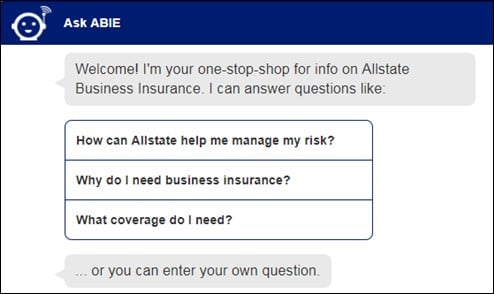

Allstate’s business insurance chatbot was developed in collaboration with Jorsek for customer service to a base of small business owners. Allstate customers can access ABIE through their website, and ask insurance-related questions that a live agent would normally answer.

These can be as simple as “what is a deductible?” to more open-ended questions such as “how does Allstate’s claims process work?”

ABIE was built of Jorsek’s AI platform easyDITA, which allows Allstate to publish information to multiple databases and channels at the same time. That data can then be labeled individually based on the type of categorization required for each channel.

This is likely convenient for Allstate in that new insurance information can be updated across the entire business using a single platform. This also likely allows ABIE to retrieve all information necessary to provide answers from one location.

Below is a screenshot courtesy of Allstate newsroom, in which the ABIE chatbot gives the user three common questions to ask and a blank space to ask their own question:

7. Progressive’s “Flo” chatbot from Microsoft Azure

Microsoft’s Azure platform offers multiple AI and machine learning-powered services, but their NLP and chatbot capabilities are prominent among them. Clients can use the Azure service to build their own chatbot for customer service.

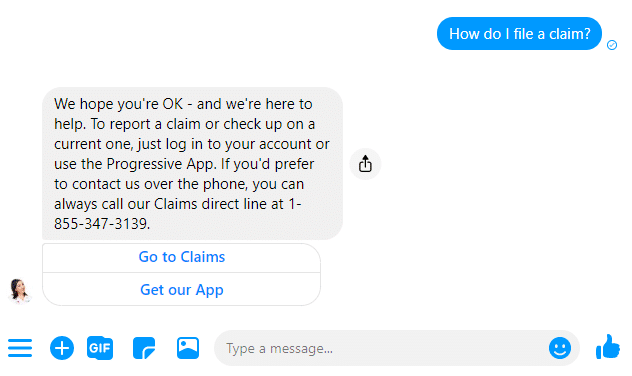

Insurance provider Progressive worked with Microsoft Azure to create a chatbot that emulates their mascot Flo, which works like a normal chatbot but with a cheerful and upbeat affect.

The chatbot references memorable advertisements in which Flo is featured and uses Progressive’s insurance database to answer questions about claims and policies.

Because the chatbot operates through Progressive’s Facebook page, the company can leverage social media responses to improve the conversational capabilities as it is used more and more. This helps the chatbot recognize new questions that are becoming more common which may prompt Progressive to update the information on the pertaining business areas.

For example, if there were a sudden rise in questions about Progressive’s premium rates, the chatbot will request that information more frequently until the company takes note and can verify that the information they are giving is accurate.

Below is an example of how Flo will respond to insurance-related questions. We asked Flo, “How do I file a claim?” and the chatbot explained how to log into one’s Progressive account and gave the phone number of their claims department.

The chatbot also offered clickable options that send the user to the claims section of the progressive website or to the app store to download the app:

8. Kinvey Native Chat

Kinvey Native Chat is a chatbot made by Progress Software for insurance companies to use to build a chatbot for customer self-service transactions. Common uses include appointment scheduling and insurance policy selection.

This allows the user to make these appointments and even purchase insurance without the need of a human employee, which saves time for the client insurer.

Because customers can make transactions with Native Chat, the chatbot itself must be trained in a way that will allow it to offer transactions to the customer and process them accurately. To do this, the software likely categorizes each inquiry as a question, ask for help, or a need to file a claim.

The chatbot would operate normally as described when the inquiries are scored above a certain confidence level. If an inquiry resulted in a confidence level below a certain threshold, the chatbot can route the question to a human employee so they can review it.

The following video demonstrates how the Kinvey chatbot helps a user find the correct insurance policy for them:

9. Elafris

Elafris offers a claims processing chatbot app that helps insurers offer their customers an easy way to make insurance payments and file and monitor claims. Using an Elafris-enabled chatbot app, insurance customers can open a conversation with a phrase like “was my most recent claim approved?”

The chatbot will then check the most recent claim the customer has filed, and will likely bring them to the page of their account where they can view it. The bot will also likely give a “yes” or “no” response including an explanation of any important details.

Customers can also request more specific claims information such as the payout amount or if the payout check has been mailed yet.

The company claims a customer can file a claim directly from the chat window used to initially contact the chatbot. The customer only needs to relay the details of their situation, such as which car was damaged and at what time.

It is likely that car insurance companies can set their chatbot up to intake the insurance information of other parties involved in the damage. The chatbot then submits the claim in full to the insurer.

This video is a walkthrough of how Elafris’ chatbot helps a user to file a claim:

10. Avaamo.ai

Avaamo.ai has two main insurance chatbot products that can help both insurance customers and employees. The customer-facing chatbots help the user decide on the right policy for them and with moving forward to purchasing it.

Users can ask the chatbot questions about the details of each policy and possibly the type of customer that usually needs that policy.

Additionally, the onboarding assistant helps potential customers set up their account with the client insurer and then likely directs them to the individual policies.

Finally, the customer-facing chatbots can act as a claims advisor which checks the status of open claims similarly to a solution like that of Elafris.

Avaamo’s chatbots for insurance employees include one called a “lead and activity manager.” This chatbot helps staff members plan customer appointments and prospecting activities. It can also update the company’s CRM automatically to increase productivity.

This is likely because the chatbot has a record of the customers each staff member is interacting with or “assigned” to.

These chatbots can also assist staff with new endorsements and sales from insurance agents. Insurance employees purportedly can access more specific customer requirements more easily.

These include amendments to insurance policy and additions to coverage. Agent sales chatbots can help onboard new team members to the staff and help them with professional planning.

Below is a short demonstration of how Avaamo’s chatbot offers insurance shopping recommendations based on the user’s needs:

Chatbots for Banking

11. Finn AI

Chatbots can also play a helpful role in helping bank account holders manage funds, payments, and other banking operations. Customer service chatbots are some of the most common chatbots in banking and usually handle numerous customer questions.

Banks benefit from this type of chatbot because it allows them to see trends in the types of questions their customers are asking and constantly update their information to fit those needs.

Finn AI‘s banking chatbot service can also be enabled for multiple languages, along with sentiment analysis that allows the client bank to detect the quality of the customer’s experience.

This type of chatbot would require a machine learning model that has been trained to recognize topics and phrases from multiple “sets” of words at a time. These sets are categorized as languages, and the software can correlate phrases from either language to data points that may be most helpful.

This capability requires the machine learning model to be trained to recognize certain topics and phrases from more than one language at a time. Languages can be categorized as individual “sets” of words, and groups of words from separate sets can match up to indicate the same question.

The chatbot can then respond to the question with an answer holding the same meaning, but written in the correct language. Finn AI claims to have helped the Nicaraguan bank Banpro in this way by helping them answer questions automatically in English and Spanish.

The image below is an example of FinnAI’s chatbot helping a Spanish-speaking customer:

12. Kasisto KAI

Kasisto’s chatbot product is called KAI, and they claim it can help banks and other financial institutions create a chatbot for their customers to make payments, review transactions and account details, and manage funds.

The software can purportedly send the conversation to a human customer service agent when it is unable to resolve a customer problem.

KAI chatbots can be deployed across multiple channels, including smartphone apps and desktop websites. Kasisto claims KAI for business banking includes a deep learning tool that can help collect and analyze data, train new machine learning models, and test new chatbots.

However, the nature of how multiple neural networks are set up for these chatbots is unclear.

Kasisto also claims their chatbot can converse with customers about a diverse set of banking issues such as loan applications, customer support, and product discovery.

The system can purportedly fulfill certain requests within the chat interface such as sending payments or changing the terms of a claim.

The video below shows a chatbot made for Mastercard using Kasisto’s platform. It shows the chatbot answering customer questions that can include personal data such as account balances:

13. Clinc

Clinc is an AI vendor offering customer-facing chatbots for retail banking. One of these chatbot software is called Finie Personal, which can process banking transactions and respond to questions and advice requests based on the customer’s banking history.

This results in a more personalized experience based on the customer’s own finances and what the company’s collection of data might be able to help them with.

The company claims the chatbot can also factor in a customer’s credit history for questions about loans and recurring bills. Finie Wealth, Clinc’s second chatbot product, is used for wealth management and financial service recommendations.

Clinc claims this app can send users notifications about good investment opportunities that come with stock prices and news updates. These investment recommendations come from the user’s portfolio balance, its performance, and the customer’s trading history.

Clinc’s client banks can deploy these applications to various channels such as mobile, web, interactive voice assistants, and messengers.

For security, Clinc employees integrate the technology at the client’s offices or headquarters and it comes with analytics and administration tools to help backend bank employees perform necessary maintenance or further training.

The following video is a showcase of the Clinc chatbot’s user interface, voice command capabilities, and resources such as graphs and other data visualizations:

14 – IBM Watson Conversation

IBM Watson and their business partner Nearshore Delivery Solutions together offer a service that helps banks create customer service chatbots in lieu of setting up a larger customer service team such as a call center.

IBM’s conversational AI software is called IBM Watson Conversation, which uses the NLP engine within their Watson AI platform to create chatbots and serve customers.

In order to create an effective chatbot that made use of all relevant aspects of Watson, the company can include the Tone Analyzer tool for sentiment analysis, and run the entire application from the IBM cloud platform.

This allows for easy integration to a client business’ digital infrastructure, and for customer questions to further train the machine learning model from all channels.

This is because the chatbot software is installed remotely across all necessary business “endpoints” or areas where a customer or staff member would use the chatbot.

The following demonstration from IBM shows how a client company may use its platform to build a chatbot. At 2:44 they begin adding subsequent dialog to initial greetings and questions:

15. Personetics

Personetics offers a chatbot for financial services aimed specifically at retail customers called Personetics Assist. The company claims the chatbot uses the customer’s most recent transaction data in order to provide up-to-date and accurate responses based on the customer’s financial situation.

Common questions Personetics Assist can answer have to do with financial advice and other services the customer may have signed up for with the client financial institution.

Some customers may just need a temporary advisor, but others could use the chatbot over a long period of time, which allows it to develop a distinct sense of the customer’s behavior.

The company claims to also use predictive analytics to predict customer questions and common issues across multiple customers. This can help the company offer its customers appropriate advice and update their information to prevent a large influx of the same question or issue.

Personetics chatbots can purportedly be run through Facebook messenger, Amazon Alexa, and possibly Skype in the future.

Watch this informational video to learn more about how Personetics chatbots work from Co-founder and CEO, David Sosna:

Chatbots for Finance

16. Cleo AI

Cleo AI offers a personalized financial advisory chatbot with a spending tracker. The titular Cleo chatbot can answer basic financial questions such as “can I afford a coffee?” and it will respond with immediate calculations based on your incoming bills and account balance.

If something changes, the chatbot can update its response with a notification. It can also purportedly provide graphs and insights from a customer’s financial data that can help them make financial decisions.

The Cleo chatbot allows the user to create a budget that it can then hold the user to when asked questions about what they can afford. The chatbot simply refers to the predetermined budget to check if the request can fit into it, allowing for a very quick calculation.

The company claims users can connect as many bank accounts as they wish and that they are accessed with security intact. They also claim Cleo can help customers manage their money by saving their spare change each week in a virtual “Cleo wallet” that can be accessed at any time.

This short, 1-minute demonstration is a quick look at how the Cleo app can assist users in managing their finances:

17. Pana

Pana is a vendor that purports to combine AI-powered chatbots and human employees to help companies and individual professionals manage travel logistics and expenses. Single users can use the app for business trips, and companies can use it for assisting guests and planning events.

These guests could include office guests such as interns, job candidates, or colleagues from overseas. It is important to note that the app requires anyone using it to create an account with a company email.

The app gives financial recommendations during business trips such as which hotel to stay at and where to eat. It can also help find the best flight to take given the dates of the business trip.

Pana claims their customers can also access their human staff when in need of troubleshooting or a better concierge.

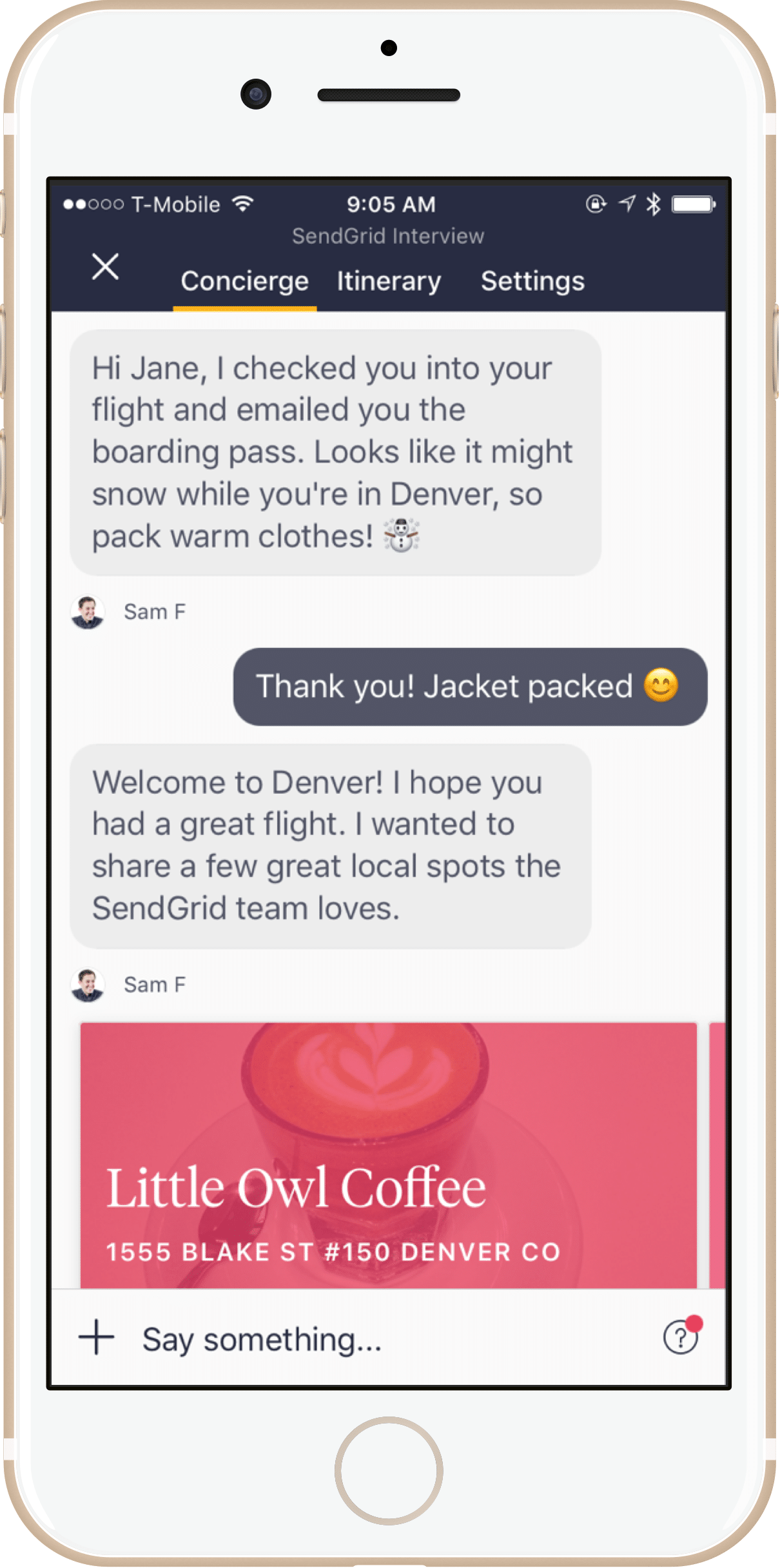

They also claim these employees can offer similar advice to the chatbot in the event the chatbot is not connecting for some reason. The paid version of the Pana app can also automatically check a user into a flight.

This image shows Pana’s chatbot updating the user on the status of their boarding pass along with a clothing recommendation based on the weather at their destination:

18. Passage AI

Passage AI offers an AI platform for building a conversational interface for financial services companies. They claim to help financial institutions with letting their customers access their bank account, investment fund, credit card information, or find a good home loan.

The platform can also be used to update users on the status of loan or credit card applications, as well as answering customer service questions such as finding a routing number.

Passage AI also claims to have numerous pre-trained machine learning models which have been prepared for various business areas in banking. These business areas include:

- Credit Disclosure, Freeze, and Report

- Credit Card balance inquiry and Credit Line Increase

- Loan Applications

- Paying off Loans

- Payroll and Invoicing for small businesses

- Retirement planning

With Passage, a bank or financial institution could create a chatbot that could do any number of these things or just one with more focused training. Depending on the client’s needs, Passage’s platform can help build a chatbot that accurately sources and translates the right data into a fulfilling answer to the user.

The video below is an example of how Passage chatbots can be used as shopping assistants:

19. Nuance Virtual Assistant for Customer Service

Nuance Communications, known for their voice recognition healthcare NLP software called Nina, also offers a customer service virtual assistant. The assistant can be accessed via voice or text, and Nuance claims it can be integrated into a company’s website, smartphone app, text messaging application, or smart TV.

The software is made for customer service for large companies, which is why a company that builds smart TVs may benefit from this.

A customer could possibly need help setting up their TV, and they could access the virtual assistant via voice once plugged in. The customer could then ask the assistant questions about setup until they have their TV settings exactly how they want them.

Nina can also be set up as an automatic prompt according to certain business rules. For example, if someone is spending a long time on the same few pages of a website the assistant can pop up and ask if they need any help.

This may require several clarifying questions, but soon Nina would navigate the user to the correct page of the site they were looking for, then ask if they can help with any decision making.

This is useful for banks and financial institutions as well, because Nina can help customers locate and choose between financial plan options.

The video below is a labeled demonstration of how the Nuance Nina chatbot works for customer service problems. The chatbot can intake typed or spoken questions when used on a smartphone:

20. Digital Genius

Digital Genius also offers a chatbot software called “Co-Pilot” and claim to help businesses like travel agencies automate the most repetitive customer support questions. They also claim the software can help human agents answer customer questions.

It may be able to do this using NLP to scan the question and then offer a recommendation of the most likely answer to the agent. This allows for more user input than a regular chatbot service and is intended to integrate with Salesforce and Zendesk.

The company claims the Co-Pilot software can automatically pull up possible responses to the client business’ frequently asked questions based on historical customer service data.

The chatbot can then purportedly send that response to the customer, or it can hold it until a human agent approves it. This might allow for a very small margin of error given that each time a human agent approves or disapproves of a response, the machine learning algorithm adapts to it.

Digital Genius emphasizes confidence as the main source of value for their product. They use confidence intervals to gauge how accurate an automatically generated answer might be, and then hold low-scoring answers off for human approval.

This may allow for higher accuracy once the answer reaches the user.

This video includes a demonstration of Digital Genius’ chatbot from president and co-founder Mikhai Naumov. The introduction and demonstration is between 0:00 and 3:00: