Deloitte, EY, PricewaterhouseCoopers (PwC) and KPMG are among the largest service providers in the accounting industry— collectively referred to as the Big Four. Many of the financial and consulting services offered by these firms – such as advising on investment decisions – involve finding patterns in very large sets of data. This data is often beyond the understanding of a single person (or team of persons) and is often “noisy” and without a set format.

The Big Four all seem to have artificial intelligence initiatives – and the goal of this article here is to compare and contrast their AI-related efforts (and purported results). A few of the Big Four have invested heavily in innovation labs and claim to embrace a new era of automation and augmentation.

In the article below we aim to answer the following three questions:

- What are the different AI technologies the Big Four are implementing and how?

- Which services are most likely to be automated first?

- What are the similarities and differences in the AI initiatives and strategy for each of the Big Four?

We’ll explore the AI investments and initiatives of these companies one-by-one, starting with Deloitte.

Deloitte

It is one of the biggest accounting brands under which lie several professionals and firms that offer auditing, strategy consulting and tax preparation related services.

As with most large consulting firms, Deloitte vies for market share and press through thought leadership – and like the other Big Four – it has increasingly focused it’s white papers and research on the topic of artificial intelligence. A recent Deloitte article breaks down AI technologies into the following discreet categories:

- Product: AI technology embedded into the product or service itself to provide all the associated end-customer benefits.

- Process: AI technology to streamline daily workflow and operations to automate and increase day-to-day productivity. Automation can happen in two forms: by either reducing manpower directly or augmenting a worker’s ability to perform a task better/faster.

- Insight: AI is used to make informed and strategic decisions to provide targeted advice to a company to new or existing businesses.

Based on our assessment, most of Deloitte’s own AI-related initiatives seem to fall into the categories of Process and Insight, as we’ll see below.

A concrete example of an AI-enabled process is the document-review platform developed by Deloitte US innovation that went live in 2014. Deloitte claims that this platform has automated the process of reviewing and extracting all the relevant information from contracts, and reducing meticulous, laborious human efforts.

The company claims that this technology has helped reduce the time spent on reviewing legal contract documents, invoices, financial statements and board meeting minutes by up to 50 percent or more.

Deloitte has recently partnered with IBM Watson. The Deloitte touts the partnership as a way to provide end users with cognitive-technology-enhanced solutions for their businesses. Following are some business use-cases as a result of this partnership:

- LeasePoint– It is powered by IBM TRIRIGA and utilizes Deloittes knowledge in leasing industry to teach the AI-enabled system to develop an end-to-end leasing portfolio

- Visual inspection of assets– Using IBM’s Maximo technology Deloitte claims to be improving asset inspection on wind farms. Learn more in this video.

Deloitte Catalyst – another recent AI initiative from the global consulting giant – is a network of startups, that are working together to translate AI technologies into practical business solutions for client firms.

Deloitte offers Catalyst companies funding, and access to Deloitte’s client base in order to partner and flesh out their business applications. Most AI firms are still figuring out exactly how to drive business value with their technology, and Deloitte hopes to forge partnerships with these cutting-edge firms to help bring the latest AI innovations to their clients. The video below explains the initiative (starting around 55 seconds):

Ayasdi, Narrative Science, and Kira are claimed to be among the businesses partnering with Deloitte in their Catalyst program.

“Technology like AI can help make these processes more efficient, accurate and comprehensive, helping us get better insights to clients sooner, and empowering our professionals to deliver high-value services to our clients”. – Craig Muraskin, Managing Director, Deloitte U.S. Innovation Group

EY

Formerly known as Ernst & Young, EY is one of the largest professional service providing firms in the world. It operates as a network of firms which function independently in different countries, collectively offering assurance, audit, tax, consulting and advisory services to companies.

The company has recently applied AI to the analysis of lease contracts. The company claims that the use of AI has made it easier to capture relevant information from contracts such as lease commencement date, amount to be paid, and renewal or termination options.

According to an article in Accounting Today, EY is working to automate the auditing process. They claim that this reduces the administrative time spent on reviewing audit documents and gives employees more time to participate in the judgment and analytical part of the process. These applications appear to be in pilot phase (which is to be expected).

as sifting through the auditing or lease documents can be extremely time consuming. According to EY Global Assurance Innovation Leader Jeanne Boillet in a June 2017 report:

“These pilots show that AI tools would make it possible to review about 70%-80% of a simple lease’s contents electronically, leaving the remainder to be considered by a human. With more complex leases (in real estate, for instance), that figure would be more like 40%, but as the tools improve, and the machines learn, it is likely that more complex contracts and data can be read, managed and analyzed.”

Another area where EY has applied AI technology is the automation of routine tasks, such as auditing (which we covered in greater depth in our full article on AI in insurance), by using it’s own proprietary Robotic Process Automation (RPA) system. EY claims that this technology, known as , helps the firm deliver more accurate, efficient audits for its clients.

EY Australia has already adopted this digital auditing technology, claiming that 50% of its bank audit confirmations were lodged using the AI-enabled system. This AI-enabled system can accept and confirm audit requests, process and provide the auditors with the relevant documentation for final analysis and judgment.

EY has also launched an AI proof-of-concept, using computer vision to enable airborne drones to monitor inventory during the auditing process. For example, this drone can count the number of vehicles in a production plant under audit, and communicate this data directly into the EY Canvas – the global audit digital platform.

According to EY, use of drones allows more data to be captured in the process of auditing. It also allows auditors to focus on risk areas rather than taking stock of inventory manually. This drone initiative seems to be in research and development mode at the time being and doesn’t seem to be a service offered broadly to EY’s client base.

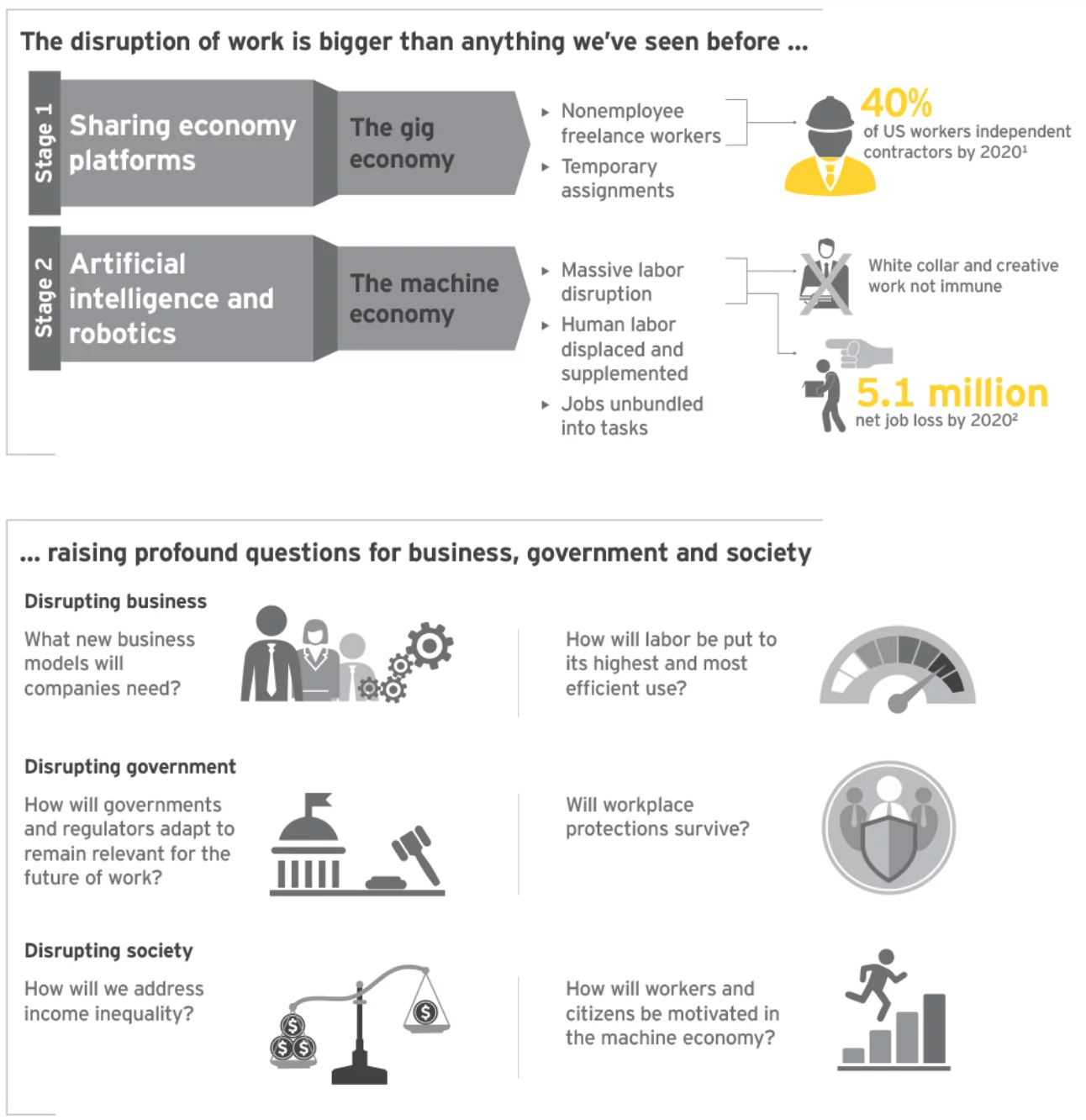

While overtly embracing the developments in AI, EY is also aware of the threat AI poses to white-collar work, and they appear to be addressing automation seriously in their thought leadership. EY’s recent report on the future of work highlights some of the societal and regulatory concerns of job automation in the decade ahead.

Predictably, much of EY’s thought leadership touts the benefits of augmentation instead of automation. EY Global Assurance Innovation Leader Jeanne Boillet says that Artificial Intelligence “has the potential to transform audit, but it will never replace the auditor”.

We find the word “never” to be downright ridiculous, but we cannot blame EY leadership from having to tout this opinion, and there is no reason to blame Mrs. Boillet for being so black-and-white about the matter, anyone in her shoes would say the same thing.

This belief in an “augmented”, not an “automated” future is a common theme among large, people-heavy legacy businesses. Many would argue that businesses of this kind (chock full of knowledge workers working in spreadsheets) are among the biggest “low-hanging fruit” for automation, and it behooves older people-heavy businesses to dispel disturbing thoughts about massive layoffs.

By no means are we suggesting that the Big Four are inherently doomed to perish by nimbler, less human-laden competitors. Rather, we want to address the fact that these firms can be expected to have only one opinion on this matter.

The impact on employee morale and shareholder value would likely be tragic if EY’s leadership (or the leadership of Accenture, Deloitte, or any other large consulting firm) were to state openly that many of their current jobs may be fully automated, and that some of these jobs would not be replaced. Hence, large firms of this kind are only permitted to give one opinion, an inherently self-serving one, one with a commitment to stave off risk and ensure it’s own survival.

We don’t consider this immoral, it’s the same kind of self-preservation we’d see in any other sector or industry. It may not be blameworthy, but it is our job here at TechEmergence to make it known that these opinions should not be taken at face value.

Whenever a company has no choice but to tout a single perspective, we’re likely to lay those facts outright so that business readers (like yourself) can make more informed decisions. We should expect to see large, people-heavy legacy companies

(For more insight into the kinds of jobs that might be first – or last – to automate, read or listen to our previous interviews with Martin Ford, Kevin LaGrandeur, and Marshall Brain – all of which are focused on the impact of automation on the job market.)

PwC

The second largest professional services firm by revenue, PwC, claims to have begun adopting AI as well. The International Accounting Bulletin awarded the ‘Audit Innovation of the year’ for PwC’s technology GL.ai in October 2017. GL.ai was developed in collaboration with H2O.ai, a Silicon Valley company that developed an AI-enabled system capable of analyzing documents and preparing reports.

Using AI approaches like reinforcement learning, PwC claims that GL.ai learns and becomes more capable with every audit (a common capability for ML applications). GL.ai has already been trained on audit data from Canada, Germany, Sweden and the UK. We were unable to find robust case studies of the technology in our analysis, and – like most of the AI applications at Big Four firms at this time – the technology seems to be in development.

They claim to have made a significant investment in Natural Language Processing (NLP)- an AI-enable technology for this purpose. NLP makes sense of complex lease agreements, revenue contracts, and board meeting minutes to form meaningful insights for clients.

Anand Rao – Global AI lead at PwC – told TechEmergence about another PwC AI use-case in the automotive industry:

“Using ‘digital twin’ technology and ‘future power’ we have helped large auto manufacturers visualize and navigate over 200,000 go-to-market scenarios to fine-tune their strategy and launch a new multi-billion dollar business in ridesharing and autonomous/electric vehicles. This particular application has won the Best Enterprise Award recently and is the wave of next generation of AI on ‘Gamifying Strategy’ – it takes the methods used to create AlphaGo and other game playing programs to the Boardrooms and Strategy Groups. We have done this at more than half-a-dozen clients”.

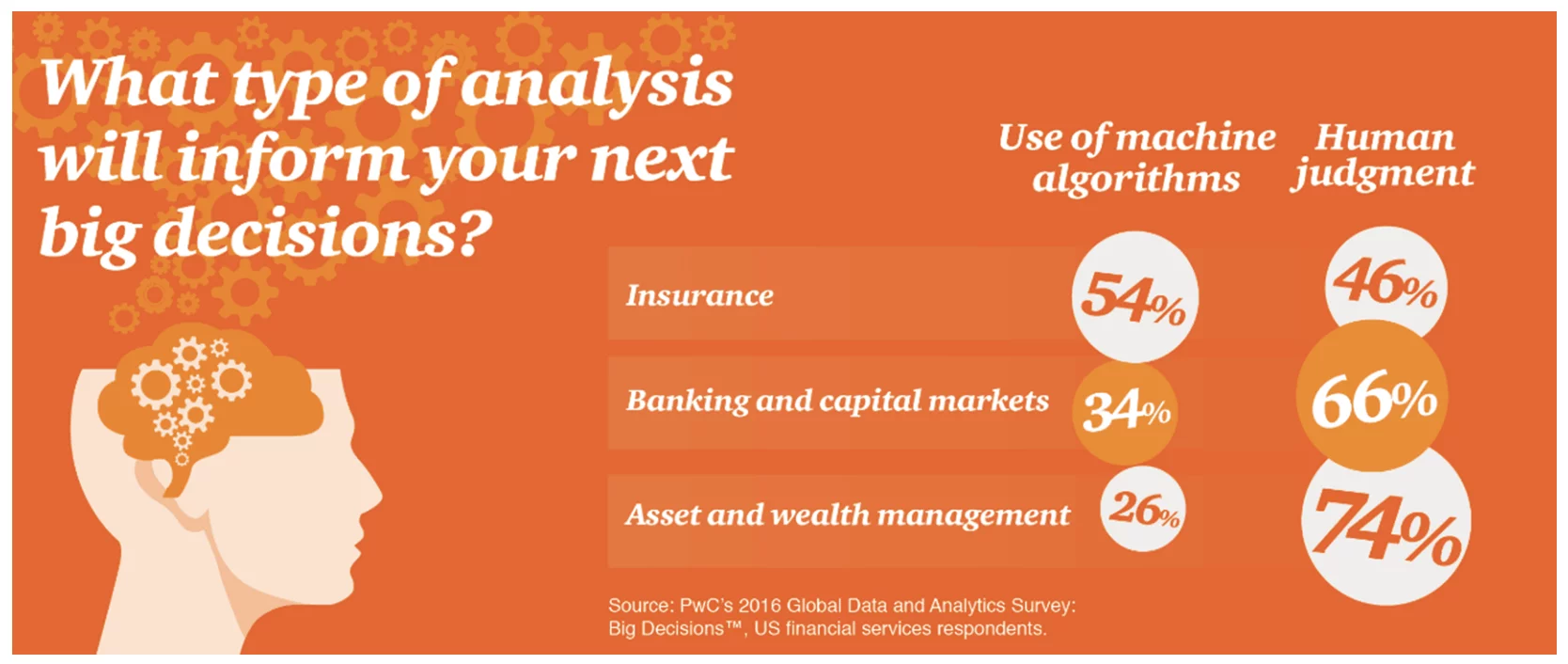

Like the other Big Four firms, PwC is actively involved in publishing thought leadership (articles, white papers, and more) on the implications of artificial intelligence. A recent PwC analysis of the financial services sector identifies a number of automation and augmentation concerns related to AI – and advice from PwC on how firms might adapt to AI in the future.

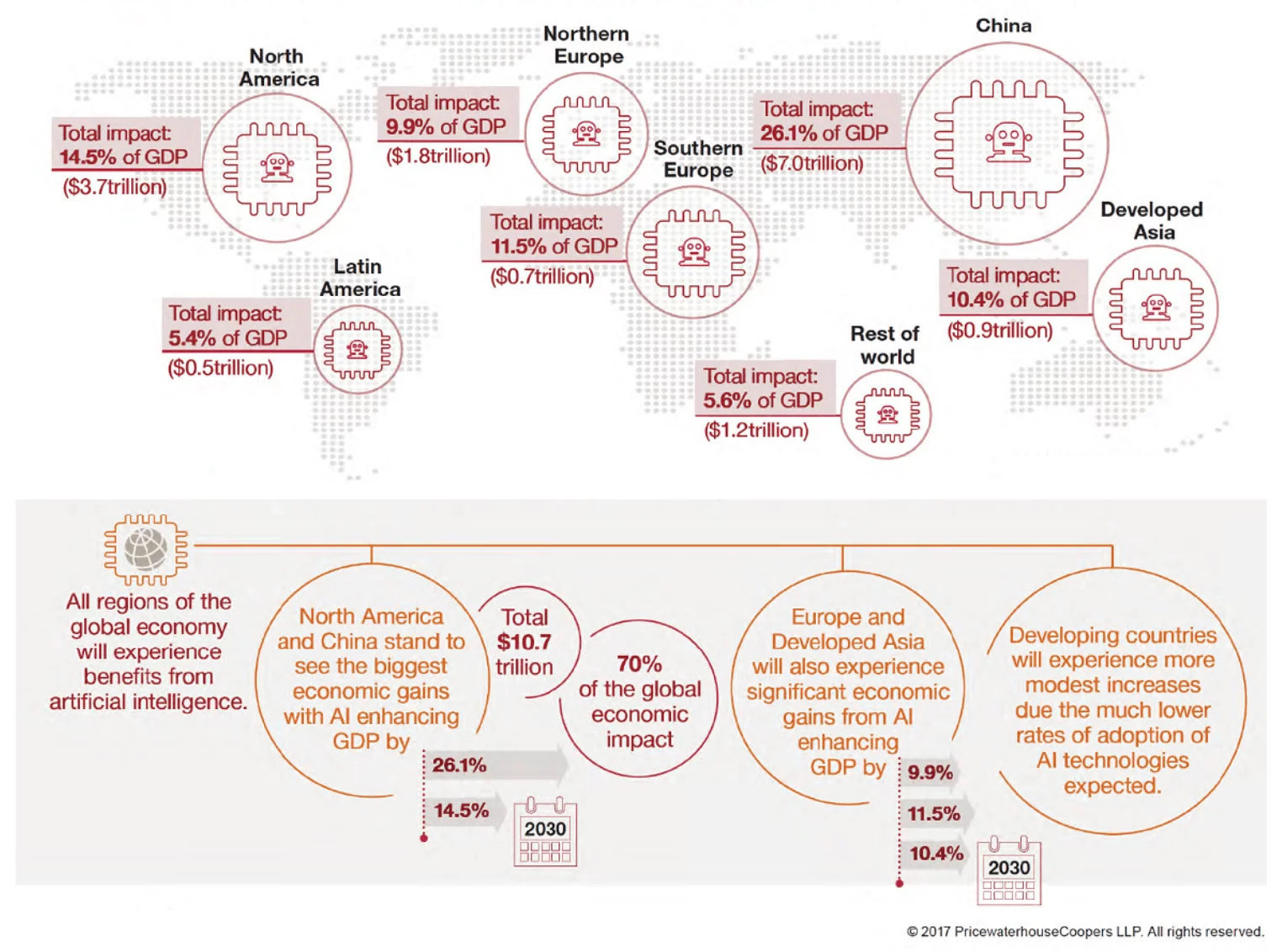

PwC’s “AI: Sizing the prize” report estimates the percent increase in GDP to be attributed to AI in various economic regions (see below). The image below is only a small snapshot, because of the complexity of the topic (and the inherent challenges in predicting the future), we advise the reader to assess multiple sources and develop their own conclusions.

“Artificial intelligence can help people make faster, better, and cheaper decisions. But you have to be willing to collaborate with the machine, and not just treat it as either a servant or an overlord”. – Anand Rao, US Analytics Group Innovation Leader

KPMG

KPMG has built its own portfolio of AI tools called KPMG Ignite. The KPMG Ignite offering is designed to enhance business decisions and process on a digital platform.

Key features of KPMG Ignite include AI tools (a few examples of which are listed below), AI integrators to make these tools compatible with existing IT infrastructure, guidance for client firms and testing, prototype development, and innovation on emerging AI applications.

KPMG is also using AI to analyze and extract information from leasing or investment agreements. Following are some of the business process where KPMG claims to have applied AI-enabled technology-

- Call Center Analytics Engine- Utilizes NLP to design a model to predict future events and even convert customer calls to unstructured text, which is then streamlined to identify keywords, customer sentiment and predict future trends.

- AI Anomalous Event Predicting Tool- Uses AI techniques to develop a model to predict future business events.

- Document Compliance Assessment Engine- Uses AI to read a documentation- contract, leasing and investment agreement- in its entirety and yield relevant information.

(Learn more about Business implications of AI from KPMG here)

KPMG signed a “Participation Agreement” with IBM in June 2016 – apparently with the intention of using IBM Watson to automate audit-related processes. It isn’t clear if this “Participation Agreement” involved paying IBM, or if both firms are looking to prove out a use-case together in a kind of barter. Little seems to be available about the present progress of said agreement.

In a 2016 press release, KPMG’s John Kelly (Senior Vice-President, Cognitive Solutions and IBM Research) states:

“Auditing and similar knowledge services are increasingly challenged with tackling immense volumes of unstructured data. Cognitive technologies such as Watson can transform how this data is understood and how critical decisions are made. By applying Watson, KPMG is taking a forward-looking approach to extending its expertise, helping professionals and clients gain new insights from critical enterprise information”

As we might expect, KPMG has joined the thought leadership game around artificial intelligence – with the intent of informing their clients and appearing ahead of the curve. Like Deloitte, they’ve created a number of layperson-friendly AI explainer videos to explain AI’s potential impact on their work:

KPMG’s “ethical compass for automation” highlights some of the societal concerns that they consider to be important in the years ahead. KPMG’s Automation Practice Lead, Todd Loar, explains the fundamental findings of their report in the 5-minute presentation below:

On the Game of Thought Leadership for Consulting Companies

As analysts in the AI industry, we’re tasked with sorting out truth from hype.

With the popularity of AI (and the growing sentiment of its inevitability in effecting all business sectors), it often behooves companies to seem ahead of the AI curve.

In the world of startups, companies increasingly see their competitors use “artificial intelligence” in pitch decks and on their “about” page – and the pressure mounts to do the same (even if they have no AI skills or talent, and even if the product is in no way predicated on artificial intelligence).

In the world of consulting firms, the same phenomenon occurs. Businesses must “keep up with the Joneses” in the perception game of AI competence, or else they’ll lose business to someone who puts up a better front. As in the startup world, this leads to a vicious cycle of mutual one-upmanship without the prowess to back up the claims.

For some reason I find that business readers often know intuitively that a startup’s pitch deck is self-serving, but they’re often unable to apply that same “taking it with a grain of salt” mentality to white papers and reports, which – like pitch decks – serve the goal of filling a company’s bank accounts, not of portraying truth for its own sake.

This disclaimer is important:

Thought leadership is perception management, not objective analysis.

This isn’t to say that we don’t believe that the Big Four are using AI. These companies have massive revenues and thousands of talented people – and based on our assessment, all four of the Big Four claim to have integrated AI into some of their service offerings, and we’d suspect that this is, in fact, the case.

Rather we imply they have no choice but to say that they are on the cutting edge of AI (or they risk losing business to their better-marketed competitors). This isn’t blameworthy, it’s business – and we aren’t here to point fingers, but to lay the situation out as it is. Time will tell which of these companies is leveraging the technology most fruitfully, and we imagine that there will be a rather intense competition among these top firms to improve their service quality and profit margins through automation.

Indeed part of our job here at TechEmergence is to do the “digging” ourselves and aim to get behind the bluster of press releases, but we’d like to remind our readers to think like an analyst as they consume information that might affect their strategy and procurement.

Concluding Thoughts on AI in the Accounting Big Four

In the sections above, we reviewed how AI is being used by all the Big Four. Based on our research on these companies, two common trends seem clear:

First, they seem to be investing in AI technologies for accounting services. AI is being integrated into the core of the business and its use is showing a gradual increase.

Second, the Four also purport to see AI as a critical factor to give them an edge over others and are in some sense competing with each other to gain AI supremacy.

The use of AI holds many promises for the future of these consulting giants. It may take away the pain of flipping through hundreds of pages for hours and making reports. A lot of data collected during auditing and tax preparation is unstructured and prone to human error. AI-enabled technology, trained on this unstructured data is increasingly capable of recognizing the errors and streamlining parts of the process.

Next in line for augmentation and automation are advisory services. Using consulting and advisory data, firms are now training AI networks to learn how to interact with client firms looking for business solutions.

The decision to relying on AI solutions requires administrative streamlining and strategic planning on many levels. The firms have worked hard to define these strategies to implement and integrate AI technologies in the workplace. For example, Deloitte aims to create process maps to keep track of the organization’s core business processes.

Our analysis of machine learning in the finance sector indicates that this industry is among the most likely to adopt more white-collar automation in the years ahead – a trend we see clearly in the analysis of the Big Four.

This will help identify business processes where AI might have the most impact. PwC, advises choosing areas that are operational or explanatory in nature and explore AI solutions to these problems before others (source). These strategies can help to facilitate a judicial use of budget, resources, and planning that goes into the use of AI in a business.

Given the impact that AI is poised to make, there has to be a discussion about the extent to which we rely solely on machine-based intelligence and decisions. Every industry embracing AI for a business solution is concerned with the impact that this technology can have on humans in the workplace. For the Big Four, this is reason for greater concern, as they operate in a people-centric business – and one that some experts would presume to be ripe for massive disruption through automation.

Our analysis reveals that the Big Four are investigating the concerns of workforce automation – though most all of their published thought leadership paints an optimistic future of augmentation, rather than one of automation. Time will tell when it comes to the effects of AI on the knowledge workers within the Big Four. My fingers are crossed that their industry – as with many others – have insight and ability to adopt. They’re certainly working on it.

Header image credit: b4f.eu