While self-driving trucks and self-driving cars make use of much of the same technology to power their AI systems, it would be a mistake to think the expected roll out date of both developments to would be identical. Their similarities can easily mask their significant differences.

The sheer weight of semi trucks creates unique technological challenges compared to self-driving cars. The substantial weight of trucks means the time it takes to stop a them is much longer than cars, and trucks have less ability to swerve to avoid an accident.

At the same, the way the way trucks are deployed creates possible uses of autonomy which would be economically viable for commercial trucks but not commercial cars. For example, some trucks will spend their entire lifecycle operating on only a limited piece of private property, such as a mine, which simplifies the legal and technical issues with creating an autonomous system.

This analysis will look at two key aspects of the development of autonomous trucks:

- The unique ways autonomous or semi-autonomous trucks are expected to be first commercially used

- When the major manufacturers, technology companies, and outside experts project this technology will see significant use

Autonomous trucks will not be deployed in a single defining moment, but in a series of steps. Instead, it is expected to roll out in several ways that first improve the efficiency of human drivers.

The current focus of many companies working in this space is not the total elimination of human truck drivers but finding ways to augment them with AI to get more miles traveled at lower costs. The first part of the article will look at several ways companies think a combination of human drivers and AI working together can reduce fuel usage and increase run time. The second part will look at how companies and outside experts expect these technology to be commercially viable.

Recent test and demonstrations which examine below indicate how even a limited level of automation could create significant ROI for commercial truck technologies.

Initial Applications of Autonomous and Semi-Autonomous Trucks

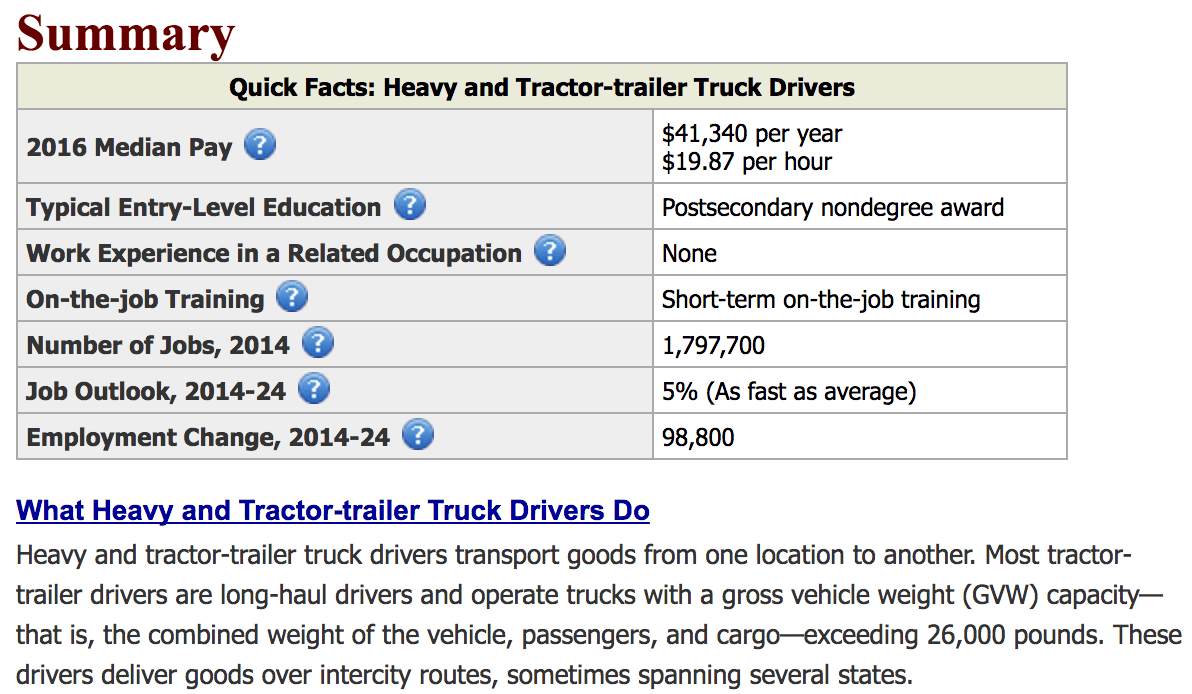

If or when it is possible to create truly autonomous trucks that can do everything current human drivers can do, in all weather possible conditions (defined as level 5 automation), it is easy to envision how that would entirely automate the industry, replacing the roughly 1.8 million heavy and tractor-trailer truck driving jobs that currently exist. However, that level of autonomy is not expected for many years.

That is why it is important to examine what companies expect to be able to use limited autonomous technology for in the short term to reduce costs, save lives, improve safety, and augment the workload of human operators. Simply achieving level 4 automation (where the trucks can drive themselves under specific – not all – conditions) is the main goal of the industry at the moment.

Below are actual uses of level 4 automation in truck already being tested by companies in real world environments:

1 – Highway Driving

One big expected first use of the technology is to handle highway driving in fair weather conditions. These semi-autonomous trucks would still have drivers on board who would handle complex things like city driving, bad rural roads, or loading; the AI system would take over on the highway. This would free the driver to sleep or catch up on paperwork.

Drivers are limited to working 60 hours a week and are required to take specific breaks. This means vehicles sit idle for long stretches of time. Theoretically, a truck that can drive itself on the highway while the driver rests would allow the truck to operate almost 24 hours a day. Under ideal conditions, one driver and an autonomous truck could effectively do the work currently accomplished by three drivers. According to the American Transportation Research Institute driver salary/wages make up roughly 40% of the marginal cost per mile for motor carriers.

Increasing the efficiency of drivers is of particular interest to the industry because of a large projected shortage in drivers. The American Trucking Association claims there was a shortage of 38,000 drivers in 2014 and that it could rise to 175,000 by 2024.

Last October Otto, which was acquired by Uber for $680 million, performed the world’s first shipment by a self-driving truck. The cargo was 51,744 cans of Budweiser. The test was a demonstration of Otto’s exit-to-exit approach, where the driver does the difficult task of getting the truck to the highway where the AI takes over. Once the truck was on the highway, the driver wasn’t even in the driver’s seat but sitting in the sleeper berth.

Since the acquisition, however, Uber seems to have shifted the focus the resources it obtained from Otto more on cars than trucks. The move is not too surprising given that Uber’s core business is car based ride sharing and they see quickly developing self-driving cars very important to to that business.

The shift appears to have more to do with Uber specific business plans than industry wide concerns about viability of self-driving trucks vs cars. For example earlier this month Waymo, which has been a leader in self-driving car development, announced they have expanded into self-driving trucks development as well.

2 – “Platooning”

“Platooning” is when multiple trucks drive in unison very close together. This lets each truck draft off the one in front of it to dramatically reduce fuel usage. Testing done for Peloton, a Silicon Valley company developing this technology, found that it reduces fuel use for the lead truck by 4.5% and the following trucks by 10%.

Platooning is dangerous to do with human drivers (as close distances enhance the risk of a crash – or worse – a pile-up), but the goal is for autonomous technology to make this practice safe. Human reaction time behind the wheel if a car brakes in front is 1.4 seconds, but Daimlers’ Highway Pilot Connect can transmit the signal between vehicles in just 0.1 seconds.

The idea is in the relatively near term to allow a driver in the front truck to control the platoon while an AI system in all of the trucks controls the ones behind it. The trucks following could be unmanned or have drivers in them who are resting. With several trucks and drivers changing out who is in the lead, the platoon could effectively run for days continuously.

Daimler demonstrated the use of autonomous technology to create a safe platoon on the autobahn last March. Three connected, autonomously driving trucks worked together to create a platoon.

3 – Private Property and Slow Routes

Large private facilities are already starting to see experiments with self-driving trucks. The small size, defined routes, low traffic and the low speed that trucks normally travel at on these facilities will likely allow for full autonomy early. Similarly, any use of trucks on public roads that requires them to travel very slowly, like a garbage route, is ripe for early adoption.

Volvo has already started using their equipment in these applications. Last year Volvo tested a fully autonomous truck in the Kristineberg Mine.

And earlier this year Volvo deployed their first autonomous garbage truck. The garbage truck moves slowly along its route, allowing a driver to walk ahead making sure each bin is ready.

Out recent interview with heavy industry AI expert Dr. Sam Kherat explored the topic of private property autonomous vehicle use-cases in much greater depth.

Initial Real-World Uses of Self-Driving Trucks – When and How

While some believe cars would need to achieve a very high level of automation in chaotic urban areas before the technology truly transforms that industry, the trucking industry could see big financial returns from less advanced levels of automation. As a result the big players in the industry aren’t as focused on completely removing human drivers from the equation as some carmakers are.

1 – The Perspective of Start Ups

Eric Berdinis, Otto’s product manager, told MIT Technology Review they are, “at least a decade away from having trucks with no driver in it.” Their push is to get a system good enough to take over during just the long stretches of boring highway driving.

Embark is a start up pursuing a similar exit-to-exit strategy of autonomous highway driving but with the human driver handling the tricky segments. It has been testing technology on Nevada roads thanks to the state’s permissive regulation towards automation. The driver could ride in the truck as they sleep, or companies could have human drivers do difficult tasks like bringing loads to staging areas right next to the highway where the humanless self-driving trucks could pick them up and drop them off. Embark does not have a public target date for their systems being commercially available but has implied it should be in just the next few years.

A revival start up, Starsky Robotics, has a different variation on the idea. While they similarly have no plans to eliminate all human control of the truck in the near term, they do want to remove humans from the truck itself. The AI would control a truck during highway driving but the complicated parts would be accomplished by a human remotely. One operator could be responsible for multiple trucks at a time. Currently their trucks operate with a safety monitor in the cab, but they hope to remove the safety driver by the end of the year.

2 – The Perspectives of Established Manufacturers

Daimler is a dominant player in the truck manufacturing business and has invested heavily in their autonomous technology both for cars and trucks. They were the first to get a self-driving truck licensed in Nevada back in 2015, but they don’t expect to fully get rid of human drivers for a long time.

They see the focus of their technology as supporting drivers rather than replacing them, by having automation take over on the highways, improving safety, and gaining greater fuel efficiency.

At the moment they are merely perfecting their autonomous driving technology for trucks and expect to have it on the market in just a few years.

Volvo has interestingly focused their self-driving truck research on applications that are low speed and have lower safety concerns. That includes inside mines, garbage trucks, and trucks that follow sugar cane harvesters in a field. Some of these simpler applications, they predict, will be commercially available in the foreseeable future.

3 – Outside Analysis – Commercial Self-Driving Trucks in 4-5 Years

While the companies directly invested in the technology have a reason to be publicly optimistic, some outside experts also believe a rather quick and impactful adoption of autonomous trucks is possible.

Early this year the International Transport Forum, an intergovernmental organization with 57 member countries, concluded that “driverless trucks could be a regular presence on many roads within the next ten years.” By 2030 the technology could replace between 50%-70% of drivers.

The ITF does acknowledge that the rate of technological development and more importantly the speed with which governments would make the necessary regulatory changes to allow for autonomous trucks makes the future difficult to predict. According to the report we could see the wide adoption of the technology by as early as 2021 — or not for over a decade if government rules slow their adoption.

Daniel Murray, vice president of research at the American Transportation Research Institute, told Trucks.com that recent demonstrations have convinced him the technology will soon see commercial use. “I moved my personal time line from 15-to-20 years up to five,” he said. According to an ATRI report from Murray, “Autonomous truck technology is on a course that will fundamentally change the trucking industry. Shifts of this magnitude do not come often–and may prove to be as momentous as the building of the Interstate System and deregulation.”

Concluding Thoughts on Autonomous Trucking

Being able to achieve full level 5 autonomy in trucks –which never requires human control– is unnecessary for the industry to realize potentially significant safety improvements (over 4,000 Americans die each year in accidents involving large trucks), fuel reductions, and labor savings from autonomous vehicles. Simply getting to the point where trucks can drive themselves on the highway or on specific routes would allow for a transformation of the industry. That is something many inside the industry and outside believe will be possible in just the next few years.

Exactly how this technology could be deployed is unknown and something different companies are betting. It could be used for platooning, letting drivers sleep in the back while their trucks navigate highways, they could be deployed as remote controlled trucks, or trucks that travel by themselves from hubs right on the highway, or all of the above.

When these uses of the technology are deployed the industry could see a reduction fuel use per mile, a reduction in insurance costs, and a reduction in per mile costs due to wages. Given that the trucking industry in the United States generates $726.4 billion in gross freight revenues, the eventual saving could be in the billions. Given the competitive nature of the trucking industry much of the savings generated by new technology would be passed on as lower shipping costs.

Job loss and workforce automation in transportation is an ongoing concern in the coming on autonomous vehicles, and trucking is certainly no exception. In our workforce automation interview with Martin Ford (author of New York Times bestseller Rise of the Robots), we spoke in depth about the economic and HR concerns of job automation in the coming 5-10 years. Martin believes that as soon as driverless cars are reliably safer (not just more efficient, but safer – i.e. less likely to get in accidents of any kind) than human drivers, adoption will be swift and inevitable.

Any reduction in the cost using trucks would have broad implications well outside the trucking industry. Trucks move roughly 70% of the nation’s freight by weight. They is almost no industry not directly or indirectly impacted by the cost of shipping via truck. Customers could see the cost of goods for agricultural products, retail, construction material, etc… reduced because of lower shipping cost.

The big question is when and if the regulation will catch up with the technology. Effectively all the uses listed above are not legal in most places. Most of the big potential economic benefits from level 4 autonomous trucks are only possible if the laws change. For example, a truck that allows the operator to rest in back while traveling down a highway would offer only modest benefits if the same rules limiting hours of operation applied.

n the past few years there has been a bevy of actively related to self-driving trucks at the state level. Florida, Nevada, and Michigan currently have some of the most autonomous truck friendly rules and are likely to be the places that some of this technology will first be used. Many of the big hurdles though are federal. This is why Michael Ducker, chief executive of FedEx Freight, is pushing for new unified federal rules for autonomous trucks. Watching how strongly the major shippers and manufacturers lobby for federal change could be a useful proxy for determine when and how quickly these developments reach wide commercial use.

Image credit: NPR