Insurers are looking to leverage all of the digital customer data that is now available to them, including one new data source that some of the largest insurance enterprises claim are actively collecting: real-time data streams from the Internet of Things (IoT).

IoT devices, such as in-car sensors, smartphones, and smart appliances, can send insurers data on product usage and driving habits among other behaviors. In turn, this data could be fed into AI algorithms that may allow insurers to offer risk-based pricing and other popular services. Insurers that don’t pay attention to the way IoT and AI are impacting their industry may have trouble competing in the coming years.

In this article we delve deeper into how AI is being applied in the insurance sector in the context of using customer data, such as those from IoT sensors, to mitigate risks, acquire new customers, and improve operational efficiency. We focus our lens on insurance activities in three specific industry sectors:

- Automotive Insurance

- Home Insurance

- Health and Life Insurance

Internet of Things (IoT) is a broad term for internet-connected technologies that collect, record and transmit data from various types of sensors such as pressure or temperature or vibration from cars, homes, and hospitals.

This includes home devices such as the Amazon Echo or Google Home, or medical devices in hospitals or telematics (integration of telecommunications and IT to operate remote devices over a network) data from vehicles. All of these devices are constantly gathering information about customers that insurance firms can use in a variety of ways.

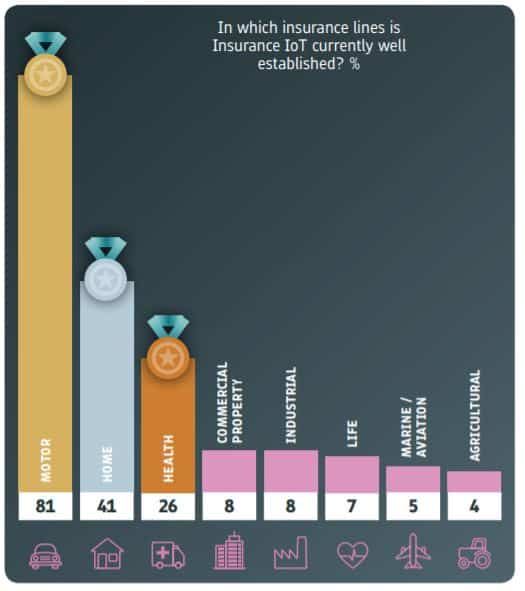

InsuranceNexus recently released their Connected Insurance Report, which took into account responses from 500 people working in insurance and related industries who deal with connected insurance. In their report, InsuranceNexus states that IoT is currently most well established in automotive, home, and health domains. The figure below from their report illustrates this point:

Automotive Insurance

Most modern cars today are fitted with a suite of sensors and electronic chips that can measure and transmit data about the vehicle’s speed, acceleration, location, route maps and so on.

Since the advent of smartphones, which have GPS and accelerometers, cars have gained another set of sensors in the phones that is constantly measuring and collecting information about customers. This type of data can potentially be used to identify if a driver’s actions on the road are too risky.

Vehicle telematics and continuously recorded electronic control data are now starting to be used as potentially valuable information in order to curb risks for auto insurance firms.

Using such connected device data to gauge insurance risks was first started in the automotive sector and it is unsurprising that most respondents in InsuranceNexus’s survey agreed that IoT was most well established for insurance in this sector (almost double the sector with the second most number of responses: home insurance).

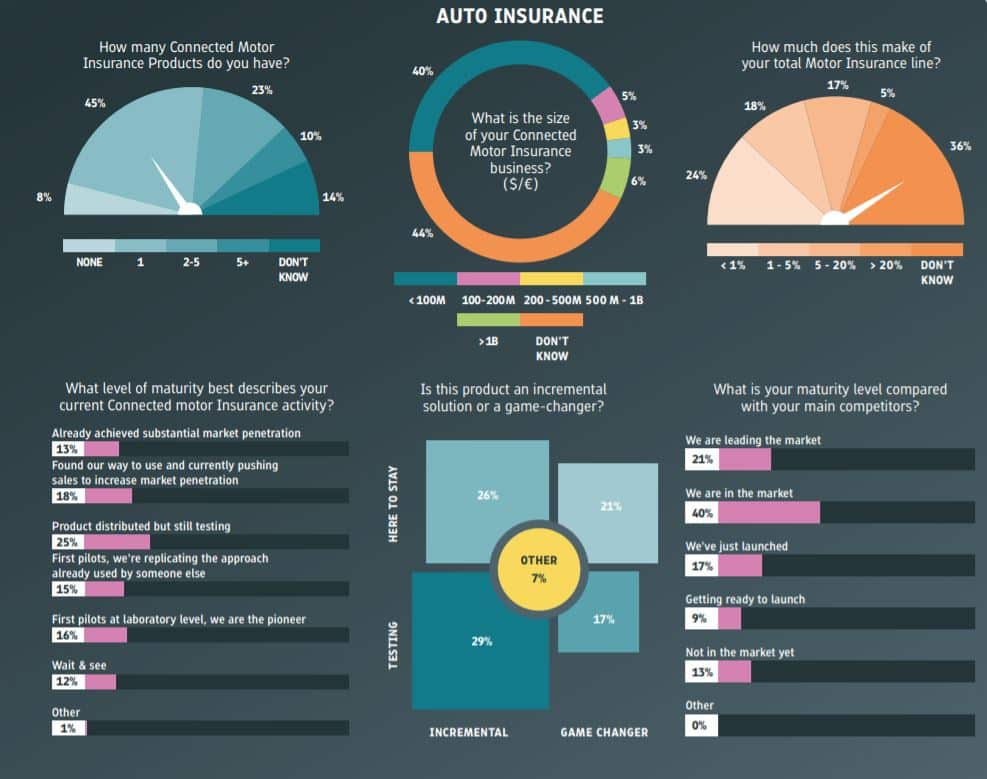

The figure below shows a snapshot of responses for several questions asked about connected insurance in the InsuranceNexus Report:

The respondents in the report seemed to suggest that AI software can help insurance firms build a better picture of their customers using telematics. In the automotive context, it is easier to acquire this type of data in a way that might be less intrusive compared to the home or health insurance sectors.

The data seems to indicate that there is a consensus among the industry experts that the opportunity in leveraging IoT data for insurance might be necessary to stay competitive. This is supported by the fact that 13% of the respondents stated that their organization had an active commercialized connected insurance product which helped them gain market share. (For more statistics, readers can download the full Connected Insurance report).

Additionally, the findings suggest that insurance firms have already invested in connected insurance products that seem to be adding value to their bottom lines.

At the moment most of these auto insurance lenders do not seem to see connected insurance products as a replacement for existing products. Rather it is being marketed as an additional augmentation of these existing products and improve sales and assess customer risk.

Insurance firms themselves seem to have caught on a little slowly in terms of achieving a level of data competency and culture of innovation in their c-suites.

One problem is the range of potential objectives. Some of these companies have now launched connected insurance products for which drivers can pay lower premiums for being safer drivers. Similarly, insurance firms can use AI algorithms feeding off telematics to reduce the likelihood of accidents, prevent fraud, recommend products and so on.

The availability of IoT sensor and car telematics data has led to the adoption of artificial intelligence in auto insurance in applications such as driver performance monitoring and insurance market analytics. We discuss these applications in more detail below.

Driver Performance Monitoring

Machine learning algorithms are being applied to customer driving data to help inform the development of products for insurance clients. For instance, Progressive Insurance claims they use machine learning algorithms for predictive analytics based on data collected from customers. Progressive claims that its telematics data collection mobile app, Snapshot, has collected 14 billion miles of driving data so far from customers. Progressive incentivizes Snapshot for drivers by using this data to identify “less risky” drivers over a period of time and offer them much more competitive policy pricing.

Home Insurance

Home insurance was second on the list in terms of how well IoT is being leveraged in the industry. One key difference between the home insurance and automotive insurance markets is that the auto insurance market is expected to mature and even drop off in the future as autonomous vehicles become more commonplace. On the other hand, the home insurance market is only expected to grow in the future as sensors are adopted in the homes of customers.

But the home insurance market is slightly trickier in terms of AI projects. While telematics data in cars is mostly related to speed, GPS data. and condition of the vehicle, home insurance IoT data includes home devices such as Amazon echos or Google homes and other internet-connected smart devices.

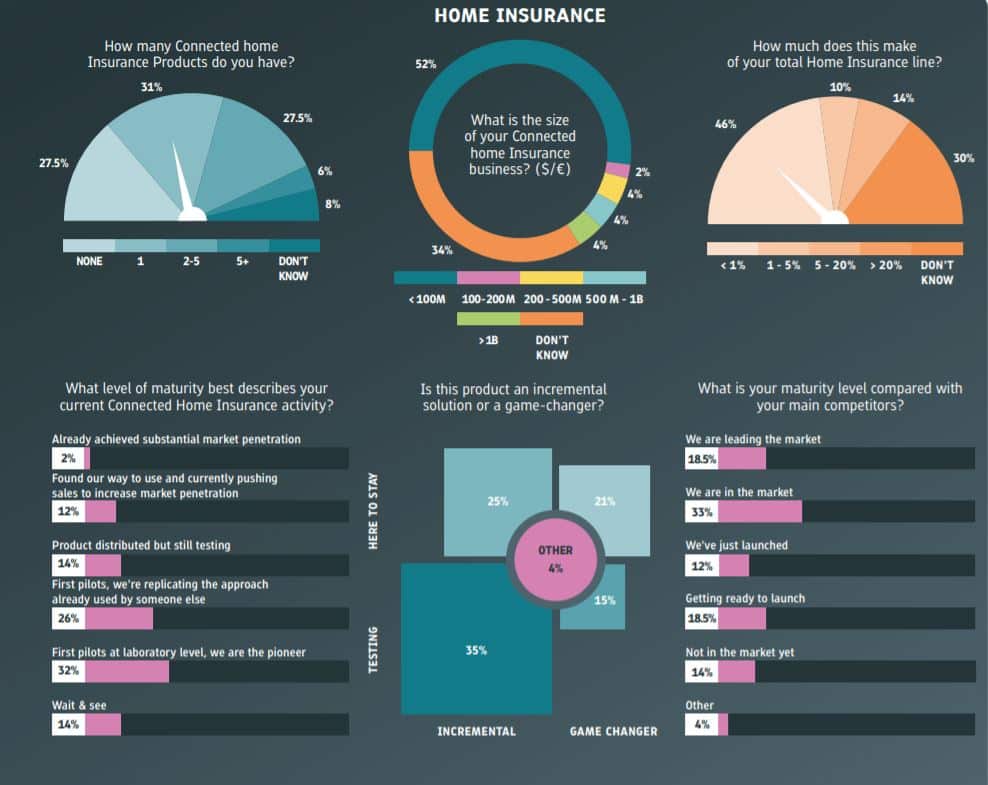

The challenge for insurance firms is that they need to feed algorithms with this limited but continuously streaming home IoT data into actionable sociological analysis that can, in turn, allow for better understanding the risks that come with a particular customer. Given below is a snapshot of the responses about the home insurance sector in the InsuranceNexus report.

The report suggests the biggest challenge for insurers in this space is to identify what kind of risk can be predicted using IoT home data. Unlike data from cars, which is more structured, data from home smart devices are somewhat unstructured and may be collected in several different formats. Making sense of all of this data and drawing insights that are actually actionable from all of this data is a hard problem to solve.

The report also found 58% of respondents were engaged in a pilot project while 14% reported that they have a commercialized product in the market already. But only 2% of respondents said they had a fully successful integration.

All of these are clear signs that the market for IoT-based AI analytics in home insurance is in its nascency at the moment. Additionally, the data also suggests that several AI vendors and in-house projects from insurance vendors in this space will become more commonplace in the near future.

These new products might effectively use AI to predict several things about customers that could help reduce risk levels.

Additionally, IoT data from home devices, although projected to grow massively in the future, may still not be at the level where the data collected is voluminous enough to warrant many AI projects at the moment.

Additionally, there are far more privacy-related social issues that insurance firms might have to deal with in terms of maintaining, storing, and managing customer information. Customers might also be less likely to allow insurance firms access to data from everyday operations at their home.

One example of such an application involves smart home monitoring and emergency assistance IoT along with a home insurance policy. The idea is that if an insurance firm can provide technology to a customer that makes accidents such as gas leaks, water damage, or stolen property less likely, then they’ll be able to pass along those savings in the form of lower premiums to their customers.

But this type of application might involve allowing the insurance firm to install cameras and other sensors in customer homes.

Health and Life Insurance

The health and life insurance sectors are likely to experience massive changes due to connected insurance since this sector has access to vast volumes of historical insurance claims and patient records.

But these sectors have been relatively slow to adopt AI technologies so far according to InduranceNexus. Hospitals are now being fitted with smart medical devices, and several consumers are now using wearable fitness trackers that measure information such as heart rates, active minutes a day, and so on.

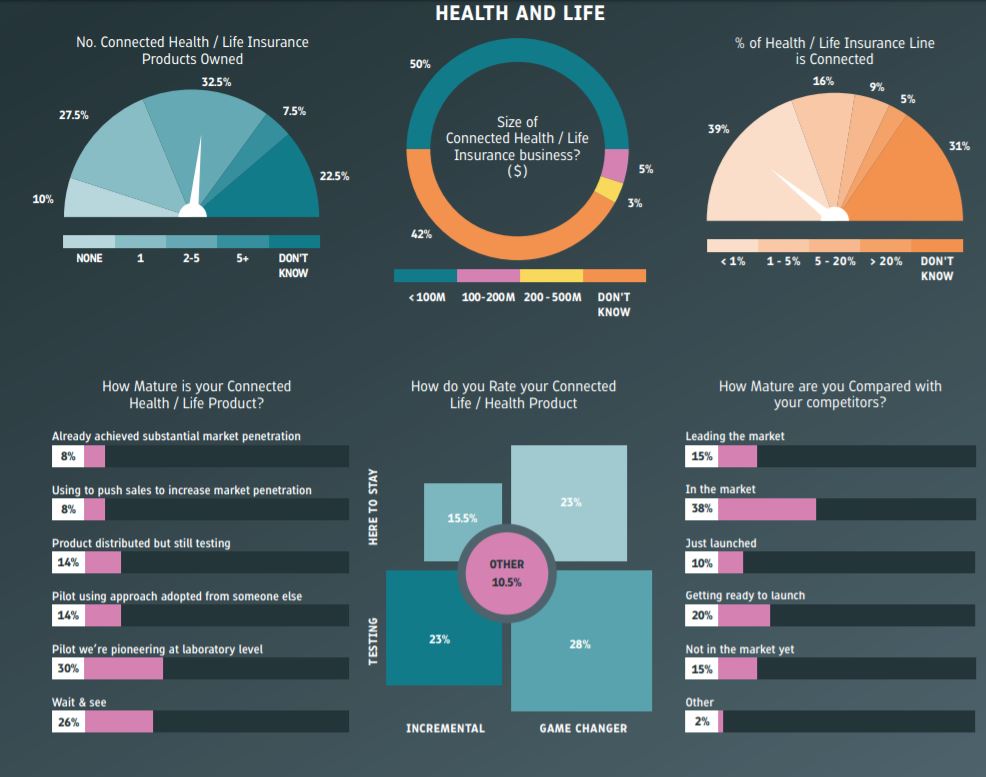

With machine learning algorithms being well-suited for large scale data analysts, we expect this sector to benefit from IoT based applications. Given below is a snapshot of the responses for how well established IoT bases insurance applications are in the health and life insurance sector.

Unlike the auto insurance sector, the number of connected insurance products in healthcare is much lower; only 30% of companies have an IoT-based product offering. In addition, according to the report, only 26% of respondents said their organization doesn’t want to be using AI technologies in the future.

That said, it seems as though health and life insurance firms are going to have to develop successful business models before the technology becomes more commonplace.

According to Vikram Renjen, SVP of Insurance for Sutherland, fitness tracker and GPS data might be the first application area in this space which sees traction:

With supplemental GPS data, wearables could monitor and report on compliance to the rehabilitation protocol of a disability claimant. Improved compliance would shorten the time until return to work.

Insurance firms are now using machine learning algorithms on healthcare data to learn about the quality of life of patients. For instance, in the past we have covered use-cases where AI algorithms trained on data related to different types of cancer and their treatments, as well as nutritional data, could help predict the quality of life of cancer patients.

These types of software can leverage data from wearable technologies and other sensors to come up with such a prediction.

In the health and life insurance space, it might be more critical to have IoT data to predict the likelihood of health issues and diseases and offer lower premiums to customers with a cleaner bill of health on average. AI software can help identify these customers and automatically prioritize them based on a predicted insurance premium for each customer.

In the past, these premiums were set manually after a medical test. Today, insurance firms can make use of several hundreds of variables using the IoT data so that life insurance underwriting can be done much more accurately.

According to the report from InsuranceNexus, AI is is expected to be applied across multiple areas and business operations in insurance. In the automotive sector, products aimed at improving driver safety are emerging, allowing for dynamic policy pricing and operational efficiency for insurers.

In home insurance, customer usage patterns for smart home devices and smartphones are now being talked about as potentially a vital resource to measure risk. In health and life insurance, telemetrics, such as fitness tracker data, are starting to be added to traditional medical risk assessment models to gain a more real-time view of patient risks.

This article was sponsored by Insurance Nexus and was written, edited and published in alignment with our transparent Emerj sponsored content guidelines. Learn more about reaching our AI-focused executive audience on our Emerj advertising page.

Header image credit: Microsoft