In a white paper about the digitalization of the chemistry and advanced materials sector published by the World Economic Forum and Accenture, total global chemical sales in 2014 amounted to $3.5 trillion and is expected to rise to $6.9 trillion by 2030.

According to Greg Mulholland, CEO of AI company Citrine Informatics, “By and large, artificial intelligence as we think of it today—being able to analyze very large-scale systematic data and find trends too complicated for humans to see and finding automated ways to extract insights—has not been used by materials companies.”

We set out to help answer questions that chemical company executives are asking today:

- What types of AI applications are currently in use by leading chemical companies?

- What (if any) results have been reported on AI applications implemented by leading companies in the chemical industry?

- Where is artificial intelligence likely to change the chemicals industry in the next 5 years?

In the full article below, we’ll explore the AI applications of each company individually. We will begin with German chemical company BASF SE.

BASF SE

BASF is a German petrochemical giant known for its range of products that includes chemicals, plastics, coatings, crop technology, crude oil and natural gas, with a 2016 annual revenue of $71.39 billion.

BASF has had active interests in the artificial intelligence recently announced its membership in Systems That Learn (STL), a research initiative that is part of the MIT Computer Science and Artificial Intelligence Laboratory (CSAIL) at a North American Center for Research on Advanced Materials (NORA) conference.

BASF Automotive Refinish Solutions – Automotive Paint Color Matching AI

BASF’s Automotive Refinish Solutions division develops and markets coatings available for the collision repair, commercial fleet and automotive specialty markets. This video is a short explainer from BASF on color development process for automotive coatings.

However, in order to find a match to a client’s specific car color, the company produces new hues regularly. This is a time consuming and an especially skilled-labor intensive task. To address this, BASF developed the advanced color matching system which applies artificial intelligence using neural networks to the process of color matching paint.

BASF’s solution includes products such as:

- SmartSCAN – A spectrophotometer (device that reads wavelengths of light to determine color) that scans a painted surface to find a color match formula based on readings from 4 different angles.

- SmartTRAK2 – A color management software that retrieves the color match formula and provides accurate mixing instructions to reproduce the hue.

Although, we must add here that BASF hasn’t offered much clarity on how the ML architecture functions for these products.

BASF – SAP Beta Testing

The company has also collaborated with business partners in AI and machine learning products. For example, it served as a beta customer to SAP by using the SAP Cash Application System that runs on the SAP Leonardo Machine Learning. The platform’s functions include automating the matching of payments to invoices.

BASF claims that the application has automated 94 percent of its payment processing with the

software. Here are Sebastian Wieczorek, Head of SAP Machine Learning, Markus Noga, VP for Machine Learning at SAP, giving more specifics on the SAP Leonardo ML platform:

BASF-Hewlett Packard Collaboration

BASF also partnered with Hewlett Packard Enterprise to develop what they claim is the

world’s largest supercomputer to support BASF’s digitization projects. According to Dr. Martin Brudermueller, BASF’s Chief Technology Officer:

“The new supercomputer will promote the application and development of complex modeling and simulation approaches, opening up completely new avenues for our research at BASF.” More specifically, it is planned to run virtual experiments and improve the “design of new polymers with defined properties.”

The video below gives more details on the development of the Supercomputer QURIOSITY by BASF and HPE:

The Dow Chemical Company

The DowDuPont Inc. was created after the merger of DuPont and The Dow Chemical Company (or more commonly known as Dow) in August 2017. Before the merger, had Dow reported $41.2 billion in annual revenue in fiscal 2016.

Dow-1QBit Partnership

In June 2017, the company partnered with machine learning and computing company 1QBit based in Canada. The collaboration aims to develop quantum computing tools to be used by Dow Chemicals in their materials science and chemical research. 1QBit plans to carry this out through its machine intelligence and purportedly hardware-agnostic software.

Although, as of this writing, no specifics as to what projects the partnership will produce in the near term – and while “machine intelligence” was announced in the Dow press release (referenced above), there is no evidence of its use.

Dow-TeslaGen Collaboration

Another collaboration was made in August 2016 with software company TeselaGen to develop a biological design platform that can possibly automate the work of Dow Chemical’s scientists and researchers. According to Otto Folkerts, a research fellow at Dow AgroSciences, “Implementing a secure computational environment to design and create molecular biology research information will accelerate our scientists’ efforts to find new crop protection and seed products for farmers around the world.”

No specific detail about the software or Dow / TeslaGen partnership seems to be available as of this writing. Although initial impressions suggest that the solution will be tailored towards automation of protocol generation and information flow, specifically in biomanufacturing.

Royal Dutch Shell

Royal dutch shell through its subsidiary Shell Chemicals, is a key player in the chemicals industry with active interests in areas like fuels, lubricants, sulfur solutions among others. Royal Dutch Shell’s 2016 annual revenue was $233.59. million

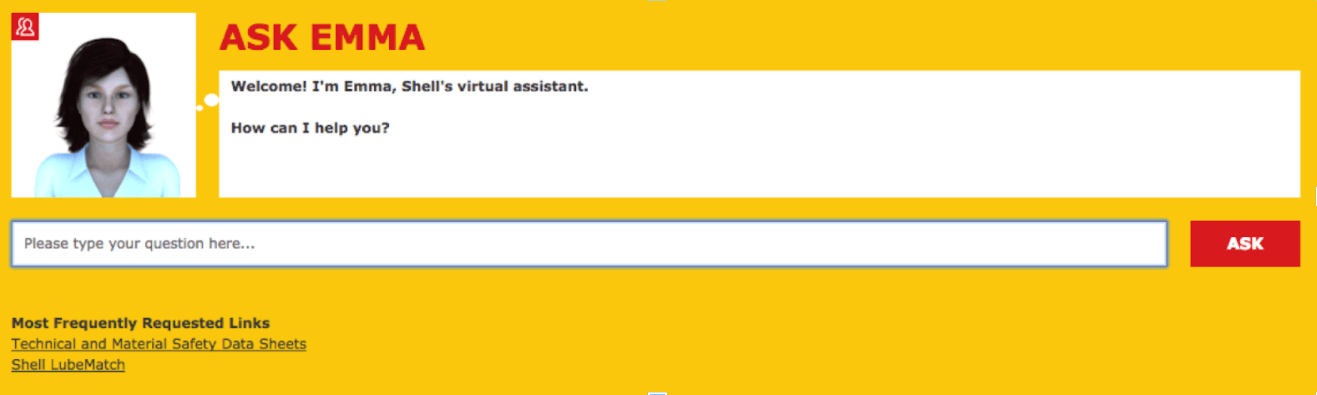

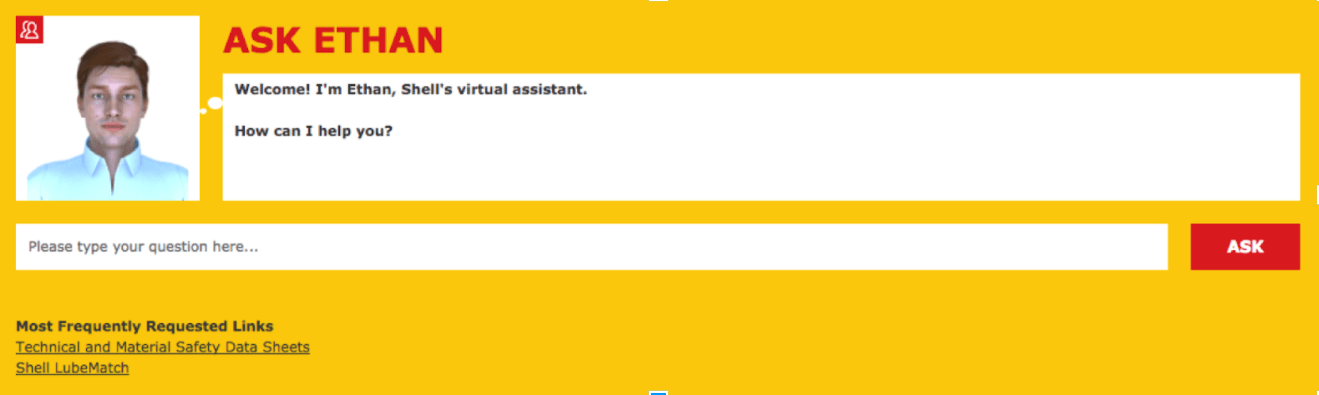

The Shell Virtual Assistant

Shell’s virtual assistant (VA) is said to be operating in 151 countries and can speak multiple languages including Chinese, Russian and German. It was introduced in 2014 in the US and UK as a low-cost tool to divert simple technical helpdesk (STH) queries. This comes after the company observed an increased demand by customers for quick assistance.

The chatbots, Ethan and Emma, are said to be capable of answering questions about “where to buy lubricants, what pack sizes are available and give information about product technical properties. The service can also attend to requests for brochures, Technical Data Sheets (TDS), Safety Data Sheets (SDS).”

The company claims that their pilot run in 2014 resulted to the following:

- 40 percent reduction in call volume to live agents

- 74 percent of issues successfully resolved

- 97 percent of questions correctly understood by the AI

- 98 percent of answers met user expectations

According to a presentation by Mark Raynes, Shell Global Solutions Technology Manager, one aspect of market trends that they noticed before developing the VA is “At least 15% of Fortune 1000 companies use a virtual assistant (Banking/Retail), 60% of customers use a company’s website as the first method for resolving their issues.” More information about Shell’s Virtual Assistant can also be found in our article focused on artificial intelligence applications in the oil and gas sector. (here)

Shell’s Smart Manufacturing System

According to a 2017 interview with Craig Walker, CIO of Shell Downstream Commercial, a line of business that concentrates on operations (such as oil and gas refining) and sales (as opposed to their upstream business where the focus is on exploration and production), they’re applying AI through the smart Manufacturing system to predict demand for oil, measure shortages of its supply, and analyze the correct mixes and blends of oil for an exact refining process. Although, it is still unclear how the system applies AI to oil demand modelling at this moment.

Known as the Smart Manufacturing system, Walker explains that the tool highlights any issues, provides options and recommendations on the best “temperatures, pressures and running speeds that can help get an extra 10 tonnes or even 100 tonnes of [refined material] out each day.”

Shell- Arria NLG Contract (Terminated)

Finally, the company announced in 2014 that it will be using software from Scottish AI developer Arria NLG to monitor its rigs and automate safety reports. No other details were provided by the company regarding its partnership and how the software specifically works. However, the software company reported just a year after that Shell has terminated its $10 million contract. This reportedly caused a 75 percent drop in Arria NLG’s shares. The oil company hasn’t yet provided any comment regarding the cancellation.

Other Chemical Companies

We’ve noticed a few chemical companies that have announced their AI exploration and programs. However, our analyses delve into the genuine business value of AI and as of this time, we believe that these companies still have to prove a real business ROI on their AI initiatives (which is natural, as these implementations are complex, and the technology is rather new).

For example, Bayer Crop Science claims that they have developed AI-based digital farming solutions like their Xarvio SCOUTING, which can determines weeds, classifies and counts insects in the yellow trap, recognizes diseases, analyses leaf-damage and shows the nitrogen status by taking a photograph of the field. In particular, a farm in The Netherlands started applying digital farming technology in January 2017.

According to their press release, “The farm implements soil scanning techniques as a basis for variable planting density, in-field digital monitoring of the yield, and crop scanning technologies to support optimum timing and variable rate application of fertilizer and crop protection products.” Bayer states that results are due by the end of 2017.

The following 1.22 minute video from Bayer North America showcases the Digital Farming Field Manager- Zone Spray in Action:

China Petrochemical Corporation (Sinopec Group) tapped ICT solutions provider Huawei to deploy its oil and gas industrial tools in four pilot smart factories. In particular, the Sinopec factory near the Yangtze River now uses Huawei’s solutions for automated truck dispatching and high-performance computing (HPC) as well as storage system and cloud communication. The company announced that the factory “adopted a series of advanced technologies and techniques, such as 4G wireless network applications, IoT-based smart warehouse, and a whole-process integrated optimization platform.”

We believe these developments are still aspirational for the company in nature since these developments are technologies of the future, not of today.

Two Japanese chemical firms also announced their exploration on AI. Mitsubishi Chemical Holdings through its President Hitoshi Oichi announced that the company established the Emerging Technology and Business Development Office that will leverage on AI, big data and the Internet of Things (IoT).

Oichi wrote that it will combine such technology with their existing developments. No other news regarding its latest developments have been released. The release seems to be a “me too” effort to avoid being seen as stagnant or out of touch – we may have a more optimistic opinion when AI applications and results are released from the firm.

On the other hand, Mitsui Chemicals Inc claims to have succeeded in predicting the quality of gas products in its production process using AI. Together with NTT Communications, the company used deep learning algorithms to process factors represented by 51 types of data such as temperature, flow and pressure to help detect quality issues and predict outcomes was chemical combinations – a task that was often performed by its employees.

Mitsui claims that the technique was based on the modeling of the relationship between the different data sets sourced from raw materials feeding into the gas reactor and reactor conditions, and gas concentrations which represent gas product quality. The data is then analyzed using deep learning algorithms that automatically process relevant factors in order to model and predict outcomes which involves arriving at an accurate forecast of the quality of the resulting gas products.

Their press release claims that the research will allow operators of chemical plants to detect faulty sensors or measuring instruments and “assess the current and likely future condition of the plant, as well as any anomalies in the chemical product.” No updates have been released since then.

Concluding Thoughts – Technology in its Infancy and Future Potential

The World Economic Forum mentions (see white paper cited at the beginning) that the timing and scale of disruptive impact by digitalization of the chemical industry is difficult to predict. We believe this is true since most of the AI applications mentioned in this article are yet to produce a valuable business impact or ROI. Again, this not unique to the chemical industry, AI is in its infancy and large enterprises with complex AI implementations can’t be expected to transform overnight.

That being said, many of the current applications are focused around using machine learning and deep learning for data analytics. The end result of this application in most cases is increased efficiencies in chemical manufacturing processes. Business leaders in the chemicals industry looking to adopt AI technologies would find it interesting to note that the major application areas for AI and expert systems in the future would be in process control, chemical synthesis and analysis, waste minimization, mineral exploration, chemometrics among others.

Furthermore, we observe that many of the large chemical companies have yet to adopt AI in their operations. We found no significant research on AI adoption from four of the top ten chemical companies in terms of sales. This includes Formosa Plastics, SABIC, LyondellBasell and Ineos.

Header image credit: Wikimedia Commons