The insurance industry is making use of various artificial intelligence applications to solve business problems, but perhaps the most versatile is predictive analytics. The ability to aggregate data from disparate sources for business intelligence allows business leaders in insurance to inform important decisions across departments.

In this article, we’ll take a look at some of the use-cases for predictive analytics software in the insurance industry.

Here at Emerj, we like to discuss use-cases with real-world examples, paying particular attention to case studies purporting success with AI software available to enterprises.

As such, in this report, we’ll be running through four vendors offering predictive analytics to insurance enterprises. These vendors offer software with value propositions such as:

- Rapidminer offers data science teams at insurance enterprises a platform for creating machine learning models for use cases such as customer churn prevention and fraud detection

- Alteryx and Guidewire offer software for ensuring that customer payouts aren’t overpaid

- Cloudera offers software that can prevent insurance employees from giving customers inaccurate quotes and detect fraud

We’ll start our analysis of the use cases for predictive analytics in insurance with RapidMiner’s platform for building machine learning models.

Customer Churn Prevention

RapidMiner

RapidMiner offers a namesake software that it claims helps data science teams of insurance companies create and deploy predictive models for fraud and churn prevention.

The company advertises their software as a predictive analytics solution for insurance companies looking to gauge customer lifetime value. The software seems to use historical transaction data from customers to mark them with a high lifetime value and is able to reveal marketing options for that type of customer.

The company also claims the software can identify fraudulent insurance claims based on claims data exhibiting fraud in various forms. It should be noted that this is distinct from an AI-powered solution for anomaly detection. Predictive analytics for fraud prevention would be simply used to detect discrepancies identified from training on claims data. This type of software would use those discrepancies to alert the user that the detected behavior could be a precursor to fraud. Whereas anomaly detection would be able to detect and flag activities as fraud in real time while a user is interacting with or submitting a claim to an online or otherwise digital platform.

RapidMiner states the software’s machine learning model needs to be trained on tens of thousands of customer accounts and digitally documented insurance claims. The customer accounts used would ideally reveal trends or behaviors that point towards churn. The claims data would consist of both fraudulent and nonfraudulent claims, with the fraudulent claims being labeled as such. Then, a data scientist would expose the machine learning model to this data, which would train it to discern which data points correlate to customers with a high risk of churn and fraudulent claims.

The software could then predict which customers are most likely to end their relationship with the client insurer. It would also be able to predict if an insurance claim is fraudulent and prevent it from processing.

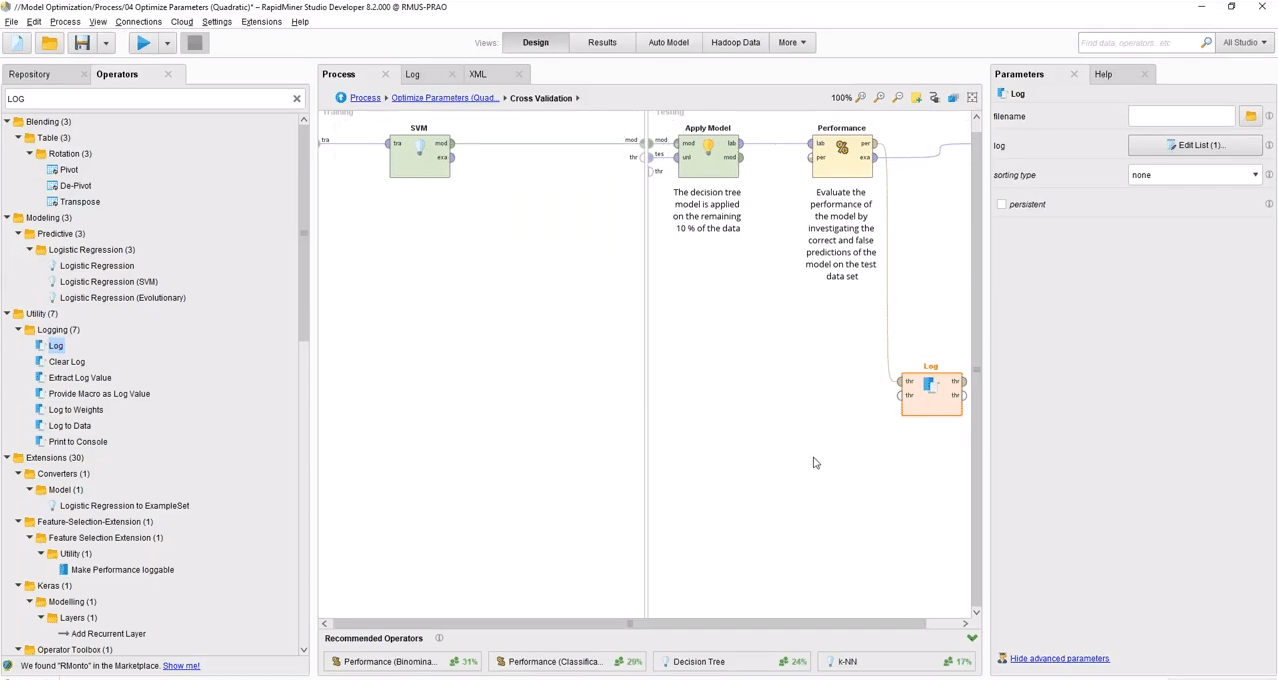

Below is a screencap from one of RapidMiner’s extensive demonstration videos showing the dashboard for creating a predictive model:

RapidMiner does not make available any insurance case stuies, nor do they list any major insurance clients. They have, however, raised $36 million in venture capital and are backed by NGP Capital, Ascent Venture Partners, Longworth Venture Partners.

Ingo Mierswa is founder and President of RapidMiner. He holds a PhD in Computer science and Statistics from TU Dortmund University.

Optimizing Claims Payouts

Alteryx

Alteryx offers a namesake software solution which it claims can help insurance companies make sure customers aren’t being paid more than their claim warrants. The software can also be used to assess the status of local markets to facilitate franchise growth. All of this is accomplished through predictive analytics.

We can infer that the software’s machine learning model likely needs to be trained on hundreds of thousands of insurance policies and claims, customer profiles, and data regarding local markets.

A data scientist would then have to run this data through the machine learning algorithm. This would train the algorithm to determine the specific data points that correlate to typical payouts for specific kinds of insurance payouts.

The software could then predict a customer’s future insurance claims and how much their payouts might be for those claims. Thus, the insurer wouldn’t overestimate the customer’s payout and pay them more than they need.

The 5-minute video below shows how a data scientist might use the software to generate customer insights based on a corpus of data:

Alteryx does not make available any case studies reporting an insurance company’s success with the software, and they do not list any major companies as clients, however, they have raised $163 million and are backed by Meritech Capital Partners and Insight Venture Partners.

Jay Bourland is Senior Vice President of Engineering at Alteryx. He holds a PhD in Applied Mathematics from Southern Methodist University. Previously, Bourland served as Senior Vice President and General Manager of Customer Engagement Solutions at Pitney Bowes Software.

Guidewire

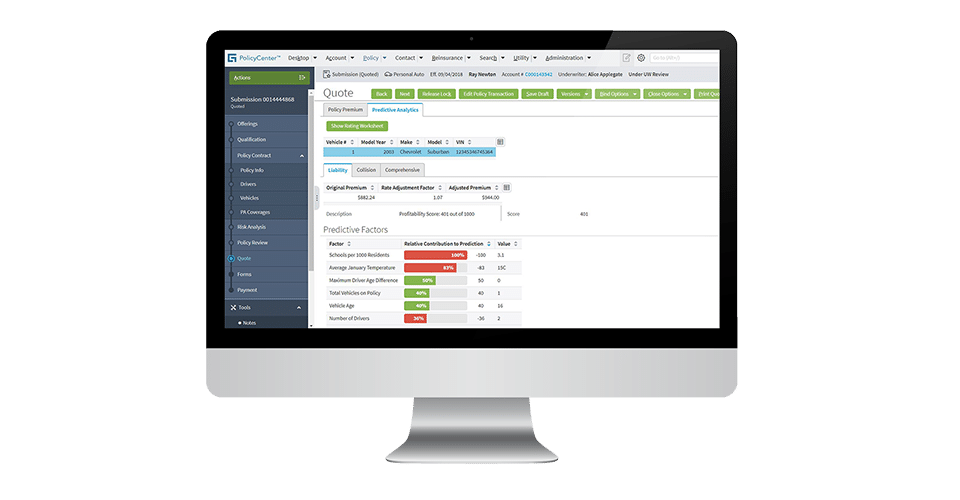

Guideware offers software applications called “Predictive Analytics for Claims” and “Predictive Analytics for Profitability.” They state their claims software can help insurance companies find and correct payout inaccuracies and identify new marketing opportunities.

The company states the machine learning models for their predictive analytics applications were trained on tens of thousands of claims and customer data. A data scientist would then expose the machine learning model to this data, training it to detect incorrect payouts for insurance claims. The software could then predict discrepancies between the appropriate payout for a given insurance claim and the payout set to be charged.

Guidewire claims to have helped Atlas Financial better manage its costs for bodily injury claims. Atlas Financial integrated Guidewire’s software into its database of claims data. According to the case study, Atlas Financial saw a 7-11% decrease in bodily injury payouts and improved customer service with faster and more accurate settlements.

Guidewire also lists Hiscox UK, ENNIA, and Hays Companies as some of their past clients.

Paul Mang is General Manager of Analytics and Data Services at Guidewire. He holds a Master’s of Science and Engineering in Industrial Engineering from Stanford University. He also holds a PhD in Business Administration for Technology Strategy. Previously, Mang served as Global CEO of Analytics at Aon.

Providing Customers with Accurate Quotes

Cloudera

Cloudera offers software called Cloudera Enterprise, which it claims can help insurance companies provide customers with the most accurate quotes and detect fraud. The company advertises the solution as being able to handle big data and data from disparate sources. They accomplish this with predictive analytics.

The company states the machine learning model for the software needs to be trained on hundreds of thousands of digitally recorded insurance claims. The claims data would consist of fraudulent and nonfraudulent claims, and both would be labeled as such.

Data on insurance quote estimates would also be used to train the software to find inappropriate quote amounts. The data would then be run through the software’s machine learning algorithm by a data scientist. This would train the algorithm to correlate certain data points to fraud and accurate quotes for insurance rates.

The software would then be able to predict fraud before it was allowed to process through the client company’s system. In addition, it would be able to predict inaccuracies in quotes in order for insurance brokers to quote more accurately.

Cloudera claims to have helped Markerstudy Group drive company growth using their software. Markerstudy Group integrated Cloudera’s software into its existing databases including a store of big data. According to the case study, they managed competition with better service when creating quotes and identifying more cost savings using Cloudera’s software. The case study states that Markerstudy Group saw an increase in policy count of 120% over 18 months.

Cloudera claims that three leading fortune 500 companies make use of their software, but none are mentioned by name. However, they have raised $1 Billion in venture capital and are backed by Intel Capital, Ignition Partners, and Accel.

Amr Awadallah is founder and CTO at Cloudera. He holds a PhD in Computer Engineering from Stanford University. Previously, Awadallah served as Vice President of Engineering for Product Intelligence at Yahoo! Inc.

Header Image Credit: SG Young Investment