Real estate is a cost for nearly every business, whether leasing, owning or managing.

Process automation from AI offers a tremendous opportunity to lower costs associated with commercial real estate, especially those associated property management.

However, some of these advances may create additional costs, particularly those associated with protecting data and safeguarding access to building automation systems. We set out to discover what AI real estate applications are available for enterprises today, and exactly where they present cost saving opportunities for businesses.

In this article we’ll discuss three ways AI will drive opportunities for savings over the next five years:

- Analytics in building automation systems

- Automation in property management job functions

- Machine learning in real estate marketplaces

We’ll also highlight a handful of companies working on important challenges for artificial intelligence and commercial real estate. Included are videos and images along the way to help the reader understand the various AI applications visually.

For each of the three opportunities we discuss, we’ll scope the savings, discuss the market opportunity and also highlight any emergent threats from AI integration in real estate technology.

Savings Driver 1: Analytics in Building Automation Systems

- Savings: The biggest opportunities for savings in building automation come from energy efficiency upgrades — savings will make the ROI case for widespread adoption of “sensorized” building system devices (e.g. the Internet of Things)

- Market Opportunity: Data from Internet of Things (IoT) devices in building systems will support an emergent market for predictive analytics

- Threats: Security software automation will drive savings, but will place additional emphasis on the need for robust cybersecurity in commercial buildings

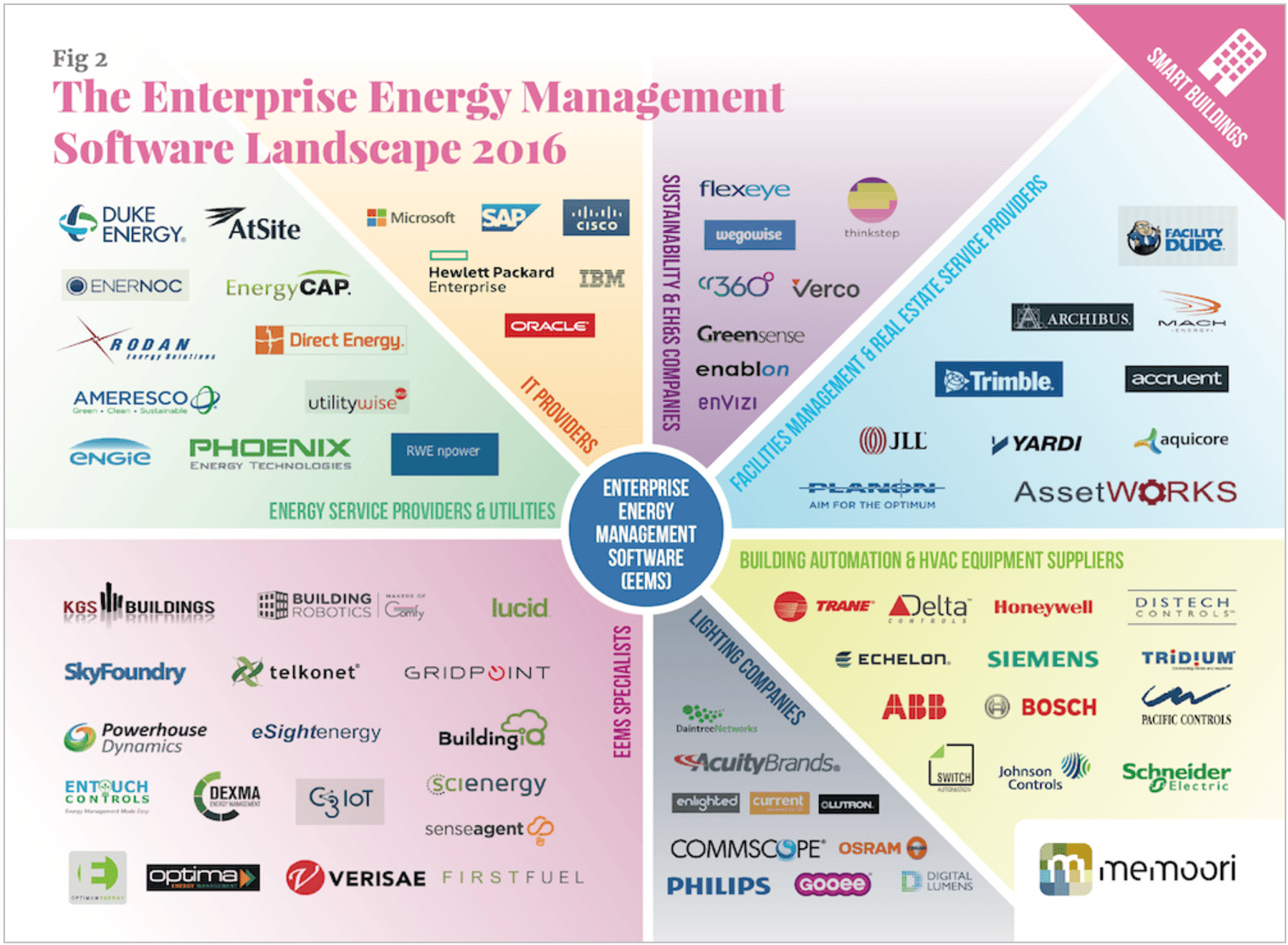

Building performance systems have evolved and diversified their offerings significantly over the past ten years. The market research firm Memoori estimates that building performance systems alone will be a $18.78 billion market by 2020, including enterprise energy management, fire and security, and property management.

However, AI in building automation systems lags behind other sectors, particularly in applications of machine learning. This lag is partly due to the challenges of integrating software automation in legacy building systems, but also has much to do with the heavily context-dependent nature of building performance data. As Dr. Sopie Loire of Ecorithm explains in a 2016 Building Automation article:

… machine learning for buildings is a surprisingly difficult challenge. Buildings are strongly influenced by dynamic forces such as occupancy, weather, and other environmental factors on a variety of overlapping cycles (intradaily, daily, weekly, monthly, and seasonal, to name a few). Most classic machine learning and data mining algorithms work poorly on time series data…

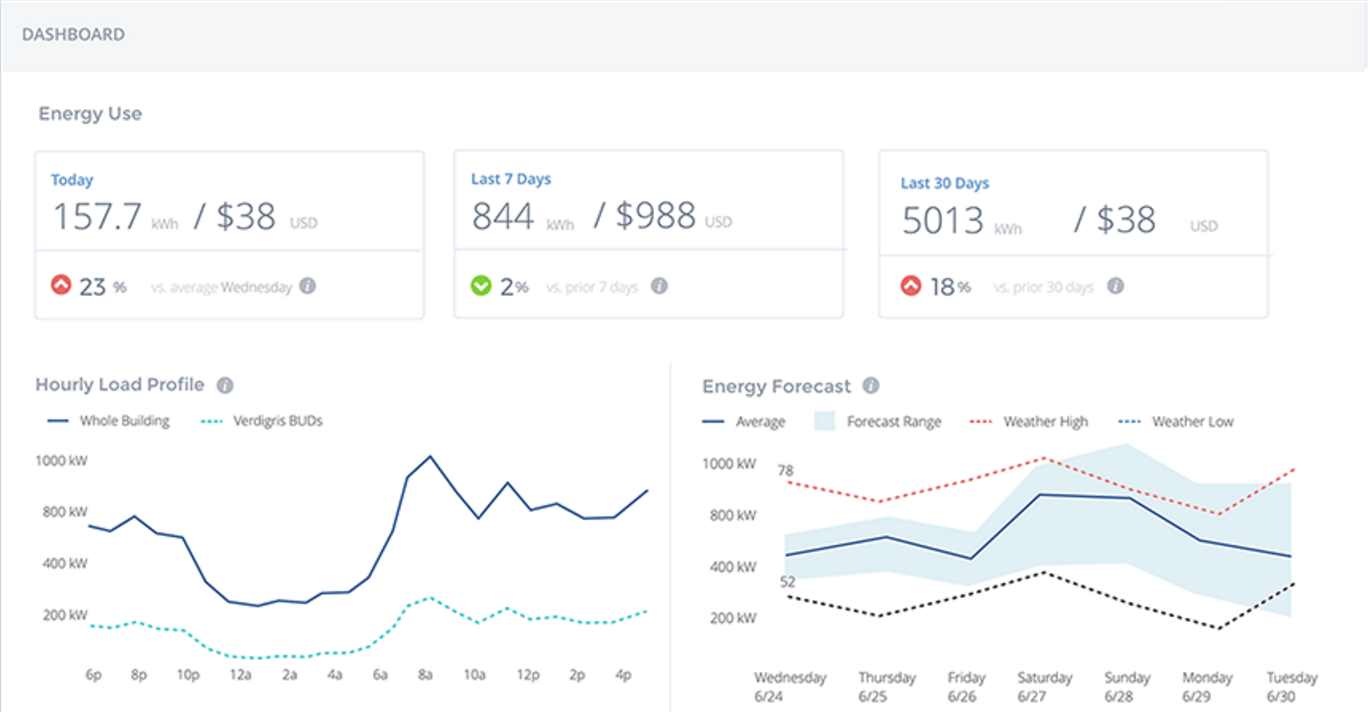

This insight is useful to consider when evaluating building performance dashboard products, such as Lucid or Verdigris. Systems that aggregate, cleanse, structure and visualize performance data are a far cry from predictive analytics, or building systems that think for themselves.

Smart LED lights and self-programming thermostats are both examples of responsive building systems that can provide useful data for a human analyst or property manager in forecasting costs, but the analytics surrounding them currently lack the context for extrapolation. That’s why the market research firm Verdantix cautions that despite the number of analytics products focused on building performance, AI applications will remain niche and human-augmented for the foreseeable future:

To start, yes, there is a lot of hype around AI, but one should keep in mind that buildings that think for themselves are still a ways off. AI is slowly being piloted to optimize specific aspects of building operations, such as predictive maintenance and building system controls.

Examples of these “narrow AI” applications include products like BuildingIQ, Pointgrab and Tellmeplus. While it’s too soon to say who the key players in this space will be, there’s no question that the opportunity for savings is massive – energy savings from HVAC alone could make the business case for predictive building analytics to any multi-campus enterprise. Below is an overview video of BuildingIQ’s product suite:

While revenue growth for predictive analytics embedded in building automation systems shows promise, connected devices may also create a new class of security vulnerabilities for enterprise building managers. These vulnerabilities are the result of emerging ecosystems of connected devices in building automation systems, rather than the results of AI – but AI can greatly magnify the risks associated with a breach.

In 2016, IBM’s X-Force Ethical Hacking team conducted a penetration test on a customer’s building automation system, and found numerous vulnerabilities in the HVAC system that would allow a malicious intruder to gain access to the enterprise’s central server, proprietary customer data and even “…extend control to several other geographically dispersed buildings.”

This is hardly an isolated incident. A 2015 paper on autonomous systems and cybersecurity by Michael Mylrea of George Washington University’s Cybersecurity Executive Doctoral Program notes, “A new and growing phenomenon appears to be attacks targeting building automation systems (BAS) and associated interconnected enterprise networks. Target was hacked through the retailer’s “Smart” HVAC system, giving hackers access to corporate networks and over 40 million customers credit card and other sensitive information.” Similarly, Rob Hayes, a director at Deloitte’s cyber risk management practice has suggested that, “A vulnerable piece of building management equipment could very easily provide an open door to company data.”

As the threat to distributed IoT devices in building automation systems increases, it will drive a market for so-called “active defense” cybersecurity solutions, such as those offered by CryptoMove. Since data in a building automation system is distributed on a network with multiple points of access, “active defense” encryption will have to become part of enterprise data security itself, rather than built into a system’s perimeter firewall.

Savings Driver 2: Automation in Property Management Job Functions

- Savings: Managers want visibility into sales and agent performance data to drive prospect conversion and improve outcomes for business development team

- Market Opportunity: AI chatbots will interact with building occupants through Amazon Echo, which boutique property owners will use to delight and reward commercial tenants with distributed concierge services

For property managers, success means representing the property owner’s interests: keeping property units full, renters satisfied and underlying infrastructure and machinery in working order. Similar to what we saw with building automation systems, most existing solutions aggregate, cleanse, structure and visualize data from existing sources, along with providing some process automation.

These solutions can provide powerful frameworks for commercial real estate brokers, agents and asset managers to gain visibility into their property portfolio. VTS and Appfolio, for example, offer sleek visualization dashboard that integrates market data, contract documents and accounting systems. These solutions are more focused on sales, marketing and managing a commercial real estate business then on reimagining the tenant occupancy experience.

Aggregating and drawing value from broad web data for market intelligence is an application of AI that we’ve seen before with companies like Signal, who mostly service big brands (who want to avoid PR disasters) and hedge funds (who want to monitor trends that might impact their investments). VTS offers a set of market intelligence tools for real estate investors, a relatively novel application of artificial intelligence in commercial real estate:

In contrast, solutions like Buildium, Rentalutions and Zenplace – all predominantly focused on residential rather than commercial property – apply process automation technology to improve the tenant/landlord service relationship.

Zenplace is the company most strongly hitched to the AI bandwagon, developing a chatbot through Amazon’s Echo that allows renters to pay their rent, place service requests and make other demands that would usually fall on the shoulders of a property manager. In December 2016, Wynn Hotels announced that they would put an Amazon Echo in every one of their hotel rooms, using Alexa to improve their hospitality experience. From a guest/tenant services perspective, AI has a clear role to play.

However, Zenplace most significant use of AI may end up being a predictive analytics solution that monitors building equipment like boilers and then solicits proactive maintenance from a qualified vendor before an outage occurs. If workable on a broad scale, this AI product sounds extremely promising and would surely have service applications in commercial real estate as well as industrial.

Savings Driver 3: Machine Learning in Real Estate Marketplaces

- Savings: Property search analytics will improve matching between prospective buyers and desirable properties, augmenting broker’s labor

- Market Opportunity: Virtual reality marketplaces will reduce friction and accelerate dealflow

In 2016, the real estate publication Inman made headlines with a challenge they called “Broker vs. Bot”, conducted in Denver, CO. First, Inman asked a Denver-area real estate journalist to play the buyer and select three homes that he liked from local property listings. Then, on April 27, 28, and 29 Inman asked three separate real estate brokers to compete against a bot “Find More Genius” to recommend homes similar to one of the homes selected by the buyer. The buyer was then asked which one of the recommended homes he preferred. Find More Genius won all three days.

Since then, the question on some brokers minds has been: does this mean that AI will replace agents? That question isn’t likely to be answered in the next few years, but there’s a good indication that the brokers who will thrive are augmenting their labor force using AI chatbots.

Companies like ApartmentOcean and Automabots are already well after this market, but selling to realtors with websites rather than using chatbots to go after buyers directly. However, some brokers have argued that the technology is still too new and risks turning off prospects who might find the bot rude or unhelpful. In other words, what true of real estate is also true of CRM in general.

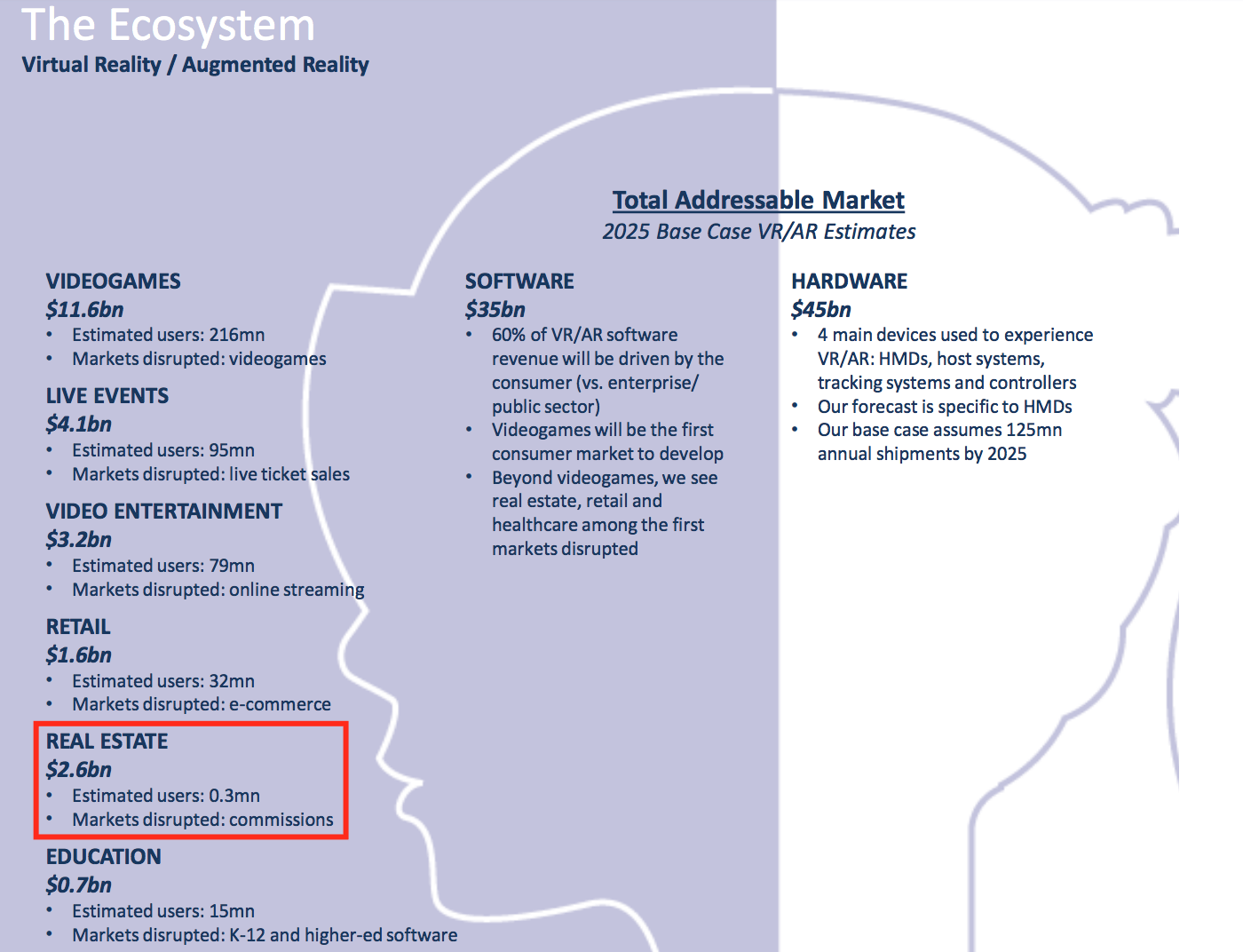

Goldman Sachs Research estimates that the market for virtual reality (VR) in real estate alone could generate as much as $2.6 billion by 2025. Given that much AI development today is in computer vision it’s likely to see 3D property visualization creating new tools for brokers and property managers. Companies like Matterport are leading the way. That said, there is no strong evidence that VR improves real estate sales, and in markets that are dominated by agents and brokers, many firms will continue to rely on proven sales tactics to convert their leads. If and when real estate buyers start consuming VR content at a more regular rate, it wouldn’t be surprising to see the industry move further in that direction.

Readers with a keen interested in AI’s applications in real estate marketplaces may enjoy our interview on “Data Driven Real Estate Appraisals” with the Chief Analytics Officer at Zillow.

Concluding Thoughts on AI in Real Estate

Artificial intelligence in commercial real estate will impact many facets of real estate management, from pricing and sales to providing tenant services. Here are three “bottom line” takeaways to consider for your next strategy meeting:

- Impact of AI on building automation systems will depend on managers’ comfort with outsourcing business processes to data-driven yet fallible machine systems. While predictive analytics offer tremendous savings through lowering energy, water and maintenance costs, connected devices in buildings will also create new vulnerabilities for hackers. “Intelligent buildings” may lower the costs of physical security through software, but will require additional investments in cybersecurity.

- Impact of AI on commercial property management will depend on consumer adoption of chatbots and virtual assistants, along with the market saturation of Amazon Echo-like devices that support them. If more hotels add Amazon Echo to their guest services, commercial real estate firms may begin to support similar technologies as they race to delight high-tech enterprise tenants with robotic concierges.

- Impact of AI on real estate marketplaces will depend on the success of brokerages who adopt chatbots and integrate search into their sales workflow. Technologies that save real estate brokers’ time and money are likely to leverage the power of existing players’ relationships and move the larger market towards AI transformation.

Image credit: Clifford Chance