According to the National Institute of Mental Health, the United States is currently battling a mental health epidemic. One in every five Americans struggles with mental illness in one form or another. According to the National Institute on Drug Abuse, opioid abuse claims about 115 American lives every day. According to the Center for Workplace Mental Health founded by the American Psychiatric Association, up to 7% of full-time workers in the U.S. suffer from major depressive disorder, the economic cost of which is estimated to be $210.5 billion per year.

When compared to other developed nations, traditional healthcare in the U.S. is notoriously costly; mental healthcare, even more so. Mental health and wellness technology is an up and coming technology space, which aims to bring easy and cost-effective access to mental, behavioral, and social healthcare to a wider audience.

Emerj CEO Dan Faggella spoke at the 2018 TransTech Conference on the current applications of artificial intelligence for mental health and wellbeing. TransTech, a global community of entrepreneurs and innovators in the mental health and wellness tech space, is of the opinion that transformative technologies are “medically and scientifically validated technologies, supporting mental health and wellbeing and thriving.” Dan had the opportunity to interview the investors present in this conference on what attracted their interest in this nascent but growing space.

This article includes:

- An overview of investing in mental health and wellness technology (2012-2017)

- An exploration of why investors want to fund mental health technology

- An overview of what investors are looking for in mental health tech entrepreneurs

- A discussion of what the future of mental wellness tech space would look like

- Expert investor quotes taken from our direct interviews and from the 2018 TransTech panel interview.

We previously covered AI for mental health in Chatbots for Mental Health and Therapy – Comparing 5 Current Apps and Use Cases. In this article, we first take a close look at how the mental health tech space fares in terms of investment and funding.

A Brief Summary on Mental Health and Wellness Tech Investment (2012-2017)

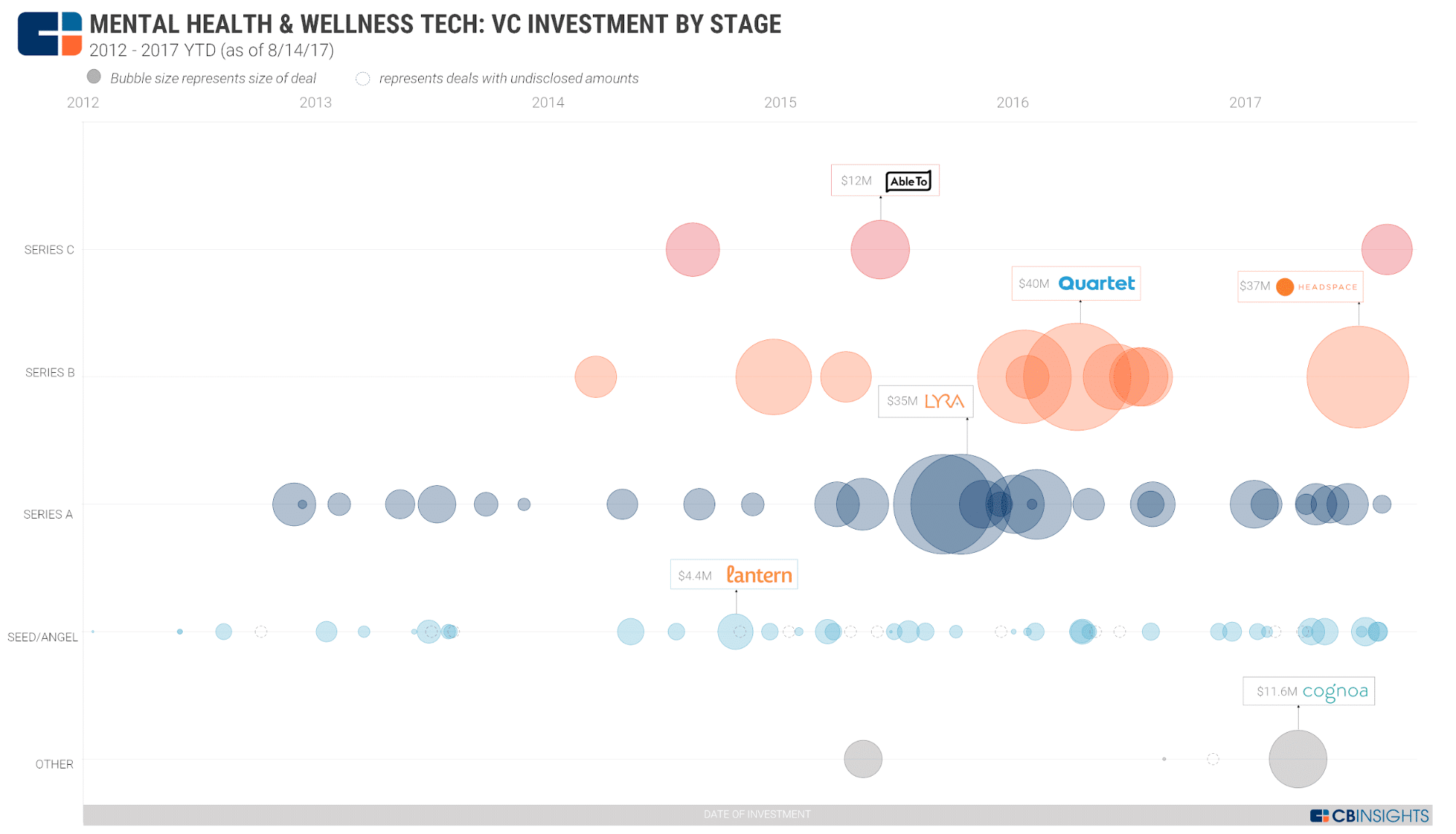

According to a 2017 CBInsights report, the mental health and wellness tech space has seen a significant rise in investments between 2012 and 2017.

Mental health tech startups supposedly leverage artificial intelligence and machine learning technologies in building telemedicine platforms, including apps that detect and track changes in emotional states, meditation practices, “biohacks,” and daily motivational text messaging services.

The chart below sourced from the report depicts VC-backed deals from 2012 to 2017:

According to the report, Quartet Health, a behavioral health tech company, leads the race in the mental health tech investment space with a $40 million Series B funding, attracting the attention of Google Ventures, among other investors. Headspace, a meditation app company, and Lyra Health, an emotional health tech company, follow the former with $37 million Series B, and $35 million Series A fundings, respectively.

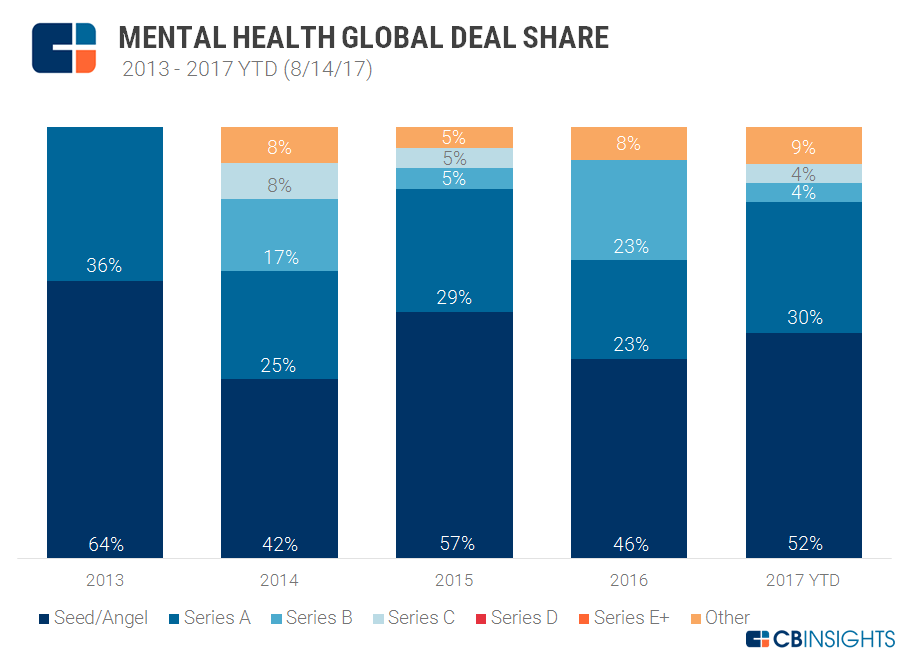

Another chart from the same report given below depicts the shares of Series A-E+ funding in the mental health tech space.

From the chart, it is evident that, as of 2017, the majority of mental health tech investments were still in the Series A stage. This is understandable because this industry is still perceived by many investors as nascent.

The report claims that these mental health tech startups aim to increase access and lower costs in mental healthcare through AI, and that investors are increasingly paying attention to this space. The investors at the 2018 TransTech conference agree. They claim that the awareness in the space is rising and users are willing to pay for such technology.

TransTech Investors on Why They Invest in Mental Health Technology

Happiness As a Value Proposition

When we interviewed Mike Edelhart, Managing Partner, Joyance Partners, he told us that he admitted to Emerj in a direct interview that his VC considers happiness as a value prop. He also admits that not many VCs share his opinion. He thinks that being healthy is the gateway to being happy. He said that his fund invested in happiness inducing/preserving technologies “at the very beginning,” and that this technology is “the biggest thing on earth now.”

“We are seeing these technologies that used to be in big machines in big mental institutions. But now, we are backing things like smart tattoos, headbands, things smaller than headbands that can get [provide] complete EKG readings. [Mental health] Tech is breaching barriers, and humans act like they want this, they need this, and they will pay for it.”

Among investors who do share his opinion on using happiness as a value prop, Miri Polachek, CEO at Joy Ventures, is one. She emailed Emerj a direct quote stating that:

“At Joy Ventures, we focus on neurowellness; specifically, we invest in and develop science-backed consumer products which enhance emotional well-being. We are inspired to invest in this field, based [on] a combination of several developments and trends:

- Understanding of the brain, as well as our ability through technology to measure and influence emotional states, have significantly advanced,

- Stress levels are on the rise, leading to many health issues and a reduced level of happiness in people’s lives, and

- Consumers are starting to look for and incorporate solutions to improve their emotional well-being – to reduce stress, boost energy and uplift mood.

Therefore, at this intersection is a huge opportunity to develop exciting new products which can help people live happier, more balanced lives, and this what excites us at Joy Ventures.”

Personal Experience with Terminal Illness. Unconventional Ideas.

Steve Curtis, Managing Director at Elevation Capital, said in the conference panel interview that he has been an entrepreneur in the mental health tech for almost 20 years, and has had a few successful exits. He elaborated that when he was 24, he was diagnosed with a rare cancer, and that this encounter with a terminal illness started his journey in this space. He mentioned that he looks for passionate entrepreneurs with a deep sense of purpose, who are also armed with enough experience and knowledge to push the mental health tech space forward.

Tim Chang, Partner at Mayfield Fund shared in a direct interview with Emerj on how the mental health tech first got his attention.

“About 8-10 years, first on the bio side, I was interested in how you accelerate your fitness. It helped me learn that 70% [of fitness] is actually what you eat, and that took me down the nutrition rabbit hole. Learning how that can be hacked [turned my attention to exploring whether] a similar playbook to develop a ‘six pack’ for your mind, spirit, emotions, and soul exists. Quantified soul, if you will.”

Although these investors seem to cite varying factors as to what they find alluring and profitable in the mental tech space, they have one thing in common: they believe in science-backed, validated technology that has already proven or is currently proving its mettle in dealing with mental health.

What Investors Look for in Mental Health Tech Startups

Using the Right “Investor Lingo”

Chang said that because the mental health tech space is still nascent, entrepreneurs in this space must find parallels in existing traditional spaces like ecommerce tech:

You might have to adjust your language into business models that investors understand. Our [investors] job is pattern recognition. So, we’re trying to lock things into existing heuristics that fit well. Realize that if you get resistance to [new ideas], that’s kind of where that is from [pattern recognition]. Paint, for example, what a direct consumer entry strategy looks like and how that may be parallel or ahead of a B2B strategy.

[While meeting with] payers or employers or insurers, being able to delineate your go-to-market paths is probably [the most important aspect]. In the near term, during these funding rounds, we [investors] are gonna be using traditional lenses and looking at those traditional business walls: ‘Are you SaaS? Are you freemium to subscription? Do you have in-app purchases?’ Those are sort of the business model ‘lingo’ terms that I think people are looking for. So, you want to just be fluent in those and understand how to adapt your go-to-market strategy for the technology you [are building].

Carrying Out Investor Research Along with Customer Research

Edelhart said that he looks at both the individual and the resilience of the underlying technology. More importantly, he urges the entrepreneurs to understand their customers in this tech space. He seemed surprised that most entrepreneurs described only their product and attributes of their products, instead of plans on how they would reach the intended customers and gauge their reaction to the product. In his opinion, business model innovation creates more value than technological innovation.

Edelhart also said admitted that entrepreneurs rarely asked him questions:

[Eentrepreneurs] very rarely ask me questions, which is crazy, because they don’t know what I’m thinking. We have 45 minutes and they talk the whole time. When I get up and leave, they have no idea what just happened.” He encourages entrepreneurs to carry out investor research as well and ask the investors if they believe in their product or technology. In his words:

Find out something about the person on the other end of the table [investors] and what’s motivating them and then find the points of commonality, just as you would in any other normal situation.

Repeat Founders

Chang said he looks for a track record of excellence in entrepreneurs. He explained that the ideal scenario for Mayfield Fund is that, more often than not, in their Series A fundings, a corporeal product might not yet have been built.

In such cases, he said he would check whether the entrepreneur is a repeat founder and has a track record of successful exits. He further advices first-time entrepreneurs to build their personal advisory board and work with other repeat founders who might become their angels and/or direct advisers. This way, they would achieve conferred credibility and build an ecosystem of support and wisdom.

Cohorts, Customers, and Clinical Results

Zack Lynch, General Partner at Jazz Venture Partners, sums up what he is likely to assess before investing in a mental health tech startup. He says that he would check for team dynamics and resilience first, and whether or not “the team around the entrepreneur would withstand the test of time.”

The business model is his next criteria. Like Edelhart, Lynch also encourages entrepreneurs to research and understand how their target customers would react to their technology and then devise a business model around it.

Finally, he stresses on clinical validation of data and technology used:

We really need to focus on clinical validation and, I mean, hard clinical results because if you don’t have clinical results in a double-blind, placebo-controlled way, I wouldn’t know…unless you can arm me with the data to be able to make an intelligent decision.

Scientific Validation

Lynch said that while his VC firm is relatively new, they have raised two significant funds and are now looking at deploying several hundred million dollars into the mental health tech space. He impressed upon the importance of scientific validation in this tech space:

Part of that [TransTech] is around the theme of human performance technology. When we talk about human performance technology, what we really mean is the convergence of emerging digital platforms—whether that’s machine learning or AI or a RV or video game technologies, eye tracking, facial recognition technology, biosensors–all that but being verified by validated science, specifically around neuroscience, mindfulness, behavioral science.

That convergence point, what we’re seeing, is the emergence of new products and platforms and services that enable individuals and teams and companies to disrupt massive market opportunities [in mental health and wellness tech and among other technology spaces]. When I look at companies like prescription digital therapeutics, which is where we like to invest, we’re looking at a pathway or a market model that is well known: biotechnology and pharmaceuticals, they’re regulated entities. They’re regulated products, and the products that get through that process are clinically validated.

Lynch revealed that he has invested in prescription digital therapeutics (PDT) companies like Akili Interactive and Mahana Therapeutics, and that he has a couple of other PDT companies in the pipeline.

He seemed particularly interested in PDT technology. He explained that “PDT is not a drug, not a medical device, but pure software, an app that goes through the FDA process and gets approved to treat a disease. Three or four years ago, it was visionary. No one had ever done it.”

He mentioned that he has invested in Pear Therapeutics, which he claimed to have become the first company to have an app approved by the FDA to treat a disease. While it is true that the app is indeed FDA-approved, we are not sure if it is the first app to be FDA-approved.

What Does the Mental Health Tech Future Hold?

The mental health technology space may yet be nascent but the investor experts quoted in this article think that this space seems to be fast approaching a breakthrough on a commercial scale. What would the future entail in the mental health and wellness tech space?

Edelhart is of the opinion that the singularity is already among us. He clarifies that:

It is not so much as the man vs. the machine. I believe that in the future we will become those machines. Scientifically, this is going to be possible.

Chang is of a similar opinion:

I think we will literally have to change our minds, technologically [speaking]. I think that is what TransTech is looking at. Things like cerebral implants, etc. I think ultimately we will shed our meatsuits.

Chang thinks that the mental health tech space is currently experiencing “technical adolescence.” He is of the opinion that humans are wired with survival mechanisms designed for a “scarcity environment.” However, our technology has created a post-scarcity abundance. The two don’t match. He strongly believes that this impedance mismatch is the reason for modern misery. He wonders whether the next phase of the mental health technology would be to help humans adjust our behavior toward an “abundance-type reality” as opposed to a scarcity mindset.

Lynch said that PDT is an example of just one area where his VC is seeing a lot of traction. He compared this industry to the biotechnology industry 35 years ago, “where there were three or four companies, and there’s yet be formed Genentech and Amgen and Biogen.” He thinks that we are on the cusp of a breakthrough with the mental health tech space, owing to a steady evolution and development of different transformative technologies.

Edelhart raises many important questions for scrutiny if the situation of human augmentation on a commercial scale should arise:

If I can perfect your bio so that it has the same capabilities as an Ethiopian marathon champion, and therefore, massively improved your performance, would that be called cheating? People in the future might have capabilities that the current ones don’t. Is that going to be speciation? Emergence of these tech and science capabilities is as good a reason for Darwinian change as any other environmental challenge, in my opinion.

Human physical and cognitive augmentation, according to many experts, is imminent. On the other hand, some think that AI will replace humanity altogether. Although, opinions shared in this article may include some far-fetched ideas, their plausibility does not seem esoteric, given that space exploration and the internet seemed nascent only about three decades ago. Time will tell.

Header Image Credit: Medtech Impact