Many large insurers are finding ways to digitize parts of their business process in preparation for future projects involving machine learning. This is especially true in claims processing, which could become faster and less error-prone if claims adjusters did not have to search through large amounts of data or paper documents manually.

In this article, we discuss three different AI-enabled claims processing applications for insurers. These include:

- Document Digitization for Claims Forms: Machine vision applications for digitizing data in paper documents.

- Predictive Analytics for Claims Processing: Predictive analytics applications for automatically extracting incident details from mobile apps and vehicle sensors to manage risk in real-time and automate the first notification of loss (FNOL).

- Text Mining for Retrieving Claims Information: Enterprise search applications for customer service agents to quickly retrieve claims information.

Document Digitization for Claims Forms

Insurance claims and supporting documents are still filed via scanned paper documents. These documents are then faxed or emailed to the insurer. The insurer is then required to manually enter the data within these documents into its system, thus digitizing the data. AI-enabled document digitization software could automate this manual data entry upon uploading a document to the AI software. This could save the insurer on costs associated with outsourcing manual data entry, as well as reduce the time it takes claims adjusters to search for the information they need to make a decision on how much to pay a claimant.

Traditional solutions for paper claims forms is optical character recognition software (OCR), which can “read” printed (and occasionally handwritten) letter and characters and translate them into digital text. OCR struggles sometimes to translate characters with nonstandard formattings, such as italics and underlining. In addition, OCR software oftentimes digitizes text into word documents, putting the onus on the insurer to copy and paste that information into a digital version of the document.

Machine vision, a type of machine learning that can “understand” images and videos, can be trained to mitigate this problem. A claims adjuster could upload a claims form into a machine vision software, and the software could turn the claims form into a digitized version of itself in the insurer’s system.

Predictive Analytics for Claims Processing

Predictive analytics-enabled claims processing applications could help auto insurers digitize their claims workflow in numerous ways. Some applications use machine vision to assess car damage and predictive analytics to calculate how much the claimant should be paid for their claim. Others use telematic sensors to detect collisions automatically and report the affected areas and the force of the impact to a claims adjuster.

Concirrus is an AI vendor that offers a predictive analytics application for automating marine and auto insurance claims called Quest Automotive. The company claims insurers can use the software to offer faster claims processing to their users through a mobile app and telematic sensors installed in customers’ cars. The Quest Automotive dashboard also purportedly incorporates customers’ historical driving data in order to assess risk.

The company emphasizes the following as two of its software’s main capabilities:

- Real-time risk management: A risk management tool that could alert insurers about high-risk actions taken by their customers, such as speeding or abrupt stops. The software can purportedly update the driver’s premium automatically and offer them safety tips.

- First Notification of Loss (FNOL): Using telematics sensors, Quest Automotive can purportedly generate and send a collision report to insurers automatically. The company claims to also use video data to determine certain details about collisions; however, they do not mention if this data is simply sent to the insurer for review or analyzed using machine vision.

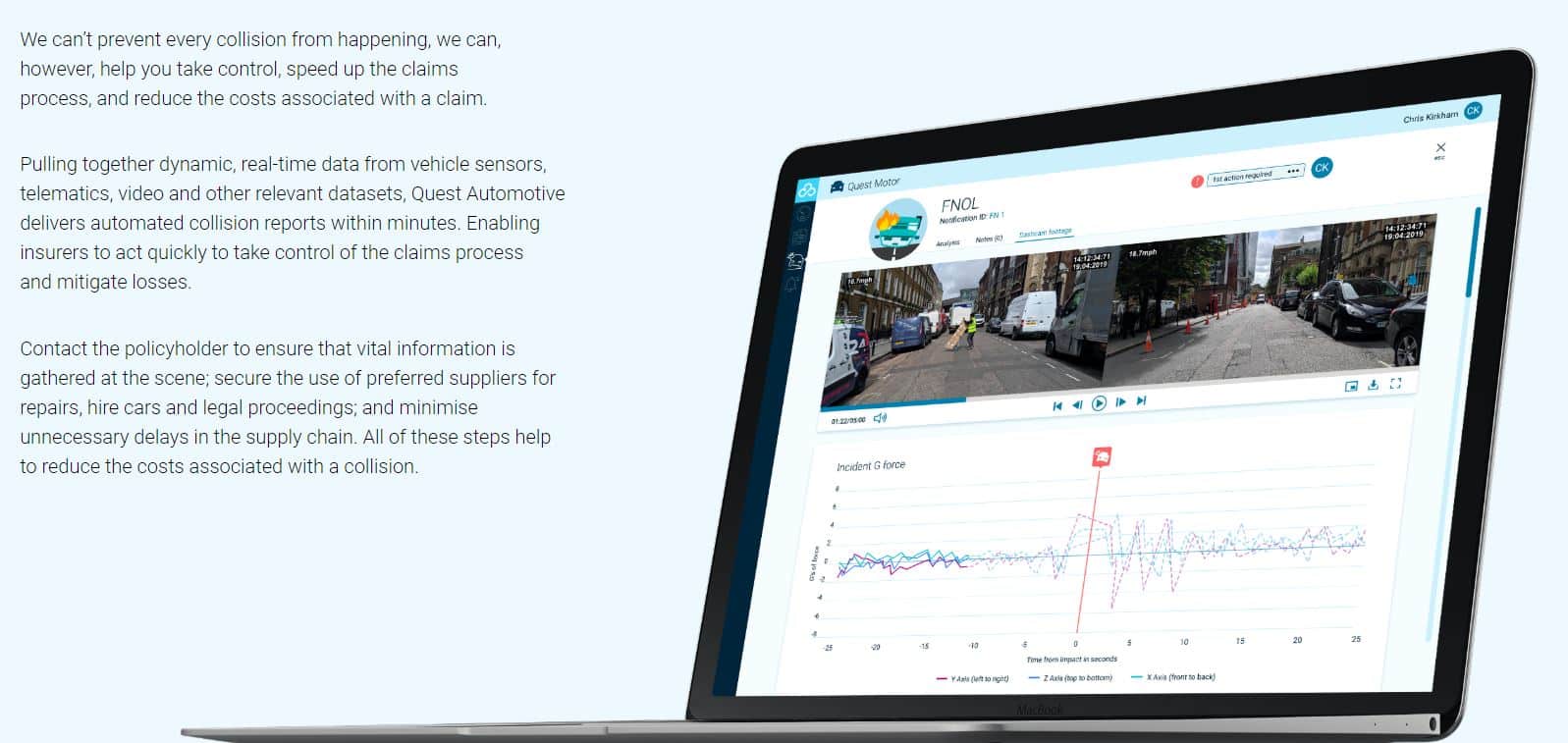

Below is an image from Concirrus’ website which shows how the FNOL function records the amount of force with which the vehicle collided with another car or object:

According to a case study Concirrus lists on their website, the company helped Acorn Auto Insurance price customer premiums more accurately based on the new insights gained from the Quest Automotive platform.

Text Mining for Retrieving Claims Information:

IBM has an NLP software called IBM Watson Explorer, which the company states could help insurers access and organize text data to verify claims are legitimate and answer customer service tickets. The software can purportedly search through text data to find relevant information that helps claims adjusters decide how much money to pay a claimant. The application could also help the customer service team find answers to customer questions by providing information from an intranet or other employee resources. This type of application is known as search and discovery, enterprise seearch, or information extraction.

IBM Watson Explorer’s machine learning capabilities, which the company calls “cognitive,” include:

- Cognitive content mining: NLP enterprise search functionality based on keywords and phrases. This could speed up claims adjustment by providing details on whether the claim has been pre-authorized or whether there was any duplicate information on the claim. This could also help health insurers determine if the medical treatment detailed in the claim was tagged with the correct classification code.

- Cognitive exploration: The user dashboard for Watson Explorer purportedly allows the user to see analytics related to their search query. This may help the algorithm find the correct information faster the next time it is requested. Claims adjusters could use this to find the payment amounts approved for prior claims for similar incidents. This would allow them to better determine payouts.

- Cognitive advice: The software can purportedly recommend the next best course of action for the user as it gradually determines what the user could be looking for. These recommendations could vary from simple keyword replacements to example documents from the database to give the user an idea of the type of form they may be looking for. The dashboard also allows users to track how the machine learning model is improving and check how long it will take to train it on given datasets.

Below is a short 5-minute video demonstration of IBM Watson Explorer and an introduction to text mining:

IBM claims in a case study to have helped a large insurer update its data infrastructure and adopt IBM Watson Explorer for both claims processing and customer service. Its claims data was purportedly funneled into a central location accessible by call center agents. The case study states that the insurer was able to reduce its claims processing time from two days to ten minutes, and saved 3 seconds on each customer service call for 14,000 agents.

Header image credit: AllRisks