Applications for artificial intelligence technology within the financial industry are most often focused on document search and fraud detection. This is especially true for large credit card companies such as Visa and Mastercard, who themselves provide technology to smaller businesses and card issuers.

Visa has been using and improving their fraud detection technology for a few years. They started a research initiative called Visa Research, which focuses primarily on AI applications for their company.

Visa Research focuses on deep learning for payments and scalable machine learning models, or machine learning models that can change the range of data used to determine conclusions based on the context of the request. They also focus on predictive analytics solutions for fraud detection.

In addition to AI, the initiative also studies advances in cryptography, the security of distributed endpoint systems such as APIs and cloud-based solutions. The initiative also researches methods of secure data acquisition and analysis. This could include proper anonymization of customer spending data as well as fraud prevention for the handling of that sensitive data.

In this article, we investigate the AI projects and initiatives at Visa and detail the most prominent of them. We clarify which aspects of the technology are actually powered by AI and which are not. This investigation includes some minor evaluations of software vendors that Visa is working with on collaborative projects.

The AI initiatives covered in this article are listed as follows:

- Detecting Credit and Debit Card Fraud

- Visa ID Intelligence – AI Consulting Services

- Finance and Travel Chatbots

Our investigation into Visa’s AI initiatives begins with their chief fraud detection technology, known as Visa Advanced Authorization.

Detecting Credit and Debit Card Fraud

Visa’s most developed AI initiative is called Visa Advanced Authorization, which is a predictive analytics application for detecting fraudulent transactions in real time. It is important to note that Visa Advanced Authorization has been the company’s solution for fraud detection for over a decade. We can infer that the technology has undergone some kind of update since that time because true machine learning solutions would not become widely available until the 2010s.

The company claims Visa Advanced Authorization is able to identify data points among specific transactions that correlate to a higher degree of fraud risk for the transaction. They state the technology can identify up to 500 unique attributes per transaction, but the examples they provide may not be as granular as one might expect. The software purportedly discerns if the transaction in question is taking place at a store where the cardholder usually shops.

Visa also details the software’s ability to detect if the transaction is with a high-value seller, such as electronics dealers or jewelry stores. The time of day and the amount of money spent are also factored in, and all of this information is compared to all aspects of the customer’s spending patterns. This may include fluctuations in customer spending patterns during the holidays or vacations.

The company states the software uses the detected risk attributes, or aspects of customer behavior that correlate with fraud, to score transactions based on risk of fraud. In this system, the number 1 poses the least risk and 99 poses the most risk. If a transaction’s score passes a certain threshold, the number of which is unclear, the system will decline the payment to prevent the fraud from occurring.

Visa claims to have made it possible for Visa Advanced Authorization to compare transactions against two years worth of the customer’s transactional data. They claim this makes it easier to recognize rarer but non-fraudulent transactions and spending habits as well as identify legitimate transactions that may have seemed risky in the past. Visa implemented this in order to reduce the number of false declines issued by the software.

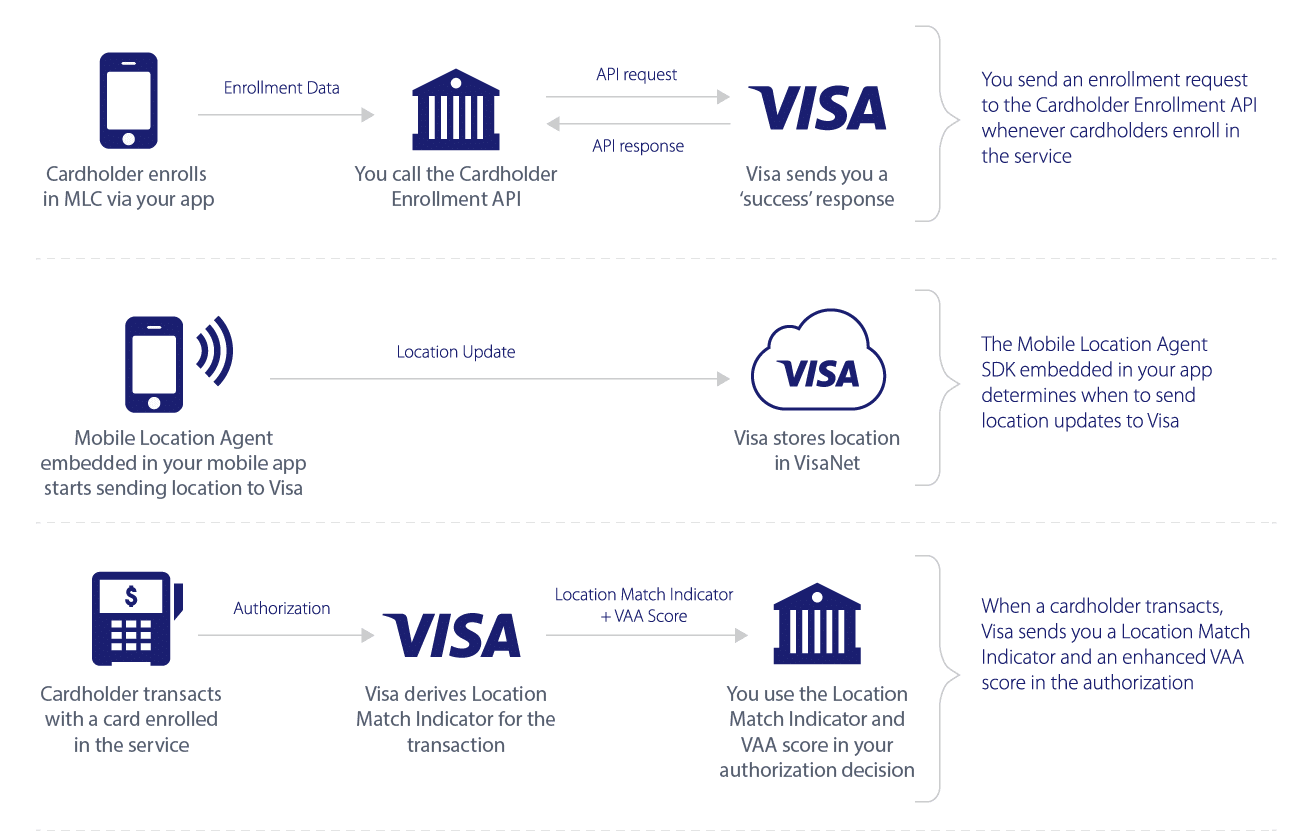

The Advanced Authorization technology is also bolstered by Visa’s Mobile Location Confirmation feature. The feature allows customers to opt in on their mobile device and allow Visa access to their geographical location. This location information is then used to prevent Visa Advanced Authorization from declining the user’s card just because they are traveling and possibly buying something out of the ordinary.

Below is a graphic from Visa’s website that illustrates how their mobile location confirmation features works in conjunction with Visa Advanced Authorization:

Mark Jamison, Global Head of Innovation and Design at Visa, wrote a piece about prominent trends in payments technology that will grow in 2019. On the subject of artificial intelligence, Jamison stresses the importance of contextual information that comes with each transaction:

The brands that get AI-powered commerce experiences right will focus on designing with new contexts in mind (e.g., voice-activated shopping often happens where others can hear, whereas messaging is more likely to happen in private), embracing new interaction models, and embedding convenience, security and privacy from the outset.

It is clear from this statement that Visa is particularly interested in using biometric data from transactions to maintain a smooth user experience within real-time fraud detection.

In order for Visa’s Advanced Authorization solution to detect fraud from transaction data in real time, it would need to be trained on millions of commercial transactions made from Visa cardholders.

In addition to the core data points within the transaction, such as the product being purchased and its price, the machine learning model would also encounter authentication data such as biometrics or Europay Mastercard Visa (EMV) chip information. Biometric authentication data includes thumbprints as well as selfies for facial recognition.

This way, the machine learning model can compare biometric data to that of the biometric data on file for secure authentication of customer accounts. The model may also be able to use this data to discern if the face is an inanimate replica or image of the customer’s face.

Once the machine learning model has been trained to discern data points that together correlate with fraud, it can begin to compare sequential transactions to identify patterns and spending habits. This is where the software might begin to highlight risk attributes, or transaction details that correlate with fraud risk, such as transactions suspiciously far from the geolocation of the customer’s last transaction.

Because the model would need to be trained on transactions that are pre-labeled as either legitimate or fraudulent, it will be able to determine if a transaction is fraud based on the data points labeled fraudulent during training. The software scores transactions based on these correlations and patterns, and is able to accept a wider range of variation in spending behavior without issuing a false decline.

Visa ID Intelligence – AI Consulting Services

Visa also offers Visa ID Intelligence, a which appears to be a kind of consulting service for other financial institutions to adopt new forms of authentication to offer their customers. This allows client companies to more easily allow their customers to make retail payments via channels that do not have keyboards or are otherwise inconvenient for inputting a password. This could include voice, facial recognition, or fingerprint scan technology at newer payment terminals that utilize smart devices.

Knowledge-based authentication methods such as security questions are also precluded from these channels, which could include IoT connected smartwatches and rings that could make payments when scanned. This is because Visa claims security questions are less secure than biometric data. Authentication methods include facial and voice recognition, fingerprint scanning, and document verification similar to check scanning.

The Visa ID Intelligence platform employs authentication solutions from four vendors that claim to use AI and have been accepted out of numerous entries into Visa’s vetting process. Though the exact criteria they used for determining eligibility is unclear, we can infer Visa was looking for companies that presented the most competency in their specific field of authentication. In the cases of facial and voice recognition, it is likely Visa was looking for companies specializing in machine vision authentication applications.

Authentication technology is a tech sector that focuses on creating applications and hardware that facilitate identity verification across digital channels. Development of this technology allows authentication companies to sell their solutions to financial institutions such as Visa or their competitors as well as developers who want to work from their technology. In this case, this would refer to AI and ML developers.

The four vendors offering authentication technology solutions to businesses through Visa ID Intelligence are as follows:

- Daon, offering facial, voice, and other biometric recognition authentication

- Au10Tix, offering machine learning based facial recognition

- ThreatMetrix, offering fraud detection with behavioral analysis

- Neustar, offering data analytics for financial marketing

Daon

Banco Neon worked with Visa and Daon to create an authentication solution that allowed their customers to use facial recognition to make payments and access accounts. Visa claims it was possible to combine their technologies with Daon’s biometric analysis because of their acquisition and integration of CardinalCommerce.

They claim CardinalCommerce is a leader in payment authentication, and that the company enhanced the EMVco 3-D secure technology powering the insertable chips in customers’ Visa cards. EMVco’s 3-D secure technology is the default security technology within EMV card chips. CardinalCommerce purportedly enabled the 3-D secure software to transmit biometric data across channels, making for a faster and more secure authentication.

Au10Tix

Au10Tix offers Automated identity authentication software as well as solutions for customer onboarding. Their onboarding solutions make use of live and government ID facial recognition, and the data from the images is extracted for further verification and know your customer (KYC) screening.

Au10Tix facial recognition software uses multiple modes of matching faces for authentication. It uses live target object detection to ensure the head in the camera view is of a real person and not a replica such as a picture or inanimate recreation.

Threatmetrix’s Dynamic Decision Platform is a solution that purportedly enhances authentication, identity verification, and scoring of payments and other financial activity for fraud. The company uses machine learning to analyze customer behavior and identify anomalous transactions based on that behavior. These transactions are then likely scored on a confidence level that they are fraud or not.

The company claims the decision platform extracts information from their Digital Identity Network, which is a hub platform for Threatmetrix’s stores of transactional data.

Below is a short, 2-minute video which features some of Threatmetrix’s past clients speaking about what they have learned about recognizing fraud with Threatmetrix:

Neustar

Neustar offers predictive analytics software for data analytics and customer segmentation for the purpose of financial marketing. They claim the Neustar Identity Management Platform (IDMP) aggregates data from multiple sources they qualify as “authoritative identity” data sources. These sources include government, telecom, utilities, and financial data streams that they claim will give business leaders a full view of their customer.

Their predictive analytics systems focus on customer data from clients’ customer bases. They also claim it can assist companies in measuring and budgeting their marketing spend.

Neustar claims their financial clients will benefit from their solutions by improving marketing campaign performance with customer segmentation and controlling media strategies with all data streams and their disposal.

Finance and Travel Chatbots

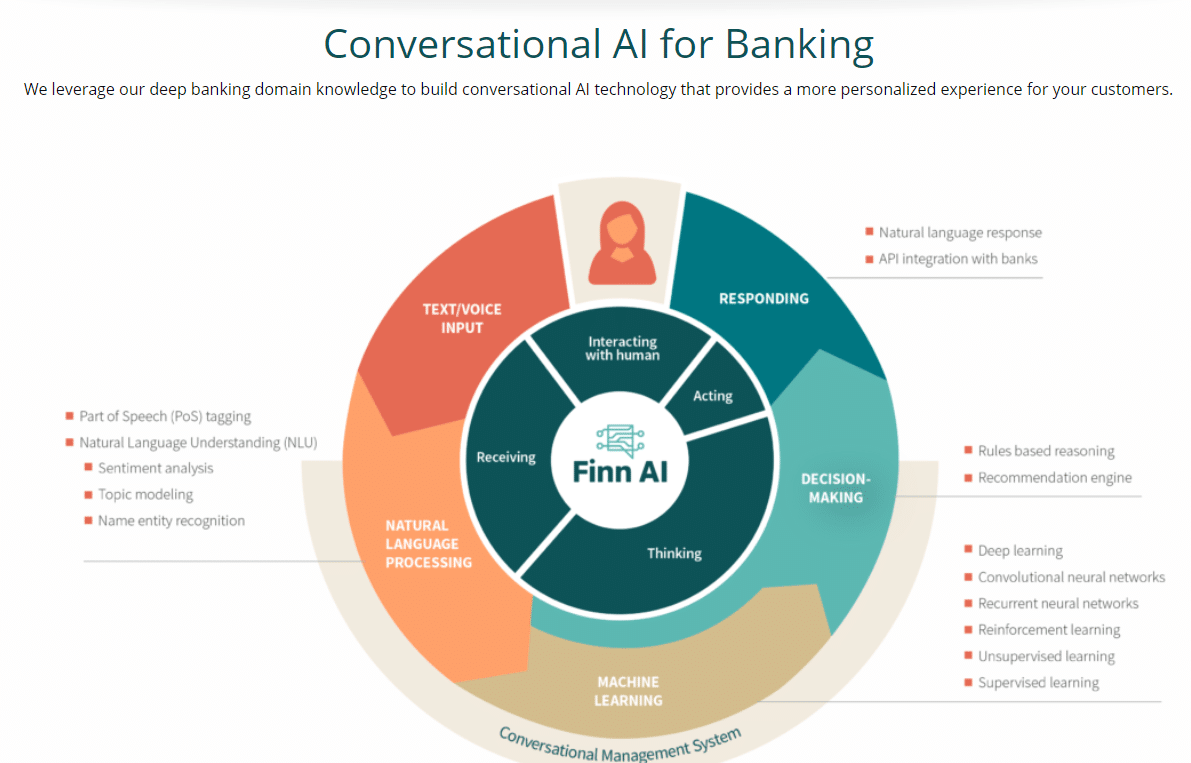

In 2018 Visa Canada announced their collaboration with Finn AI, a Vancouver-based fintech company. The collaboration allows Finn AI to use Visa’s APIs from their developer platform and to enhance the natural language processing technology within Visa’s chatbot software.

Visa claims their customers will benefit from the improved functionality of their customer service chatbot. The chatbot can purportedly provide exchange rate information to customers landing in a new country as well as help the customer find the nearest ATM.

Customers can purportedly chat with Visa’s Finn AI-powered virtual assistant in order to prepare their bank, mobile banking app, and debit card for travel. This could include making sure mobile app travel notifications are turned on before leaving. A customer may also disable a misplaced card to prevent fraudulent transactions by querying the chatbot to do so.

Below is a graphic from Finn AI that details how their conversational AI for their chatbots works:

We interviewed Madhusudan Mathihalli, CTO and co-founder of Passage AI, about how to get a chatbot to handle varied requests and what kinds of tasks conversational interfaces are best at. When asked what chatbots will be able to do in the coming years, Mathihalli said,

You can [ask a chatbot] ‘hey, I’m looking for something Asian in San Francisco and I’m looking for a table for 2 between 7 and 8 pm.’ Now, what if we do not have that restaurant available? What if we don’t have the particular requirement satisfied? You and the bot should be able to negotiate and land on a particular restaurant of your choice that’s available.

It is clear that Mathihalli sees an even more conversational version of the chatbots we use today as an inevitability for the future. Collaborations between large companies like Visa and advanced technology companies like Finn AI may be useful in improving chatbot applications across industries.

According to a case study from Finn AI, the company helped Bank of Montreal launch a chatbot for their mobile app that improved their customer experience. Bank of Montreal wanted to improve their customer service by providing their customers with the ability to make bank appointments and ask financial questions when away from their bank.

The case study states that by the time the solution was launched, Finn AI and Bank of Montreal had covered over 250 individual customer questions in there training. They also covered over 200,000 possible utterances which include sentence fragments and colloquial language. By the time the case study was published, Bank of Montreal had already seen an improvement of their Facebook customer feedback scores by +1 point.

Header Image Credit: PYMNTS