Artificial intelligence and machine learning adoption among different industries represents a new chapter in digital transformation. However, according our own research across industries, AI adoption in 2017 remains low with majority of major success stories coming only from the largest tech players in the industry (Google, Baidu, Apple, etc). McKinsey Global Institute estimates that in 2016, tech giants invested $20-30 billion into AI, while smaller companies altogether invested an estimated $6-9 billion.

There is growing interest and speculation on the prospect of companies adopting AI and ML, and we tried to gauge what they think about the possibilities of this technology in their businesses. More specifically, we wanted to know what investors, founders and tech employees think about:

- The importance of AI and ML in their current areas

- Their future plans of adopting the technology, and

- The reasons why more firms are hesitant about adopting AI into their operations

In the charts and article below, we explore the survey responses from more than 100 professionals during the Applied Artificial Intelligence Conference in May 2017 in San Francisco organized by Silicon Valley-based venture capital firm BootstrapLabs. Commentary in this article was contributed by Emerj founder Dan Faggella, and writer Edgar Alan Rayo.

Survey Summary from the Applied Artificial Intelligence Conference 2017

(Note 1: Click here to see the actual survey that was filled out by attendees of this conference, otherwise, see the basic breakdown of the responses below.)

(Note 2: A note about the survey itself: Our survey was handed out at the beginning of the event (before the presentations), and attendees were encouraged to fill one out before leaving. Survey respondents to our AI perspective survey included 24 founders, 22 technical employees, and 55 “other” guests (including academics, non-technical employees, investors and executives). Majority of the respondents represent firms dealing with services and/or software products. Of these, those B2B Services firms outnumber B2B Software firms. In addition, more than half of the respondents come from small-scale enterprises. The survey itself can found here via Google Sheets.)

Demographics

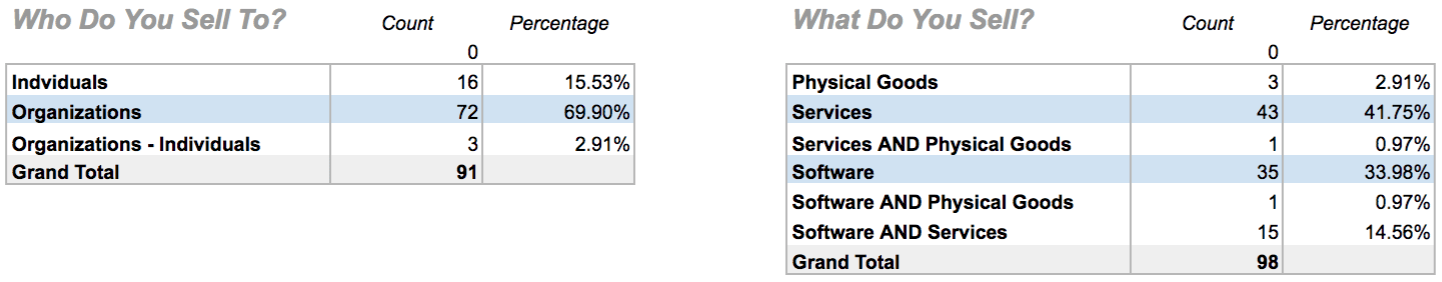

We surveyed just over 100 attendees from the conference (many of which were filled out on paper at the conference itself, others were filled out via online survey), and only a handful of the respondents neglected to record (a) who their business sells to, and (b) what their company sells.

As you can see, the bulk of our the respondents (and presumably the bulk of the attendees at the 2017 Applied Artificial Intelligence Conference) sell to businesses – nearly 70%.

As to what they sell, most of the respondents either sell services (~42%) or software (~34%), with a only a handful selling physical products, and another small group (~14.5%) selling both software and services. For the sake of making the most of this relatively small sample size, we focus mostly on the insights from the “Software” and “Service” firms in much of the graphics and commentary below.

Question 1 –

Commentary from Dan Faggella:

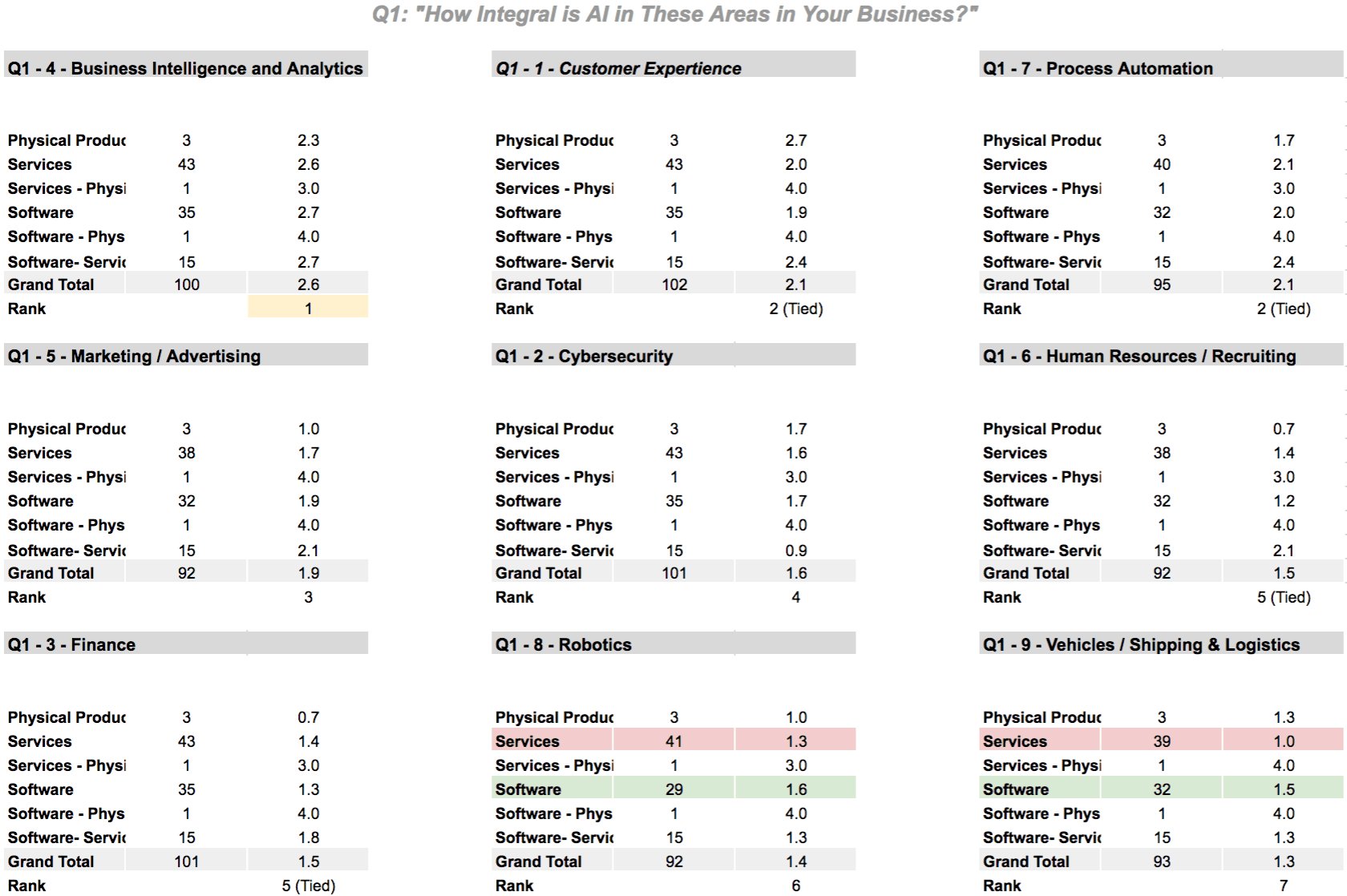

In the graphic above, the “application areas” of AI are listed in order of importance, as ranked on a 1-4 scale by attendees. Business Intelligence ranked highest, Vehicles / Shipping & Logistics ranked lowest. Customer Service and Process Automation tied for second place in terms of perceived importance from respondents.

The difference between the respondents whose companies sell software versus those who sell services were relatively minimal. For some strange reason we did see software firms placing a higher import on Vehicles / Shipping & Logistics and Robotics, though it’s unlikely that these companies are currently using AI in those business functions today. Otherwise, the rankings seemed relatively consistent respondent groups.

Commentary from Edgar Alan Rayo:

While the general sentiment for the importance of AI/ML in different categories is similar across groups, it’s interesting to note that Services and Software companies view business intelligence and analytics as the low-hanging fruit. This is in line with the results of our previous BootstrapLabs event survey where business leaders ranked business intelligence ahead of other categories as the area that they would like to learn more about.

We surmise that business intelligence and predictive analytics appeal to these professionals to garner a deeper understanding of the sales, marketing and operations trends within their companies. The metrics they gather can be used to develop predictive models to heed on possible future outcomes – a valuable ability that could supplement business intelligence. The differences are rather small but this is a guess.

In addition, we have noticed that between Software and Services companies, the former emphasize more on the importance of AI in marketing whereas the latter views human resources as a more significant field for AI/ML applications. This somehow explains the nature of Services firms to put more stress on talent development as a strategic priority due to the nature of their business.

This does not mean, however, that Software companies do not consider their talent as valuable. This shows instead that they are more predicated on using AI/ML to improve the quality of their products. In addition, marketing also ranks high among Software companies most probably owing to the fact that most of their sales processes are accomplished using digital channels and their marketing campaigns run on digital marketing elements (content marketing, PPC marketing, funnels, among others).

Some Software companies have also rated robotics and vehicles higher compared with the responses by Services firms. We believe this is only aspirational since the software companies in our survey are unlikely to realistically use robotics or self-driving cars in the near future.

Question 2

Comments by Dan Faggella:

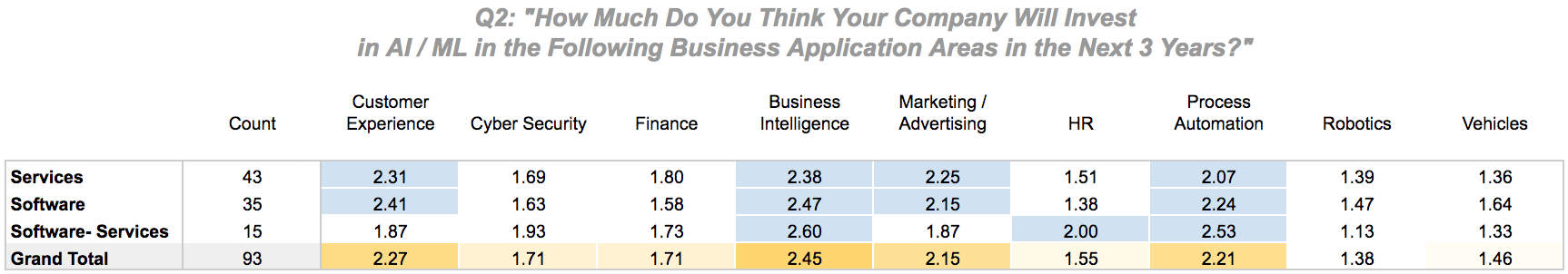

In terms of future AI investment over the next 3 years, again Business Intelligence took the number one spot, with Customer Service and Process Automation just about tied for second place. The differences between Software and Services firms were again minor.

Commentary from Edgar Alan Rayo:

When asked which area their company is most likely to invest in AI/ML in the next three years, both Services and Software firms weigh in more heavily on business intelligence and analytics, and customer service, followed by marketing and process automation. We assume that these preferences are ranked higher compared to others because of their quantitative nature that translate into being a good fit for AI/ML applications.

It is also worth mentioning that cybersecurity has been regarded by survey participants as one of the lesser AI investing priorities. However, our observations state otherwise since there is a lot more interest in data security today. Since many modern cyber security solutions are integrated with machine learning (and may or may not market this fact overtly), it may not be on the radar as “machine learning” per say.

It’s also possible that Business Intelligence is a more appealing and interesting area for business leaders and managers (i.e. the attendees at this conference), and Cyber Security may not be appealing to many members of a corporation except for its IT security specialists.

Question 3

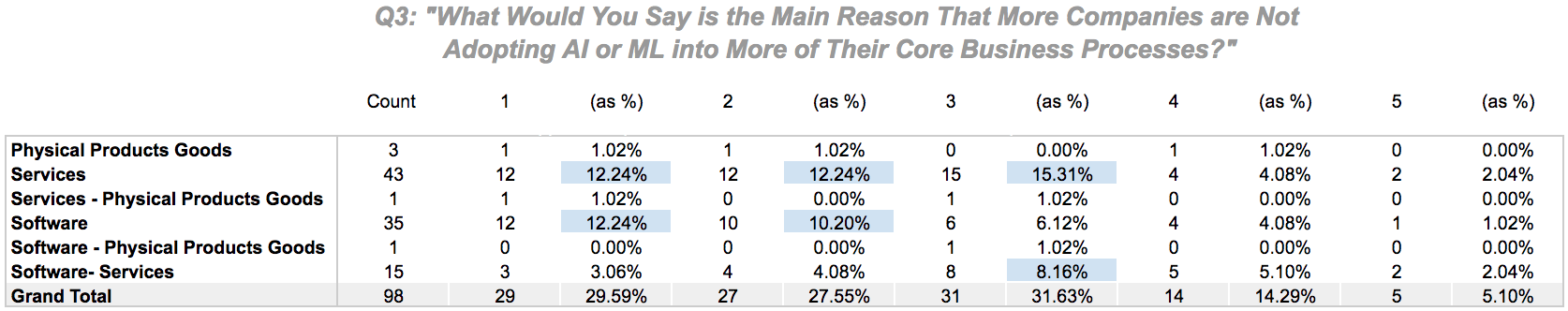

The above question asked respondents to rank the following reasons that more companies aren’t adopting AI:

- Applications are experimental and not capable of substantial ROI

- The applications work, but there are not enough use cases

- Companies lack the specific AI talent or expertise to use AI applications

- No financial commitment to adopt

- (Other)

Comments by Dan Faggella:

The first three reasons had similar percent responses, but lack of talent barely eked out an edge over the other reasons. Lack of talent clearly isn’t the only issue for AI adoption, as there seems to be a genuine lack of faith in some applications, and lack of tangible evidence of results for others. We found it interesting to see relatively even rankings here.

Case studies are for AI applications are indeed hard to come by – which is one of the reasons we work so hard to actively collect and simplify AI case studies here at Emerj (see our case studies selection). In slow-moving sectors like healthcare, it may be years before definitive and convincing AI use-cases are available – while areas like marketing and customer service have many current use-cases (see one of our recent case studies about how Dole Foods improved in-store product sales by using artificial intelligence to rapidly test their ad creatives).

Commentary from Edgar Alan Rayo:

It’s interesting to note that – digging deeper into responses by role – almost half of those who identified themselves as investors (5/12) cite the experimental app’s lack of assurance in delivering ROI. This reflects investors’ bias against risking a huge investment that is likely to put a company in the red because of a products lack of direct operational benefits.

Concluding Thoughts and Take-Aways

Comments by Edgar Alan Rayo:

Though our set of responses is not intended in any way to be conclusive, there are a few interesting themes that seem to warrant illumination:

- Business intelligence and analytics seemed to be the most essential area that most respondents believe they can see AI deliver results. Our discussion using case studies across industries provides a more in-depth look on this area.

- Software companies put more weight on AI applications in marketing – possibly because of their inclination toward digital marketing strategies. Services companies, on the other hand, are more interested in the use of AI in human resources.

- Along with business intelligence and analytics, respondents also foresee future investments in AI applications that relate to customer service.

- Company founders believe that finding the right talent who can work on their firm’s AI applications is a challenge, while technical employees cite the experimental state of most applications today as a hindrance to AI adoption.

Header image credit: BoostrapLabs (a photograph from their 2017 conference)