Progressive is one of the largest auto insurers in the US. The company has been experimenting with AI since the middle of the 2010s, with customer-facing applications that update insurance premiums based on driving habits and answer questions in a chat window. In this article, we discuss both of these AI use-cases. More specifically:

- Snapshot: Progressive’s Snapshot program, which seems to use predictive analytics to adjust a customer’s premiums based on their driving behavior.

- Flo Chatbot: The company’s customer service chatbot, which could help customers with purchasing a policy or filing a claim.

Emerj’s AI Opportunity Landscape research in insurance shows that Progressive’s Snapshot program follows a trend in which auto insurers use predictive analytics applications to determine how risky a customer or insurance applicant is: Approximately 21.6% of AI products in insurance are applications of this type.

In contrast, although several of the largest insurance companies in the US have experimented with chatbots, the insurance industry hasn’t prioritized chatbots the way the retail industry has, as chatbots make up only 8% of the AI products in insurance.

We begin our exploration of Progressive’s AI initiatives with their AI-enabled Snapshot program for usage based insurance:

Snapshot: Usage-Based Insurance

Progressive claims to use a predictive analytics application that uses driving data collected from their clients to offer usage-based insurance (UBI). This means that Progressive could price their customers’ insurance policies based on how well they drive.

The program, called Snapshot, requires customer to install a device into their car’s diagnostics port or download an app to their mobile phone. As the customer drives, the device or app records information about the driver’s behavior and feeds it into a predictive analytics algorithm. The algorithm seemingly offers employees at Progressive a recommendation on whether to increase or decrease the customer’s premium payments after the initial 6 month period during which they have the Snapshot device or app installed.

The algorithm purportedly factors for:

- How often a customer drives and for how long at a time. This is one of the most common factors within “pay-as-you-drive” programs like these.

- How often a customer speeds. Regular speeding may signal that the driver is a greater risk.

- How forcefully a customer brakes, which could signal that the customer is not braking soon enough.

- How sharp the customer’s turns are, which, again, may signal that the customer needs to break sooner.

Progressive’s Snapshot program is the result of work with AI vendor H2O.ai. Below is a video that explains this work and how AI makes Snapshot possible:

H2O.ai claims that Progressive’s underwriters were able to create and analyze new risk models faster after adopting the vendor’s AI platform.

Flo Chatbot

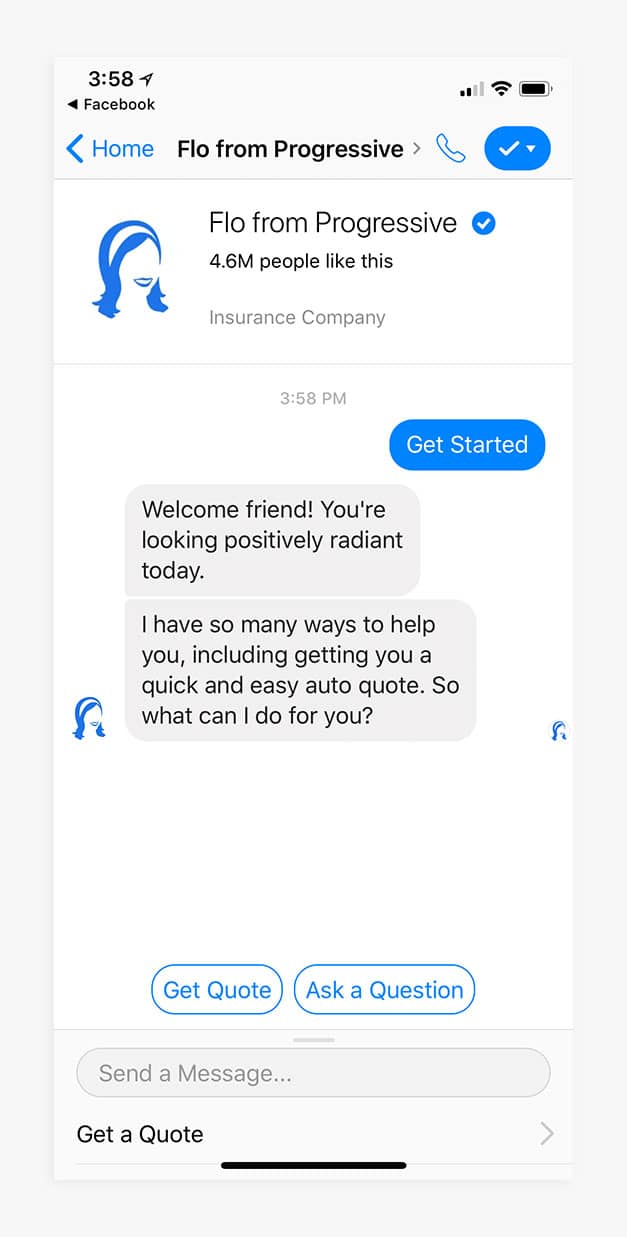

Progressive also worked with Microsoft Azure to create a natural language processing-enabled chatbot that emulates its popular mascot character, Flo. The Flo chatbot is a virtual assistant for customer service that customers could access through the company’s Facebook messenger account. It also references some of the commercials that Flo appears in and purportedly uses Progressive’s knowledge base to identify answers to customer service questions.

The Flo chatbot can purportedly help customers:

- File a claim

- Get an auto insurance quote

- Change premium payment due dates

- Answer basic questions about auto insurance, such as “What is a deductible?”

The company may also be able to leverage social media responses as data to improve the chatbot’s conversational capabilities. For example, some customers may not know about the chatbot and leave their question as a comment on a Facebook post. Progressive could use these comments as a means of further training the chatbot.

Emerj for Insurance Leaders

Insurance leaders use AI Opportunity Landscapes to discover what their competitors are doing with AI. This gives them the information they need to keep up with top players in their industry, direct their efforts toward high ROI AI projects, and avoid AI applications that lack any evidence of widespread adoption.

Now more than ever, it’s important for insurance leaders to make wise decisions about where to spend their budget. Emerj can help. Learn more about our research services.

Header Image Credit: Motor1.com