Optical character recognition (OCR) is a subset of machine vision technology that focuses on recognizing written letters and characters and reproducing them digitally for later use. This opens up many possibilities for the banking industry, including some security solutions, and notably, document digitization.

This AI application is less common in the banking industry than other AI applications, even within the capabilities of machine vision. There is more documented success for facial recognition software and white-collar automation for banks than there is for document digitization, but the possibilities are equally varied.

In this article, we highlight how AI-based document digitization could help banks. We also list various documents a bank may want to digitize, along with an explanation of a bank’s benefits for digitizing them.

We also highlight the successes banks have had with implementing the software for various goals. These include an overall upgrade of enterprise automation, using the data for transaction risk assessment, and facilitating the efficiency of a company mailroom.

The document digitization market in the banking industry is relatively nascent, and because of this we have included a section at the end of this article about why that might be and what the future could hold.

In this overview we’ll cover:

- Machine Vision OCR for Banks – What’s Possible, how it’s being used, and how other banks are benefitting from integrating this technology into their processes.

- Document Digitization’ Nascency in Banking, and what banks considering this type of solution should look out for before making a decision on whether to work with a vendor or not.

We begin our overview of document digitization in banking by discussing the possibilities the technology holds for the industry and what a bank can accomplish with data from scanned documents:

Machine Vision OCR for Banks – What’s Possible

Optical character recognition (OCR) software must be installed in a system with a camera that can produce high-resolution images of paper documents in order to convey the information accurately. It accomplishes this by recognizing letters and characters by shape and reproducing them in a digital format in the same order they were written.

OCR digitizes all information from scanned documents and that information can be saved to a database for customer information and important records. A bank may find an OCR solution useful if they had a robust backlog of physical documents about their clients. This is especially true if they want to use that new data to uncover previously unexplored business insights such as indicators of low fiscal responsibility found in banking history.

Banks could benefit from using OCR to digitize documents such as:

- Customer facing services, such as checks for remote deposits

- Details on a credit or debit card

- Paper applications for mortgage loans and credit cards. This also includes completed mortgage forms once applications have been accepted.

- Bank statements for customers proving their banking and credit history

- A bank’s mailroom intake, to then be routed to the appropriate staff

Scanning all of this data would result in a high influx of new digital data for the bank to store, and it would need to be easily accessible to other departments in order to be useful.

We spoke to Muriel Serrurier Schepper, Business Consultant of Advanced Data Analytics & Artificial Intelligence at Rabobank Digital Bank in Holland, about how to integrate AI into legacy businesses. During this interview, Schepper spoke about the most important steps for banks to take in order to use their big data silos that may be difficult for the average employee to navigate. She spoke about how they turn this data into actionable insights to be used for the training of whatever machine learning model they may need.

These key steps include:

- Building an interdisciplinary team of AI talent that can understand concepts across business departments

- Facilitating communication between this team and the involved departments in order to keep everyone informed of new developments or data requirements. This can also help employees highlight where data science projects overlap and generate value.

- Seeking out problematic areas within each department in order to assess how the bank infrastructure needs to improve in order to adopt AI and in which areas.

- Maintaining realistic expectations of the team and the technology. In most cases, even OCR solutions will not be fully automated and will require a human monitor to decide how the scanned data is saved and where it is sent.

When asked about how Rabobank reached the point where she knew the company needed to centralize all of its data from outside streams and internal data silos, Schepper said:

What we saw at the end of 2015 is that many domains within the bank which operate in silos were looking into different AI solutions and were talking with a lot of vendors…We realized if we carried on this way, we would end up with four different vendors and we would let the vendors learn a lot about applying AI in business, while we ourselves would be very ignorant.

We also saw that a lot of people who were dealing with these vendors actually didn’t know what they were talking about at all. So we felt it would be good to create a center of excellence from where we could coordinate and bring in knowledge to select and implement AI solutions within the company and also being able to bridge between the different silos to help them work together and find one solution together.

Here, Schepper observes how detrimental it can be to have a lack of communication between banking employees and AI vendors, making the bank unable to help itself when it comes to process automation.

She saw that to succeed Rabobank was going to need to accrue this information for itself, and sought to access all of the company’s big data and implement a solution that would allow them to more easily leverage their big data for further projects.

If a bank implemented a strategy such as the one Schepper outlined in our interview, they may be able to more easily integrate an OCR solution into their business. Their large data stores of banking and customer information could help train a machine learning model for an OCR application on the types of forms the bank most commonly processes.

This data could be routed through a central data stream where all data scientists or analysts from other departments could access it.

One concern some may have is the level of job displacement that thoroughly integrated OCR could create. If a company that used numerous employees to electronically disseminate information from physical documents chose to adopt an OCR application, many people may be out of a job.

That said, experts do not seem to have a clear consensus on how this type of AI disruption will affect the bottom level staff at established enterprises and small businesses. We spoke to Nishant Chandra, PhD and Senior Director of Data Products at Visa about how banks can use recent trends of AI disruption to their advantage on our podcast AI in Banking. When asked about how he felt about the importance skill evolution within businesses using AI, Chandra said,

“My argument is skill displacement versus job displacement. … Each generation has performed cumulatively than the previous generation. … Skill is like water. You can start putting this water inside a dam and think that the skill can only grow within this, but no. Skill will find a way to get out of the dam. Whether we have a pseudo-dam like [many countries] having very protective work environments or [only] giving opportunities to residents of the country. Or it may be constraining the technology transfer from other geographies or anything else. … if there is a person with a very special skill, that person will find a way to create the next big wave in the world. Exactly like water. The water will cumulatively come up and breach the dam.”

Applied AI Initiative Possibilities with OCR for Banks

OCR could be a key technology to automating business operations in banking because of the various types of paper documents still in use across the industry. This technology is most useful to banks that have not employed an entirely paperless solution for their document processing system or still accept paper documents from customers for the sake of convenience.

A bank’s customers could benefit from OCR technology with smartphone apps that allow them to scan checks in order to make a deposit remotely.

In most cases, the app will simply take a high-resolution picture of the check and send it back to the bank’s database to be run through the OCR application. Otherwise the OCR would take place within the mobile app and the resulting data would be sent back to the bank.

Banks could employ OCR at ATMs to accurately digitize the personal information on a bank card to be verified by a security system. Some banks in China use OCR in conjunction with facial recognition software to provide two layers of security at ATMs. Some of these ATMs require inserting a photo ID, which the software scans for the customer’s name in addition to their face.

Applications for financial services such as mortgage loans and credit cards can also involve a high volume of paper documents that multiple employees can be reviewing at the same time with document digitization.

Banks could also use OCR software to scan paper applications along with various other forms of paperwork that the customer may use to convey responsibility or creditworthiness. The software could be trained to recognize new text arrangements and alert a human monitor about the change in format.

Perhaps the most common type of document banking OCR vendors claim to handle are bank statements. These could be needed to establish a banking history with a new account holder or loan applicant who can only access their paper records. The bank would then have proof of income on a new client without the need of an employee to verify each document.

Using Document Digitization for Rick Management

Banks could also employ OCR as a means of stronger transaction security and risk management. When used in conjunction with other automated operations such as RPA and natural language processing (NLP), OCR technology could add another layer of risk assessment for any paper document. This means the company could integrate OCR into their fraud detection or risk assessment system by factoring in data extracted from physical documents when determining risk.

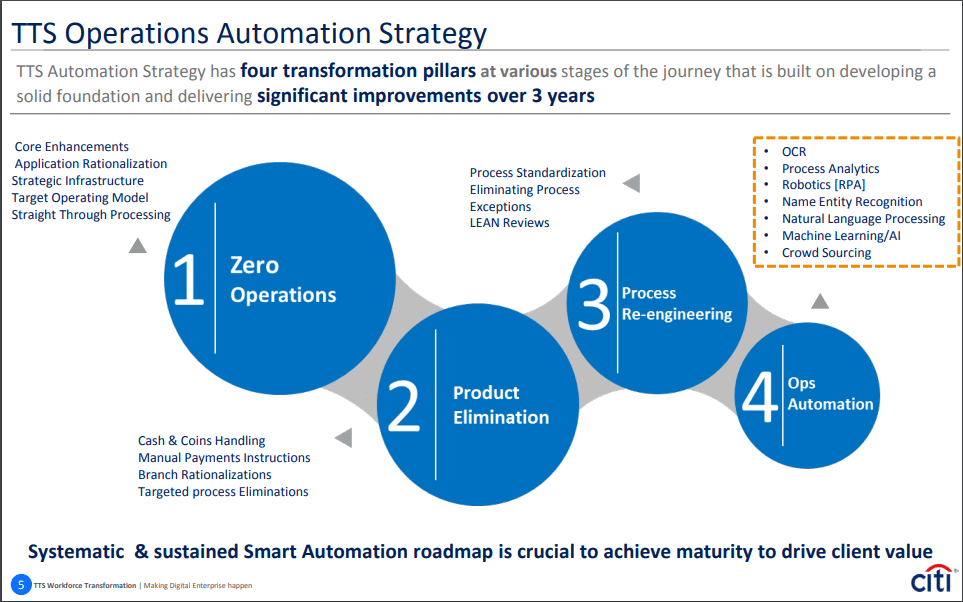

Citibank highlighted this in their 2017 machine learning and cognitive computing presentation for their advisory board.

In the graphic below from Citibank, the company illustrates that once their core processes have been automated, they will attempt to get rid of any unnecessary processes and standardize their practices. This purportedly would prepare the company for client- and public-facing operations automation, which would include OCR, NLP, and other solutions:

Finally, banks could instrument an OCR system within their mailroom, which would allow them to digitize all the paper mail they receive. Then, each piece of mail would be automatically emailed to the intended recipient.

Vendor Example: ABBYY

ABBYY is a software vendor that offers this type of OCR integration as an alternative product to their typical FlexiCapture OCR solution. This type of integration allows for a bank to instrument document digitization across all incoming mail for the business. Mailroom employees would simply scan the mail into the system and sort the documents through a FlexiCapture user dashboard.

Below is a 2-minute demonstration of how ABBYY FlexiCapture for mailrooms works. This does not show the physical documents being scanned, but what the software can do with the scans after. The user shows how they can group scanned documents and decide where they need to be sent, along with any delivery notes:

The company lists a press release indicating a french bank’s success after employing it. The client was a savings banking group called Group BPCE, and the press release states that they employed ABBYY’s FlexiCapture solution for mailrooms. They were purportedly able to fully digitize their incoming paper documents and accurately route them to the correct staff each piece of mail was intended for.

For more information on the possibilities for adopting AI within banks, our readers can download the Executive Brief for our AI in Banking Vendor Scorecard and Capability Map report.

Why Document Digitization is a Nascent AI Use Case in Banking

Document digitization for banking is a relatively nascent use case when compared to other machine vision and OCR applications within the industry. Occasionally, OCR is used concurrently with facial recognition to verify the text on a photo ID or bank card.

When we researched software vendors offering OCR document digitization to banks we found very few companies that were actually likely to be using AI. Multiple vendors did not list any case studies or press releases regarding a bank’s success after implementing their solution.

Most of the OCR companies we found also lacked significant venture capital for their AI projects along with any impressive host of AI staff. These are bad signs when considering a software vendor to provide one’s business with an AI solution. This is because they are indicators that there may not be enough experts working at the company to be able to develop a reliable AI application.

In cases such as this, we caution our readers to stay aware that some companies may claim to use AI for their solutions even though they do not indicate AI talent, case studies, or any venture funding.

Software vendors are selling various AI applications to banks for various types of automation using predictive analytics for business intelligence and anomaly detection for fraud management. Compared to these applications, document digitization is perhaps the most nascent according to our research. Below is a list of reasons this is most likely the case:

- Banks see the technology as a means of transitioning to paperless first.

- OCR may require more than one type of AI application to stay useful to the business

- Digitization and scanning solutions to not require AI to be efficient enough for most banks at this time.

A bank considering AI-based automation for their business may think of document digitization as a means of taking all of their paper documents and converting them into data for the future. This could be true even if they are not looking for a data analytics solution for that scanned data.

If a current bank were capable of converting to a completely digital platform that no longer handled paper documents, they would have likely made this change already. The alternative is that they have been researching this technology for a long time but have not decided to implement any existing solution. Banks that have a reliable system of data entry from scanned documents may overlook this upgrade in place of a more problematic business area.

Complications with OCR Adoption in Banks

Once banking documents have been digitized with the OCR software, a bank may need to use another AI application to leverage this new data in a meaningful way. This means they will need to seek out a new software vendor, establish a new integration plan, and wait likely several months for the machine learning model to train on their enterprise data.

This is a very time-consuming process which may result in a higher cost than the benefit gained from the OCR-scanned documents. Business leaders in banking should familiarize themselves with what expectations are reasonable from integrating a solution such as this, as well as requirements to make that integration as smooth as possible.

Banks may still benefit from a solution that can help them move to a fully digital platform. Software like this can facilitate file transfer and company communication as new information enters the system.

A bank does not need to leverage this data for any type of analytics or AI project in order for document digitization to be helpful. However, this is usually the case as other applications such as anomaly detection require large amounts of training data entering a system in real-time and is common in the industry.

Finally, machine vision and OCR may not be necessary for helping banks digitize their paper documents. Human error remains a significant hurdle overcome for physical data entry, this type of solution may be too much of an investment for a bank that does not have a large number of incoming documents to be digitized.

In these cases, it may be better for banks to wait for larger financial institutions and AI firms to take bigger risks on implementing automation such as this, and adopt solutions as they become more proven to work.

Header Image Credit: tbxi.com