For a tech subsector on everyone’s proverbial lips’ at the moment, things can hardly be described as ‘easygoing’ for the AI vendor startup market in 2023.

In so many words, the fundamental dynamic can be best described in the following narrative. Starting in the mid-2010s, AI went from being a well-known technology among tech hub residents to a ubiquitous and recognized presence at kitchen tables across the post-pandemic developed world – though perhaps not for the most comforting reasons.

A Pew Research poll from 2022 found 37% of American adults feeling more concerned than excited by AI. Another 45% in the same survey said they were equally worried as they were excited about the changes these new capabilities would bring to the world.

Justified or not, AI in 2023 is being looped in requisitely with perceived adjacent – and, frankly, far less proven – financial services-related technologies such as blockchain and cryptocurrencies. The controversies therein are making for a much more challenging marketing environment with unparalleled hype paired with wild misunderstandings of AI’s true capabilities.

Still, there’s money on the table to win – or perhaps more accurately: there’s too much money already on the table to stop now, with AI capabilities projected to add $15 trillion to the global economy by 2030. So how do AI vendors succeed in such a promising climate with strong headwinds?

The following article offers proven strategies for enterprise AI vendors – gathered from interviews with enterprise and vendor leaders across the Emerj podcast and written content platforms. Our guidance falls into six categories this article will discuss in depth:

- Identifying the Customer

- Market Messaging

- Focusing on the “Straight Line”

- Sales and Marketing

- Approach to Serving Clients

- Selecting Use Cases

To reinforce the integrity of our guidance, we will reference previous Emerj best practice guides and podcast content throughout.

Who Is the Customer?

Generally, B2B AI vendors are more successful the closer they can reach into the C-suite with their messaging, the farther they get away from leaders who get paid to code.

Thoughtful vendors will target the following leaders in their messaging:

- Vice Presidents

- CFOs

- “Heads of” divisions, or officially named departments

- Director-level positions outside of IT

In other words, vendor sales teams should target experienced leaders whose resumes don’t involve writing code but are responsible for solving the company’s most significant business problems and commanding the budget to execute those solutions.

Usually, companies with under $10-20 million in funding make the mistake of believing their primary sell might be to anyone in IT or data science leadership. After the $50 million funding cap, many vendors figure out data teams are a dead end. Besides, decision-making powers in many organizations behold data teams to such a leader within the business anyway.

The conflicted interests in advancing an outside AI solution for IT and data science teams therein should be obvious. Still, institutional biases also insulate corporate data science teams in favor of a more defensive attitude about budgets.

Our best advice for the problem of eventually turning these stakeholders into allies is first to work around them, then with them to achieve strategic and capability ROI:

(Source: Emerj)

Market Messaging

For vendors, market messages that can address a known pain point or workflow problems are ideal – not general AI-buzzword themes, and not “here are all our wide range of capabilities” themes. For B2B businesses, in particular, marketing messages risk becoming jargon-driven and ripe for abuse in the name of establishing positioning language.

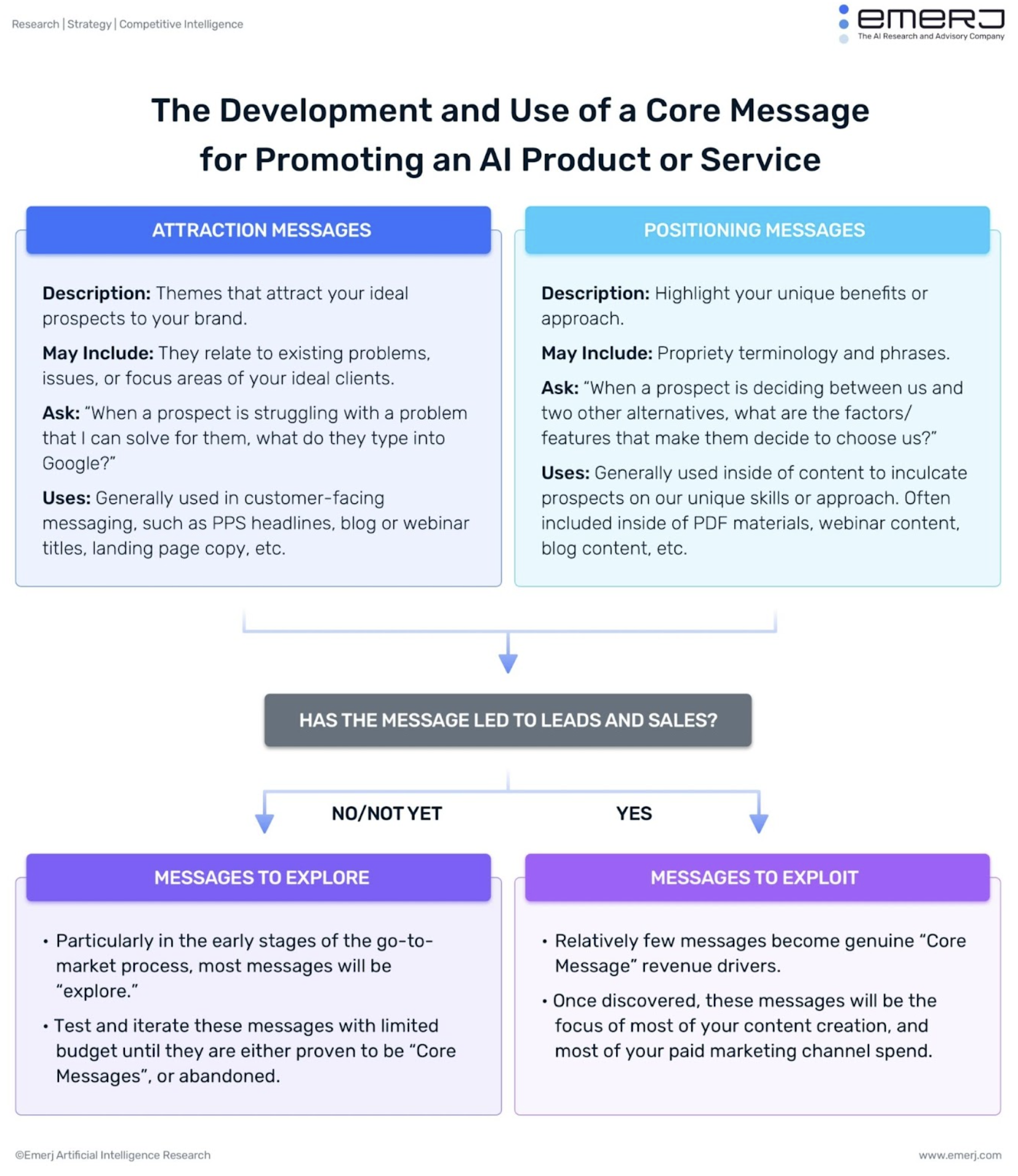

There is a natural tendency of early startup vendors to keep their messaging as open as possible. We generally refer to the early stages of marketing messaging, where vendors can’t help but keep positioning language open-ended, as the “explore stage.”

While the impulse is understandable, we consistently find that keeping marketing messaging open-ended in the long term is a mistake. If vendors can’t leave the exploration stage, they’ll have much more difficulty finding profitability as a business.

Instead, we find a far superior strategy for vendors in the following steps:

- Pair down incremental decision-making in marketing language to selecting beachheads in specific industries

- Focus their beachhead messaging on industry-specific pain points, particularly in workflows

- Offer positioning language on the capabilities of their solution after

Moreover, the best way vendors can ascend from the explore stage is by deliberately determining what person in an enterprise has the budget and need for the capability the vendor has built. In other words: Who in the organization is kept awake at night worrying about the problem your business is trying to solve?

By effectively targeting these individuals based on market, estimated budget, and their needs, vendors are in a much better messaging position to claim significant market share as they grow and develop “core messaging”:

(Source: Emerj)

Focusing on the “Straight Line”

Vendors will also want to develop content that addresses the same point that will motivate clients to buy their products. What they really want is a “straight line” from content to purchase, usually through an opt-in page to a webinar or white paper that leads to a sales call tied directly to the pain point addressed in the content.

What is further meant by a “straight line” content marketing strategy is that:

- No one will go to the landing page if the content does not deal with specific pain points.

- If the content deals with specific pain points, but the landing page does not, anyone who opts into the content is probably not worth considering a viable sales lead.

There has to be a direct connection – the “straight line” – from the prospect’s pain point to the vendor’s message, to the landing page, through the content, and straight to the opt-in sales call to talk about the solution to the prospect’s pain.

Sales and Marketing Best Practices

The best practice that startup AI vendors, particularly, can exercise regarding sales and marketing strategy is selecting industries and beachheads early and sticking to them. If early AI vendors can secure these beachheads and prove they can improve workflows where their potential partners are feeling the pain, then they will successfully secure market share.

The problem can be early stakeholders advising budgetary weariness, caution, and open-ended marketing language to cast the broadest possible net with the market. We have seen in our observation of the startup market that, over and over again, this is a road to nowhere as an early AI vendor marketing strategy.

In so many words, vendors need to prove to their markets that they know their subject matter. They do so by creating a direct line of communication from their sales professionals – speaking about their customers’ problems and pain points over the phone – to the marketing department translating those problems and pain points into the focal points of future messaging.

Vendors can effectively make these connections between sales and marketing departments starting by asking their sales professionals the following questions:

- What was the reason customers bought from us?

- Which narratives (problems, pain points, opportunities) should we market to our target titles (VPs, CFOs, heads of departments, etc.)?

- What are the most significant objections that these titles have had to our value proposition?

- How have you overcome them in face-to-face selling?

Marketers can use these answers to lead with the right messages, preemptively overcome hurdles to trust and objections and move the conversation to a sale.

What is essential for vendors to remember is that, with a new product line or service, some of your feedback will not necessarily be from buyers but from other prospects in the pipeline. These professionals can provide clues as to pain points in workflows and help develop separate beachheads for landing-and-expanding strategies elsewhere in the prospect organization. Such efforts are not entirely fruitless in the sales and marketing process.

The questions in the bulleted list above are essential to ask not only of buyers but also prospects in the pipeline as well, as it’s important to know:

- What attracts the prospect to the vendor offering?

- Which individual in the pipeline can actually make the purchase? Why or why not?

Creating that connection between sales and marketing that turns prospect feedback into effective messaging can only be done if industries and beachheads are consciously chosen once the vendor is equipped to emerge from the explore stage.

Approach to Serving Clients

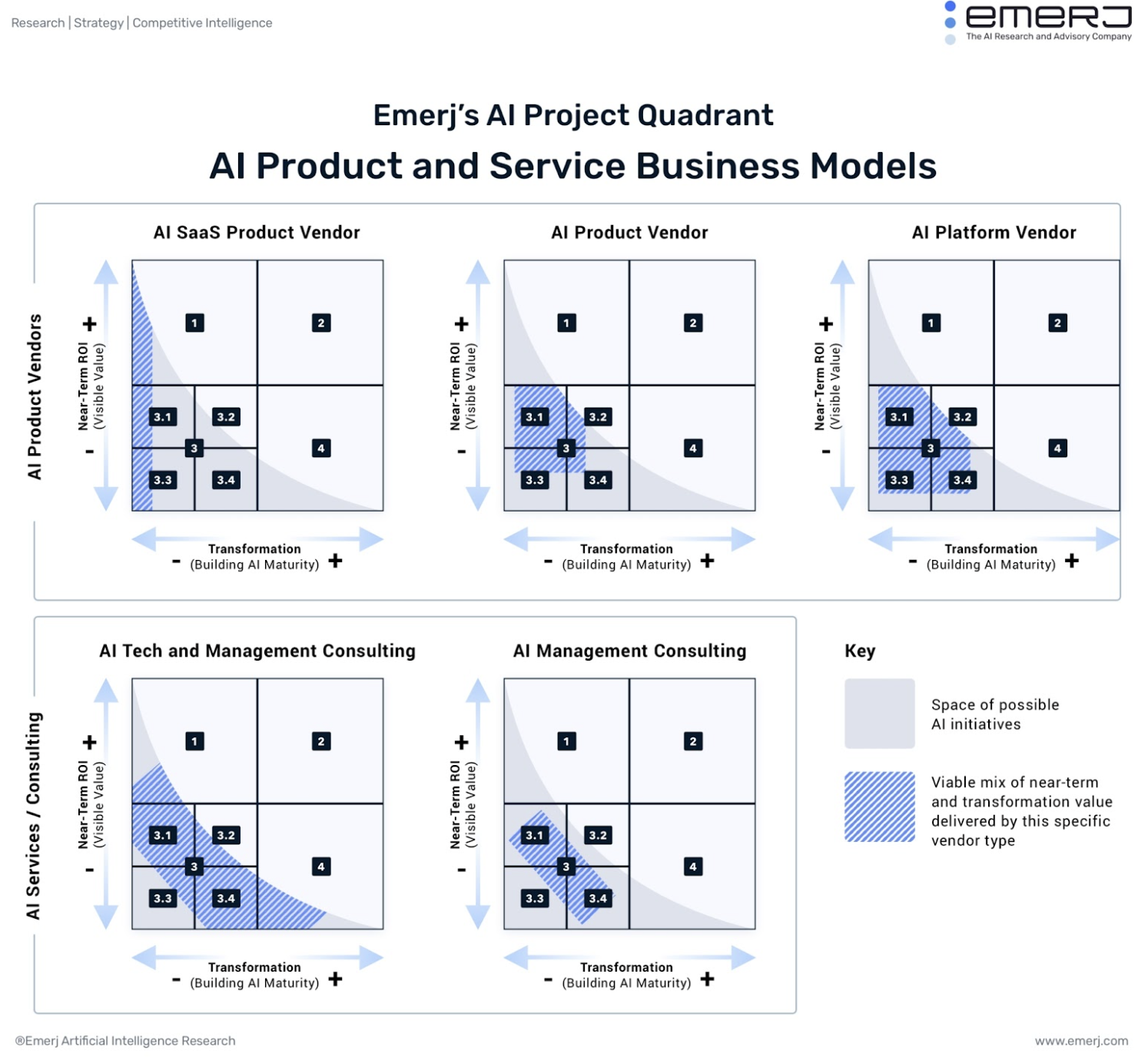

Over the last decade, AI vendors have learned the hard truth that achieving immediate ROI from an AI project is at odds with building long-term AI capabilities that can fundamentally transform a business. Furthermore, to sustain AI capabilities long-term, adoption teams must constantly track and discuss some sense of ROI.

For example, a fraud model needs to be constantly trained and updated to stay ahead of new kinds of fraud. If a client doesn’t update their fraud model, it will mean diluted results and interruptions in recurring revenue for the vendor. In such a way, the business models of successful AI vendors must be fundamentally different from traditional SaaS companies by the very nature of striking that balance.

(Source: Emerj)

From here, there are two general approaches that AI vendors can take. The first is an AI SaaS hybrid approach (top left-most figure in the graphic above), whereby the vendor:

- Leans into the immediate ROI and away from the intense training, workforce, and transformational leadership involved in building AI maturity.

- Typically fits their product as a small dashboard into an existing workflow, which needs to be integrated with more data and performs a simple and ultimately time-saving task.

- Tends to operate more like a consultant and traditional SaaS company in marketing and practice.

The second and far more intensive path is the Platform or “land-and-expand” (top right-most figure in the graphic above) approach, whereby the vendor:

- Has the funding means to lean into the intense training and incremental building of initial relationships with client stakeholders – let’s say, in fraud detection – to educate them in using the vendor’s comprehensive platform.

- Can play the long-term “land-and-expand” game, integrating other stakeholders within the prospect organization to use their platform in other potential use cases. If the initial partnership started in fraud detection, the vendor might be able to attract attention from another stakeholder in the organization dealing with communications surveillance.

- Operates aim to become fully integrated with the prospect’s business and achieve long-term ROI because they have expanded to the point that the client can’t possibly conceive of separating themselves from or “turning off” the platform.

Obviously, the second ‘Platform’ approach is complex for many reasons, not least because it requires tremendous upfront investment and the long-term strategic capacity not just to land – but expand. Without expanding, the ROI necessary for a Platform approach to succeed can’t be realized if only a few individuals at the client organization use the platform for few or spare functions.

Selecting Use Cases

As we advise in the case of in-house enterprise adoption, the best philosophy for selecting use cases is to pick smaller operations that don’t alter existing workflows.

From here, two strategies emerge depending on the vendor’s place in the Saas to more pure AI scale as a solution.

- For Saas: You want to land quickly, using little resources, and leave just as quickly.

- For AI Platforms/land-and-expand strategies: You can expend more effort and resources in your landing, but you should be as expedient and explicit in your plans to expand once the landing is over.