The insurance industry is dominated by large global firms that deal with thousands of customers filing insurance claims every day. Claims processing is a huge part of the insurance business process and improving turnaround time for each claim is critical to reducing operational costs at insurance firms.

As such, insurance carriers might find it challenging to improve their claims processes due to the sheer scale of incoming claims. In other words, it’s difficult for them to pick up on patterns within their claims data that they may want to act on. This is a classic case for artificial intelligence. AI could help carriers to meet customer demands that might arise from patterns in claims data at scale without dramatically increasing operational costs.

Several Insurance carriers have already worked alongside AI vendors to deploy AI in various applications; we previously detailed the application landscape for AI in insurance and distilled some of the key trends in this space.

In an effort to understand what technologies insurance carriers need to focus on in order to improve business operations in claims processing, Insurance Nexus released the Connect Claims 2019 Report. The company surveyed over 600 executives, including Chief Claims Officers, from the insurance sector worldwide. Insurance Nexus details the results of their survey in the report including:

- Pointers for insurance carriers on how they can integrate new technologies such as machine learning, NLP, and robotic process automation by maintaining compatibility with their existing legacy systems.

- The report also discusses which technologies might disrupt claims processing where insurance carriers need to invest to make use of limited time and budget and maximize impact on customer and business efficiency.

- Identifying which divisions inside large insurance carriers might be most impacted in the short to mid-term by using technologies such as AI to improve claims processes.

Insurance Nexus states that the survey included respondents from insurance companies (48%), services/solution providers (21%), brokers and agents (13%) and technology providers (12%) from across the globe. Of these, the majority of respondents were from Europe (39%), followed by North America (26%) and Asia Pacific (16%).

With the survey being focused on claims, a majority of the respondents (40%) were from claims or special investigations unit (SIU) divisions in insurance firms. Apart from this, 21% of respondents were C-level executives, and a significant portion were from the digital transformation, innovation, strategy, and IT teams. According to Insurance Nexus, the survey included companies that offered B2B, B2C, and property & casualty insurance.

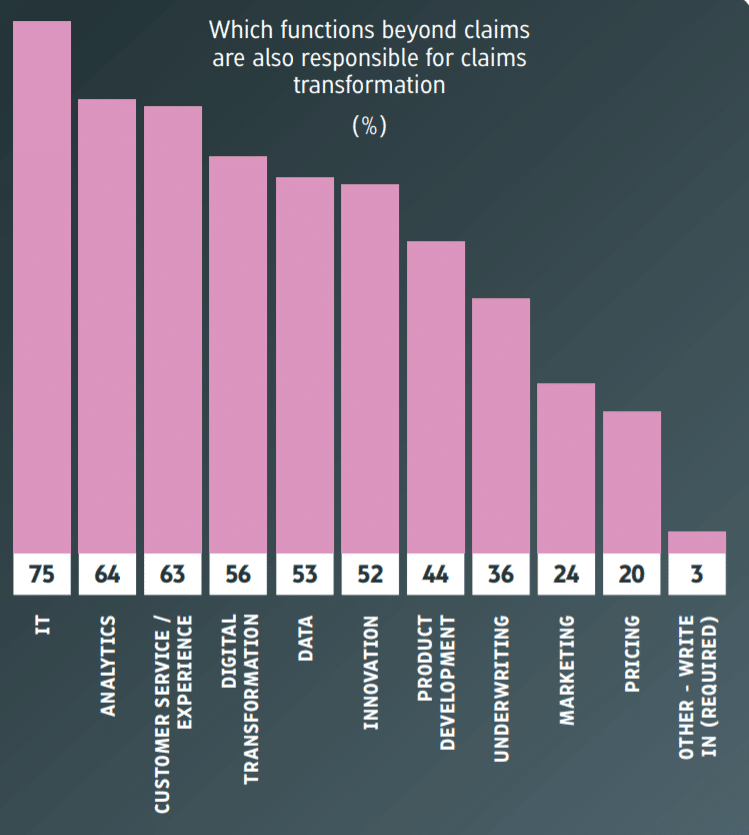

Which Functions Beyond Claims are also Responsible for Claims Transformation?

The report from Insurance Nexus identifies that apart from functions performed by claims or special investigations units themselves, IT (75%) and Analytics (64% ) are the business functions that might contribute the most to improving claims processes. This might indicate that insurance carriers have now realized that having access to large volumes of data and the right kind of data science resources can help glean actionable insights from the data.

Strong analytics and IT teams can also give insurance firms options for automating claims fraud detection. Natural language processing (NLP) software might identify patterns in historical fraudulent claims applications and raise red flags if those patterns show up in new incoming applications. AI approaches such as anomaly detection or predictive analytics might help insurance carriers find fraudulent claims faster and with higher accuracy than human counterparts.

For example, AI software can help identify fraudulent insurance claims based on historical claims data. Predictive analytics might help detect discrepancies in an application that were previously identified in old fraudulent claims by training on claims data. Insurance carriers might find that predictive analytics helps with detecting suspicious claims that might be fraud. Anomaly detection-based AI software might help insurance carriers detect and flag activities as fraud in real time while a user is interacting with or submitting a claim to an online platform.

But data alone is not a sufficient condition for successful implementation. AI and data science require a high degree of technical capabilities to analyze the data and derive meaningful insights.

Hiring data scientists and software development expertise alone might not be a winning strategy in the long-term. This is mainly due to the fact that the cost of deploying technologies such as AI or machine learning while high currently, will likely drop to the point where it is accessible to a majority of insurance firms. It is also likely that most AI-based capabilities achieved will become universal in the industry in the long term.

The key to achieving impactful differentiation might lie in understanding customer needs and improving customer experience. 63% of respondents felt that after IT and analytics, customer service functions might impact the claims processes the most.

Turnaround time, which is the time it take to process each insurance claim, might be critical to delivering customer satisfaction. The report from Insurance Nexus also states that one in seven customers believes the claims process for their insurer takes longer than necessary.

At the same time, creating a claims process that is fast, but does not make it easy for the customer to track and be informed about the status of their claims applications, might still cause issues for customers. Thus, it might be critical for insurance carriers to invest in technology that helps make their claims processes faster while simultaneously ensuring that the process is open, transparent, and predictable.

At the moment, AI applications might still be termed nascent in the insurance industry, and the vendor landscape seems to be rapidly evolving. As such, insurance firms might have a host of technologies of varying capabilities to choose from.

That said, with the insurance industry expected to embrace new technologies the most in the short to mid-term period, insurance carriers might find that they need to iteratively improve any such implementations over time. This might be derived from the fact that 52% of respondents cited innovation as the key to claims processing improvement.

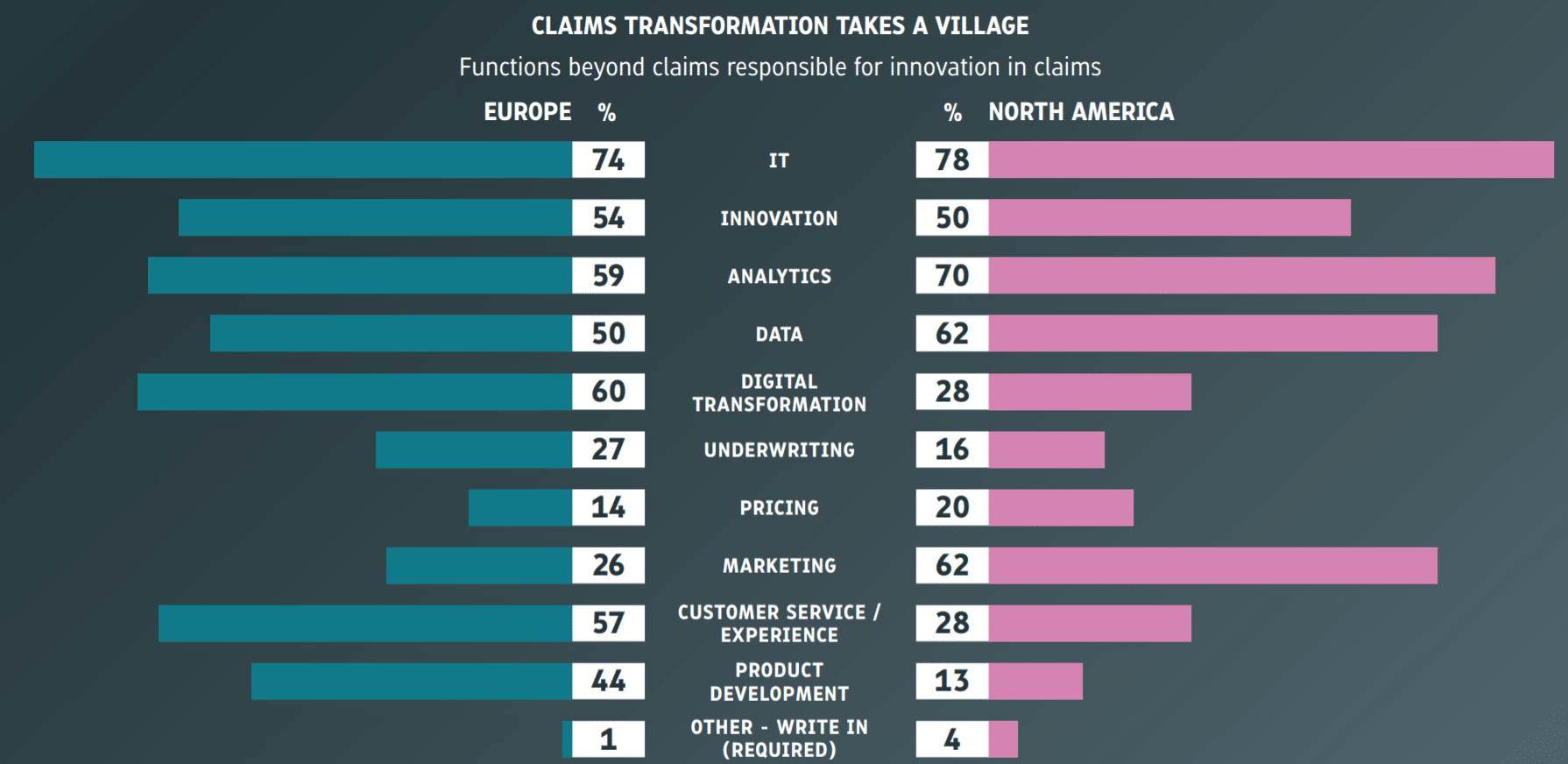

Comparing North American and European Approaches

North American respondents seemed to believe that analytics, marketing, and data are the functions that might help improve claims processes the most while European insurance firms seemed to favor investing in better product development, customer service, and underwriting as a way to improve claims processing efficiency.

In terms of customer service, North American insurers might be hindered by the fact that building customer relationships is directly impacted by broker networks. Carriers in North America might fight it challenging to have direct relationships with their customers, thus affecting the claims experience.

In many cases, North American insurance firms might find that dealing with broker networks might cause issues such as data loss and duplication, improper product recommendations or unforeseen delays in claims management.

On the other end of the spectrum, in Europe, insurance carriers more commonly interact with their customers more directly, eliminating any data errors caused by middlemen such as brokers in the process. This might very well explain the higher percentage of insurance carriers in Europe believing in a claims improvement strategy based on digital innovation and product development.

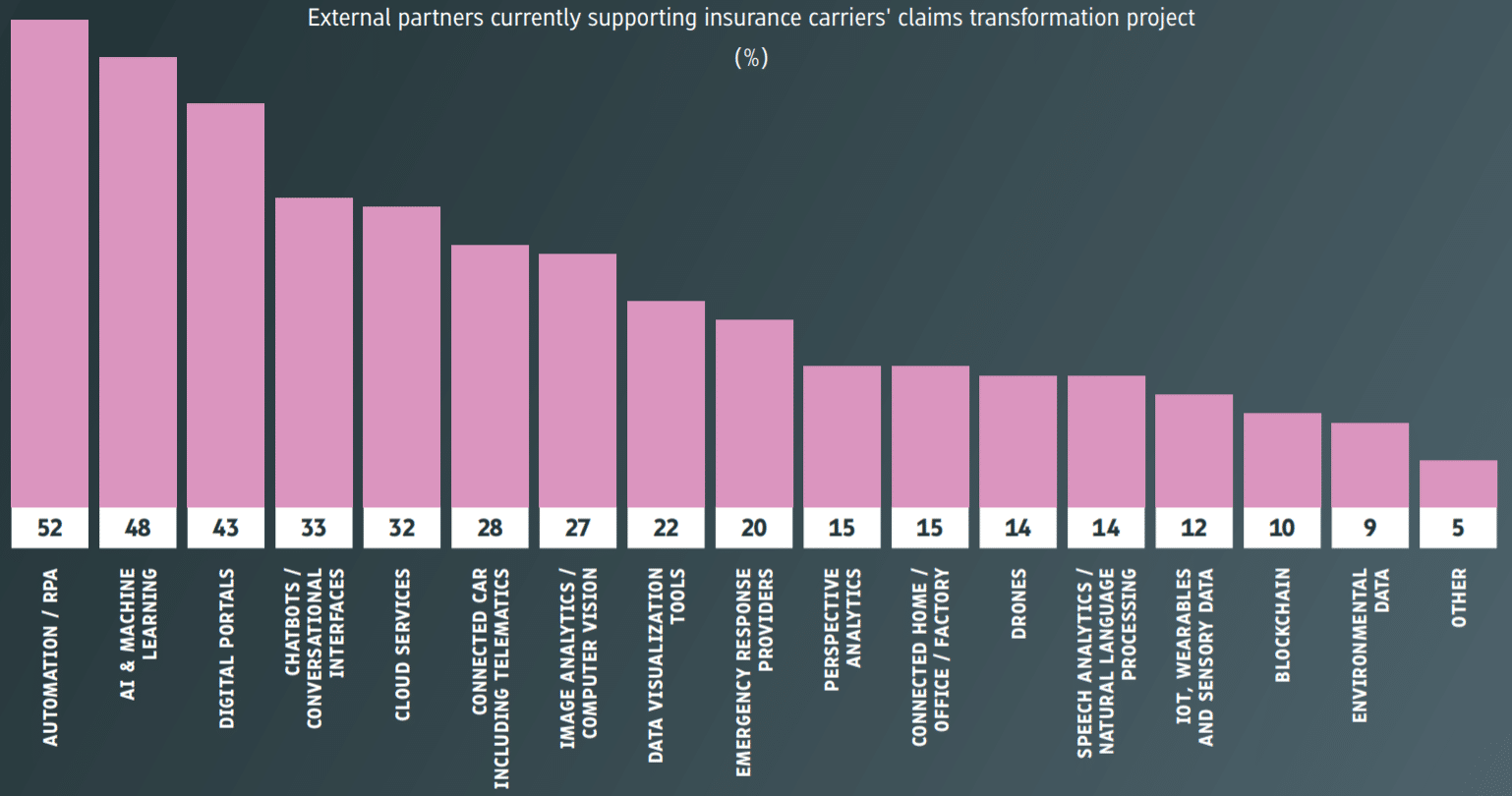

External Partners Currently Supporting Insurance Carriers’ Claims Transformation Projects

With IT and Analytics being the most prioritized business functions, it might seem unsurprising that many insurance executives who took part in the survey stated that they are working with external vendors to support Automation/RPA (52%), AI and Machine Learning (48%) implementations. According to the report, AI and machine learning were largely applied towards the automation of insurance claims processes and improving customer experiences.

In alignment with the top business functions chosen by the respondents, which included customer service, IT and analytics, several insurance firms have also invested in chatbots and conversational interfaces. But the effectiveness of chatbots is still not clearly understood to be significant in all cases.

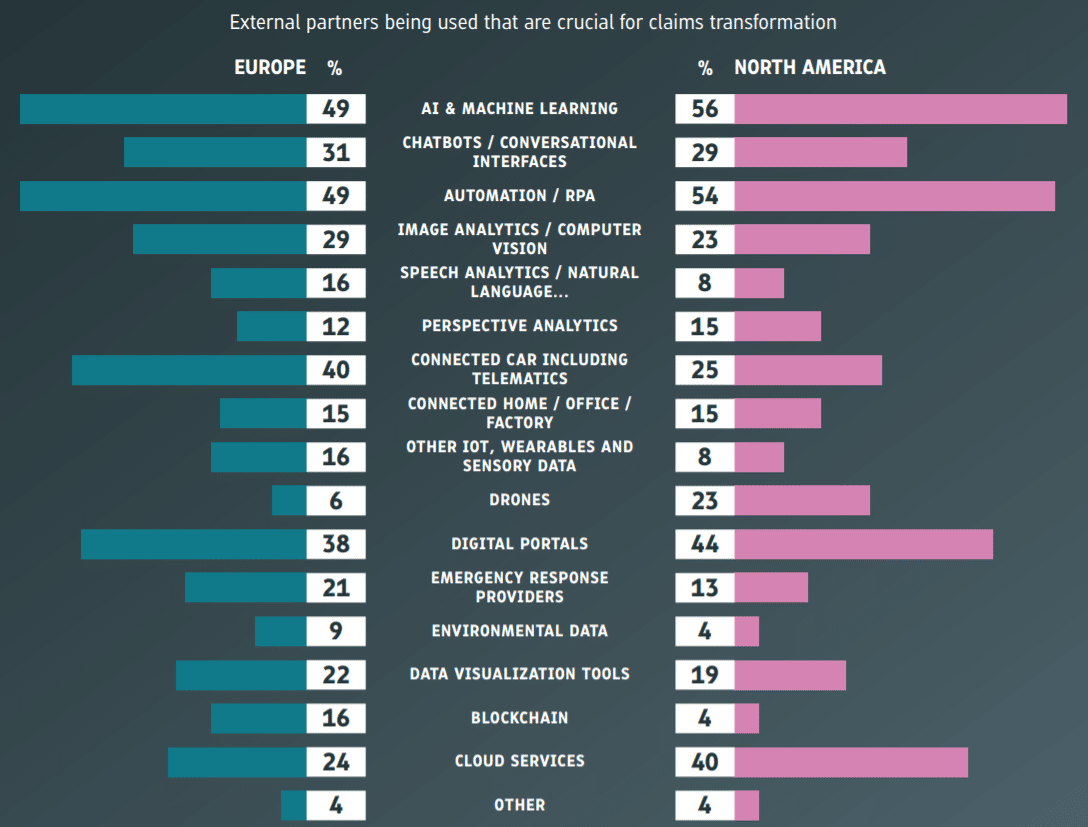

Comparing North American and European Approaches

A majority of insurance firms in both North America and Europe claim to be working with external partners for AI, machine learning and related projects such as chatbots. Yet insurance carriers in the two regions vary in terms of adoption of some of the other technologies.

For instance, auto insurers seem to be a lot more interested in collecting car telematics data to personalize insurance products than insurers in North America. This might be due to the more developed connected car ecosystem in Europe.

The recent GDPR regulations in Europe also seem to have affected the way insurance firms in Europe and North America view cloud services. The report suggests that American executives favor cloud services (40%) more than Europeans (24%).

The lower scores for technologies such as Internet of things, natural language processing, and speech recognition might suggest that insurance executives might still be unaware of the nuances in AI and related technologies. That said, insurance executives identified that AI and machine learning are technologies that they might have to pay attention to at some point in the future.

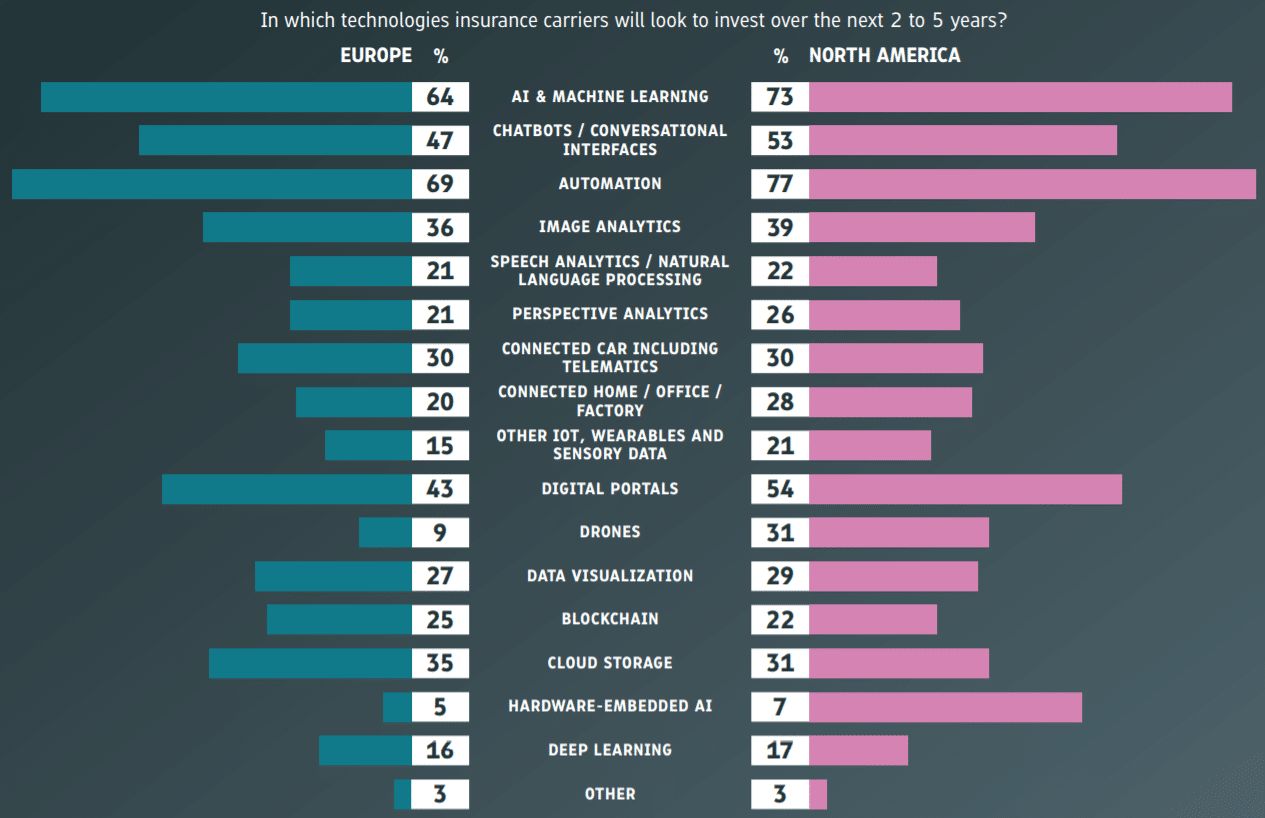

Technology Investment Trends – 2 to 5 years

In the short to midterm future, insurance firms across the globe might likely continue to invest in automation, AI and machine learning projects with 73% and 61% of respondents looking to invest in these areas respectively.

The report also indicates that the next two to five years might see the most disruptive changes to the claims processes in insurance firms. Both American and European executives indicated that they plan to invest in automation projects in the next two to five years although this investment might likely reduce to some extent in long term between five to ten years.

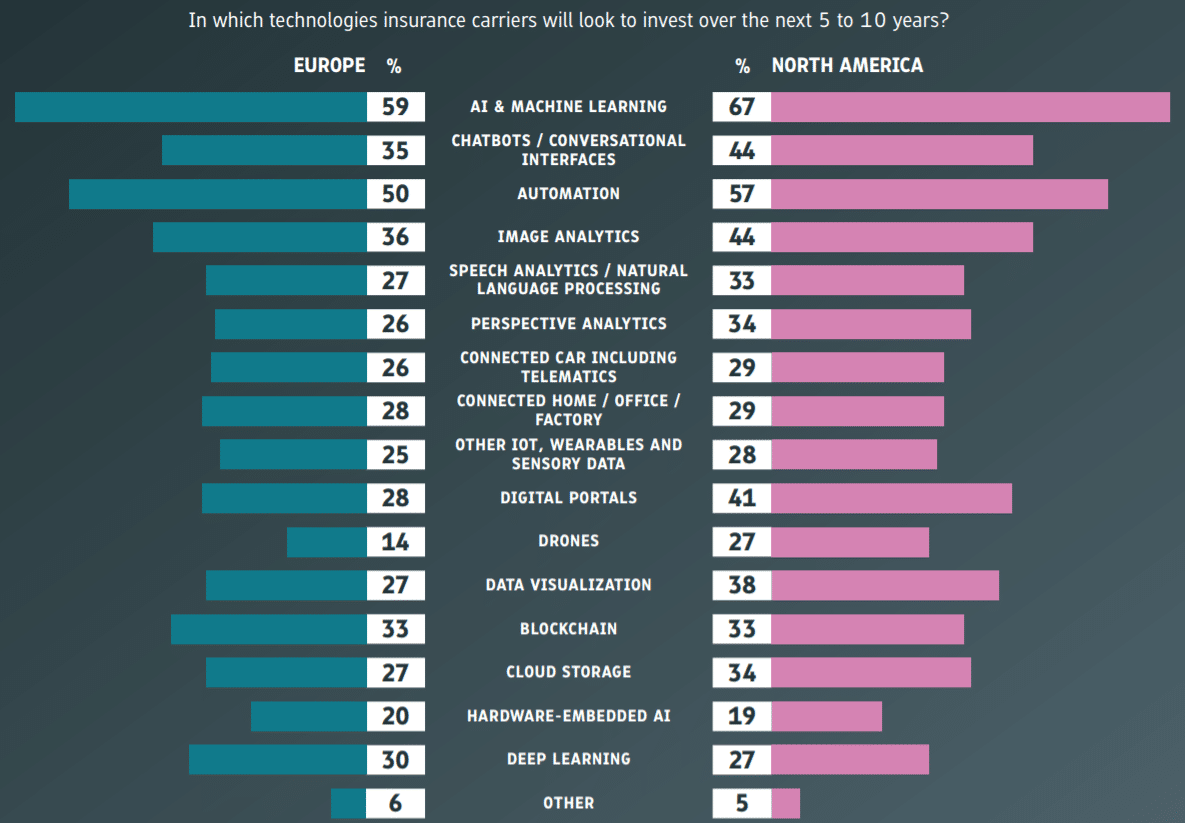

Technology Investment Trends – 5 to 10 years

It seems likely that in the long-term, automation will be more accessible due to reduced costs and resources needed. In essence, in the next five to ten years insurance firms might expect to have finished upfront spending on RPA and automation.

AI and machine learning, however, seem to be continued areas of interest for investment among both European and North American insurance executives even in the long term. Over the next five to 10 years, 67% of North American carriers will look to invest in AI and Machine Learning while 59% of Europeans will commit to it. This may reflect the degree of complexity of the technology, as well as the level of upkeep required for the data needed to feed these systems.

Concluding Thoughts

The report from Insurance Nexus identified many critical areas that might help business leaders make the right decision with regards to technology investments. We distill some of these below:

- IT and Analytics might be the key functions that help insurance firms improve their claims processes

- Customer service and experience improvement are a vital part of claims and insurance carriers might find that working with external third party vendors for technologies such as AI and machine learning helps speed up the process.

- Currently, most smaller and medium insurance firms might find that they don’t have enough capital to completely overhaul their claims processes. Yet this might change in the long term.

- Investing in AI might be the highest priority for insurance carriers in the next two to five years

- AI and Machine Learning capabilities are expected to mature in the next five to ten years, with increased investment expected in that front in the coming decade.

There was almost unanimous agreement among respondents that AI and machine learning are going to be the areas of maximum investment for insurance carriers in the near future. Bt most such initiatives require a lot of data, resources, and capital. Insurance firms might need to initiate organizational changes and train their employees to manage AI and data science projects.

The results of the survey suggest that the complete extent of use cases for AI and other technologies, such as deep learning, have not been explored a lot currently by insurance experts. That they’re likely to invest in it so much less than AI and machine learning when deep learning, in fact, falls under the AI and machine learning umbrella perhaps indicates that the respondents don’t really know what deep learning is. This shows the nascency of AI in insurance, despite the fact that AI has several established use cases in insurance already. In other words, insurers don’t seem to be aware of what will soon be available to them with AI and machine learning.

Additionally, European insurance carriers seem to be slightly less open to AI investment in the long term as compared to North American insurers.

These investments might help insurance firms around the world improve efficiencies in claims processes and allow for much-improved customer experiences With the insurance industry catching on to the benefits of digitization, the interconnectedness of divisions in an insurance firm might only grow in the future.

Insurance firms that have traditionally used legacy systems and largely function with each division’s data being siloed, might find it challenging to assimilate all of their data and derive insights. Business leaders as such might need to find ways reorganizing their teams to get them operating as a connected, efficient entity.

This article was sponsored by Insurance Nexus, and was written, edited and published in alignment with our transparent Emerj sponsored content guidelines. Learn more about reaching our AI-focused executive audience on our Emerj advertising page.

Header Image Credit: Insurance Information Institute