Robotic Process Automation (RPA) is a rule-based software solution that automates repetitive tasks without any self-learning capabilities. It is not inherently artificial intelligence. RPA vendors now offer AI-tools as add-ons to their automation platforms. This includes RPA applications in banking where some form of AI, such as computer vision or natural language processing, is a part of the automation workflow.

In the banking and financial industries, which involve large-scale manual workforces, RPA has been used in the past with the aim of saving cost, time, and human effort. For instance, banks have used RPA software to automatically retrieve information from external auditors or correct formatting and data mistakes in incoming funds transfer requests.

Several vendors now offer RPA software that have AI capabilities added on as a feature. In essence, AI capabilities can potentially make regular RPA software “intelligent” and capable of getting better at tasks over time.

Readers looking for more context on RPA can refer to our article, What is RPA?, which deals more with how RPA systems function. The article also explains how RPA can allow human employees to focus on tasks that software cannot yet automate.

In this article, we focus on use cases that involve both RPA and AI in the banking industry. Although, readers can view the video below (from SAP) in order to get a better understanding of the context behind RPA and intelligent software robots that use AI technology:

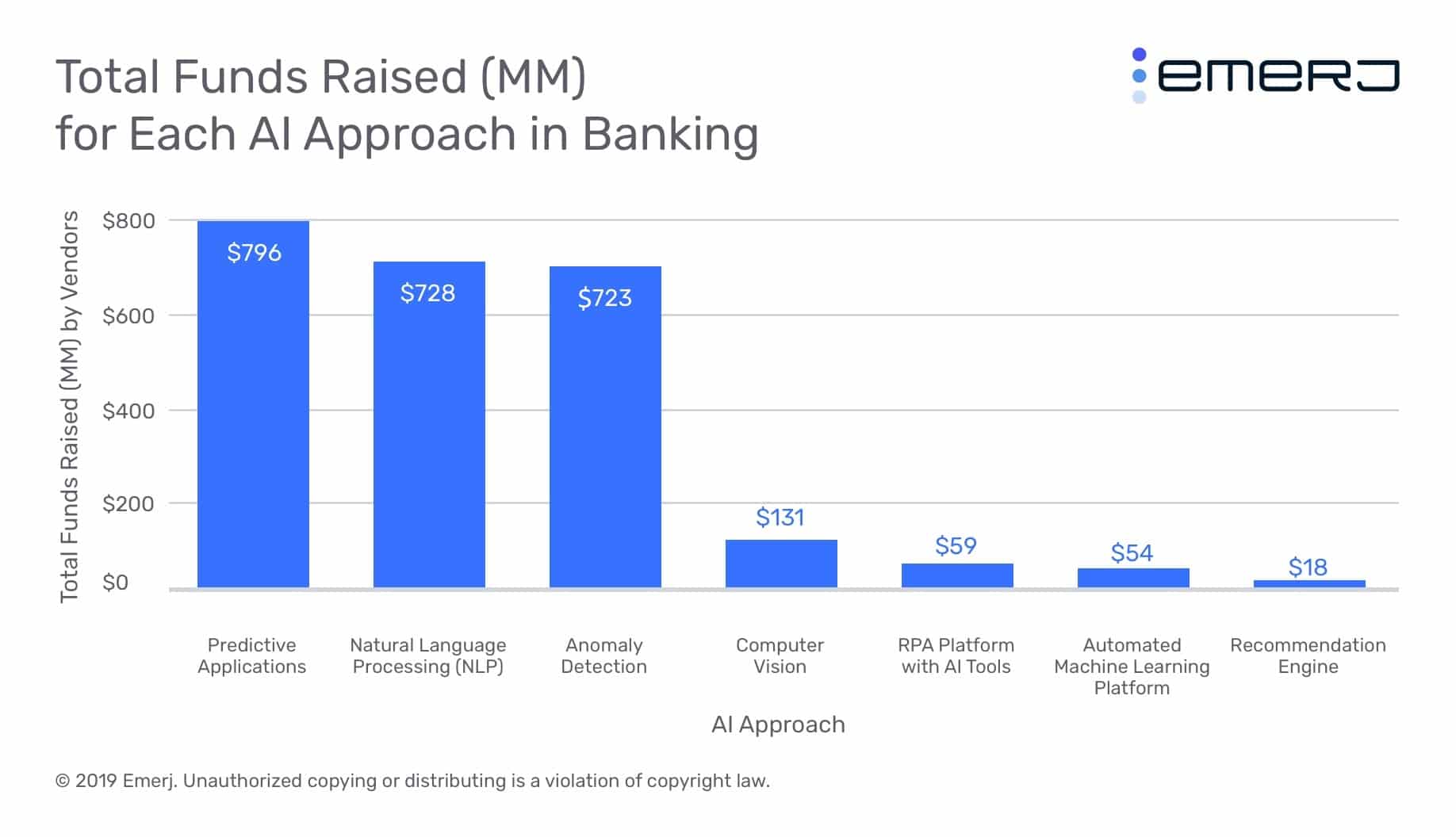

We recently launched our AI in Banking Vendor Scorecard and Capability Map report where we categorized over 77 AI product offerings catering to banking functions.

In our report, we found only one vendor selling into banking specifically that offered an RPA platform with additional AI features. That said, there are several RPA vendors that are not banking specific and offer AI features in their products, and these platforms can potentially be applied to banking use cases. We discuss one of these vendors, UiPath, later in this article.

Insights Up Front

Despite this low number, we expect RPA platforms to add AI enhancements to their products in the next five years since the capabilities gained from this would be hard to compete against for products that are not AI-based.

Blue Prism, the vendor covered in our report, raised $59 million, more than vendors offering Recommendation Engines, but far less than vendors offering anomaly detection, natural language processing, and predictive analytics products. The breakdown of funding by AI Approach across AI vendors in banking is presented below:

That said, in the banking industry, there are several repetitive processes in functions like fraud, cybersecurity, compliance, risk management. For example, in compliance operations, employees might need to copy information from an internal document to compliance forms. In fraud detection, employees might need to sort through vast volumes of data in spreadsheets, extract specific data points, and generate an incident report. RPA has the potential to automate parts of these processes.

Business process automation across banking functions is also an area where RPA products can add value if they come with AI capabilities. BNY Mellon, for example, claims it deployed 220 “software bots,” instances of RPA software, which they acquired from Blue Prism.

The experts we spoke to for our research seemed to agree that banks that have engaged in successful RPA projects might find it easier to transition into AI.

This is largely due to the fact that these organizations have already allocated IT budgets, have existing IT teams, and have some existing data infrastructure to draw on. Although this does not guarantee success in AI projects, adding AI features to an existing RPA platform might be relatively simpler to do.

For example, in a consumer loan processing application, employees at banks might need to do highly repetitive manual tasks, such as copying and pasting information between emails, loan-processing systems, and several government websites. The process usually goes as follows:

- When the customer calls the banks, a customer service employee on-boards them into a loan processing system.

- The consumer loan officers at the banks then perform a manual credit rating check and then usually copy all this information into other databases required for compliance or data storage purposes

- The information given by the customer, such as names and addresses, are cross verified against government records on websites

This whole process is manual and needs to be done over and over again for each customer.

An RPA implementation might vastly speed up this process and allow for loan officers to focus on more pressing intellectual tasks.

When the loan officer receives the on-boarded customer data, at the click of a button, an RPA software could automatically perform the credit check, copy all the information to other databases and cross verify the data against government records all automatically, allowing for more time to enhance customer service experiences.

Examples of these added AI features can be computer vision or natural language processing for automated document digitization and context-based searching among vast volumes of data. For instance, lawyers at banks might have to spend thousands of hours reading through paper contracts and other documents.

An RPA system with integrated computer vision and natural language processing capabilities could automate workflows for digitizing paper documents and then taking the digital text and making it searchable through contextual NLP-based search. Such a system may save banks thousands of hours of work by lawyers or loan officers.

RPA Use-Cases in Banking

Since RPA can broadly be applied to a vast number of business process automation projects, there are several well-established use-cases in this space. In this section we delve deeper into a few of these use-cases along with examples:

Optical Character Recognition

RPA platforms can come with intelligent OCR solutions which can help banks take handwritten forms or applications and automatically convert, verify, and edit the appropriate field in corresponding electronic forms. For example, if a customer submitted a handwritten KYC form, human employees are required to manually transcribe all this information into digital forms in several steps along the process. This is a time-consuming, repetitive task.

When an RPA platform is used, an employee could scan a paper KYC form and the digital image is sent to a software robot. AI-enhanced RPA software can automatically read through each character in the form and replicate it in digital forms.

The software gets better at this process over time through inputs from customer service operators during the training process where each character that is not correctly identified is corrected, eventually increasing the accuracy of character recognition. The overall business benefit is in cost and time savings for banks.

Automatic Report Generation

Banks are required to create compliance reports for any fraud and cybersecurity incidents that they come across in the form of Suspicious Activity Reports or SARs. Compliance officers manually read through all the investigation reports and fill in the necessary details in the SAR form.

The form is well-structured and the information that needs to be provided for each incident is usually largely similar. Yet the task is highly repetitive and eats up a lot of time and manual effort.

RPA platforms with natural language generation capabilities can read through lengthy compliance documents and extract the relevant sections from each document in order to create the SAR.

The software can usually be trained with inputs from the compliance officers on which parts of each document best fit each section of the report. The business benefits lie in vastly reducing the time taken to perform this task, which also means reduced operational costs.

Customer Account Onboarding and Account Closing

Banks can deploy RPA platforms to enable software robots that can help automate the process of collecting and sending the information collected during an onboarding meeting between a bank employee and a customer. First, the advisor fills out an on-boarding form during the call and then updates similar information on the customer portal.

This is a repetitive and time-consuming task and deploying RPA systems for this task might potentially lead to efficiency savings and reduced errors in transfer of this information.

For instance, if a customer attempts to close their loan account, RPA software bots can be used to verify if the loan amounts have been completely repaid and the bank’s processes have been followed for the closing of the account.

RPA Vendor Profile: UiPath

In this section, we look at UiPath, an RPA platform provider that claims its software is equipped with AI features that can help banks and financial institutions automate credit scoring, fraud detection, and other processes. Below is a video demonstrating how UiPath’s “desktop automation” function works:

The company’s RPA platform is made of individual software parts: Uipath Studio, Uipath Orchestrator, and software “robots.” UiPath claims banks and financial institutions input data such as credit history information of loan customers and transactional information from banking customers to detect fraud.

UiPath Studio is a visual flowchart interface that enables users of the software to create and control automation workflows. The output of this scripting in UIpath Studio is sent to the UiPath Orchestrator.

The Orchestrator software allows institutions to select, run, and monitor the performance of each of their software robots and workflows. For instance, banks can create robots that automatically scour through transaction data to identify suspicious activity.

The RPA Platform also has additional AI capabilities, such as intelligent optical character recognition (OCR) and natural language processing (NLP) tools. UiPath claims they are developing machine learning capabilities in their RPA platform that will allow for intelligent software robots that learn over time to do a particular task better.

In a case study, UiPath claims to have helped an unnamed global investment bank with automated trade matching operations. Trade-matching is a part of the trading process where trade details between the client and broker are compared in order to execute the trade.

This matching needs to be performed within a certain window of time, failing which trades may require human intervention in order to be executed.

According to the case study, UiPath claims the bank was experiencing several errors in their trade matching process and human analysts were spending far too much time in this process which was recorded as around 40 minutes.

The bank purportedly deployed Uipath’s RPA platform to perform trade executions and claims to have reduced the average time taken for each matching operations down to 3 minutes after the integration of the software.

RPA Adoption Best Practices

Banks who have previously engaged in RPA projects might be interested in adding artificial intelligence capabilities to their software robots to optimize their functioning over time. We might see RPA platforms that have machine learning techniques built into their functions to automatically prompt businesses with insights on improving efficiency. RPA might still be a necessity only for firms with large enough scale of operations where the integration and capital costs are justified by the cost savings achieved through automation.

The experts we spoke to also seemed to suggest that the adoption of AI and RPA in banking might play out in two phases.

Smaller and medium-sized banks might embark on one-off projects simply due to budget constraints or unclear leadership. Automated document digitization and contract abstraction are good examples of such projects. Large firms with existing IT budgets, teams, and existing automation efforts might focus on overhauling some of their business processes using RPA and AI. Ian Wilson, Former Head of AI at HSBC and one of the advisors in our AI in Banking Vendor Scorecard report seemed to agree:

There’s two parts to AI adoption in my opinion: the ‘do what you are currently doing better phase’ and the ‘reimagine your business phase,’ and I feel everyone is focused on the first phase right now. So a lot of RPA is where I see AI being applied. That’s where banks already have existing automation efforts and budgets allocated. What’s driving things right now is cost reduction.

Vendors and news media are often using the term “Cognitive Robotic Process Automation (CRPA)” to describe RPA with AI features. CRPA is a type of RPA software integrated with additional cognitive abilities in order to automate perceptual and judgment-based tasks. For instance, AI vendor Expert System seems to define CRPA on their website as follows:

Cognitive automation is not machine learning by itself. Cognitive automation leverages different algorithms and technology approaches such as natural language processing, text analytics and data mining, semantic technology and machine learning.

CRPA might become more common in banks with phase 1 projects being able to do tasks that banks already do with higher efficiency. In phase two, which might require even more vast volumes of data and technical data science know-how, RPA platforms might be more seamlessly connected with AI capabilities taking a larger role in how the enterprise RPA platforms were developed in the first place.

Banking leaders looking to engage in RPA and AI projects can use the following steps as a jump-off point to achieve successful implementations:

- Starting small with pilot projects can help iron out any kinks in the project before scaling up. In banks, lending operations usually have several repetitive manual tasks that might be a good starting place for such projects

- Identify workflows that involve rules-based tasks such as copying specific information. These might ideally be high volume tasks that occur with low frequency such as creating a lengthy annual compliance document or low volume tasks that occur very frequently such as bank reconciliations.

- Working with RPA developers to implement projects might help in cutting down deployment times since any such project is not going to be a one-time installation, but rather developing a system and then testing the system over time to increase its accuracy.

Header image credit: BBVA