When it comes to business applications of machine learning, marketing is always near the top of the list. Modern digital marketing offers a huge volume of quantifiable data for teams to work with, and marketing can be said to take precedent over other areas like customer service and business intelligence because of it’s direct tie to driving revenue. Machine learning marketing applications are still relatively novel for most small and medium-sized business, but this may change drastically over the next five years.

In this expert consensus, we reached out to over 50 executives running companies at the intersection of AI and marketing. Our goal was to determine the applications of machine learning and AI that are driving strong business value now, as well as the applications that would make the biggest different in the next five years. If you care about leveraging AI or ML for your bottom line, then this consensus should be helpful in shedding light on opportunities in your industry.

To help you find the insights you’re looking for quickly, we’ve broken this content up into the following sub-sections:

- Background of Respondents – Information about the executives and companies who participated in our research

- Selling AI / ML Marketing Products and Services – Details how what markets and departments our respondent companies are targeting for customers

- Current and 5-Year ROI – Consensus data on which industries and which applications were seen to be most and least promising for applying ML to marketing

- Adoption Predictions – Respondents provide us with feedback as to when machine learning will be a near-ubiquitous facet of any marketing software

- Complete List of Companies Interviewed – We’ve listed our participant companies at the bottom of this article for reference

In each of the graphics below, you’ll see details about the exact question that we asked our participants, in addition to details about whether the questions were multiple choice (where choices were pre-defined), or open-ended (categorized manually by Emerj).

1 – Background of Respondents

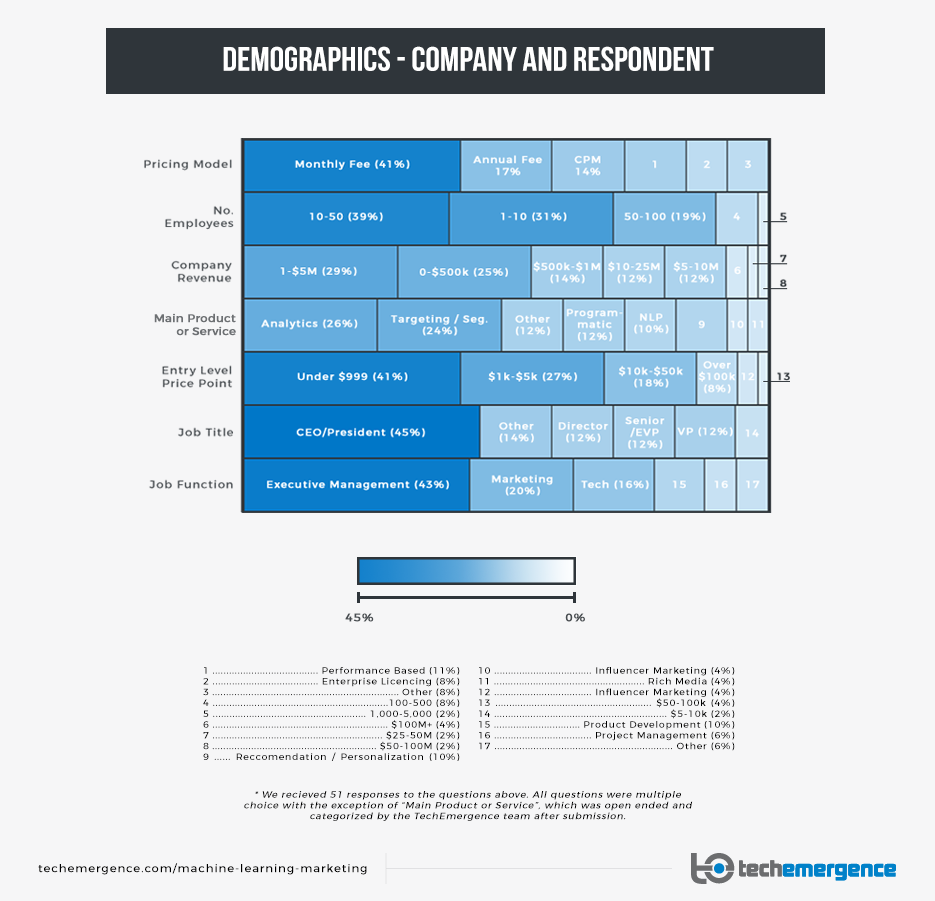

It took our team over two months to reach out personally to dozens of executives at AI marketing companies, and we gathered responses from over 51 total companies. While we received responses from 55 companies, four of those companies were determined not to actually be leveraging AI in any significant way.

In the first graphic below, you’ll see a breakdown of background information about our respondents, including their price points, pricing model, estimated revenues (as of 2016), and information about the executive who filled out the survey (their job function, title, etc.).

This isn’t the most interesting or insightful chart in terms of assessing ML and marketing trends, but it is probably the most insightful chart with respect to understanding the machine learning and marketing landscape.

1a – Respondent Overview

1a – Respondent Overview

As evidenced in the chart above, most of the companies are rather new; most have been founded within the last two to five years. This may in part reflect the kind of companies who responded—there might be a tendency for smaller firms to respond more readily to requests from market research firms like us—but it seems much more likely that this is a genuine reflection of the state of the field. Marketing companies whose value proposition is predicated on AI or ML are a relatively new phenomena. Seventy percent of the companies polled were under 50 employees.

“Analytics” topped the list as the most popular product or service offered by these companies, with “Targeting and Segmentation Technologies” coming in at a close second; the two combined represent 50 percent of all responses. Products related to programmatic advertising or natural language processing were also relatively popular, but much less so than the top two.

2 – Selling AI / ML Marketing Products and Services

We set out to not only learn about the companies in this space, but about what and how they were selling, as well as to whom. The set of graphics below help shed light on these matters, highlighting the value propositions that these companies pitch and as well as the types of clients targeted for sales.

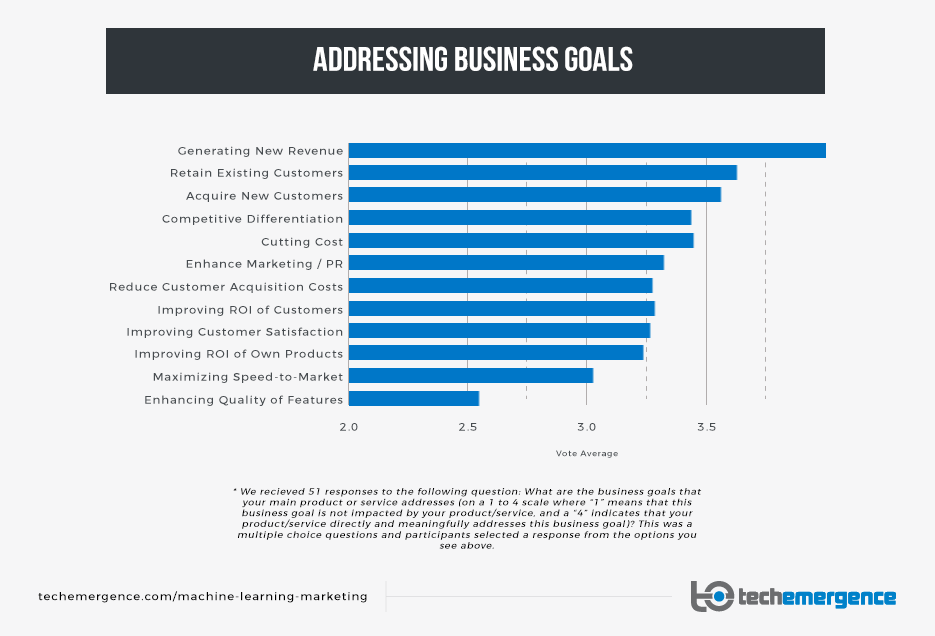

2a – Business Goals Addressed

The above chart essentially distills which business challenges our sample companies address, based on their own 1-through-4 scoring of each individual challenge.

Most companies seemed to highlight “Generating New Revenue” as a primary value proposition of their service. We can imagine that executives (particularly founders) would be biased in their statements; regardless, it’s interesting to note that “Generating New Revenue” is the aggregate prime business problem that most companies claim to address first and foremost.

Ranked second was “Retaining Existing Customers”, not surprising given all the focus on segmentation, targeting, and churn prediction that we saw among the companies’ products. The third most popular response was “Acquiring New Customers.” The business challenges of “Improving Customer Satisfaction” and “Enhancing PR” received lesser ratings.

It should be noted that “Acquiring New Customers” or “Improving ROI of the Client’s Own Products” can both be couched under the umbrella business challenge of “Generating New Revenue.” The same can be said of topics like “Maximizing Speed to Market” possibly fitting under “Cost Cutting.” Despite this potential vagueness, “Generating New Revenue” seemed to be a more common aim of companies in our sample than “Cutting Costs.”

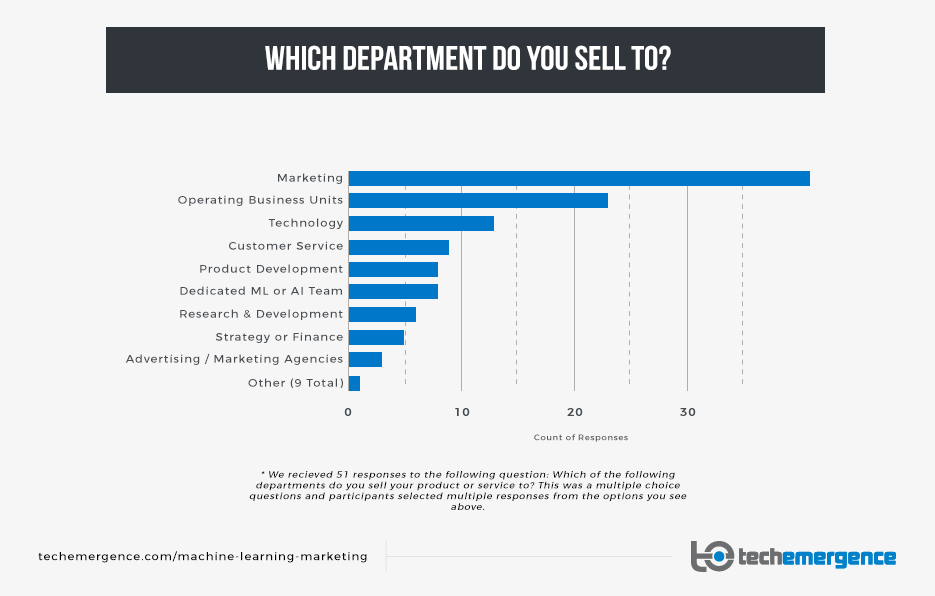

2b – Departments Targeted for Sales

It is evident from the chart above that the companies in our sample tend to target the marketing department within their client companies. Far less frequently, companies aim to sell directly to departments of a company specifically focused on technology. It seems quite rare that companies ever get the opportunity to sell directly to an AI or ML business unit, and we can presume that very few prospect companies have a designated AI department or task force at this point in time.

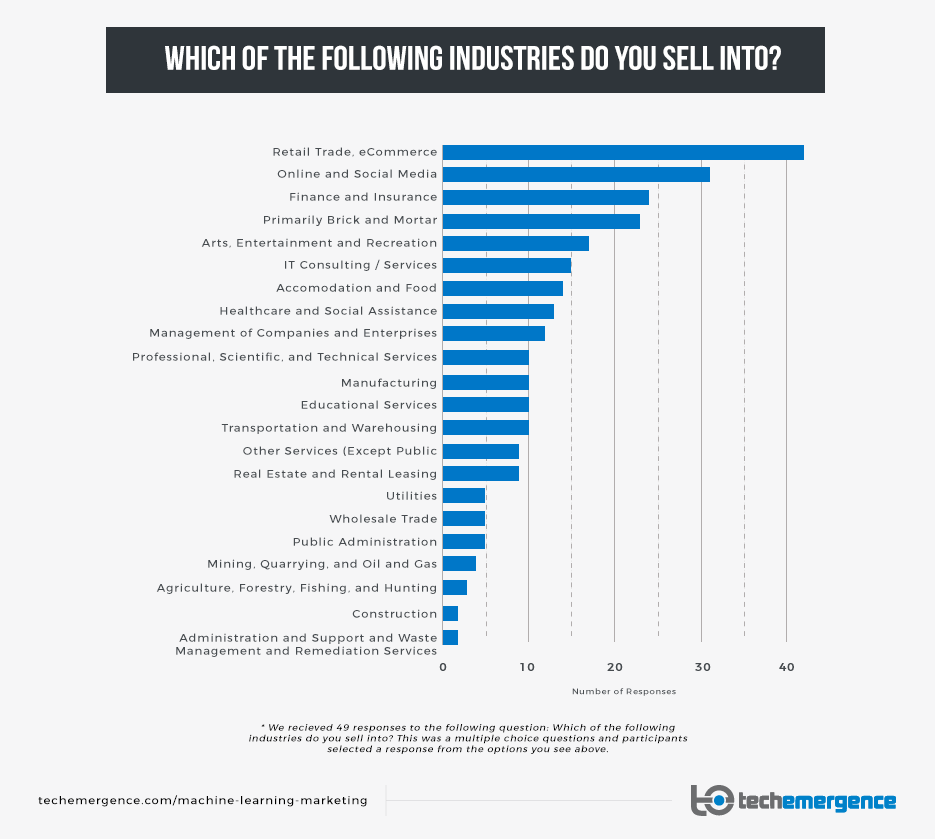

2c – Industries Targeted for Sales

Over 80 percent of our sample companies target eCommerce and retail, while just over 60 percent are targeting online and social media companies. No other industries stood out as representing 50 percent or more of respondents.

In the complete data set and the open-ended responses therein, it seems evident that eCommerce and online media allow for the constant creation of quantifiable data, as well as relatively easy streaming and storage of this data.

Compared to an online shoe retailer, a brick-and-mortar shoe store is less capable of quantifying all its customers’ behaviors and signals of intent, as well as in driving sales at scale. Even a large chain of physical shoe stores would have a much larger “data wrangling” problem than a single large eCommerce site that doesn’t have to deal with physical receipts, varied point-of-sale software, and other tangible barriers.

It seems likely that until more “traditional” businesses find ways to streamline their data ingestion and digestion at scale, online business models will gain most of the fruit from AI marketing tech. Today, in-store behavior tracking is still experimental and extremely expensive.

Industries with less volume of sales data, such as large B2B firms, should generally expect to gain less from ML than companies who can garner huge volumes of sales data.

Similarly, industries based more on distribution than marketing (industrial and agriculture businesses might be considered here) are less likely to benefit from these technologies. As a result, we see very few of our sample companies targeting these industries.

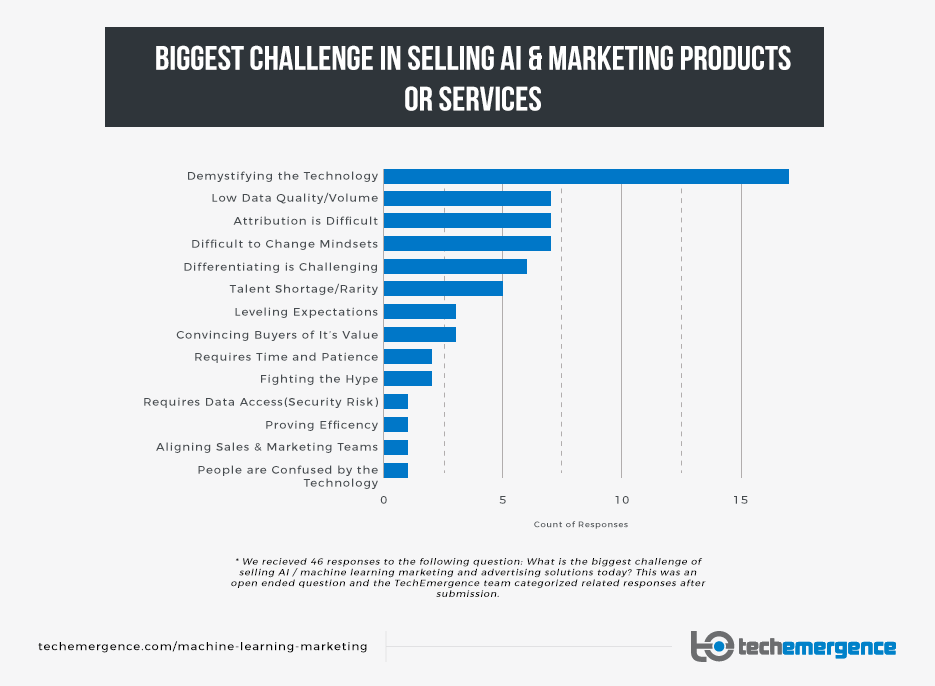

2d – Challenges of Selling AI Marketing Tech

The open-ended responses from our participants showed an overwhelming challenge with “demystifying” AI and machine learning technologies. This appeared as the outlier for sales challenges, garnering nearly as many responses as the next three top challenges combined.

An astute reader might be aware that such a response could very well be viewed as an “excuse” for underdeveloped sales skill or marketing / positioning, but we believe that this top response should be taken more seriously—despite its use as a possible “cop out” by less adept salespeople. AI and machine learning marketing technologies are rather complicated, and explaining the advantages of using such “advanced” technologies is indeed challenging. After hundreds of interviews with AI founders and execs, it’s clear that at the time of this original writing (early 2017), AI is seen as something for “early adopters.”

With time, we can expect that such technologies will become more readily accessible and ubiquitously in use, but at present AI continues to intimidate most prospects.

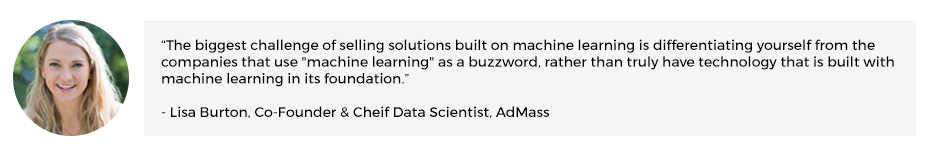

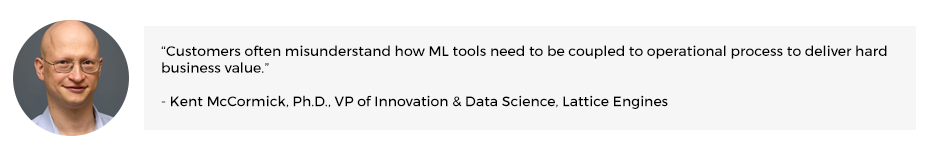

A double-edged sword seems to exist, where promoting “cutting-edge AI” might garner attention and prestige on one hand, but might “spook” prospect companies on the other. It might be advised that companies de-emphasize “AI” and instead directly promote the results that these applications drive for clients. In a recent interview titled “How to Raise Money for Your AI Startup,” Canvas Ventures partner Ben Narasin recommended this exact approach. Featured below is a selection of direct quotes in response to this question:

What is the biggest challenge of selling AI / machine learning marketing and advertising solutions today?

3 – Current and 5-Year ROI

The graphics below related to our questions about the return on investment (ROI) or profit potential of machine learning marketing tech.

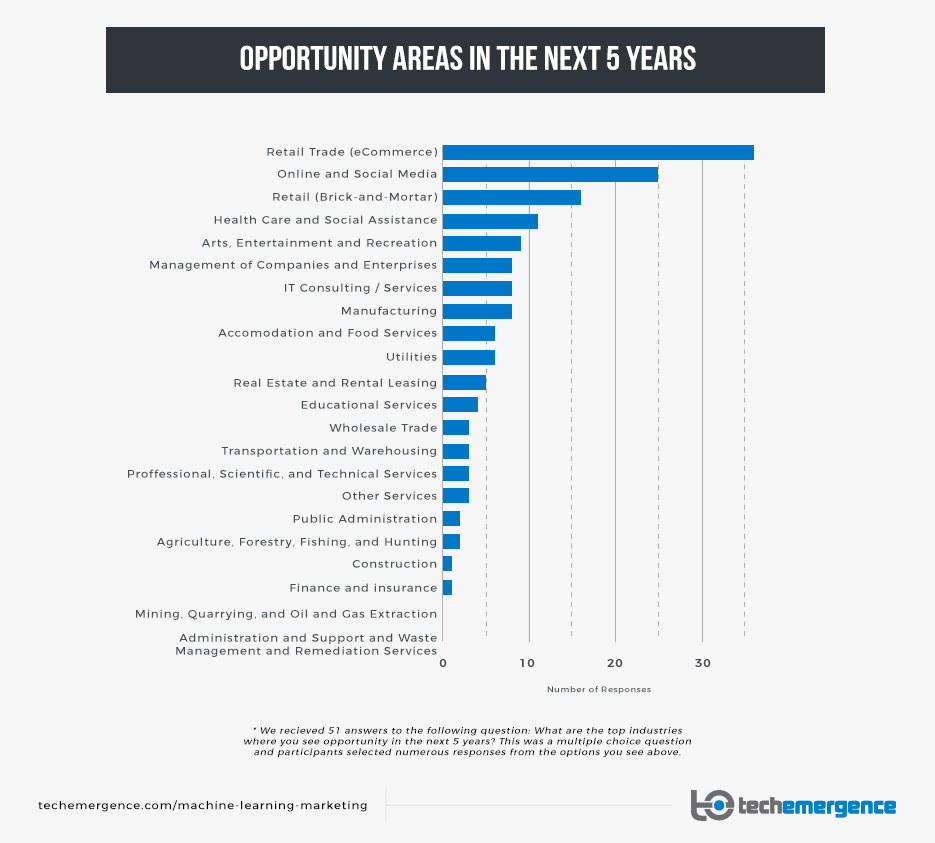

3a – Industries with AI Marketing Potential in 5 Years

Our sample companies don’t seem to believe that the areas of opportunity for AI in marketing will shift much in the coming five years. The chart above reflects (almost exactly) the industries that our sample companies are already targeting as customers for AI and marketing tech. We suppose that few of our respondent companies will focus exclusively on targeting and selling to sectors that aren’t poised to reap significant benefits from and leverage AI heavily.

From the data above, it seems our sample companies believe that direct-to-consumer industries (as opposed to business-to-business domains, or public-private sectors like healthcare) will benefit most from AI marketing developments. For reasons stated in graphic 2c above, this is not surprising but is indeed worth noting for executives considering marketing technology investments.

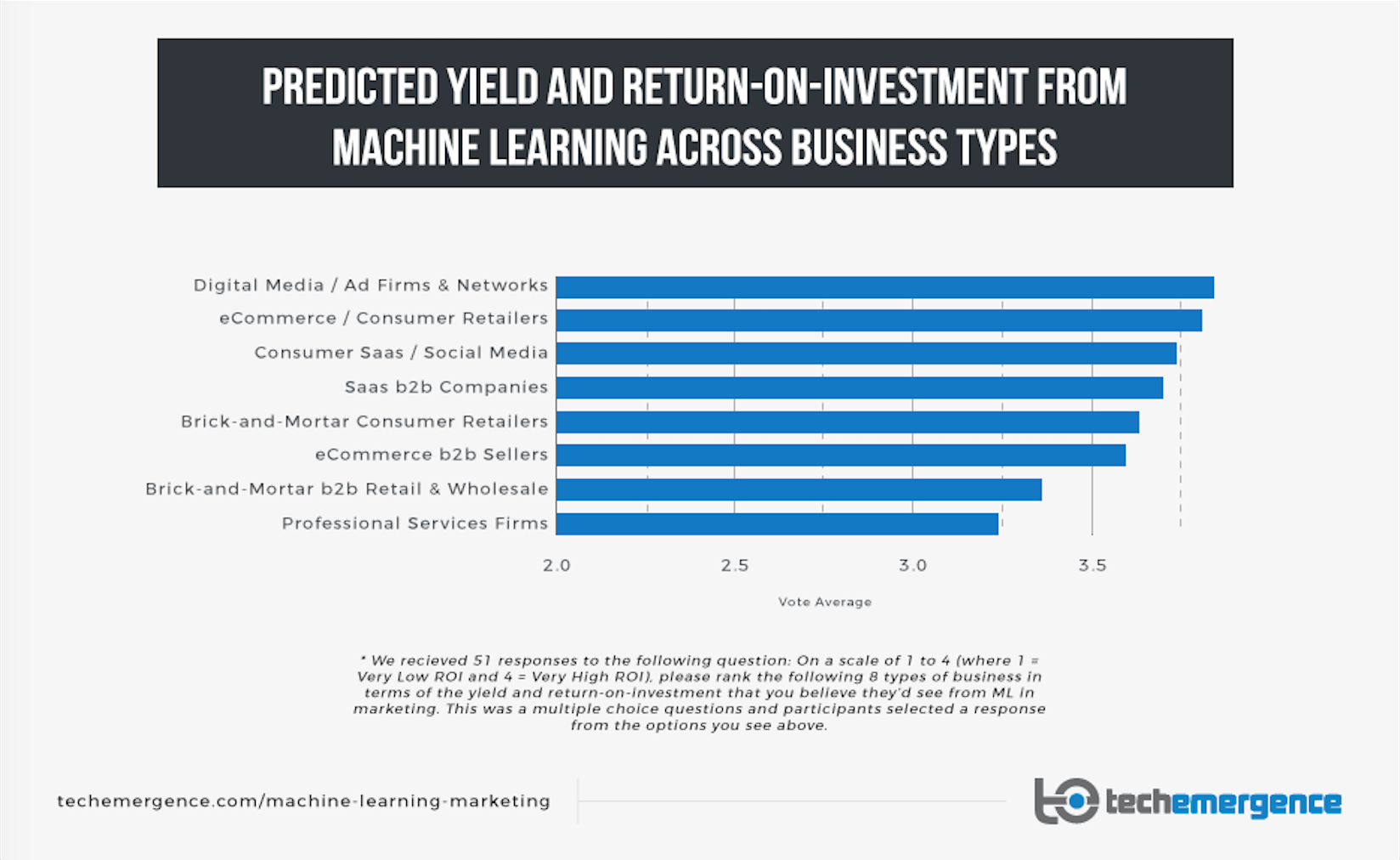

3b – Businesses with Most Potential for Value with AI in Marketing

Not all businesses are created equal when it comes to machine learning applications. Regardless of industry, certain business types have access to more data, more streams of data, and more organized and useful data. Our executives from this research sample showed a strong preference for businesses that “live and die” quantifiable digital interactions, the kind of data that can train machine learning models and iteratively improve its performance over time.

Digital media and eCommerce companies topped the list, with SaaS and social media businesses coming in a relatively close third. Our guess is that SaaS and social media ranked below the top two listings because such businesses are less common than the first two. Very few of our sample companies sell exclusively or directly to the social media or SaaS space; literally anyone under the sun can create an advertising-driven site, or an eCommerce store, but it’s much harder to write software or to create a one-in-a-million popular social media platform. The market for the latter is smaller, and so our companies may have ranked them lower as a result.

B2B physical businesses and service firms ranked low across the board. From our collected quotes and rankings, we presume that these businesses have much less quantifiable transaction data and/or that their sales rely much more on non-quantifiable human relationships, phone calls, trade shows, etc. Lack of unity and quantifiability across these channels make them much less likely to take immediate advantage of machine learning in marketing.

Featured below is a selection of direct quotes in response to this question:

Which type of business do you believe to be most poised to profit from machine learning in marketing and why?

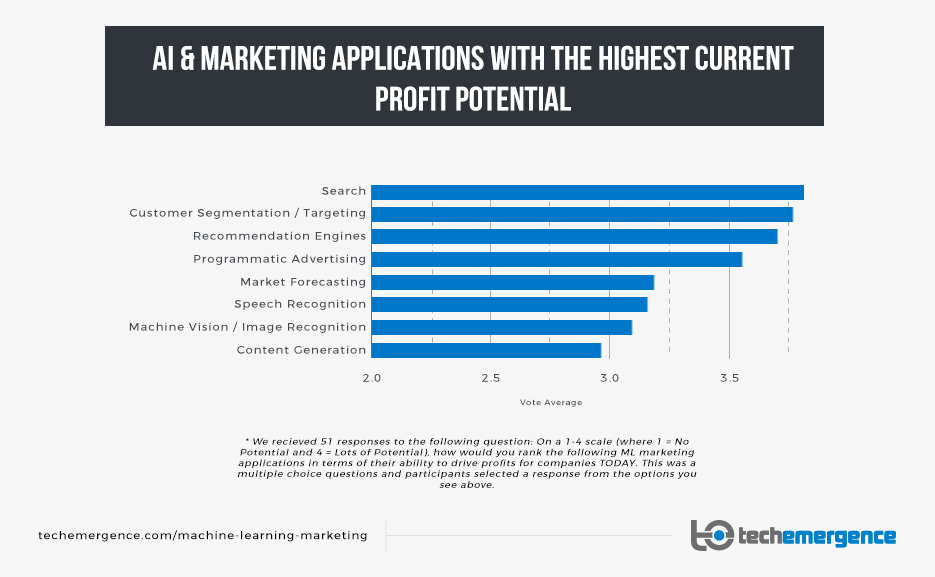

3c – AI Marketing Applications – Current Profit Potential

“Search” was voted as the most profitable current application of AI and ML in marketing. It’s worth noting that none (or very few) of our sample companies focused exclusively or mostly on “Search” as their main value proposition. Our own article on the applications of AI in marketing and advertising highlighted search as one of the most prominent current applications, and this consensus seems to highlight its current importance.

As a market research firm, we found it interesting to see companies voting to highlight an application that was different from their own value proposition. It is possible that “Search” was voted to the top simply due to its ubiquity online, and it’s also possible that many of the companies we polled didn’t believe “Search” to be important enough to build an entire company around. What doesn’t seem to be debatable is that “Search” is an influential marketing technology that executives recognize as valuable.

From the chart above, it seems that today’s AI marketing executives don’t believe that content generation and market forecasting have nearly the same profit potential as “Segmentation / Targeting” or “Programmatic Advertising.” As might be expected, far more of our sample companies are working on the latter than the former.

3d – AI Marketing Applications – 5-Year Profit Potential

Unlike our “Current Profit Potential” question, we made our “5-Year Profit Potential” question open-ended. The responses lined up reasonably well with the top value propositions of our sample companies. One can imagine that if these forward-looking AI marketing companies are willing to stake their futures on a core value proposition (such as “Recommendation / Personalization” tech), they would also believe that such a technology has a strong future for driving value for client companies.

Interestingly, the number one value proposition of our companies was “Analytics.” Even in the coming five years, it seems as if analytics-related applications aren’t listed in this projection. “Decision Support” and “Forecasting” seem related to analytics, but they remain rather low in profit potential, according to the same companies working on analytics technologies. It is possible that our sample companies may be developing analytics technologies specifically for recommendation or customer segmentation, which would mean that analytics alone is simply wrapped up or included under the guise of another application. Curious readers can dig into the data themselves to develop a conclusion.

Featured below is a selection of direct quotes in response to this question:

Which option above has the most profit potential five years from now and why?

4 – Adoption Predictions

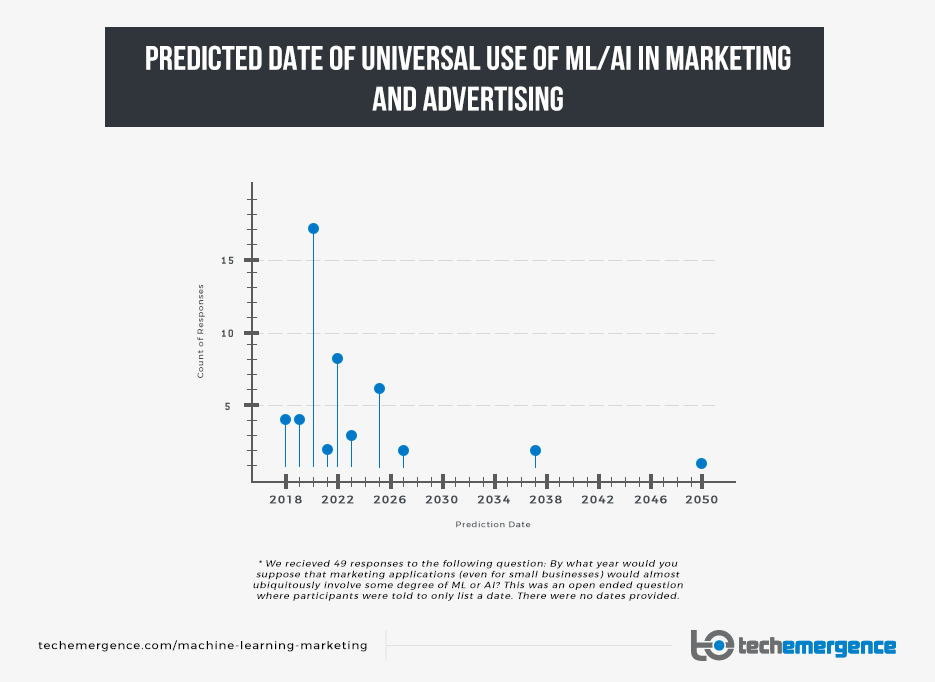

The last section in our machine learning marketing survey asked executives to predict when AI / ML would be ubiquitous in marketing technologies, even for small businesses. Some investors and founders seem to believe that AI will be an integral part of nearly all marketing products of the future, just as nearly all businesses must now have a website and some kind of CRM. We were interested in getting a sense of a time projection for this transition.

4a – Predicted Date of Ubiquitous AI Integration in Marketing Tech

The question above was open-ended, so respondents simply entered the year that they believed to be the correct response. On the aggregate, the estimates seem aggressive. It seems highly unlikely that “most” marketing applications will integrate some kind of AI or machine learning by 2018 or 2019. That being said, “2020” was the date predicted by 17 unique respondents, giving us reason to pause.

Though we might imagine that founders and executives would be “optimistic” about adoption of their own technology, we wouldn’t have expected such an unusual consensus on the same date.

Related AI Market Research

Our main objective at Emerj is to provide clarity on the implications and applications of AI, with perspectives from the best minds in the field. If you enjoyed this consensus, you might enjoy some of our other research and surveys of AI executives:

- Where to Apply Machine Learning First in Your Business

- Investing in Artificial Intelligence, Perspectives from 29 AI Founders

- AI Founders and Executives Predict 5-Year Trends on Consumer Tech

Complete List of AI Marketing Companies from Consensus

We are grateful to have had the opportunity to survey many innovative and interesting companies from all over the world for this consensus. Without them, these graphics and insights wouldn’t have been possible. The list of responding companies can be seen in the table below:

| AdMass Inc. | iDatalabs Inc. | PushSpring |

| Arts & Analytics, Inc | Infinite Analytics | Real Life Analytics |

| Automated Insights | Intelliber Technologies, Inc. | Receptiviti |

| Beeketing | Jivox | relevante.me |

| Bitext | Kahuna | Roxot |

| Blueknow | Lattice Engines | Sales Temperature |

| Boxever | Lumanu | Sentiance |

| Busigence Technologies | MarianaIQ | spotad |

| Cision | MentAd | Sriya DXI LLC |

| Concentric | MOCA Platform | Strossle |

| Cortex | Nara Logics | Suzu Technologies |

| Cortical.io | ownerIQ | Unbxd |

| Drawbridge | Panamplify | Velocidi |

| eEffective | Phrasee | Vioby |

| Evergage | PipeCandy | Visenze |

| Exacaster | PK4 Media | YOptima |

| Grapeshot | PredictiveBid Ltd | Zealr |