The insurance industry is a competitive sector representing an estimated $507 billion or 2.7 percent of the US Gross Domestic Product. As customers become increasingly selective about tailoring their insurance purchases to their unique needs, leading insurers are exploring how machine learning (ML) can improve business operations and customer satisfaction.

The greatest opportunities seem to lie, perhaps unsurprisingly, in claims and underwriting. According to our AI Opportunity Landscape in insurance, approximately 46% of AI vendors in insurance offer solutions for claims and 43% for underwriting.

No other sources have taken a comprehensive look at the impact of AI among the leading insurance companies in the U.S. We researched this sector in depth to help answer questions business leaders are asking today:

- What types of ML applications are currently in use by leading insurance companies such as Allstate and Progressive?

- What (if any) tangible results have been reported on ML applications implemented by leading insurance companies?

- Are there any common trends among their innovation efforts – and how could these trends affect the future of insurance?

This article aims to present a comprehensive look at the four leading insurance companies and their use of AI. Our “top 4” rankings are based on the National Association of Insurance Commissioners’ 2016 ranking of the top 25 insurance companies.

Through facts and figures, we aim to provide pertinent insights for business leaders and professionals interested in how machine learning is impacting the insurance industry.

Before we begin exploring each company, we’ll present the common patterns that emerged throughout our research in this sector.

Machine Learning at Insurance Companies – Insights Up Front

The most popular AI application from the top four industry leaders currently using AI appear to be:

- Chatbots/AI assistants: Responding to internal agent inquiries and providing guidance on business protocols (see Allstate below, or see our previous article on customer service AI use-cases).

- Driver performance monitoring: Machine learning algorithms are being applied to client data to help inform the development of products for insurance clients. (see State Farm and Liberty Mutual below).

- Insurance market analytics: Machine learning algorithms are being applied to interpret driver data in an effort to monitor market trends and identify business opportunities (see Progressive below).

(Note: For readers with an interest ML finance use-cases beyond insurance, please refer to our “overview” article of machine learning applications in finance.)

In the full article below, we’ll explore the AI applications of each insurance company individually. We will begin with State Farm, the #1 ranking insurance company based on the 2016 National Insurance Commissioners ranking.

State Farm

In an effort to explore the ability of computer vision to identify distracted drivers, State Farm launched an online competition in 2016. The competition resulted in 1,440 participants and the company offered a total of $65,000, divided into 3 prize levels.

The dataset provided by State Farm was comprised of photos of drivers described as “2D dashboard camera images.” Participants were challenged with the task of classifying the perceived behavior of each driver using a list ten categories including:

- Safe driving

- Texting

- Operating the radio

- Talking on the phone

Competition scores were calculated using a log loss metric ranging from a minimum value of 0 to a maximum value of 1. The goal of a machine learning model is to achieve a score that is as close to zero as possible, which indicates the level of accuracy of a given model.

The first place application which achieved a score of 0.08739 utilized two neural network models and focused image classification on two main photo regions: the head region and the bottom-right quarter where the driver’s hand normally appears.

From a business strategy perspective, a patent application and the company’s Drive Safe & Save program provide evidence which suggests that driver data collection and interpretation will play increasingly important roles in State Farms’ approach to customizing insurance options and providing customer discounts. This improved use of data is consistent with one of the most important broad trends in AI and insurance (which we’ve written about in-depth previously).

Liberty Mutual

In January 2017, Liberty Mutual announced plans to develop automotive apps with AI capability and products aimed at improving driver safety. Solaria Labs, an innovation incubator established by Liberty Mutual, has launched an open API developer portal which integrates the company’s proprietary knowledge and public data to inform how these technologies will be developed. An Application Program Interface or API is essentially a toolkit that provides the blueprint for building software applications.

The insurance company is reportedly experimenting with a new app to help drivers involved in a car accident quickly assess the damage to their car in real-time using a smartphone camera. The app’s AI component would be trained on thousands of images from car crashes and as a result could also provide damage-specific repair cost estimates.

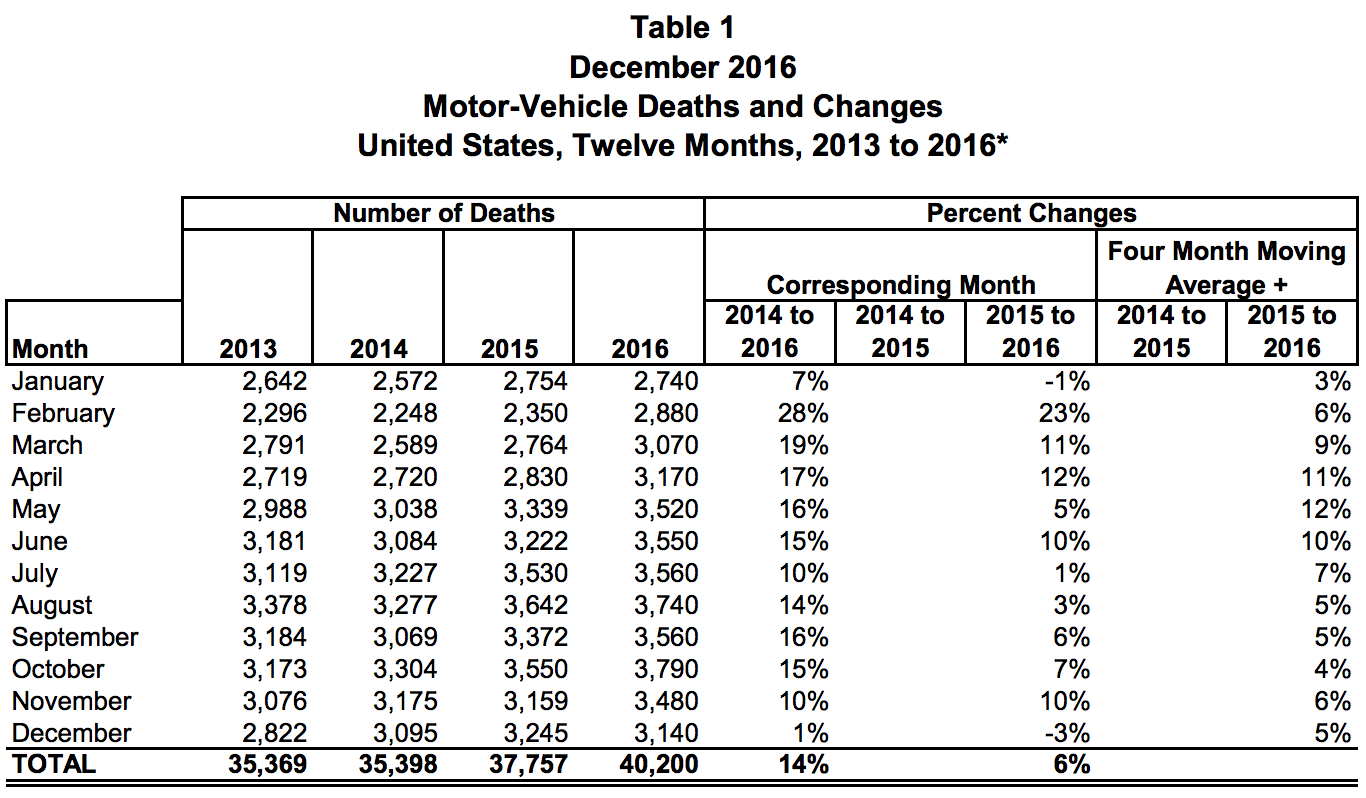

This is a timely initiative considering that motor-vehicle fatalities in 2016 peaked at 40,200; the highest amount recorded in nearly a decade. From an economic perspective, in a single year, the estimated healthcare costs totaled over $80 billion. The Bureau of Labor Statistics estimates that the median salary of an insurance adjuster who assesses auto damage was $63,510 in 2016.

In May 2016, Liberty Mutual announced the launch of its $150 million venture capital initiative, Liberty Mutual Strategic Ventures (LMSV). The early-stage venture fund will focus on innovative technology and services specifically designed for the insurance industry.

The VC firm has invested in companies such as Snapsheet, a smartphone application that reportedly allows users to receive auto repair bids from local body shops within 24 hours. Snapsheet’s president CJ Przybyl has stated that AI and machine learning are used to support the company’s data analysis process.

“The technology sector has been among the most volatile sectors of the stock market. Technology companies involve greater risk because their revenue and/or earnings tend to be less predictable, and some companies may be experiencing significant losses…Nonetheless, the potential for future growth in areas such as cloud computing, digital advertising, artificial intelligence, and interconnected devices remains compelling. Therefore, [Liberty Mutual] has continued to emphasize investments in these and other areas where we see opportunities to capitalize on rapidly emerging trends in technology.” –2016 Annual Report

Allstate

Earley Information Science (EIS) is an agency which reportedly helps businesses improve performance outcomes through data analysis. Allstate partnered with EIS to develop a virtual assistant called ABle (the Allstate Business Insurance Expert). ABIe (pronounced “Abbie”) was developed to assist Allstate agents seeking information on Allstate Business Insurance (ABI) commercial insurance products.

Before ABle was deployed, agents were accustomed to selling personal lines products such as health or homeowners insurance. However, when the company decided to shift its focus to selling commercial insurance, many agents had a steep learning curve and encountered challenges accessing the information they needed to effectively communicate with potential clients. As a result, Allstate found their sales support call center consistently flooded with inquiries from agents and ultimately “long wait times” translated to “lost business opportunities.”

ABle, who appears as an avatar, reportedly provides agents with step-by-step guidance for “quoting and issuing ABI products” using natural language. EIS claims that ABle processes 25,000 inquiries per month.

The company’s strategic move aligns with research on insurance trends published by The Boston Consulting Group and Morgan Stanley. The report projects an increasing decline in personal lines and a “65 percent reduction of the personal auto insurance market by 2030.” A contributing factor to this trend is the anticipated debut of autonomous vehicles.

In Allstate’s 2017 annual report, the company discussed a multi-year effort to hone the expertise of its agents with a goal of positioning them as “trusted advisors” for their customers.

“To ensure agencies have the resources, capacity, and support needed to serve customers at this level, we are deploying technology, processes, education and support focused on relationship initiation and insurance and retirement expertise. This includes continuing efforts to enhance agency capabilities with customer-centric technology while simplifying and automating service processes to enable agencies to focus more time in an advisory role.” – 2017 Annual Report

Progressive

Progressive Insurance is reportedly leveraging machine learning algorithms for predictive analytics based on data collected from client drivers. Progressive claims that its telematics (integration of telecommunications and IT to operate remote devices over a network) mobile app, Snapshot, has collected 14 billion miles of driving data. Progressive incentivizes Snapshot for “most drivers” by offering an auto insurance discount averaging $130 after six months of use.

“We were collecting a lot more data, it was coming to us at a much faster pace. One area where we were seeing a pain point was our time to insight and we decided to use machine learning algorithms as a way to better understand the data so we could make predictions about what’s happening in the insurance marketplace. What was historically a bottleneck where we couldn’t entertain other lines of business, we can actually address their data science and predictive modeling needs now because we have a much faster throughput of our models and the business value we would be able to generate.” – Pavan Divakarla, Data and Analytics Business Leader, Progressive

Consistent with current auto insurance trends, in Progressive’s 2016 annual report the company marked an increase in commercial lines from zero to 9 percent from 2014 to 2016. Comparatively, personal lines reportedly increased from 2 to 6 percent during the same time period. 2016 revenue totaled $23.4 billion.

H20.ai developed the open-source machine learning platform software utilized by Progressive Insurance. H20.ai claims that its software is in use by 9,000 organizations and over 80,000 data scientists. To date, the California-based software company has reportedly raised $33.6 million in Series A and B funding.

Concluding Thoughts on ML in the Insurance Industry

AI is emerging in the insurance industry and is being applied across multiple areas including the interpretation of data, business operations and driver safety. Strategies to improve driver safety are particularly timely as insurers attempt to strike a balance between the recent spike in auto accidents and increasing auto insurance rates.

Auto insurers are also challenged with carefully monitoring driver trends as technology becomes increasingly adopted within the auto industry. Data interpretation through machine learning will be an important application in the coming years for identifying business opportunities in an evolving market.

However, there is some resistance to AI as autonomous vehicles are expected to reduce automobile accidents thus reducing the need for auto insurance. Daniel Burrus, noted author and strategic advisor on tech innovation to leading insurance companies argues that the “risk is shifting” from the driver to the auto manufacturer and the companies that design the smart technologies. Burrus posits that the need for insurance is not being eliminated and insurance companies must be prepared to adapt to these new business opportunities.

Anand Rao, partner at PwC and Global Artificial Intelligence Lead posits that while certain elements of automation technology are already integrated into many vehicles, it will take approximately 12 years for car parts to completely change and 15 to 20 years for fully automated vehicles to hit the market. Emerj’s research on autonomous vehicles has shown considerable funding allocations for self-driving technology including billion-dollar investments by Ford and Toyota.

When it comes to how insurers should prepare for this shift, AI technologist Francesco Corea emphasizes that insurance companies “should be ready to engage intelligently with new types of data and adapting their models and infrastructures to fully embrace the potential of AI.” He argues that the industry should embrace a new “cultural mindset” because it is “the greatest barrier to early adoption of AI solutions in insurance contexts.”

We will continue to monitor how the insurance industry evolves as we anticipate the field will continue to be impacted by AI overtime.

Emerj for Insurance Professionals

Large insurance carriers use Emerj AI Opportunity Landscapes to assess what is possible and what is working with AI in their industry. This allows them to pick high ROI first AI projects in areas such as claims processing, fraud detection, underwriting, and customer service. AI Opportunity Landscapes allow insurance carriers to explore a ranking of AI vendors in insurance, giving them a starting point for selecting an experienced AI vendor that has the best chance of delivering value. Emerj also provides a complete analysis of the AI initiatives at the top insurance companies, of which this resource is only a fraction. Contact us to learn more.

Header image credit: 5i Solutions Inc