The amount of data companies have on customers and the number of channels customers are using to interact with businesses have grown significantly in the past decade. Artificial intelligence may hold great promise in optimizing customer and client interactions.

The five largest Customer Relationship Management (CRM) vendors by market share in 2015 were Salesforce, Oracle, SAP, Adobe Systems, and Microsoft. These five companies make up almost half of the entire CRM market. All of them have been investing in their internal development of machine learning and AI, while also buying AI startups.

In the article below, we will explore the AI applications of each of these five CRM leaders, helping business readers to understand:

- AI capabilities are currently available for each of the five CRM giants

- Tangible results have been yielded by today’s AI applications in CRM

- Upcoming AI applications are being developed and may be available soon

The first company this article will focus on is Salesforce. They are by far the dominant player in this sector with more market share than their top four competitors combined. They have been aggressively investing in AI to maintain their position and are the benchmark by which most other companies are being judged by possible clients.

Salesforce wants corporate clients to be convinced that AI is this the future of CRM. An IDC White Paper, sponsored by Salesforce, projects that the use of AI in CRM will boost global business revenue by $1.1 trillion from 2017-2021. They claim that it could result in 800,000 net new jobs.

Based on corporate data and their surveys, IDC believes this use of AI will grow dramatically in the next few years. A survey conducted by IDC found that 28% of all respondents say their organizations have already started using AI and an additional 41% plan to adopt AI in the next two years. IDC concluded that worldwide spending on cognitive/AI systems was only $8 billion in 2016 but believes that this spending could reach $46 billion by 2020.

It is probably in Salesforce’s interest to heavily emphasize the prevalence of AI in CRM, as they are the largest firm in the space, and the one most likely to invest heavily in CRM AI applications. For this reason we should take this report with a grain of salt. Whether or not you believe IDC’s projections, CRM services is a highly competitive and growing business sector.

Salesforce

Over the past few years, Salesforce has been aggressively developing AI services in-house and acquiring many AI companies. They have also signed major deals with other companies focused on AI.

According to CB Insights, Salesforce acquired four AI startups (Tempo, MinHash, PredictionIO, and MetaMind) during 2015 and 2016 to add their technology to their applications.

- Tempo – An AI powered smart calendar app that shows you the information you need before a meeting, which Salesforce has since shut down.

- MinHash – An AI that looks for marketing trends, which Salesforce has since shut down.

- PredictionIO – An open source machine learning company, which Salesforce acquired for their technology and donated the open source addition to the Apache Software Foundation

- MetaMind – A deep learning company that specialized in technology, which Salesforce has since shut down.

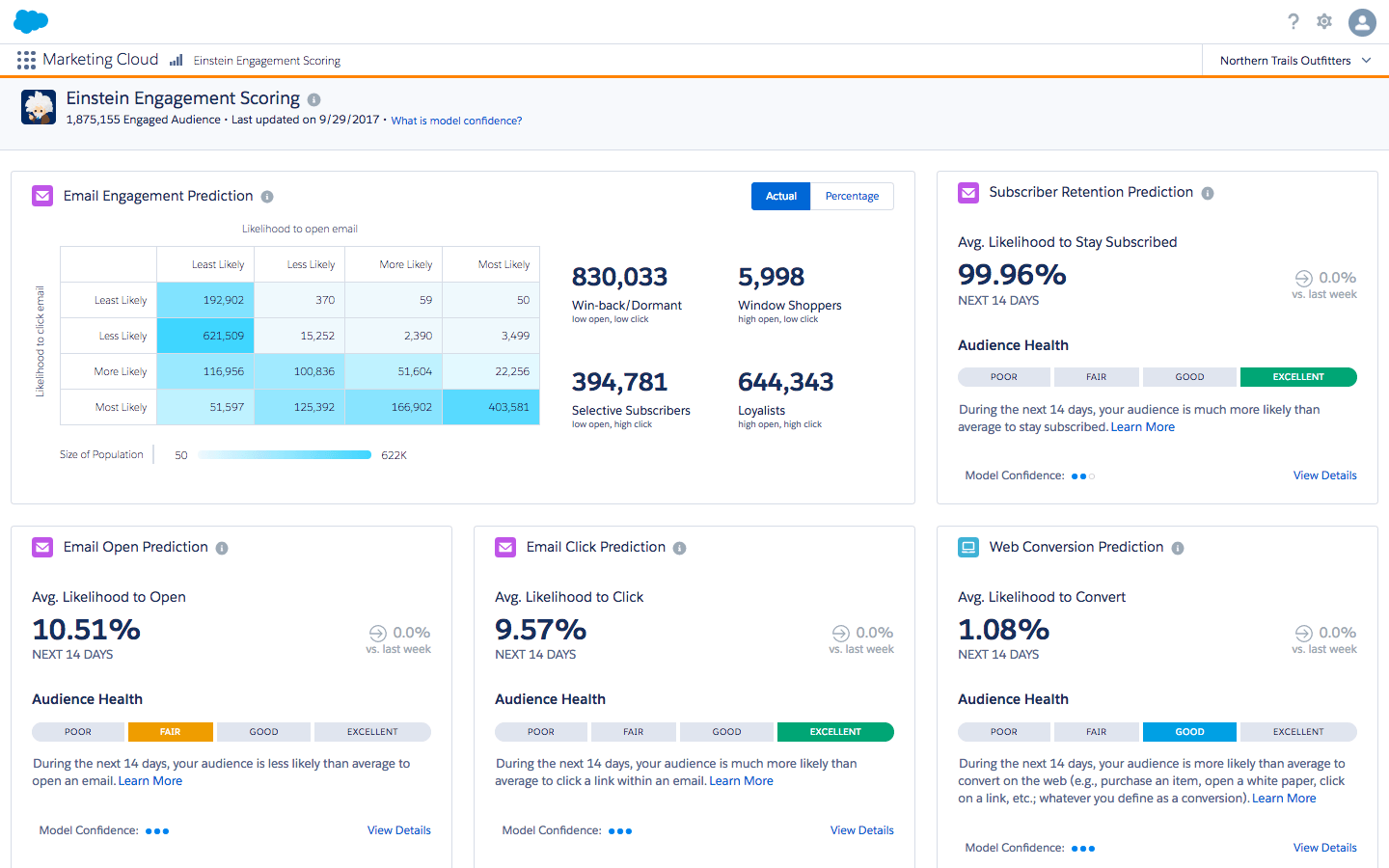

This focus on AI allowed Salesforce to introduce their AI tool, Einstein, in late 2016. Their goal is to simplify the use of AI for their clients, and make AI capabilities accessible to clients without a robust technical AI skill set. This emphasis on “accessibility” is a common value proposition for nearly all B2B AI applications, in CRM or otherwise – and time will tell if Salesforce can indeed make the tools accessible to less technical users.

Salesforces offers a broad range of uses for Einstein, including account insights, lead prioritization, automated data entry, ad personalization, insights into social media conversations, product recommendations, image classification, and more.

The 1-minute marketing video below highlights a few of the promoted features of Cloud Einstein:

Black Diamond, a Utah-based outdoor equipment company, claims that it initially used to manually upload on-site product recommendations for its customers, which ate up their time. These manual recommendations were not personalized for the customer, meaning that it most likely did not recommend related or relevant products that the customer was most likely to buy.

Black Diamond also claims in its case study that after integrating its system with Einstein’s recommendation engine, which uses customers’ historic data, purchase behavior, and affinities to offer relevant recommendations through machine learning, it was able to increase conversions by 9.6 percent and drive a 15.5 percent increase in revenue per visitor. However, it is not clear in what time period (in days or months) they supposedly achieved these results.

They also claim Einstein Activity Capture was able to eliminate an hour a day of manual data entry for sales representatives at Silverline.

While the market price and demand for the CRM AI technology are currently high, Salesforce CEO Marc Benioff no longer sees major acquisitions as likely in the short term. Instead, he is working on improving their offering via partnerships. Their most high profile AI partnership is with IBM.

In March, Salesforce announced it was teaming up with IBM to integrate Watson’s data and tools into their CRM system, giving their clients access to Watson’s existing information sources and its ability to analyze their data. For example, integrating IBM weather predictions into their market strategies.

The short video below highlights a few sample capabilities of IBM and Salesforce integration:

Just one small example of how this partnership works is through the use weather forecasting, which IBM has heavily invested in become a world leader in. With real time access to Watson’s weather data, companies using Salesforce can directly warn their customers who might be negatively impacted by changing weather conditions.

For example, Watson might determine it is about to hail in Houston. Car insurance companies can then use Salesforce to quickly alert all their customers in the area about to be hit to take precautions. This use case is explored in the IBM demo below:

According to this IBM “smartpaper,” a study conducted by an insurance carrier client of The Weather Company, a subsidiary of IBM, reports that 52% of policyholders who received weather alerts “moved their vehicles” to avoid potential damage. [] Further, the results of specific use case around hail storm warnings state that only 6% of the alerted policyholders filed for damage claims. [].

Salesforce is also working to add new capabilities to Einstein. Two functions currently in beta are Einstein Intent and Einstein Sentiment. They use natural language processing to classify whether the text of a message is emotionally positive or negative and determine what the intent of the message is, respectively.

For example, a company could put to use Einstein Sentiment to classify the tone of their inbound customer emails and accordingly identify positive brand evangelists and escalate dissatisfied customer responses into service cases. Einstein Intent, on the other hand, can be used to augment Einstein Sentiment. It could classify each negative response and identify the source of customer dissatisfaction, like lost shipments and returned orders.

source

Another function in pilot is Einstein Object Detection. It is designed not only to detect and classify objects but also to identify different objects in an image and their location. Like the below video demonstrates, a company could use a picture of a shelf to quickly know how much inventory is on display or customer could take a picture of something they want and the program could tell them where to buy it.

Salesforce’s documentation page for Einstein Vision states that this application can be used within CRM to help customers find products, to help customer service agents identify a product related to a customer complaint, and more. We were unable to find any current use-cases of this technology with Salesforce’s customers.

Oracle

Oracle announced the launch of their Intelligent Cloud Applications the exact same day Salesforce announced Einstein. At the time, Oracle’s project leader told ZDNet they were “trying to avoid the hype and build apps that people can buy, use and make money with.” Instead of creating a single, all-encompassing new “AI brand,” Oracle has been focused on specific AI and machine learning applications in their cloud services — ready-to-use apps that can be quickly and easily tailored to a specific uses.

Earlier this year, Oracle introduced several new AI powered functions to their customer experience cloud (CX Cloud Suite). According to the company, these include:

- AI-powered personalized marketing/experience – personalizing the content each customer receives.

- Predictive recommendations – using a customer’s data to recommend products they would be most interested it.

- Optimizing the selling process for representatives – opportunity analysis of clients to create guidance to help close deals.

- Chatbots

Since then Oracle claims to be adding more AI powered functions to its cloud.

Last year, Oracle bought Crosswise, a data company that offers machine-learning based cross-device data, which could be used in cross-device advertising, personalization and analytics. Oracle appears to have bought this technology to augment its data cloud platform.

Oracle claims their big advantage in AI is their unique access to enterprise data. The company claims to have “5 billion global consumer and business IDs, with more than 7.5 trillion data points gathered monthly.” These data points include historical and dynamic customer data such as click-stream and social activities, and inputs such as weather, lookalike audiences, etc. Such customer information can be mined to find customer behavior patterns. The long term vision is being able to have AI that can provide more seamless and natural direct customer service across platforms.

Oracle President of Development Thomas Kurian said at the recent Oracle Openworld conference that there vision of the future is, “No longer is it just web and mobile screens, but you could speak to the application. You can interact with it with messaging. You can take pictures, and we can identify images, compare them with other things, and automate transactions.”

Our research seems to indicate the these claims about the use of AI in Oracle’s CRM are aspirational, there don’t seem to be any presently developed products for machine vision at the company. While this may merely be posturing by Kurian, we suspect that Oracle will indeed be developing AI initiative actively in its CRM offerings. How it will compete with Salesforce in this regard – only time will tell.

SAP

German software giant SAP has the goal – according to Global VP Volker G. Hildebrand – “to build machine learning technology into all our software, across every line of business and industry we serve.” This includes SAP Hybris, their main cloud CRM service.

In July the company relaunched SAP Leonardo, their []integration platform to enable companies to more easily integrate AI and machine learning into their business. SAP Leonardo appears to integrate the various SAP product offerings for machine learning, IoT, big data, analytics, etc.

Similar to Salesforce (and to the claims made by Oracle), SAP is also developing machine vision applications for it’s Hybris CRM product. While we weren’t able to find Hybris client use-cases of this machine vision capability, the short video below shows what it might hypothetically be able to do for clients:

The company also announced machine learning facial recognition capacity for SAP Hybris, a platform that “sells omni-channel customer engagement and commerce solutions.” SAP claims the system will allow stores to automatically determine the age and gender of customers entering their locations, and make personalized product recommendations based on the stock information. This capacity was just announced in October.

Among the products SAP is currently developing is Charly the Chatbot. This chatbot is a customer-facing, “conversational commerce app.” It is a prototype designed to function as a digital assistant for individual consumers to help them find products, make recommendations, request refunds, etc. [[ ]] This prototype, according to SAP, is an “experiment on microservice-based business models.”

How SAP plans to use this in the B2B CRM context is not very clear. At present, Charly seems to be limited to Facebook Messenger. The 6-minute video below highlights the basic features of the software:

SAP is also experimenting with using their technology on Pepper Instore Assistance, a robot that is designed to act as a personal, in-store customer service rep. The demo video below showcases how the robot helps a customer locate a product with its QR code as input.

Both Charly the Chatbot and Pepper Instore Assistance are currently prototypes. We aren’t certain of when these initiatives will become regular offerings for SAP, and it’s unclear exactly how they’ll integrate with Hybris.

Other CRM Competitors

It is worth noting that Saleforce’s dominance in market share and AI initiatives seems to have many of the large companies scrambling to keep up. We see this pattern in other industries as well. When a large player in a given sector begins applying AI and letting the world know about it, other companies often have to (a) posture as if they aren’t being left behind, and/or (b) innovate and compete on technology.

Adobe, another top CRM company, announced their AI tool, Sensei, in November 2016 just weeks after Salesforce launched Einstein. Adobe has been steadily adding more capacity to Sensei, including personalized recommendations and a feature it calls as “One-Click Personalization.” Adobe Target, the personalization engine offered by Adobe Marketing Cloud employs Auto-Target, which aims to personalize customer experience across devices with “just one click.”

“For example,” Adobe claims, “a hotel chain can feature its tropical properties and content for a reward member, knowing the individual prefers to travel to warm destinations based on bookings and mobile app engagement.”

Exactly who are using these features and AI capabilities, or indeed if there are businesses using these features at all remains anyone’s guess. Adobe has not included any customer stories or case studies to support its claim on its CRM AI capabilities so far.

In addition, Adobe and Microsoft have over the past year been steadily expanding their CRM related partnership to combine their AI abilities to improve the competitiveness of their offerings. Earlier this year they announced they would build on “both companies’ strong track record in data science and machine learning.” Adobe and Microsoft, they said, “are collaborating on a semantic data model for understanding and driving real-time customer engagement.” This move came just weeks after Salesforce announced their deal with IBM regarding the use of AI.

Below is a short video featuring the “relationship assistant” used in Microsoft Dynamics 365:

An example of how their CRM relationship is growing is this recent announcement from Microsoft, which states that Microsoft would make Adobe’s e-signature system their preferred e-signature solution, and Adobe would make Microsoft’s new chat-based workspace their preferred collaboration tool on their cloud offerings. This news article explains that “Adobe Sign integration with Microsoft Teams, the chat-based workspace, will enable electronic agreement creation, approval and signature processes across teams. The Adobe Sign app in Microsoft Teams includes a tab to send documents for signature and a bot that allows team members to manage and track documents.”

In addition to this, the announcement also mentions that “the companies will explore opportunities to continue collaborating on artificial intelligence, analytics and intelligent document automation.”

In 2016, Microsoft acquired Genee, an AI company using natural language processing to help automate the process of scheduling with potential clients. They also bought Maluuba, an AI company focused on “our team has focused on the areas of machine reading comprehension, dialogue understanding, and general (human) intelligence capabilities such as memory, common-sense reasoning, and information seeking behavior”. This technology could enable a more organic and conversational interaction between AI and humans. The goal is to have AI assistants or chatbots that could tell what you want even if you don’t use the exact right phrase.

Upcoming Applications of AI in the CRM

In only the past two years there has been a flood of CRM companies claiming to be adding machine learning and AI capabilities to their products. Each of the top companies in the industry claims to be adding new AI-powered services and capabilities or is announcing plans to add such capabilities basically every few months.

These companies seem to be convinced that AI is the way of the future in CRM, or at least that they need to make a serious investment in AI if they want to be able to remain competitive. At the very least, CRM leaders seem to feel the pressure to “keep up with the Joneses” in terms of AI initiatives – maintaining a perception of being “cutting edge” amidst the flurry of AI excitement that’s hitting the business world.

Analyzing large volumes of consumer data to spot basic trends, improve efficiency, compare the impact of ad buys, track customers, etc… are not new ideas. This data analytics work is something businesses have been doing for decades. These are functions that CRM companies provided before officially adding machine learning to their tools. As a result, the use of AI for these functions could be seen more as an evolution than a revolution. Companies claim using AI in these functions is allowing them to improve efficiency of what they have been doing, but it is mainly an improvement on what came before.

The most interesting uses of AI in CRM are allowing CRM programs to perform entirely new functions that were not possible before. Among the functions AI has recently added to CRM or that companies expect to add in the near future are:

- Chatbots that can heavily augment or replace human agents. The Charly Chatbot experiment by SAP would make a good example for this capability.

- Continuously customizing user experiences through predictive recommendations using the customer’s historical data

- Natural language processing that can automatically sort and categorize customer service or sales inquiry requests

- Voice recognition online and in store

- Complete information about consumers across points of contact and social media

- Emotional analysis of communications – detecting the sentiment or intent of a customer inquiry

- Object recognition to both help consumers find products and companies to quickly analyze product placement

- Facial recognition that can change ads in real time

- Robots to directly help people in store

(Readers with an interest in other future AI trends in the CRM may be interested in our CRM-focused interview with Bastiaan Janmaat of DataFox, on the AI in Industry podcast).

Some of these uses are fairly new and others are only in pilot at the moment. Even the functions currently in use are being actively refined and improved as companies use them and could change significantly in just the next few years. Which, how much, and when any one of these uses will have the biggest impact on the industry is still mostly an unknown.

There seems to be a general belief throughout the industry that if you throw enough possible AI uses in CRM at the wall, at least some of them are going to stick. It is easy to understand why some people would think this way, in this particular industry. There are numerous applications of AI being developed right now, and many of them would have either a modest or major impact on CRM.

Data analysis, social media analysis, speech recognition, object recognition, facial recognition, etc… all can impact CRM. For AI to create a big impact, companies don’t need all of these to pan out, just some of them. Only time will tell which specific AI applications will become critically useful for customers in the coming years ahead – but in the CRM industry, it’s clear that the race is on.

This article was updated and extended by Emerj’s Radhika Madhavan before publishing.

Header image credit: enablon