eCommerce is a bustling segment of the retail industry representing an estimated $102.7 billion or 8.3 percent of total U.S. retail sales in 2016. Total retail trade was approximated at 5.9 percent of the national GDP in 2016. As digital transactions become the standard method of purchasing goods and services, leading eCommerce firms are exploring how AI can enhance brand competitiveness and customer loyalty.

To gauge the impact of AI among leading eCommerce firms across the globe, we researched this sector in depth to help answer questions business leaders are asking today, including:

- What types of AI applications are currently in use by leading eCommerce firms such as Amazon and eBay?

- What tangible results have been reported on AI applications implemented by leading eCcommerce firms?

- Are there any common trends among their innovation efforts – and how could these trends affect the future of eCommerce?

This article aims to present a comprehensive look at the four leading eCommerce firms and their use of AI based on 2016 sales revenue sourced from company financial reports. By the time you’re done reading this article, you’ll have a strong sense of clarity about the current and future applications of AI for online shopping.

Before we begin exploring each company, we’ll present the common patterns that emerged throughout our research in this sector.

Artificial Intelligence in eCommerce – Insights Up Front

The most popular AI applications from the top four industry leaders currently using AI appear to be:

- Chatbots/AI assistants: Responding to customer inquiries, responding to voice commands for simple tasks and providing product recommendations through interactions using natural language (see Alibaba and eBay below)

- Smart logistics: Machine learning algorithms are being applied to data to help automate warehouse operations. (see JD.com below).

- Recommendation engines: Companies are analyzing customer behavior on their websites and using algorithms to predict what products may appeal to customers and provide recommendations. (see Amazon below).

In the full article below, we’ll explore the AI applications of each eCommerce firm individually. We will begin with Amazon, the #1 ranking eCommerce firm based on 2016 sales revenue.

Amazon

Machine learning – Recommendation Engine

Alexa, which has become a household name, is one of Amazon’s more visible AI applications. However, one of the company’s most lucrative applications of AI is less apparent and more integral to its operations.

Machine learning drives the algorithms which are core to Amazon’s targeted marketing strategy, allowing the company to predict what products will most likely interest customers and to provide customized recommendations based on customer searches. It has been estimated that Amazon’s recommendation engine drives 35 percent of total sales.

Automation and Robotics – Amazon Robotics and Prime Air

Automation also plays a central role in the evolution of the industry leader’s approach to warehouse operations. After Amazon’s estimated $775 million acquisition of warehouse robot manufacturer Kiva Systems, Inc (now Amazon Robotics) back in 2012, to date, the company has a reported 100,000 robots in operation across its warehouse locations worldwide.

An emerging application is the company’s Prime Air delivery drones. The effort to improve delivery efficiency and reduce shipping cost is particularly relevant for the leading eCommerce firm. According the company’s 2016 annual report, from 2014 to 2016, Amazon’s net product shipping costs steadily increased from approximately $4.2 billion to $7.2 billion. Shipping costs are categorized under “cost of sales” which represented 70.5 percent and 64.9 percent of total operating expenses, in 2014 and 2016.

In December 2016, Prime Air was launched in a private trail in the United Kingdom. Amazon claims the drone successfully delivered its first 5 lbs package within 30 minutes. It is estimated that Amazon once peaked at 26 million online item purchases in a single day.

The pilot started with just two customers and is expected gradually expand to more customers over time in other countries including the U.S. Current government restrictions on the use of drones may pose challenges to deploying Prime Air in the U.S. The company is reportedly in working with regulatory agencies both in the U.S. and other countries to expand Prime Air.

“At Amazon, we’ve been engaged in the practical application of machine learning for many years now. Some of this work is highly visible: our autonomous Prime Air delivery drones; the Amazon Go convenience store that uses machine vision to eliminate checkout lines; and Alexa, our cloud-based AI assistant. But much of what we do with machine learning happens beneath the surface. Machine learning drives our algorithms for demand forecasting, product search ranking, product and deals recommendations, merchandising placements, fraud detection, translations, and much more. Though less visible, much of the impact of machine learning will be of this type – quietly but meaningfully improving core operations.” – Jeff Bezos, Amazon CEO, Letter to Shareholders (2016)

(For readers with a strong interest in drone applications, refer to our article on drone delivery, and our other article on commercial drone regulations.)

Deep learning – Amazon Go

Amazon Go is an emerging initiative which is part of the company’s heavier push into the grocery industry, evidenced by the estimated $13.7 billion acquisition of Whole Foods Market. The company claims that it leverages deep learning combined with computer vision and sensor technologies to track “when products are taken from or returned to the shelves.” Products are tracked in a virtual cart and customers are charged via their Amazon accounts.

This process would eliminate the need for a traditional check-out system. Currently one Amazon Go store is in operation at Amazon’s headquarters in Seattle, Washington which opened in December 2016. However, an innovative initiative of this kind is not without its challenges.

In March 2017 it was reported that the system experienced technical difficulties processing and tracking payments for more than approximately 20 customers at one time. As Amazon works to improve its model, the ideal customer capacity for this technology may require a smaller store design and a certain number of human staff on site to monitor operations and provide tech support.

JD.com

Automation and Robotics – Warehouse logistics

In 2016, reports circulated that Beijing-based JD.com engaged in a strategic partnership with Siasun Robot & Automation Co Ltd. The purpose of the collaboration was to use automation technology, such as robots, to improve warehouse operations. Ideally, this system would improve the speed and efficiency of product sorting and delivery in warehouses, thereby cutting costs and ultimately increasing revenue.

As of May 2016, JD.com had reportedly established seven logistics centers responsible for operating 209 warehouses throughout China such as its automated logistics and warehouse complex in Gu’an China.

Reports claim that the number of online orders hit a total of 1.26 billion in 2015 (double the amount of orders in 2014) and approximately 85 percent of those orders were delivered within two days.

It is possible that the logistics centers improved the company’s capacity to process orders and product shipment speed, however, this was not specifically confirmed by the aforementioned reports.

In July 2017, Richard Liu, founder and CEO of Beijing-based JD.com, stated that AI is a necessary component of the company’s business strategy going forward. The company reportedly aims to use AI to reduce the number of JD.com employees from approximately 120,000 to 80,000 over a decade and significantly increase its profit margin.

According to reports, November 2018 is the company’s target date for the debut of its

“first unmanned warehouse” and AI and robots will be responsible for handling jobs related to “parcel sorting, packaging and categorization.”

“Why must JD.com use AI and robots today? It is because we have exhausted all traditional technology and methods to improve retail costs and bring efficiency to its maximum potential. This is not because we like to follow a hot trend. This is our only choice to achieve another critical breakthrough in efficiency maximization.” – Richard Liu, CEO (July 2017)

AI Assistant – LingLong DingDong

Yeah that’s the legit name of the device. Legit. Moving on with the rest of the article now:

While the product name may not allude to a bold statement at first glance, JD.com is looking to compete with Amazon Echo with its own home speaker technology. The LingLong DingDong, which essentially performs the same functions as the Echo, currently responds to natural language commands in Mandarin and Cantonese.

Priced at approximately $118 per unit JD.com offers its product at a reduced price point compared to the Echo which averages about $180 per unit. Below is a brief description of JD’s smart speaker, with some context on the Chinese smart speaker market:

Smart home technology in the Chinese market is projected to reach $28.8 billion by 2018.

Alibaba

AI assistants – Tmall Genie and Ali Assistant

In June 2016, it was reported that Alibaba hired former Amazon senior principal scientist Ren Xiaofeng to lead its AI efforts. The move signals a concerted effort to enhance its competitive edge against the leading eCommerce firm. During his four years at Amazon, Xiaofeng states that he played an instrumental role in building the framework for Amazon Go.

The company’s efforts to compete with Amazon are also apparent in the launch of Tmall Genie, a very similar product to the Amazon Echo. The voice activated AI assistant debuted in July 2017 and is sold for less than its U.S. counterparts at 499 yuan (approximately $73.42).

Tmall Genie performs tasks, such as controlling smart-home devices, checking the weather or a user’s daily schedule. Currently the device is only available in China and is programmed to received commands in the Mandarin language. If Tmall Genie is successful, time will tell if and when Alibaba will attempt to expand its market reach beyond China. CNBC reported on Alibaba’s Amazon Echo competitor in July 2017:

Alibaba’s AI assistant technology also found in the Ali Assistant, a customer service chatbot that processes both written and spoken inquiries. The chatbot reportedly processes 95 percent of customer inquiries.

Machine learning – Recommendation engine

Alibaba claims that AI algorithms are helping to drive internal and customer service operations including smart product and search recommendations: Alibaba’s software tracks customer browsing and interactions with the website to offer product recommendations.

(For more insight on AI algorithms, read our full guide titled ‘Artificial Intelligence Algorithms and Their Business Applications’.)

Machine learning – Smart logistics

Through the company’s logistics affiliate Cainiao, AI is used to help map the most efficient delivery routes. Alibaba claims that smart logistics have resulted in a 10 percent reduction in vehicle use and a 30 percent reduction in travel distances.

In March 2016, Alibaba invested 10 billion yuan (approximately $1.53 billion) in the Cainiao Network for roughly 47 percent equity interest in the company.

eBay

AI assistant – eBay Shopbot

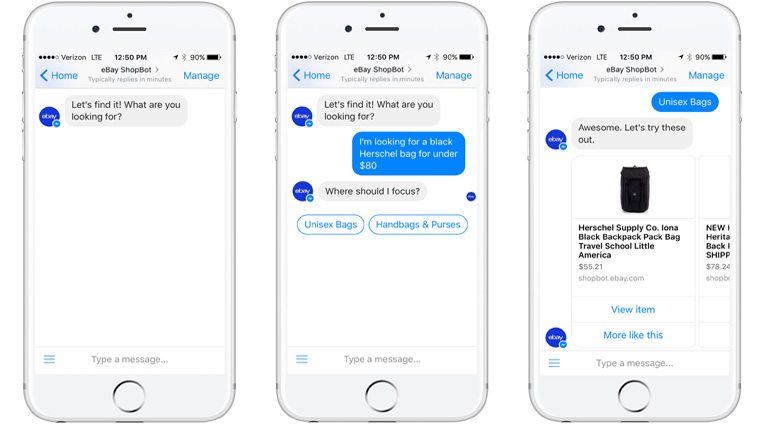

As a successful early competitor in the field of eCommerce, the company is looking to use AI to maintain consumer interest and a competitive edge. The eBay Shopbot, a chatbot accessed through the Facebook messenger platform was first piloted in October 2016.

The bot functions as an AI assistant to help users easily find products of interest using natural language. Users can communicate with the bot via text, voice or using pictures taken with their smartphone of images related to a particular product.

There is a lack of published evidence to substantiate whether the chatbot has proven to be a significant driver of revenue for the company. However, there is evidence to suggest that machine learning is an integral component of eBay’s business strategy.

“We apply machine learning techniques to item-to-product matching, price prediction and item categorization tasks on eBay. We also employ them for attribute extraction, generating the proper names of browse nodes, filtering product reviews and more. Machine learning helps us optimize the relevance of shoppers’ search and navigation experiences.” – Selcuk Kopru, eBay Research Scientist (August 2016)

Two out of six of eBay’s acquisitions in 2016, Salespredict and Expertmaker, were companies with platforms built using AI.

“What AI is going to do is accelerate the pivot from simple clustering around inventory, to combining intelligence about individuals, behaviors, trends, and context…We recently acquired Expertmaker – a company that has created an advanced AI platform enabling optimization and automation. We currently expect to apply their technology across our platform, to help improve shipping and delivery times, trust, pricing, and more.” – Devin Wenig, eBay President and CEO, May 2016

Concluding Thoughts on Artificial Intelligence in eCommerce

AI is emerging in the eCommerce segment of the retail industry and is being applied across multiple areas including processing customer service inquires, product packaging and delivery, and internal operations.

The economic impact of eCommerce must also be considered as some firms anticipate reducing their number of employees in favor of increased efficiency and cost savings. While a certain degree of job losses may be inevitable, research findings published in a 2017 report by the Progressive Policy Institute suggest that from 2007 to 2016 eCommerce produced 355,000 jobs while 51,000 jobs were lost in the general retail sector.

Emerj’s research on the retail industry at-large has revealed an important trend that is also applicable in the eCommerce sector: Applications that have the highest likelihood of broader retail adoption are those that have a direct, hard-line return on investment.

Therefore, smart logistics and recommendation engines are poised to continue to bring value to to companies investing in these technologies and are proving profitable for industry leaders such as Amazon.com.

In Emerj’s interview with eBay’s chief data officer Zoher Karu, Karu suggests that small and mid-sized businesses should organize their data around their customers in order to gain real business value.

Karu posits that the majority of businesses typically organize data in other ways such as by region, country or channel. As a result this often leaves gaps in gaining a thorough understanding of the customer perspective. Examples of customer-centric data include customer type, highest value customers and customer purchasing frequency.

We will continue to monitor how the eCommerce sector evolves as we anticipate the field will continue to be impacted by AI over time.

Header image credit: HerCampus.com