Since the early 2010s, major banks have used anomaly detection – an AI technique for identifying deviations from a norm – for automating fraud, cybersecurity, and anti-money laundering processes.

In fact, according to our AI Opportunity Landscape research, approximately 26% of the venture funding raised for AI in the banking industry is for fraud and cybersecurity applications, more than any other use-case category.

In this article, we cover the different approaches to AI banks can employ for detecting payment fraud, loan fraud, and customer onboarding fraud. We also discuss the data each approach requires and how that data is used for fraud detection purposes. More specifically, this article explores:

- An overview of machine learning for fraud detection in banking

- Anomaly detection for recognizing inconsistencies or inaccuracies in payment and application information

- Predictive analytics solutions for detecting fraud across multiple banking channels

We begin with an overview of machine learning for fraud detection in banking.

An Overview of Machine Learning Fraud Detection in Banking

Banks could benefit from a machine learning-based fraud detection solution in that they would be able to instrument it across more than one channel of data to be analyzed. This would mean the model could be trained to detect fraud within more than one type of transaction or application, or both of these at the same time.

It is important to note that a somewhat robust team of data scientists may be necessary in order to properly implement a solution like the ones mentioned in this article. We interviewed Jason Sundram, World AI Lead at Facebook, about building effective data science teams. When asked about how he goes about looking for new recruits for an AI team, Sundram said:

I think there’s a lot of ingredients…there’s a lot of focus given to the people who have the PhDs, and for sure they’re a crucial part of the equation. But really having somebody who represents the stakeholders so that you can really figure out how are you going to deliver something, that’s really going to be valuable is important. And there’s a bunch of other skills that become super important, especially at the scale that we’re at.

We can infer from this quote that not every member of a working data science team may necessarily need a high-level academic background in AI. Sundram highlights the usefulness of someone on the data science team who is more in tune with the market and customer base.

This makes sense because technically-skilled data scientists may not know which variables to experiment with to get the best results.

Data science dashboards for those working on the machine learning model once it is implemented typically allow access to the data from which the software made its correlations. This allows banking leaders and data scientists to develop a more keen understanding of how the software may have reached its conclusions, or at least which data is likely to have given rise to its correlations.

Vendor Example: Teradata

Teradata is an AI firm selling fraud detection solutions to banks. They claim their machine learning platform can enhance banking fraud detection by helping their data analytics software recognize potential fraud cases while avoiding acceptable deviations from the norm. In other cases, these deviations may be flagged and end up as false positives that offer the system feedback to “learn” from its mistakes.

According to a case study listed on their website, Teradata helped Danske Bank modernize their fraud detection process and reduce their purported 1,200 false positives per day.

The case study states that by the time Danske Bank had finished installing and implementing Teradata’s solution, they were able to:

- Reduce their false positives by 60% and were expected to reach 80% as the machine learning model continued to learn.

- Increase detection of real fraud by 50%

- Refocus their time and resources toward actual cases of fraud and identifying new fraud methods.

We continue our coverage of AI software for fraud detection in banking with anomaly detection and how it could recognize risk factors within daily banking processes.

Anomaly Detection for Payments Fraud

Anomaly detection-based fraud detection and prevention solutions are more common than those of predictive and prescriptive analytics. This type of application requires a much more common machine learning model that is trained on a continuous stream of incoming data. The model is trained to have a baseline sense of normalcy for the contents of banking transactions, loan applications, or information for opening a new account.

The software can then notify a human monitor of any deviations from the normal pattern so that they may review it. The monitor can accept or reject this alert, which signals to the machine learning model that its determination of fraud from a transaction, application, or customer information is correct or not.

This would further train the machine learning model to “understand” that the deviation it found was either fraud or a new acceptable deviation.

This kind of baseline could also be established for interactions with various other banking operations or entities. In addition to account owners, fraud can come from merchants and issuers, and their transaction information can be used to train a machine learning model to recognize transactions processing properly. This would usually involve pricing, but could also involve the omission of unpaid merchandise.

We interviewed Kevin Lee, resident Trust and Safety Architect at Sift Science, an AI fraud detection vendor. We asked Lee about the differences between today’s fraud detection capabilities and that of five to ten years ago. His response highlighted AI’s capability to detect fraud within these banking entities.

With regards to the challenge banks could face when considering the possibilities of fraud from each facet of the business, Lee said:

If you were a merchant, you obviously had confidence in yourself, of course I’m going to deliver these goods that I’m selling, but now you get into a scenario where I could be bad, the merchant could be bad or both could be bad and so it becomes more complex to figure out who’s bad, what’s the story and what is going on in this space. As a result it’s become much more difficult to decipher who’s good and who’s not.

Another possibility is in spending behavior, which would allow the machine learning model to recognize fraudulent details of retail shopping or eCommerce. Geolocational data may be important for these types of applications, as it is common that fraudulent transactions occur far away from where the account owner lives.

Vendor Example: Feedzai

One vendor selling anomaly detection-based fraud detection software to banks is Feedzai. The company claims their software can help banks prevent fraud and money laundering by developing detailed risk profiles on customers and scoring them based on granular data.

The company claims that their OpenML Engine software can help a bank’s data science team build their own machine learning models for fraud detection using the software’s provided fraud models.

Below is an image detailing how it works by showing the flow of data from data lakes and APIS into the OpenML Engine and then out to deployment. The data from deployment also appears to funnel into the feedzai risk studio, where it is analyzed and transferred back to the data lake:

Feedzai claims to have helped one of the top retail banks in the US more accurately detect fraud. They published a case study showing that bank’s success with the software, but did not mention them by name. This is important to watch out for when considering AI software vendors, but because of Feedzai’s team of AI talent and marquee clients such as Citibank we are confident that they do actually use AI.

According to the case study, the client bank found that their current fraud detection process for the online application of their main application processing system had been rejecting over half of the applicants. This resulted in significant losses the bank wanted to prevent in the future.

They needed a risk scoring application that could run through new account applications and only accept those that revealed a low risk rate for fraud. The bank wanted to make sure the only applications to be pushed to manual review were indeed risk, and that the risk factors were highlighted for faster decision-making on the part of the human monitor.

The client bank deployed Feedzai’s fraud detection software within their application processing system using their own databases. This purportedly made Feedzai’s software the chief decision-making engine for the onboarding process for new customers and could check their identities, eligibility, and assess fraud risk of individual customers. The case study also states that software was also able to ask follow-up questions specific to the customer when it was not presented with enough information to make a decision.

Feedzai claims in the case study that the client bank saw a 70% increase in newly onboarded customers after integration with their software. They also say the bank saw no increase in fraud losses even though the number of approved applicants increased.

Predictive and Prescriptive Analytics can Detect Fraud from Multiple Sources

Machine learning models for fraud detection can also be used to develop predictive and prescriptive analytics software. Predictive analytics offers a distinct method of fraud detection by analyzing data with a pre-trained algorithm to score a transaction on its fraud riskiness.

Prescriptive analytics takes the predictions made from the correlations of a predictive analytics engine and uses it to provide recommendations for what to do once fraud is detected.

Both predictive and prescriptive analytics software require the same data and training to implement. Banking data experts or data scientists employed by the client bank will need to label a high volume of transactions as either fraudulent or legitimate, and then run all of them though the machine learning model. This allows the machine learning model to be able to recognize fraud methods used in the fraudulent transactions.

For example, a fraudulent transaction may be for a product the account owner has never bought or would likely never buy. Additionally, the geographical location of the person who made the purchase may not line up with where the account owner was at the time of purchase.

The software can detect these inconsistencies after being trained, and so it will be more sensitive to those data points within transactions and flag them if the location data and the purchased product is suspicious.

Banks are likely to already have all of this data labeled due to their storage of bank records from years past. Fraud experts at the client bank working on the machine learning model will need to label which transactions are fraudulent or not while the system is being trained. The software gradually improves at discerning between fraud and legitimate banking operations as it is exposed to more labeled transactions.

Banks can use predictive analytics-based fraud detection software to detect fraud across multiple channels involved in payment processing. This could include recurring payments for financial services such as financial advisory or eCommerce payments that may involve a separate processing service. Additionally, banks can use this software to detect fraud in mobile apps for banking or remote ordering and paying for goods and services.

Applying Predictive Analytics Fraud Detection to Various Channels

With regards to recurring financial services payments, the process would largely stay the same. However, the data analyzed is more likely to involve changes to payment information and when they were done. These payments are automatically charged, and in the case of a decline the account holder is notified and the payment is rejected. A fraudster could attempt to change their billing information to someone else’s, which a predictive analytics application might be able to recognize.

eCommerce payments often need to go through a third party payment processing system that the merchant has a partnership with. For example, crowdfunding website Patreon uses Stripe to process their payments, which a bank using predictive analytics software could recognize as a separate entity. The software could compare the processing data for a given transaction with an established baseline for how Stripe is supposed to process payments.

This allows the software to recognize when a transaction uses a third party service so as to decrease false positives. Otherwise, the software may identify extra entities as new possible fraud methods.

Mobile banking and eCommerce apps could also be protected from fraud using predictive analytics. This process is similar to how normal merchant or financial service payments might be analyzed but is distinct in that it has to cover the individual structure and processes of each mobile app the bank may want to scrutinize. There is likely some overlap between the design of many mobile apps with in-app purchases, but this still may pose a challenge to banks.

This challenge comes from the ever-updating nature of smartphone apps. Predictive Analytics software could also detect anomalous user behavior within these apps, such as logging into an account from a phone that the account owner has never even seen. This can be discovered with smartphone geolocational data as well as if the phone holds any of the customer’s personal data. This may enable the software to detect a fraudulent login before any fraudulent transactions can occur.

Vendor Example: DataVisor

One vendor selling predictive analytics-based fraud detection solutions to banks is DataVisor. The company claims their software can provide risk scores for in-person and eCommerce transactions, claims, loan applications, and financial services payments. They also claim to have software with the capability to proactively search for and detect new risk factors based on newly found fraud methods and new emerging ones.

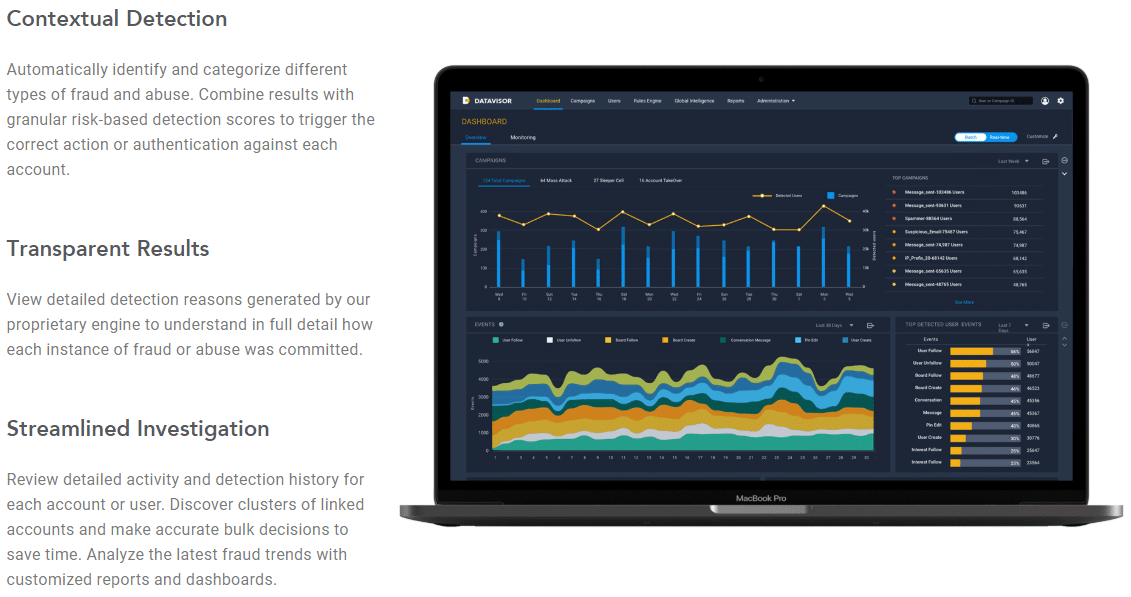

Below is an image showing how DataVisor’s platform looks on a computer screen, alongside a few notes about how this dashboard is beneficial:

According to a case study published on their website, DataVisor helped one of the U.S.’ largest banks detect use of specific fraud methods in their online applications for loans. These include the use of forged identities, stolen identities, and coordinated attacks on their portfolio of customer data.

The case study states that DataVisor’s unsupervised machine learning engine was able to analyze all of the applications together. This allowed it to extract subtle correlations between them to recognize fraud where it had previously gone unnoticed.

DataVisor claims that their software was able to uncover 30% more fraud at an accuracy rate of 90%. The case study also states the false positives amounts to 1.3% of those fraud detection instances.

Emerj for Banking Professionals

At Emerj, the AI Research and Advisory Company, we help global banks select the right AI-enabled fraud detection vendors, assess where AI can fit in their fraud detection workflows, and increase the success rate of their fraud detection technology initiatives. Clients use AI Opportunity Landscapes to mitigate financial and regulatory risk, decrease false positives, and reduce overhead costs.

We also help global banks develop winning AI strategies that allow them to apply AI successfully to banking processes well into the future. Contact us to learn more.

Header Image Credit: PYMNTS.com