Retailers and financial institutions are adopting artificial intelligence and machine learning in their business to solve various business problems such as cybersecurity and document digitization. However, many of these companies are also using AI to improve their payment processes for their clients and customers. These types of applications are usually layered into an existing payments technology stack, which could include straight-through processing (STP) or robotic process automation (RPA).

In this article, we cover three companies that deal with large volumes of payments every day and how they leverage AI to make them faster, more accurate, or safer. We also infer how they most likely work, and discuss the benefits they saw after implementing their AI solution.

The companies whose AI payments solutions we cover include:

- Citigroup, or Citi Treasury and Trade Services (Citi TTS), and how they use predictive analytics to facilitate their accounts payable process. We also cover their new partnership with Feedzai to offer payments fraud detection solutions to Citi TTS clients.

- Starbucks, and how their mobile ordering app has added machine learning and natural language processing (NLP) to help each customer order their items and pick them up quickly.

- Paypal, and how their customer service chatbot can assist users in making payments, requesting refunds, and checking the status of their account and refund requests.

We begin our exploration of artificial intelligence in payments with Citigroup’s AI-powered accounts payable process and how it works in concert with STP.

Citigroup

Accounts Payable

Citi Treasury and Trade Solutions within Citigroup is leveraging AI software in facilitating the accounts payable process. They claim to have improved upon their already heavily automated accounts payable solutions, which likely includes RPA and STP.

While RPA technology can replicate and execute the most simple and repetitive tasks, STP is known for streamlining payment and routing information across the appropriate channels.

The high volume of payments, which include those created by teams outside of a client’s treasury department, make it more difficult for that department to identify new types of payments. Citigroup claims that AI can address this issue and uses their Payment Outlier Detection Service pilot as an example. The video below gives an overview of the initiative:

Using machine learning, the company was able to create a pilot project for automatically detecting new categories or types of payment that a client company interacts with. One example of a new payment category would be a new loan plan offered by a financial institution. The system could recognize this as a new company offering and allow the payout to go through.

This would allow other parts of the technology stack, such as STP, to more easily carry out their tasks. For example, an STP program would be able to process routing information on a new type of payment immediately.

This is because the Payment Outlier Detection was able to categorize the payment, which would assign to it the proper destination for the routing information.

The pilot software most likely accomplishes this by checking each payment against a pre-established baseline of normal payment behavior specific to the client company. Citigroup claims the software can trigger alerts in real-time to show human employees that there is a new type of payment.

If the payment is incomplete or is otherwise erroneous, a human employee can reject the payment altogether.

If it is simply an abnormal but still acceptable type of payment, such as an invoice from a third party they only work with occasionally, the client can accept it. This may allow the AI to adapt to this new type of payment in the future.

Citigroup’s AI for payment processing is likely accomplished with predictive analytics. This is because they would need a machine learning model that can be trained on the client company’s treasury and payment behavior and adapt frequently to new types of payments.

It is unlikely that it would require another AI approach such as anomaly detection because it is more commonly used for risk management and fraud detection. Instead, predictive analytics could generate a confidence level for each payment, and the client could determine the threshold at which an abnormal payment should trigger an alert.

Risk Management and Feedzai Partnership

Citigroup has also recently partnered with Feedzai to integrate their AI platform for risk management and fraud detection for their banking and commerce clients. Citi themselves claims they will be integrating Feedzai’s platform for monitoring transactions into its currently available services and platforms. This may give clients more control over their risk management for all of their transactions.

In reference to this new partnership, Manish Kohli, Global Head of Payments and Receivables, Citi’s Treasury and Trade Solutions (Citi TTS), has said, “Our strategic partnership with Feedzai demonstrates our deep commitment to using technology to drive innovation. With the help of Feedzai’s solution, we can scale rapidly in an effort to deliver value to our clients, allowing them to make payments securely, efficiently and without friction, across the globe.”

Indeed, it appears that Citi TTS is focused on providing accurate risk management that does not slow down the claims processing technology already present within many of their solutions.

Because cyber-attacks, fraud, payment processing, and fraud detection are all constantly innovating, Citigroup’s clients expect the speed of their payments to keep up as well. The company claims that their integration of Feedzai’s anomaly detection software will help their clients stay on top of new threats without slowing down their transactions.

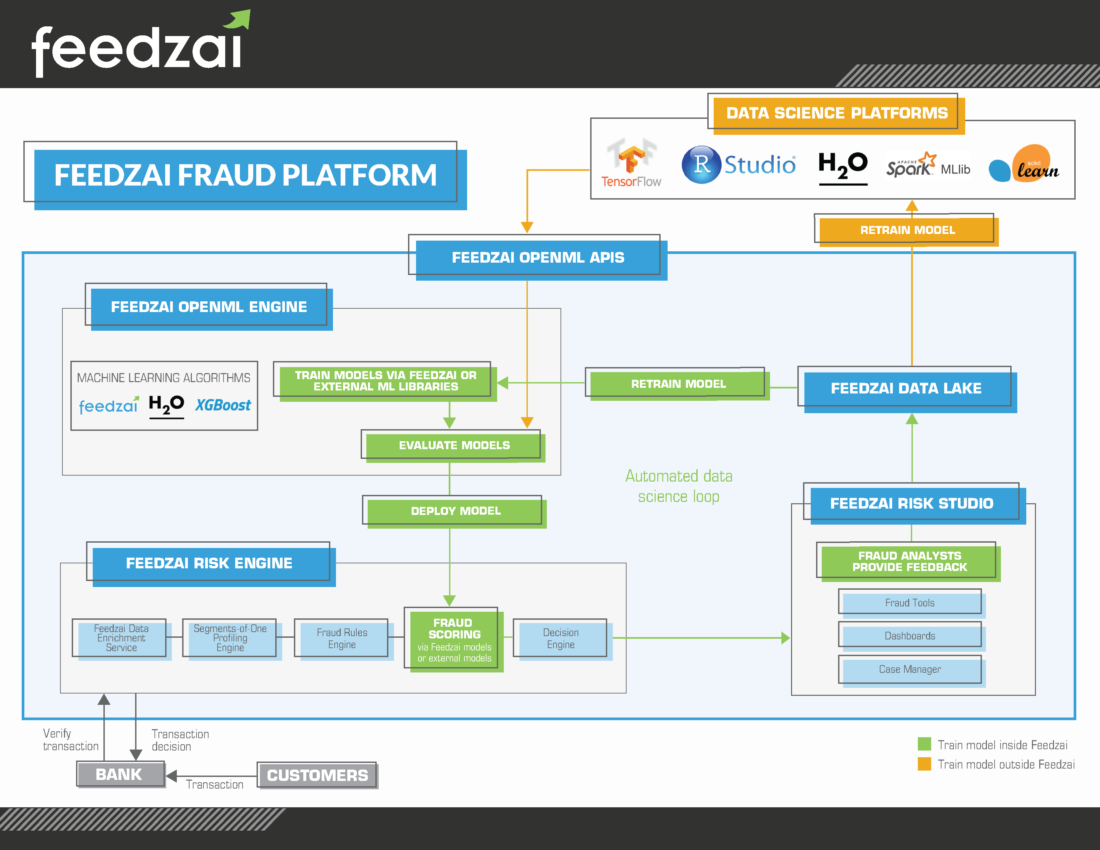

Feedzai has stated that their OpenML Engine software can help banking data science teams create machine learning models for fraud detection using the fraud models provided. It is likely that Citi TTS has used some form of this to create their own models for their banking and commerce clients.

The image below details how Feedzai’s AI platform works. It depicts the flow of data from large stores or “lakes” and APIs into OpenML Engine. The engine then deploys the data for experiments and real-time analysis. The data from deployment also funnels into the “Feedzai risk studio,” which may or may not be a part of the Citigroup partnership:

The software purportedly can accomplish this by monitoring each transaction for discrepancies or changes in payment behavior and analyze these anomalies before they are cleared to continue through the system. Citigroup claims that they will likely have a new solution that leverages Feedzai’s anomaly detection in 2019.

Starbucks

It may be surprising to some to find out that Starbucks has recently become something of a leader in mobile payment technology. The My Starbucks Barista app for mobile ordering allows customers to select their preferred Starbucks location, type or speak their order into the app, and then pay. All the customer needs to do at the store is pick up their order.

The app has been taking in innumerable weekly payments for years since its inception in 2009. This is likely because Starbucks was able to leverage Automated Clearing House (ACH) payments, as well as Natural Language Processing (NLP) later, within the same app.

ACH payments systems automate the process of clearing payments to be paid out from the client company. This is a way for retailers and financial institutions to transfer money without using wire transfers, cash, paper checks, or credit card networks.

This allows for faster payment processing, and also is likely to be more “lightweight” on a mobile app for payments. This is because ACH would form a single stream for payments to follow, because the method for transferring money will be the same no matter the customer.

The NLP technology is where Starbucks leverages AI to help the customer along from order to payment, which would encompass their routine customer journeys using the app.

The app is essentially a chatbot service that is linked to Starbucks’ product, pricing, and payment databases. It is programmed to ask for more details on the items in the customer’s order, as well as allow them to customize their drinks just as they would with an in-person barista.

Customers can also do all of this by speaking their order and subsequent payment information into the microphone of their smartphone. The app will then add the items to the customer’s cart, where they can review them in case of any mistakes or possible changes.

Additionally, a customer can likely ask to pay with their credit, debit, or Starbucks gift card. Like other mobile ordering apps, it may also be able to save multiple payment methods for later use by asking to do so in the app.

According to the company, customers will soon be able to access the My Starbucks Barista app from their Amazon Alexa to use what they call “Starbucks Reorder Skill.” This feature will allow the customer to reorder their “usual” from Starbucks with a single voice command.

This may result in a push notification to the customer’s cell phone to alert them of a new payment and receipt.

All of this conversation-based customer service would have to be made possible with NLP. The machine learning model would need to be trained to understand voices of different pitches and tones ordering every item on the Starbucks menu. Additionally, training data would need to include the large number of customization options for each item, including warming up certain foods and adding cream or milk to their coffee.

Once the machine learning model was trained and deployed, it could most likely automatically update to changes to the menu as well as how people speak their order.

PayPal

PayPal also claims to use AI to power their customer service chatbot, which can run through messaging apps such as Facebook messenger. Their CTO, Sri Shivananda, has spoken about how their machine learning algorithms are much more viable now that the hardware required to run them has become cost-effective. When asked about how he thought AI might fit into a plan for improving payments, Shivananda said:

Recent advancements in compute, like GPUs, have made the algorithms that have existed for a long time commercially viable and effective. We are always looking to see how we can mechanize the creation of insights from data. A recent innovation is our customer chatbot. You can actually get a refund or resolve a dispute through a system that understands context and is highly privacy oriented.

For security reasons, the PayPal chatbot asks the user to log into their account each time they use it to access personal data. It can also show the user a window with their disputed payments listed so they may check the status of each dispute.

Customers can ask the bot questions or for help with various aspects of their PayPal account. These inquiries include:

- Why a payment was declined

- Reporting an unauthorized charge

- Their account password

- Limitations set on their account

The chatbot also covers questions about refunds, and can also help the customer request or check the status of a refund. Customers can also use the app to check the processing time of a payment or refund, which may give some users peace of mind while waiting for money to arrive back in their account.

PayPal also claims to leverage machine learning for fraud and risk mitigation across their payments platform. They purportedly use hundreds of identifying elements present in every transaction to ensure the customer is making an intended purchase or payment.

No extra passwords are necessary, and the PayPal One Touch service does not require any kind of biometric data to release the payment.

Instead, they leverage the innumerable amount of data points that link a safe transaction back to the account holder to establish a sense of normal spending for each user. The company likely accomplishes this using predictive analytics because of the way the machine learning model would need to be trained in order to handle the spending habits of millions of users.

Some users have very volatile spending habits while others have more typical trends across each year.

Predictive Analytics would likely be better at handling this variety because each instance of the algorithm would take time to establish its own unique sense of normalcy per user. Data points from each transaction are most likely fed back into the machine learning model to help it improve.

Header Image Credit: NTT Data