Some financial institutions have begun investing in departments that focus on artificial intelligence and machine learning applications that could determine their customer’s sentiments towards market developments. These applications fall under the category of sentiment analysis. We have previously covered some of the top the machine learning applications in finance. In this report, we focus on AI-based sentiment analysis applications for the finance sector.

As of now, numerous companies claim to offer sentiment analysis software that could assist financial analysts or other employees at banks and financial institutions in aspects of their roles from generating reports faster to searching documents for relevant information.

We researched the space to better understand where AI comes into play in the finance industry and to answer the following questions:

- How is sentiment analysis currently used in the finance world?

- What tangible results has sentiment analysis driven in finance?

This report covers vendors offering software across three applications:

- Data Search and Discovery

- Report Generation

- Process Automation

This article intends to provide business leaders in the finance space with an idea of what they can currently expect from sentiment analysis software in their industry. We hope that this article allows business leaders in finance to garner insights they can confidently relay to their executive teams so they can make informed decisions when thinking about this kind of AI adoption. At the very least, this article intends to act as a method of reducing the time business leaders in finance spend researching sentiment analysis companies with whom they may (or may not) be interested in working.

Data Search and Discovery

AlphaSense

We previously covered AlphaSense and their data search and discovery application in our Natural Language Processing Applications in Finance report.

AlphaSense is a New York-based company with 128 employees. The company offers a market data collection software, which they claim can help financial institutions create a search engine for financial market developments.

AlphaSense claims that their database of market developments are periodically indexed with additions to the existing millions of documents, such as public company filings and conference call transcripts.

The AlphaSense search engine then parses topics, concepts, and ideas from these documents to find valuable pieces of investment information. The system then provides a summary of the most relevant information for search queries from employees at financial firms on the search engine interface. Once they find information of interest, users can access more detailed information in the same interface.

AlphaSense does not make available any case studies reporting success with their software.

AlphaSense claims to have over 800 clients, such as banks and investment firms including 66% of Dow Jones Industrial Average (DJIA) companies.

Dmitry Kan is Head of Search at AlphaSense Inc. He holds a PhD in Computer Science from Saint Petersburg State University. Kan is also the founder and CEO at AI Startup SemanticAnalyzer.

Report Generation

Narrative Science

Narrative Science is a Chicago, Illinois-based company with more than 100 employees. The company offers a software called Quill, which they claim can help financial institutions communicate insight from structured data using natural language generation (NLG).

Narrative Science claims users can integrate the Quill software into their existing business processes to aid with tasks such as report generation. For instance, a financial company that uses human analysts to create narrative reports, such as a detailed sales report for a regional manager, might automate the generation of those reports by training Quill on existing reports. According to Narrative Science, human analysts and subject matter experts are needed to train the NLG algorithm to generate reports accurately. Then, Quill can learn to identify relationships in the reports and understand which parts of the reports are the most relevant, eventually enabling companies to generate reports in natural language of the appropriate sentence lengths, structures, and word variability. The system then provides a narrative report that can be produced at scale and personalized for an individual.

Below is a short 7-minute video demonstrating how Quill works:

Narrative Science claims to have helped an unnamed US bank automate the generation of Suspicious Activity Reports (SAR). SARs are a type of document that financial institutions must file with the Financial Crimes Enforcement Network (FinCEN) after detecting a suspected money laundering or fraud event.

According to the company, the bank’s fraud detection team worked alongside natural language processing experts from Narrative Science. The Quill software was calibrated to automatically write SAR narratives for any suspicious money-laundering activity detected by the bank’s fraud team. The bank reportedly automated the SAR narrative writing process and could generate reports at a scale that was previously not possible using human writers. According to Narrative Science, this resulted in the bank saving $225,000 annually and reducing the time taken for generating each SAR from 4 hours to 1.5 hours.

Narrative Science also lists Credit Suisse as one of their past clients. Unfortunately, we could not find evidence of any C-level executives on the team with previous educational or work experience in AI projects, but they have raised $43.7 million in funding over seven rounds.

Lexalytics

Lexalytics is a Boston-based company with 45 employees. The company offers a software tool called Semantria, which they claim can help banks and financial institutions automate the process of analyzing and gathering insights from surveys using NLP.

Lexalytics claims users can integrate their software tool Semantria with Microsoft Excel and perform text or sentiment analysis for surveys and social media data captured in excel sheets. Then, Semantria uses natural language processing to categorize the feedback from the customer survey data to identify the positive, negative, or neutral tones in the content. The system then provides outputs in the form of categorized data in the same excel sheet allowing users to see graphical representations of which queries were most common or who were the largest promoters or detractors among the customers who submitted feedback.

Below is a short 2-minute video demonstrating how Semantria works:

Lexalytics claims to have helped evolve24, a big data analytics firm, automate social media monitoring. Evolve24 needed to process large amounts of social media data rapidly in order to provide analytics products for their customers. Human analysts at evolve24 were facing trouble in processing such a large volume of text data. Evolve24 worked with Lexalytics to integrate a text analysis tool for their big data analytics solutions which could aid with entity extraction for names of people, organizations, places, events, quotes, employment or relationships. According to Lexalytics, this resulted in evolve24 managing to process over 4.5 million documents per day after an integration period that lasted two months.

Lexalytics also lists Microsoft, HP, Oracle, and Mckinsey as some of their past clients.

Paul Barba is Chief Scientist at Lexalytics. He holds a Bachelor’s degree in Computer Science from the University of Massachusetts Amherst.

Process Automation

Stride.ai

Stride.ai is a Bangalore-based company with 17 employees. The company offers a text and sentiment analysis software called TEXSIE, which the company claims can help banking and insurance firms gauge customer and market sentiments using NLP and machine learning.

Stride.ai claims users can integrate their text and sentiment analysis tools using APIs to automate internal business processes involving information extraction and analysis from unstructured data such as text documents or images. Then, TEXSIE uses image recognition and natural language processing for business process automation applications where historical data from banking and financial documents are used to train algorithms with human input to classify, summarize and analyze data automatically.

Stride.ai provides a live demo of how TEXSIE functions on their website. Interested readers can test the keyword identification, sentiment analysis, and text summation capabilities of the software.

Our research yielded no results when we tried to find case studies for the software.

Stride.ai also lists Full Tilt Ahead, an Atlanta-based academic design studio, and Appbackr as some of their past clients.

Krishna Chaitanya Munjam is Senior NLP Engineer at Stride.ai. He holds a Bachelor’s degree from Indian Institute of Technology, Madras. Previously, Munjam served as NLP Analyst at Cognizant. We caution readers to be wary of companies that claim to do AI without any C-level AI experts on their team.

TheySay

TheySay is a Northampton, England-based company founded in 2012. The company offers a plug and play software tool called PreCeive, which they claim can help financial institutions with text-based data analysis and categorization of sentiments using NLP.

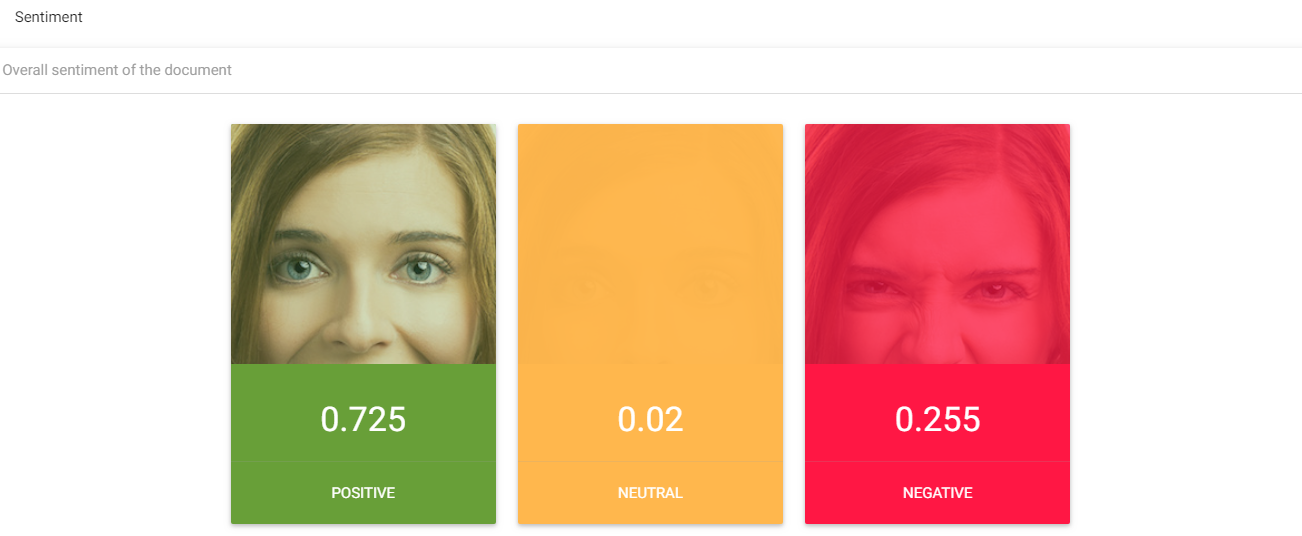

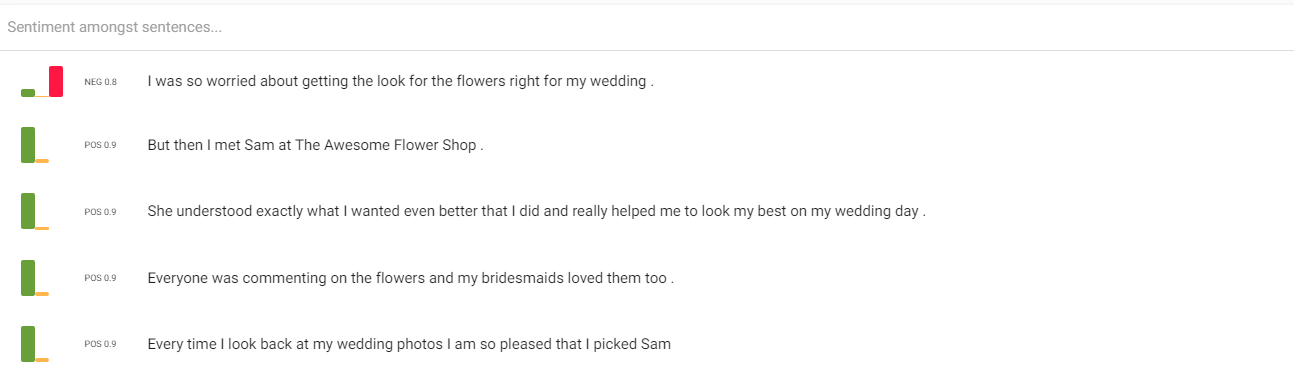

TheySay claims users can integrate the PreCeive tool through an application program interface (API) which can be accessed by employees in a financial firm to gauge customer moods, emotions or sentiments from feedback forms or other customer interaction documents such as call transcripts or emails. Then, PreCeive uses NLP and machine learning to automatically classify and discover insights about products, people, companies, issues, and events from text-based data.

TheSay claims the accuracy of its tool’s sentiment analysis has been improved over several real-world business applications, and businesses can further customize the tool with input from their internal financial subject matter experts. The system then allows businesses to develop applications that involve text-analysis without having to create the technology from scratch.

Below are screen grabs from a demonstration of the PreCeive software’s sentiment analysis capabilities as per TheSay’s website. We entered arbitrary example text and received the following analysis:

TheySay claims to have worked with a financial institution to automate categorization and insight generation from customer emails. The financial firm reportedly received over 10,000 customer emails every day and had to categorize and report them to meet Financial Services Authority (FSA) regulations.

The firm was using human analysts to manually categorize these emails which were proving to be slow, expensive, and inconsistent. The firm used TheySay technology to automate the process and deliver insights gleaned from these email messages to inform their customer service and marketing teams. We must add here that the client was unnamed, and so readers should take this case study with a grain of salt.

TheySay does not list any major companies as clients, but they have raised around $2 million in funding and were acquired by Vista Equity Partners.

There does not seem to be any C-level executives on the team with an AI background.

Takeaways for Business Leaders in Finance

Based on the companies we found it seems as though NLP applications for information search and discovery for financial market data seem to have established use cases from companies such as AlphaSense (claims they have over 800 clients who use their products) and Narrative Science ( raised over $43 million). Both companies seem to have successfully established clearly what cost and revenue benefits can be gained by automating search processes or extracting information using AI.

There seem to be two approaches AI vendors are taking with respect to understanding the overall sentiments in financial data – creating search engines that can comb through news and social media to archive and summarize details that might be considered most impactful for a business or using existing internal company documents (both structured and unstructured) to understand, classify and generate succinct reports from the raw data which are indicative of positive, negative or neutral sentiments in the data.

However, establishing use-cases for customized AI integrations could last for three to five months typically and models may still need to be fine-tuned for accuracy well beyond that timeframe.

Business leaders also need to be aware of the fact that the integration of sentiment or market analysis AI systems would also require financial domain experts to work in collaboration with data scientists in order to arrive at more accurate models.

In most cases, human analysts will still be a key part of the process for the next two to five years in most applications of sentiment analysis in finance, although it’s use might become fairly ubiquitous in that period.

In the near term, banks should not expect to easily be able to automate their business processes or gain business intelligence from their data without embarking on a lengthy integration process starting with managing and organizing their data. The largest enterprises may have the budget and staff to pursue the technology, but based on our research, there seem to be plug and play offerings from vendors which can be used by organizations for certain applications.

Header Image Credit: DOCUMENT Strategy