The Allstate Corporation, or simply ‘Allstate,’ was founded by Sears, Roebuck & Co., then-president General Robert E. Wood in 1931. Auto liability insurance began as the company’s flagship product and remains so today. The company added various coverage types throughout the 50s and 60s, including commercial, health, life, and personal liability insurance.

Today, Allstate is the United States’ largest publicly-held personal lines insurer by revenue. The company recorded revenues of nearly $51 billion in 2021. Allstate wrote over $41 billion in direct premiums that same year, including almost $10 billion in homeowners insurance, the second-highest total of all insurance providers.

In this article, we’ll look at how Allstate has explored AI applications for its business and industry through two unique use cases:

- Faster Product Knowledge – Allstate Business Insurance claims that it uses AI models to help agents acquire knowledge about insurance products faster and better streamline the quoting process.

- Automated Transcription – Allstate claims that it is able to derive meaning and context from customer calls to enhance customer experience and facilitate problem resolution.

We’ll begin by examining how Allstate has focused on the use of AI to help its agents acquire product knowledge faster.

Faster Knowledge Acquisition for Agents

When Allstate opened its new Allstate Business Insurance (ABI) division, the company stated that it was a challenge to get timely, relevant, and streamlined information to their agents. One of Allstate’s partners on the project, Jorsek (renamed “Heretto”), claims that it needed a real-time solution to answer business needs and insurance questions. Introduced in 2018, the tool remains available as a reference for business and individual customers.

Prior to implementing the Allstate Business Insurance Expert (ABIE), agents who had questions regarding new business insurance products had limited references to consult. Policies and procedures governing business insurance products were published as PDFs in the company’s SharePoint repository, and accessing the information was time-consuming. Moreover, Jorksek claims its help desk volume spiked and put potential policy sales at risk.

To solve the problem, Jorsek states that the Allstate team first identified agents’ most frequently asked questions before searching through PDFs, finding the answer, and capturing it in a DITA XML file. Using the information model captured in DITA, solutions were classified according to “type.” For example, step-by-step processes were “Tasks,” facts in look-up tables were “Reference,” etc.

A customized search experience was then implemented using what appears to be language and speech AI models. Earley Information Science (herein, “EIS”) claims to have helped Allstate develop this capability.

EIS claims that the system helps guide agents “step-by-step” through the quoting and issuing of ABI products. For example, if an agent asks, “What is the SIC code for an Advertising Agency?” the customized search would return a table or relevant codes. If an agent asks, “How do I quote and issue a commercial auto policy?” they would see a step-by-step procedure to quote and issue the policy.

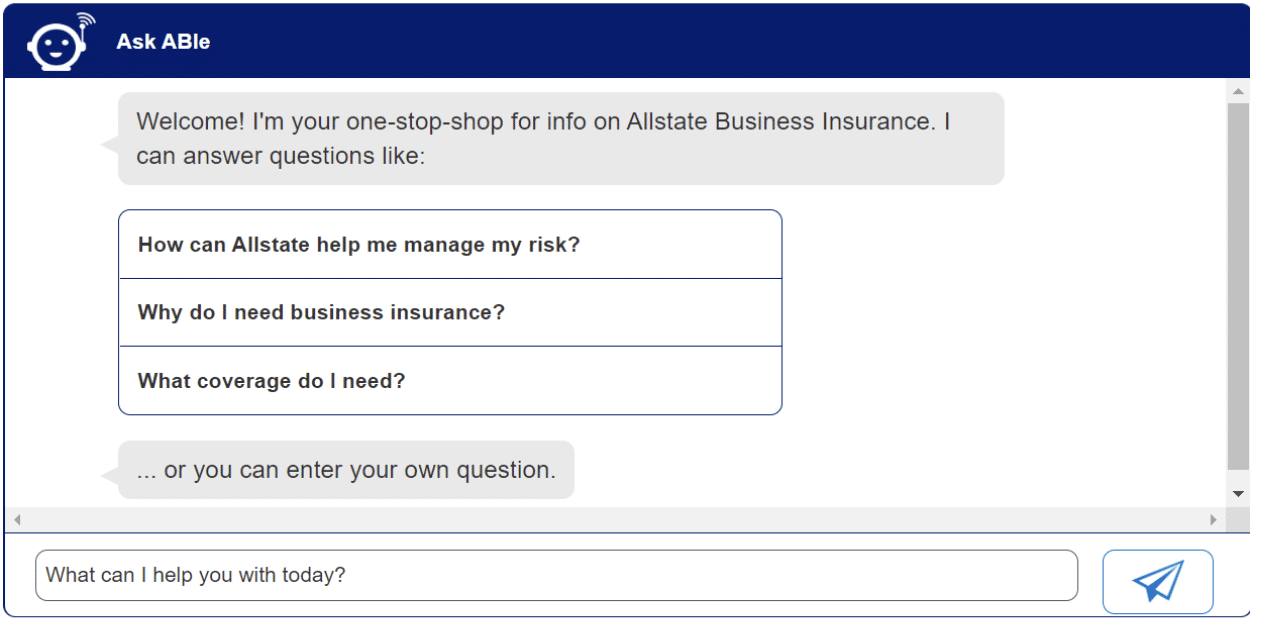

ABIE is also used as a reference tool on the front end. A business customer can use the “Ask ABIE” tool, which appears on the “Chat & Help” section of Allstate.com’s business insurance section, and find real-time answers. The system begins with a list of three questions and a prompt that informs the customer that they can ask their own.

Concerning business results, EIS claims that ABIE can handle over 25,000 customer inquiries monthly and that this number is growing quickly. EIS claims that ABIE is faster than calling the help desk and that agents have easier access to the necessary knowledge to “become effective at selling, quoting, and issuing business insurance.” Finally, EIS claims that the sales of commercial policies have grown, although no specifics are provided.

Automated Transcription

When people are in a car accident, it takes time for their nerves to settle. Unfortunately, it is also during this time of confusion and fear that some of us call our insurance company. As a result, some of the speech that may come from a person who has recently been in an accident may be unclear.

It is also during this call with their insurance provider that a person gives a lot of information. Olivia Mahler-Haug, who works in the claims, innovation & delivery department of Allstate claims,

“… we realized that when a customer reports their accident, initially they were providing a whole bunch of rich detail that we’re not able to capture effectively.”

Rebecca Harasymczuk, product leader at Allstate, adds, “When a customer calls us, it’s a pretty traumatic experience for them. So we want to make sure that they can move through that feeling of fear and reduce all of their effort and the friction that they need to go through.”

Connor Walsh, platform lead in the claims technology solutions department of Allstate, claims to have developed a solution that could:

- Capture all of the voice calls they had with their customers.

- Transcribe calls using AI

- Take “rich detail” provided by the customer and infer meaning

- Create custom models specialized for insurance-specific vocabulary.

To develop this solution, Allstate partnered with Microsoft’s Azure Cognitive Services. Per Microsoft, Azure Cognitive Services is “a comprehensive family of customizable cognitive APIs for vision, speech, language, and decision making.” Below is a video that provides an overview of the capabilities of Azure Cognitive Services.

Based on Allstate’s claims of what their customized software can do, we can infer that they likely used Azure’s “Speech” capacities, including conversation transcription, speech transcription, and custom speech. To infer meaning from the speech, we can infer that Allstate also used Azures “Language” capacities, including text analytics and language understanding.

Concerning tangible business results, we could not uncover specific, quantifiable outcomes related to the project apart from employee anecdotes pertaining to enhanced customer service.