AutonomousNEXT released a report on the opportunity that AI might create in the banking and financial services industry. The report estimated that by 2030, the potential cost savings by applying AI in banking, investment management, and insurance were $490 billion in front office operations, $350 billion in middle office, $200 billion in the back office operations.

Inkwood Research estimated the market size for artificial intelligence in Europe was forecast to grow at 44.45% CAGR over the projected years of 2018-2026. It follows that AI would find its way into the European banking industry. In our previous reports, we detailed how the top American and Indian banks are applying AI. As of now, numerous companies claim to assist banking employees in aspects of their roles from automating business processes to predicting risk.

We researched the space to better understand where AI comes into play in the European banking industry and to answer the following questions:

- What types of AI applications are currently in use by European banks?

- What tangible results has AI driven in the European banking industry?

- Are there any common trends among these innovation efforts? How could these trends affect the future of banking in Europe?

This report covers vendors offering software across four applications:

- Customer Service

- Debt Collection

- Document Search

This article intends to provide business leaders in the European banking industry with an idea of what they can currently expect from AI in their industry. We hope that this article allows business leaders at European banks to garner insights they can confidently relay to their executive teams so they can make informed decisions when thinking about AI adoption.

Customer Service

Atos

Atos is a Bezons France-based company with over 80,000 employees. The company offers a platform called Atos Codex AI Suite, which the company claims can help banks build AI products with applications such as predictive analytics, video analytics, cybersecurity, and more using machine learning.

Atos claims banks can use their platform to create AI systems for improving customer service. According to Atos, banks with historical CRM data (such as SalesForce) can generate personalized customer profiles that can be accessed from a web portal by a bank’s customer service team members.

Below is a short 1-minute video demonstrating how Atos AI Codex Suite works:

Atos claims to have helped Ulster Bank improve customer experience. Ulster Bank had been using SalesForce as its CRM tool since 2008 and had collected a lot of historical data. The company needed a way to more fully utilize the capabilities of SalesForce’s new AI tool, Einstein. Atos was tasked with cleaning and organizing the bank’s data to make sure it fit the format requirements for Einstein. Atos was also tasked with developing an Einstein-based “next-best product” recommendation engine for the bank’s relationship managers. Atos claims the bank was able to segment their customer base more accurately, but no measurable results were disclosed in the case study.

Atos also lists the European Space Agency, British Petroleum, and Johnson & Johnson as some of its past clients.

ING

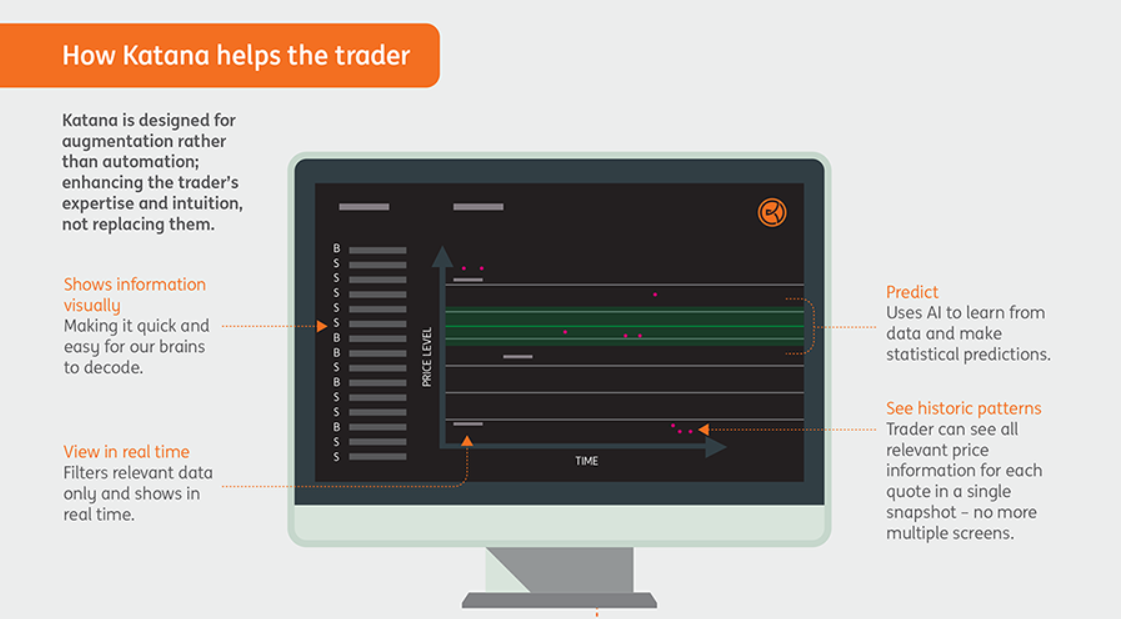

ING is a Dutch banking services provider founded in Amsterdam in 1991. The company claims to have developed an internal AI tool called Katana, which they claim can help bond-traders make better buying and selling pricing decisions using predictive analytics.

ING claims bond-traders can install the tool on their trading systems and access the Katana interface (as shown below). Katana can reportedly use historical and real-time bond trading data to make statistical predictions about prices for bond quotes. Then, Katana uses machine learning to predict the most optimum prices to buy and sell the traders selected bonds in the interface. The system then provides an output in the form of recommended pricing for the various quotes in the interface.

The infographic below from ING’s website depicts some of the major features which ING highlights within the Katana interface:

ING claims that pilot testing of their Katana platform for traders in the emerging markets (EM) desk in London showed that they were able to quote prices faster for 90% of trades, reduce the cost of trading, and traders quoted the best possible price more frequently. ING did not provide information on how much the cost of trading was reduced nor on how frequently traders quoted the best possible price before testing Katana.

ING exclusively uses the Katana tool internally, and so there are no available case studies for the software.

Gorkem Koseoglu is Global Head of Artificial Intelligence and Robotics at ING. He holds an MBA from the TSM Business School, but his LinkedIn profile does not disclose in what field he holds a degree. Previously, he served as an intelligent network manager at Lucent Technologies. We caution readers to be wary of companies that claim to do AI without any C-level AI experts on their team.

CogniCor

CogniCor is a Barcelona-based company with 64 employees. The company offers chatbot services which they claim can help banks improve customer experience and generate leads using natural language processing (NLP).

CogniCor claims banks can integrate their chatbot with websites or apps to help improve customer experience and ease. The chatbots are trained on enterprise data from the bank and even unstructured documents such as PDFs or internal portals. Then, the chatbot application categorizes and extracts the most relevant information from these documents which might help answer questions from customers. The system then provides a conversational interface for the bank’s customers which can help them with discovering banking products.

Below is a short 4-minute video of a panel discussion delving into how CogniCor chatbots work:

CogniCor does not make public case studies for their products.

CogniCor also lists Atos, TATA Capital, ICICI Lombard and Federal Bank as some of their past clients.

Sindhu Joseph is CEO at CogniCor . She holds a PhD in Artificial Intelligence from Autonomous University of Barcelona. Previously, Joseph served as Research Engineer at Honeywell where she worked with data and text mining.

Debt Collection

CollectAI

CollectAI is a Hamburg-based company founded in 2016. The company offers a software which they claim can help banks, credit unions, and other financial institutions automate and improve debt collection using NLP and machine learning.

CollectAI claims banks can integrate the CollectAI system into their internal debt collection workflows. The system can be accessed through a management web portal which notifies debt collection officers about which channel of communication to reach the customer, when to do so, and with what type of message. The CollectAI system is trained on historical customer communication data from multiple channels, such as email, WhatsApp, text message, and postal letters. The software uses machine learning to identify the right time of day and proper tone of voice for the communication (such as friendly, amusing,l or assertive) in order to send a message with the highest likelihood of receiving a reply from a debtor. The system then provides these suggestions on the management portal in the form of alert notifications that debt collection officers can execute on in order to improve engagement with their debtors.

We could not find a suitable demo video for how the CollectAI software functions.

CollectAI claims to have helped Hanseatic Bank identify the best timing and digital communication channels for debtor interactions to increase the likelihood of payments. According to the case study, the CollectAI system helped Hanseatic bank’s debt collection team notify customers at the best possible time with payment reminders for credit card and consumer credit debt. According to CollectAI, Hanseatic Bank saw a 14% increase in their total debt collected within six months of integrating CollectAI’s system. It is unclear how much CollectAI’s software contributed to this 14% increase, however.

We were unable to find any mention of enterprise-level companies on CollectAI’s website.

We were unable to find any C-level executives with AI experience on the company’s team. The company does, however, employ people it gives the title of “data scientist,” including

Alexey Kiselev, who holds a Master’s of Technology in Nonlinear and Laser Physics.

Document Search

Eigen Technologies

Eigen Technologies is a London-based company with 73 employees. The company offers a software which they claim can help banks and financial institutions automate the extraction of data from unstructured documents using NLP.

Eigen claims users can input the Eigen software with financial data from documents in the form of word docs or PDFs. Eigen claims their software can classify documents in several European and Asian languages. The software can be integrated on-site or in a cloud environment. Eigen claims their NLP algorithms are not pre-trained for any specific language and can understand the context in each document to categorize it under a certain attribute (chosen by the client bank through human input).

Once the data has been classified and segmented, Eigen’s software also uses machine learning to find patterns in the data that could help banks lower costs, new opportunities, predicting risks, and meeting regulatory requirements. The system then provides a queryable interface on its dashboard, where bank employees can contextually search for information (such as excerpts from regulatory documents relevant to a particular region) augmenting their speed and capability.

Eigen does not have a demonstration video available showing how its software works.

Our research yielded no results when we tried to find case studies for the software.

Eigen also lists Goldman Sachs, ING, and Hiscox as some of their past clients.

Lewis Z. Liu is CEO at Eigen. He holds a PhD in Atomic and Laser Physics from the University of Oxford and an MA in Theoretical Physics from Harvard.

Takeaways for Business Leaders in European Banking

Based on the companies we found, AI applications for customer service and automation of document data extraction seem to have the most traction. Advancements in NLP have made it possible to extract data in several languages from unstructured financial documents.

This might largely stem from the fact that NLP applications are usually developed using existing software libraries, which eliminate a large part of the work required from companies that purchase them. AI-based document search and discovery in many different languages might become more capable in the near future.

Debt collection applications for AI are still nascent. That said, since banks collect records of customer interactions, debt collection could be ripe for disruption by way of AI in the next three to five years in Europe.

A majority of the AI startups and established companies seem to be centered around UK, Germany, France, and the Netherlands. The historically strong financial sector in the UK and the existence of reputable AI schools have made it a hub for AI applications in banking and finance.

Governments in Europe are also investing in developing AI ecosystems and training data science talent. For instance, the UK government announced the AI Sector Deal, in which around 50 leading tech businesses contributed to a £1 billion ($1.3 billion) fund, including £300 million of new private sector investment and the training of over 8000 computer scientists and 1000 PhDs in AI.

Larger banks will find that AI can successfully help automate and streamline several internal business processes, such as document digitization. Customer service and product discovery are other areas where AI might become ubiquitous in the near future in the European banking sector.

Business leaders in finance need to be aware that the automation of business processes or gaining business intelligence from data using AI is a lengthy process starting with managing and organizing data. Oftentimes, this involves consulting external experts and large upfront costs. The largest banks with the budget and staff to pursue the technology might find AI more valuable in the near term.

Header Image Credit: MarketWatch