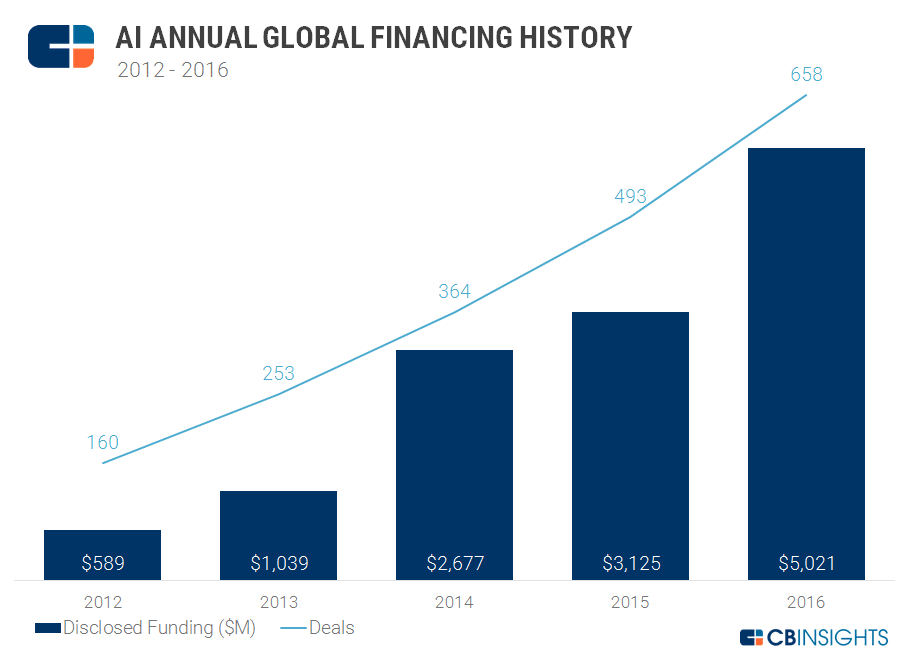

Investments in artificial intelligence continued on an upward swing in 2016, following through on the technology’s promise to disrupt how business is done across industries.

While venture capital (VC) investments for 2016 fell overall (especially in the first quarter – source Bloomberg Reporting), they stayed strong and continued their upward trends in the AI sector, including companies specializing in general AI technology and supplying verticals with AI-driven applications.

Corporate venture capital investments have also expanded, with a record number making first-time investments in 2016. This year, Baidu launched its $200M venture capital unit (Baidu Venture*), focused explicitly on AI. A number of new accelerators were also announced, including a partnership between NYU Tandon School of Engineering’s AI NexusLab and Manhattan-based firm ‘ff Venture Capital’, which will provide initial funding in exchange for a 6% stake in each company (the university will receive a 2% stake).

The goal of this brief is to provide an aerial survey of the VC investment scene in 2016 – to look at where investments have been made in AI, the impact on specific industries, and consider what the investment scene may look like in 2017.

Below are a series of research sources focused on AI deals, investment activity, and investor sentiment around AI. We encourage interested readers to explore the reference links:

Venture Investments in Artificial Intelligence 2016

Source: CB Insights

AI Company Categories Covered: Companies applying AI solutions to verticals like healthcare, security, advertising, and finance, as well general-purpose AI tech.

VC Investment Insights:

- Data Collective (DCVC) has been the most active VC investor since 2012, with a record of backing more than 20 AI-driven companies. DCVC funds entrepreneurs applying AI and other emerging technology towards global-scale enterprise

- About 62 percent of venture investment deals for 2016 was in U.S. startups, a drop of about 17 percent from 2012. The UK held 6.5 percent of total deals worldwide, followed by Israel’s 4.3 percent

- More than 173 startups using AI as a central part of their product or service raised a record $1.3B in funding in 2016

- The top-funded VC round involved Gett, an Israel-based ride-sharing app that applies AI to assist in on-demand car deployment and operation of autonomous cars; Volkswagen backed the company in a $300M corporate minority round

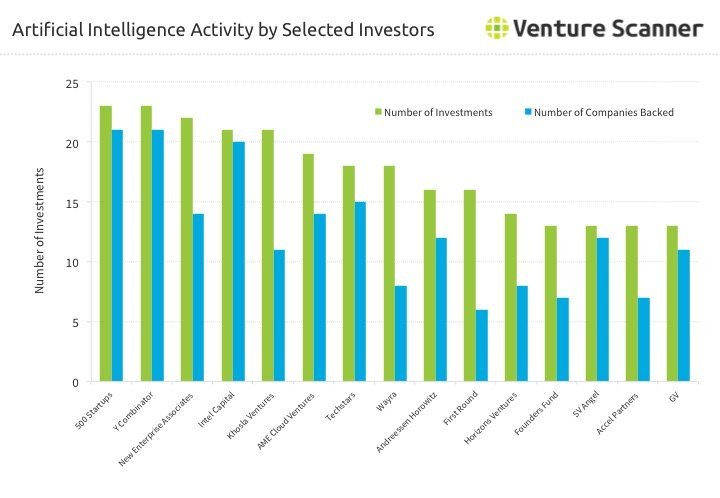

Source: Venture Scanner

AI Company Categories Covered:

- Computer Vision / Image Recognition (Applications)

- Computer Vision / Image Recognition (Platforms)

- Context Aware Computing

- Deep Learning / Machine Learning (Applications)

- Deep Learning / Machine Learning (Platforms)

- Gesture Control

- Natural Language Processing

- Personalized Recommendation Engines

- Smart Robots

- Speech Recognition

- Speech to Speech Translation

- Video Automatic Content Recognition

- Virtual Assistants

VC Investment Insights:

- 500 Startups and Y Combinator were VC leaders (based on tracked investments) for both the number of investment rounds and number of AI companies that each funded for Q4 2016

- As of July 2016, the US had the highest AI VC funding at an estimated $3.1 billion

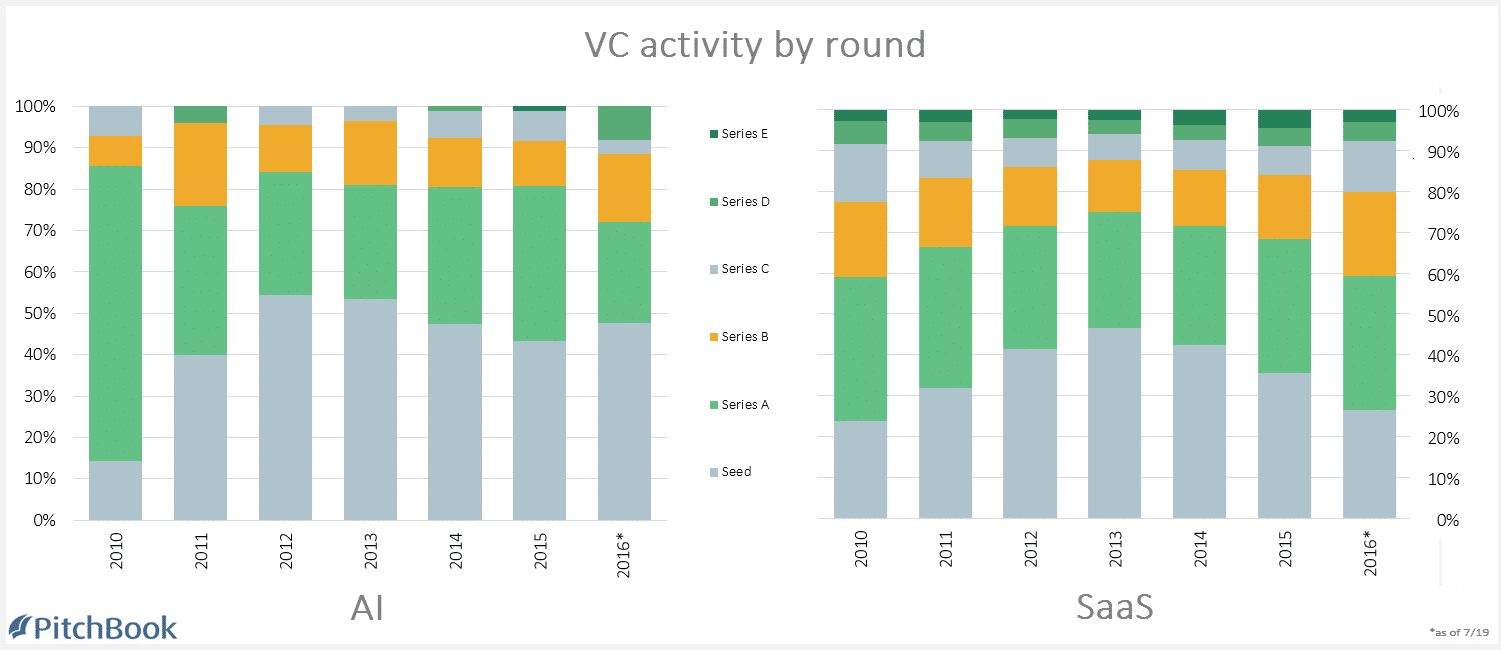

Source: PitchBook

AI Company Categories Covered: Companies creating AI products for horizontal and vertical markets, broadly.

VC Investment Insights:

- At the of this report – published in July 2016 – 48% of the 79 VC deals done in the AI industry were funding seed-level companies. In comparison, the SaaS industry received 26% of VC funding for seed-level companies

- While Khosla Ventures tops CB Insights’ most active VC company list, it’s a close second to Data Collective in VC companies tracked by PitchBook; Data Collective invests primarily in companies applying machine learning and AI technologies to disrupt giant industries (including fraud and risk detection, healthcare services, aerospace, transportation, and others)

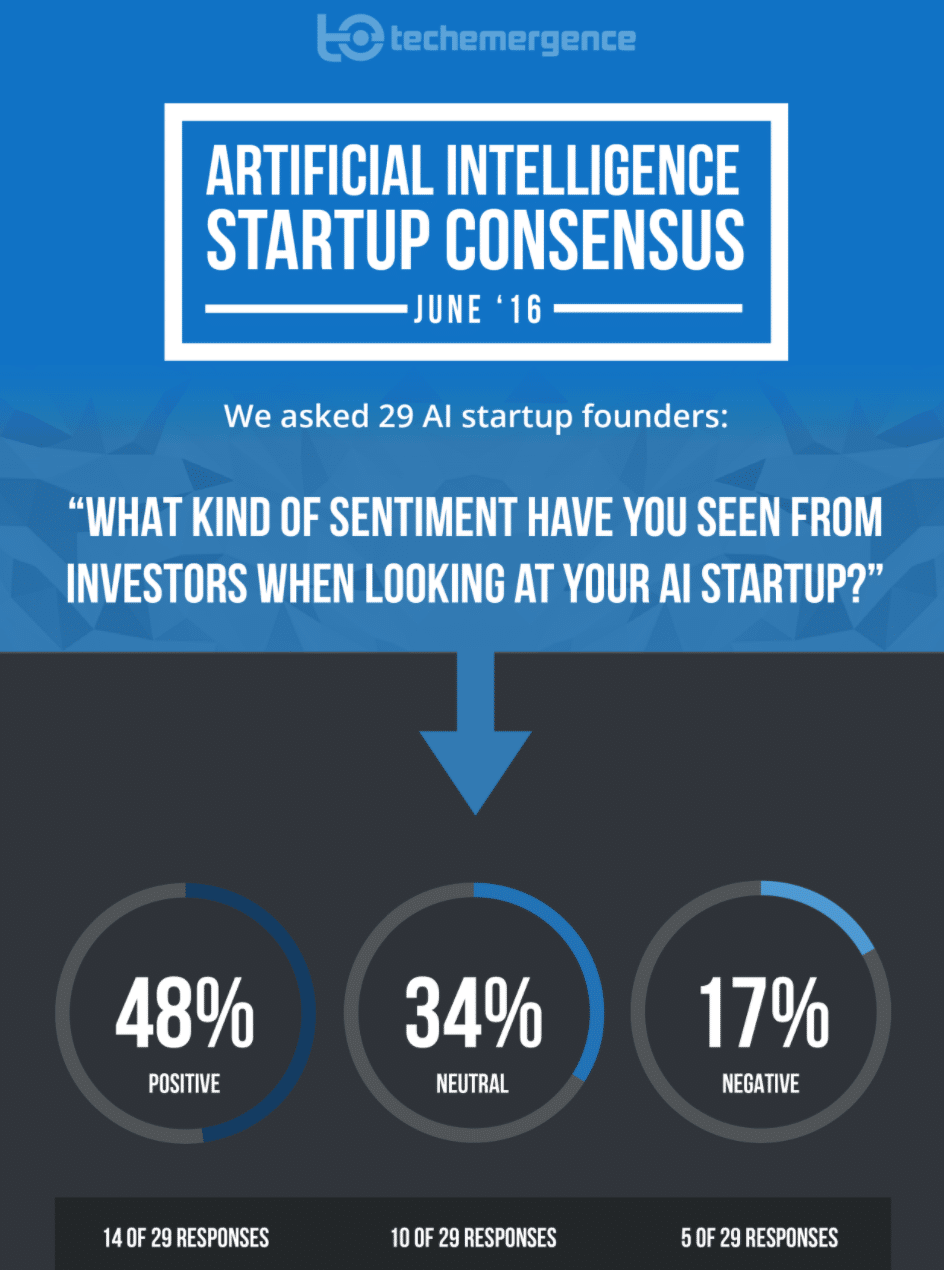

We’ve included the following insights from our own consensus on this topic, which features related perspectives from 29 AI startup founders and execs:

Source: Emerj

AI Company Categories Covered: Various industries, all companies in the consensus are startups.

VC Investment Insights:

- In response to the question on category of sentiment that founders have seen from investors in their space, 48% responded with a positive response, 34% with a neutral response, and 17% with a negative response

- Notable quotes from each category:

- Positive – “Investors understand that AI will help remove the routine aspects of many tasks, and so they are excited about AI helping humans be more productive,” Bernat Fages, Co-Founder, Assist AI

- Neutral – “Investors are excited by, but rightfully cautious about the claims made by AI startups. This is a new and emerging technology…” James Gupta, Founder, Synap

- Negative – “Ai is a very hot space – but investors will remain skeptical of hardware startups that deploy AI because of the large capital requirements…” Mark Palatucci, Co-Founder, Anki

View the full infographic and all responses in our full AI investor sentiment article.

Key Takeaways

1 – While VC investments for 2016 may have fallen overall, they stayed strong and continued their upward trends in AI. Seed-stage funding still takes the cake.

2 – There doesn’t seem to be an industry that will remain untouched by AI. There are certainly those with larger shares of VC investments, like autonomous vehicles and general AI-building platforms (software as a broad industry secured the majority of VC investment in 2016), while others – like the clean tech industry – seem to have struggled in providing strong returns on investment. We predict that the strongest domains (software and biotech) will continue to see strong investments in 2017, along with increases in companies providing artificial intelligence applications in healthcare.

3 – The majority of VC-funded AI companies are still in the US, with most located in San Francisco and Silicon Valley (New York and Boston rank third and fourth, according to Martin Prosperity). It will be interesting to watch whether new AI accelerator programs in places like New York and startups in Europe (particularly Western) and Canada continue to attract increases in VC funding in 2017, and whether SF-based companies will continue to see an increase or find a plateau.

Readers with an interest in the prevalence and categorization of individual AI sectors (healthcare, marketing, etc…) may glean value from reading our ongoing guide titled Artificial Intelligence Industry – An Overview by Segment.

This article has been updated as of May 5, 2017 to reflect new research and industry progress in AI venture investments.

Image credit: Deloitte University Press