As a business leader, you know the essential role of telecommunications in running a business. In the digital era, the telecom industry has shifted from basic phone and Internet service to a sector that is going high-tech and constantly evolving into a more mobile, wearable and automated environment.

The Telecommunications Industry credits Big Data with pushing telecom spending in the U.S. ahead of Europe for the first time in history in 2014. Today’s leading telecom companies are leveraging AI to process Big Data, improve operations and increase revenue. However, no sources have taken a comprehensive look at AI applications within these companies.

- What types of AI applications are currently in use and which are in the works by customers and employees of telecom leaders such as AT&T and Verizon?

- Are there any common trends among their innovation efforts – and how could these trends affect the future of telecom?

- How much has been invested in AI and emerging tech innovation across leading telecom companies?

This article aims to present a succinct picture at the implementation of AI by the six leading telecom companies in the U.S. based on total annual revenue as reported in the Fortune 500. We know that the telecom industry is evolving and every change has direct effects on business and commerce. Through facts and figures we aim to provide pertinent insights for business leaders and professionals interested in how AI is impacting telecom.

Before diving into the applications of each of the six leading carriers, we’ll explore some of the common patterns that emerged throughout our research in this sector.

Telecom Artificial Intelligence – Insights Up Front

The most popular AI applications in the six top telecom leaders appear to be:

- Customer service chat bots – Automating customer service inquiries, routing customers to the proper agent, and routing prospects with buying intent directly to sales people (see CenturyLink’s “sales assistant” use case below)

- Speech and voice services for customers – Allowing customers to explore or purchase media content by spoken word rather than remote control (see DISH Network’s partnership with Amazon’s Alexa below)

- Predictive maintenance – The ability to fix problems with telecom hardware (such as cell towers, power lines, etc) before they happen, by detecting signals that usually lead to failure (see AT&T’s predictive maintenance efforts below)

While the largest firms (AT&T and Verizon) seem to be farthest along in their predictive maintenance applications, chatbots and voice interfaces seem to be nearly ubiquitous as major initiatives across the firms analyzed.

In the full article below, we’ll explore the AI applications of each telecom company individually. The top six U.S. telecom companies below have been rank-ordered by 2016 revenues beginning with AT&T.

AT&T’s Artificial Intelligence Applications

The company has taken a “software-defined” approach to its operations and delivery of services and AI is apparently driving much of that strategy. Mazin Gilbert, VP of Advanced Technology at AT&T Labs, organizes the company’s integration of AI into 3 phases or “generations of application types”: 1) Speech Recognition 2) Network Transformation and 3) IoT and Big Data.

The first generation encompasses “voice apps and speech recognition technology” while the second generation focuses on the company’s software-centric approach towards a “self-healing and self-learning” network fueled by artificial intelligence.

At the customer service level, AT&T leverages AI to process all “online chat interactions” and this has also been replicated in the firm’s entertainment sector. In 2015, AT&T acquired DIRECTV for an estimated $48.5 billion, a move that reportedly contributed to a 11.6 percent increase in consolidated revenue totalling $163.8 billion in 2016. In December 2016, AT&T rolled out Atticus, the entertainment chatbot that operates through the Facebook Messenger platform.

“We intend to continue our focus on cost reductions, driving savings through automation, supply chain, benefit design, digitizing transactions and optimizing network costs. In addition, the ongoing transition of our network to a more efficient software-based technology is expected to continue driving favorable expense trends over the next several years.” – AT&T Inc. 2016 Annual Report

Recently, the company announced the testing of a drone to expand LTE network coverage in the form of a Flying COW (Cell on Wings). Art Pregler, Unmanned Aircraft Systems (UAS) Program Director, has stated that the company is exploring ways to incorporate AI and machine learning for the analysis of video data captured by drones for tech support and infrastructure maintenance of cell towers.

In our one-to-one interview on the “AI in Industry” podcast, AT&T’s Mazin Gilbert, he identified predictive maintenance as a major AI initiative within the company.

“We are implementing AI to help us to identify where these breakpoints are, and help to repair those in an automated way without human intervention. This goes for hardware failure, software failures.” – AT&T’s Dr. Mazin Gilbert

Of course the process does involve human beings, but AT&T aims to use this human effort in a much more efficient manner. Ten years ago, the company would need to send field workers to company sites to check up on hardware periodically – and the company may not know if there was a problem with a specific tower or transformer unless it broke down and needed to be repaired.

Dr. Gilbert explains that the signals and behavior of different “nodes” within AT&T’s network (say, a cell tower) can tip the company off to an impending problem, and they can send a human along to repair it in advance so that customers never notice an outage at all.

I got the impression from my interview with Dr. Gilbert that this predictive maintenance initiative is still in the works, and one can imagine it may take quite some time to calibrate all of AT&T’s sites in this manner. It’s interesting to note that a number of startup companies – including Chicago-based Uptake – are aiming to bring this same kind of functionality to other heavy industry companies.

With AT&T being the ninth largest US firm by revenue, it makes sense that they’d develop much of the technology they need in-house, but their smaller competitors will almost certainly have to partner with AI vendors.

(Readers interested in how telecom giants route their data – and balance their traffic volumes across the network- may benefit from listening to our interview with Jay Perret of Aria Networks.)

Verizon‘s Artificial Intelligence Applications

In 2016, the company closed the year with reported consolidated earnings of $126 billion which reflects a decrease of approximately 2.4 percent in total revenue from the previous year. In his letter to stakeholders, CEO Lowell McAdam, references Verizon’s focus on increasing network usage and monetization through the development of “platforms, content and applications.”

While we weren’t able to find any resources about Verizon’s own predictive maintenance efforts, we can assume that they are in use today based on the fact that Verizon offers such services (which they call “condition-based maintenance”) to other carriers.

In February 2017, Verizon announced the launch of a new “business and technology venture” called Exponent, a set of B2B services that it is offering to other global carriers. Composed of five main technology platforms, including media services, cloud computing, and big data & artificial intelligence the suite of digital tools is designed for carriers both domestic and aboard.

The company’s big data & artificial intelligence platform, described as “ready out of the box” (which must be taken with a grain of salt), offers users the ability to take the data they currently collect and use it towards activities such as “personalized marketing campaigns, laser-targeted advertising, and deep customer engagement.”

Comcast‘s Artificial Intelligence Applications

Comcast has recently introduced its first XI Talking Guide. This voice-activated artificial intelligence tool “speaks” show titles, network names and time slots, facilitating the fundamental aspects of television navigation. The accessibility of the Guide intentionally expands to a wider market of disabled customers, particularly the visually impaired.

The US Census estimates that nearly 57 million individuals have a disability, many of whom are likely Comcast customers (as Comcast is the third largest carrier in the US by revenue). Vocal relay is available which shows what appears on the screen and the Talking Guide also supports DVR programming. The company is exploring customization features such as rate of speech. Comcast’s Accessibility Lab continues to explore the possibilities of their artificial intelligence designs.

The Comcast Accessibility Lab has also launched a voice remote that allows customers to interact with their Comcast system through natural speech. Users speak commands for key navigation including show searching, favoriting content and channel surfing. Voice commands are designed to work in Comcast programs on mobile devices as well as other home-based electronics.

The Comcast Labs DC Research Team leads the organization in technological research. In addition to the Voice Interface work, the DC Research Team also focuses on analyzing metadata and using machine vision to help determine what kind of content consumers might like. This sounds an awful lot like what Netflix does to optimize and recommend it’s content for each user (by looking at what the user clicks on, where they pause, what kinds of content they like to watch in sequence, what factors make them “binge” on content, and more). It’s not surprising that the other less nimble players in the media space would do the same.

(We’ve written a good deal about recommendation engines in our article on everyday uses of artificial intelligence.)

Comcast Ventures is part of a consortium of investors that have reportedly invested $56 million in Interactions, a tech company that focuses on artificial intelligence ventures. Interactions aims to streamline the improvement of the customer service experience for Fortune 500 companies.

While we couldn’t find any Comcast sources about chatbot development, complaints on the company’s support forums seems to suggest that chatbots are in use on some level already. Not surprisingly, the technology has a long way to go before it becomes a viable option to fully handle customer questions (even the chatbot efforts of the “big 4” tech firms haven’t been able to make chat interfaces seamless and delightful yet).

Spectrum‘s Artificial Intelligence Applications

In May 2016, the Federal Communication Commission (FCC) approved a merger between Charter Communications and Time Warner Cable. The merger also included an acquisition of Bright House Networks. The deal was estimated at $65 billion and the brands are now collectively known as Spectrum.

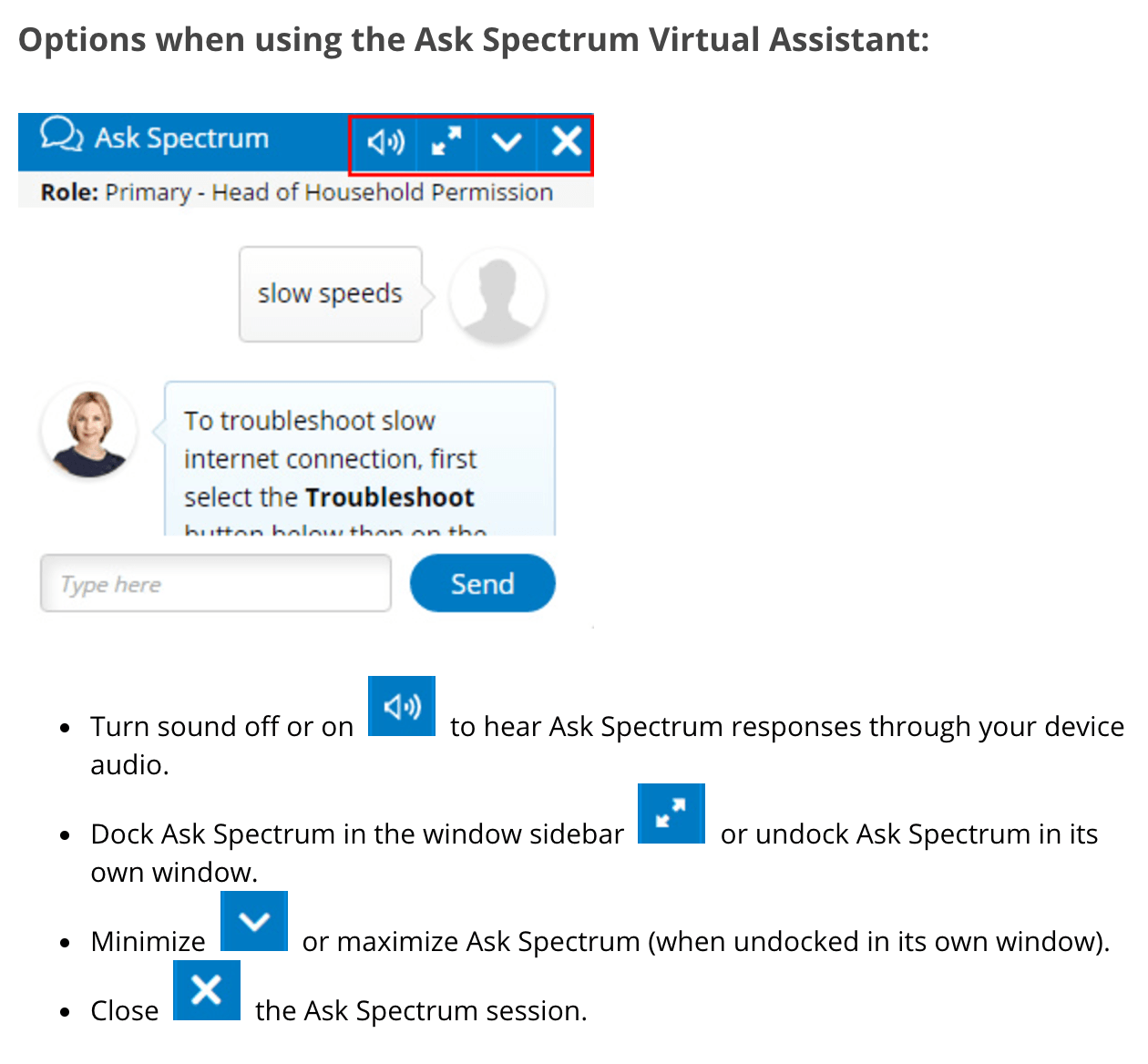

The Ask Spectrum virtual assistant utilizes AI to help customers with troubleshooting, account information or general questions about Spectrum services. Customer inquiries may range from identifying service outages or ordering Pay-Per-View events. Users are provided with tips for using Ask Spectrum on the company’s website and are referred to Live Chat representatives if their questions inquiries cannot be resolved by the virtual assistant.

CenturyLink‘s Artificial Intelligence Applications

In 2016, the telecom provider implemented an automated sales assistant into its business model. The AI-driven assistant named Angie was designed by Conversica, a company touted as “the only provider of artificial intelligence-based lead engagement software for sales and marketing.” The Harvard Business Review reports that Angie averages an estimated 30,000 emails each month and analyzes the responses to identify “hot leads” (who we can assume are routed swiftly to salespeople without much further waiting).

Results from an initial pilot showed that Angie could properly interpret 99 percent of emails that were processed while 1 percent were forwarded to human managers. Sales reps are able to save time spent on outreach and follow-up who could each have an average of 300 accounts.

In April of this year, Conversica announced that Kate Cindric Federhar, CenturyLink’s Marketing Operations Manager would lead a presentation on how other companies may benefit from Conversica’s AI software at the Marketo Marketing Nation Summit in San Francisco, CA:

DISH Network‘s Artificial Intelligence Applications

Over the past year, DISH Network has become the first TV provider to collaborate with Amazon. Looking to improve customer service through the integration of AI technology, DISH has designed a DVR system that is compatible with Amazon’s Alexa products.

To enable functioning, users connect their DISH Hopper DVR system to Amazon’s Echo or Echo Dot Alexa devices and adjust settings through on-screen navigation tools. The joint venture allows DISH to provide users with voice-enabled television navigation at no additional charge. Alexa is designed to perceive and process spoken commands with natural phrasing. Examples of typical commands include: “Go to ESPN,” or “Find The Voice”.

In July 2016, DISH Network VP Vivek Khemka announced the company’s venture into the development of another accessibility product–the Voice Remote. The company’s VP compares the product to smartphones for its design which boasts convenience, speed of functions and ease of access.

Sized to fit into the palm of the hand, the Voice Remote functions by processing the user’s natural speech and speech patterns to execute most navigational functions. Search results are narrowed as additional description is provided. In addition to its AI technology, the Voice Remote features a touchpad for access to adjust core settings. However, the Voice Remote is limited as it pertains to the amount of detail that can be processed.

Concluding Thoughts on AI in Telecom

It’s not surprising to see chatbots and voice interfaces as among the most popular use-cases of artificial intelligence in this sector. Companies with huge B2C operations (millions or tens of millions of customers) are most suited to benefit from both text and voice applications, for a number of reasons:

Customer service is a massive expense for any company with over a million customers, and chatbots hold a promise of significantly improving efficiencies.

Companies with massive volumes of incoming customer support requests have the most data available to train chatbot of speech recognition systems, allowing them to “drink in” the huge wave of support and use it as fuel for better interfaces with customers.

Carriers like Verizon have historically had a stronger in-home presence than tech giants like Microsoft or Amazon. If you rely on one company for TV, internet, and cell phone service, you’re likely to interact with them frequently. Amazon’s Alexa has stepped in as a first-mover in intelligent home devices, and it’s likely that telecom firms will want to have a similarly delightful customer relationship with the help of natural language processing.

It seems likely that within two or three years, all of the telecommunications companies on the Fortune 500 will be leveraging predictive maintenance technologies. Companies with thousands of towers have the opportunity to gather huge amounts of data on this equipment, allowing them to “tune in” to signals of stress or failure – and calibrating their maintenance efforts accordingly.

With such large and spread-out infrastructures, telecom companies will likely host an ecosystem of companies leveraging data for uptime and functioning. This ecosystem will undoubtedly cross over into nearly all of heavy industry – though we’re most likely to see the implementation of these technologies with big Fortune 500s before these technologies trickle down to SMBs.

Image credit: EUBrasil